When you look at Plasma closely, you start to feel what it is really trying to fix, because the biggest pain in stablecoin payments is not some abstract technical detail, it is the uncomfortable moment right before you hit send, when your mind is racing with questions about fees, delays, and whether you are about to get stuck because the network expects you to hold the “right” token just to move your own money, and Plasma is basically built around removing that stress by making stablecoin settlement the center of the entire chain, not a side feature, not an afterthought, and not something users have to learn advanced tricks to access.

At the technical level Plasma is structured like a deliberate blend of familiarity and speed, because they want developers to build with the same EVM assumptions they already trust while the network itself is tuned for fast settlement, which is why the execution side is built on a Reth-based execution layer that keeps the environment fully EVM compatible, so existing Ethereum-style contracts and tools can be used without forcing teams to rewrite everything, and the consensus side uses PlasmaBFT, described as a pipelined implementation of Fast HotStuff that is designed to reduce time to finality and keep it deterministic, which matters deeply for payments because merchants, users, and institutions do not want “probably final,” they want the calm certainty that the transfer is done and cannot be casually undone.

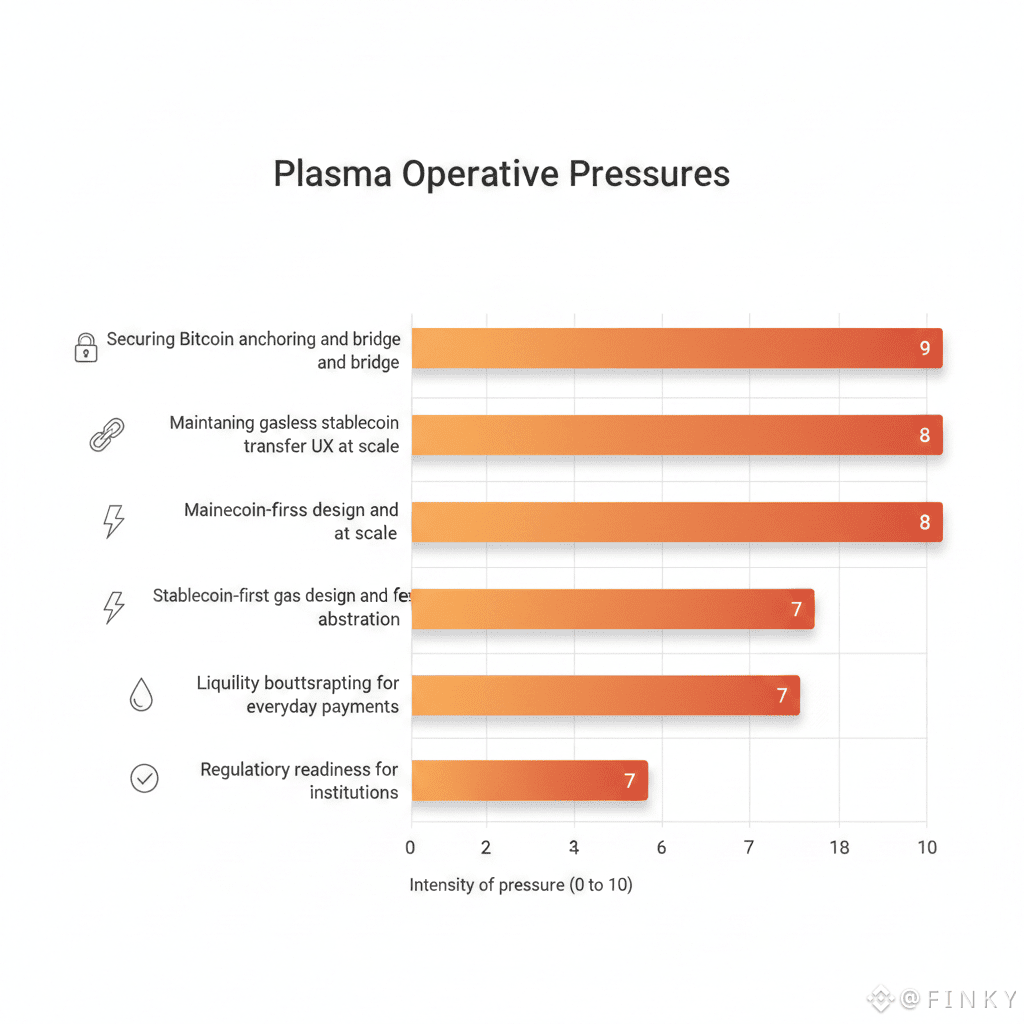

Where Plasma becomes emotionally different is in how it treats stablecoins like the default experience, because They’re not just promising faster blocks, they are trying to remove the psychological friction that stops normal people from adopting stablecoins as daily money, and the project’s stablecoin-native contract direction is meant to make basic stablecoin behavior feel smooth instead of awkward, with the most attention-grabbing example being the idea of gasless stablecoin transfers for direct USD₮ payments through an API-managed relayer system that is intentionally scoped to direct transfers and designed with controls to reduce abuse, so the “free” feeling is protected rather than turning into a spam magnet that ruins the network for everyone.

For anything more complex than a simple transfer, Plasma still accepts the reality that networks need sustainable incentives and spam resistance, but instead of forcing people to keep a separate gas asset ready at all times, Plasma’s design highlights stablecoin-first gas through a standard EIP-4337 paymaster approach that lets fees be paid in stablecoins, and that changes user behavior in a quiet but powerful way, because when someone is already holding stablecoins, it feels almost insulting to be blocked by a missing gas token, and this is the moment Plasma is trying to soften, since If the system makes people feel trapped, they will not build their lives on top of it, but if the system makes them feel capable and calm, adoption stops being a theory and starts becoming routine.

Plasma also talks about a Bitcoin-anchored security direction that is meant to strengthen neutrality and censorship resistance over time, but the important detail is that the Bitcoin bridge and the pBTC issuance system are explicitly described as under active development and not live at mainnet beta, which is actually a healthy kind of honesty in an industry where bridges are often the most attacked surface, because it signals that Plasma is not pretending the hardest parts are already solved, and it leaves room for careful iteration rather than rushing something that could break trust in one bad day.

Now the token question matters, because a chain can feel wonderful for users and still fail if the economics cannot carry it through real volume, and Plasma’s docs describe XPL with an initial supply of 10,000,000,000 at mainnet beta launch, with unlock details that include a 12-month lockup for US purchasers and a full unlock date stated as July 28, 2026, and whether you care about price or not, these details matter because payment infrastructure must survive long periods of boring usage, sudden spikes of attention, and moments of panic, and I’m pointing this out because It becomes a serious settlement network only when incentives, security, and user experience all stay stable at the same time.

If you want to judge Plasma with real-world eyes, you should watch the metrics that reveal human behavior rather than hype, because stablecoin transfer count is only meaningful when it is made up of many frequent transfers that look like commerce, payroll, or remittances, and time-to-finality under load is the heartbeat of the network because a payment chain is judged on the stressful days, not the quiet days, and adoption of stablecoin fee payment flows will show whether the stablecoin-first design is truly becoming normal rather than remaining a marketing story.

Finally, one of the most practical signs that a network is trying to become real is when external infrastructure and test tools appear and people actually start testing flows instead of only talking about them, and in January 2026 a guide was published describing how teams can claim test tokens and begin interacting with Plasma testnet through a faucet, which matters because the path to trust is repetition, testing, and painful edge cases, not vibes, and We’re seeing that kind of groundwork show up when a project is trying to move from concept into something builders and users can lean on.

I’m not going to pretend Plasma is guaranteed to win, because payments are ruthless and the world puts enormous pressure on anything that moves money, but I can say the emotional target is clear and the design choices line up with it, because Plasma is trying to turn stablecoin transfers into something that feels simple, fast, and dignified for the people who need it most, and if they keep executing with discipline, protecting the user experience while staying honest about what is still being built, then it will not just be another chain people talk about, it will become quiet infrastructure that people trust without needing to understand it, and that kind of trust is the rarest asset in this entire space, because it grows when technology finally starts serving humans instead of asking humans to serve technology.