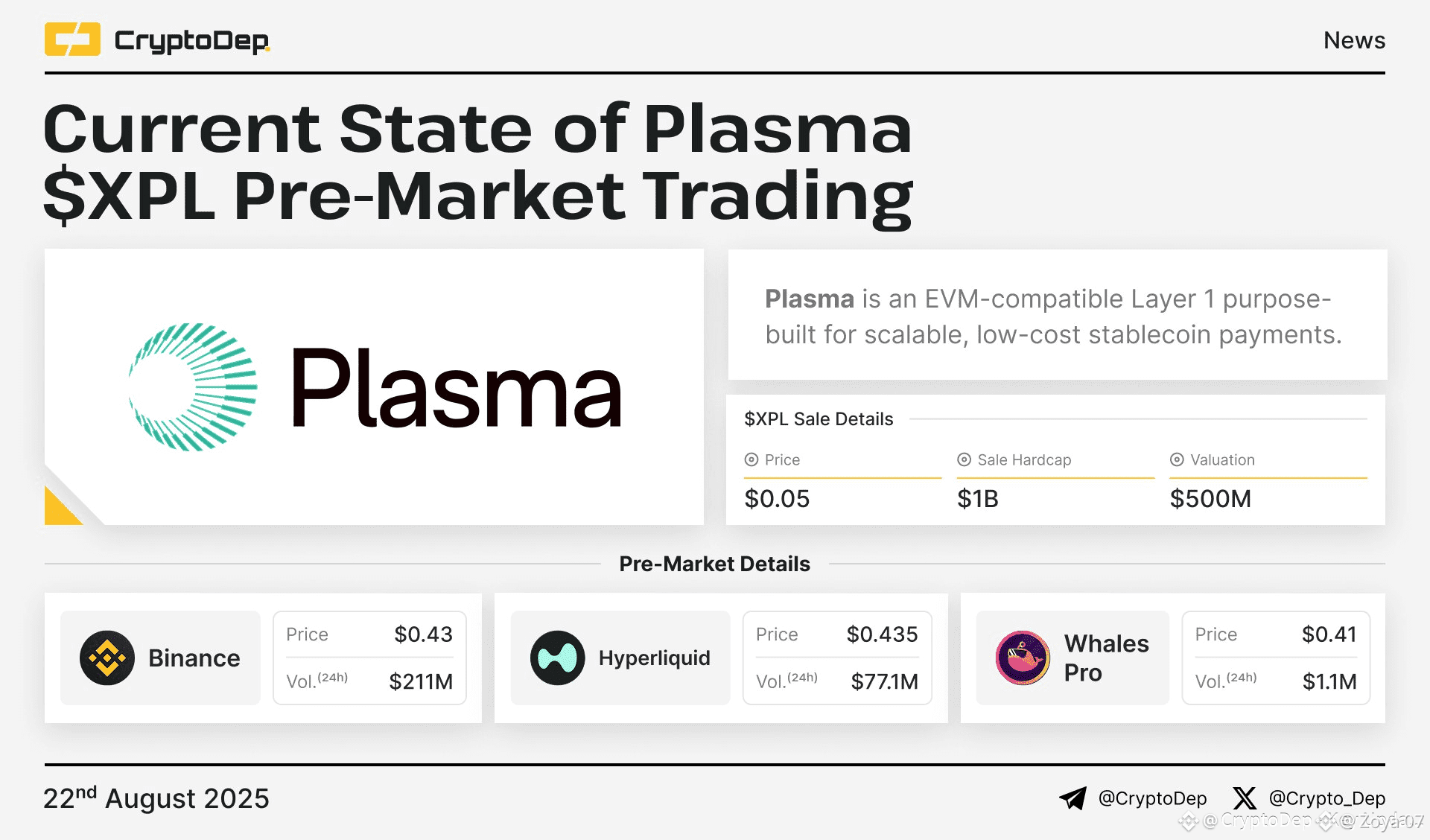

@Plasma $XPL was born from a simple but powerful idea: if stablecoins are already the form of money people and businesses choose to move on-chain, then why continue to treat them as second-class citizens on networks built for something else? As we step into 2026, that conviction has hardened into a practical blueprint a Layer 1 blockchain designed from the ground up to make stablecoin settlement fast, cheap, and institutionally secure, while keeping the door open for developers who want the full flexibility of EVM tooling. Rather than shoehorning payments into a general-purpose chain and asking users to adapt, Plasma flips the script and builds rails where sending digital dollars feels as easy and frictionless as using any modern payment app, with native features that remove the typical frictions of crypto payments.

Plasma

What distinguishes Plasma from many other chains is that its architecture and product decisions are motivated by payments first. The protocol includes native support for zero-fee USDT transfers and allows gas to be paid in stablecoins, which removes the awkward step of asking users to hold or swap for a volatile native token just to move value. This is not an afterthought or a smart contract hack it is embedded in the chain’s primitives so businesses and everyday users can rely on predictable, low-cost flows without extra complexity. That user-centric approach is visible in how Plasma describes gasless transfers and stablecoin-first gas options that make micropayments, remittances, and high-volume commerce practical at scale.

Plasma

Beneath these features sits a custom consensus engine called PlasmaBFT, an evolution of HotStuff-style Byzantine fault tolerant protocols optimized for the needs of global settlement. PlasmaBFT is engineered for very low finality latency and high throughput so that payments can settle in near real time and the network can handle commerce at scale. By combining pipelined consensus and performance optimizations, the chain aims to deliver the kind of responsiveness merchants expect from traditional payment rails while preserving decentralization and security properties appropriate for a Layer 1. For builders, the outcome is familiar Ethereum-style programmability alongside performance characteristics tailored to money movement, enabling smart contracts and payments workloads to coexist without the usual tradeoffs.

Security and neutrality are central to Plasma’s long-term value proposition. The project implements a model of Bitcoin-anchored security, periodically committing state to Bitcoin to create an additional, trust-minimized security layer. That design choice is meant to appeal to institutions and markets that prize censorship resistance and auditability; by anchoring critical checkpoints on Bitcoin, Plasma signals a conservative approach to settlement finality that complements its performance ambitions. In practice this gives financial counterparties more confidence that settlements are robust, and it helps position the chain as a neutral plumbing layer for dollar movement across jurisdictions.

The product vision for Plasma purposely narrows its focus to payments and settlement, and that narrowing unlocks clarity. Instead of promising to be everything to everyone, the team has prioritized a set of primitives fast stablecoin transfers, configurable gas tokens, confidential transaction options, and deep liquidity integrations that together make it dramatically easier for merchants, remittance services, and fintechs to design user experiences that disguise the blockchain under the hood. This is a subtle but important shift: when a blockchain’s specialty is settlement, onboarding flows change, UX expectations simplify, and the economic models for microtransactions and merchant rails become viable in ways they often are not on general-purpose networks.

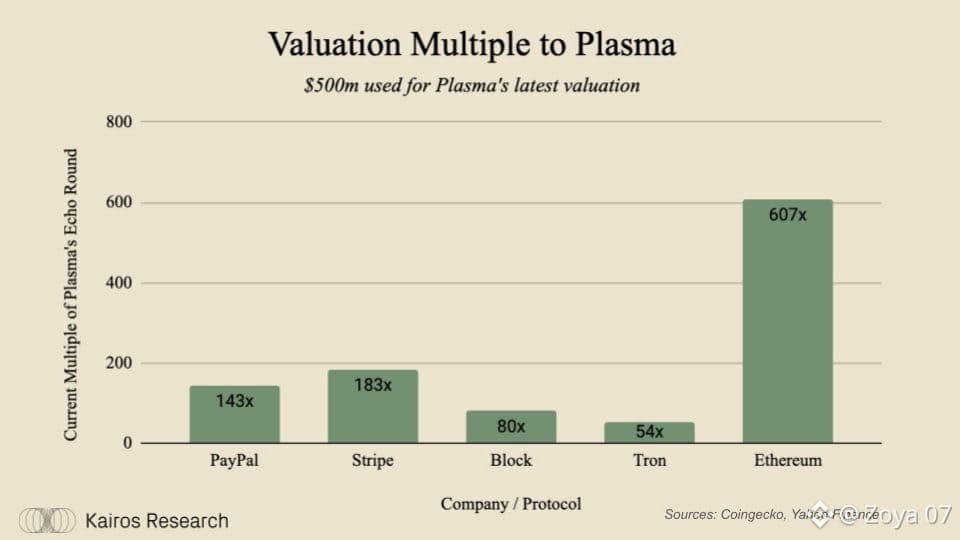

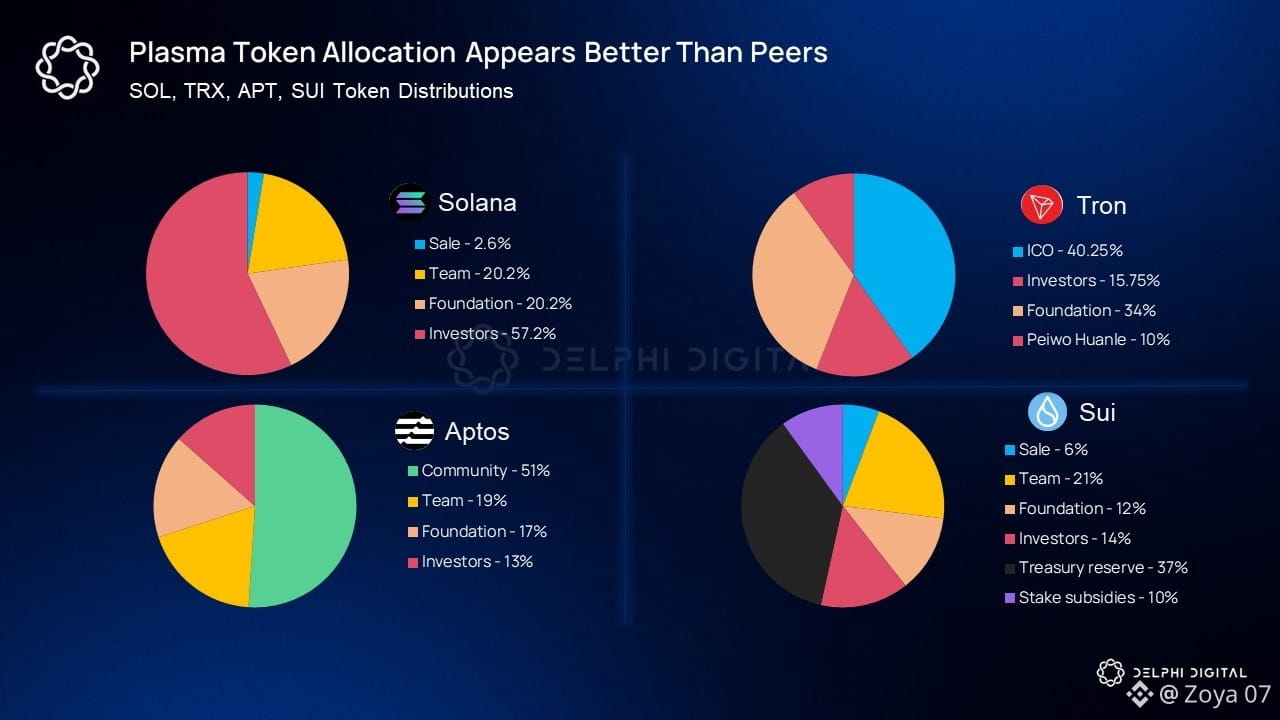

From the ecosystem perspective, Plasma has attracted meaningful investor and developer attention precisely because stablecoins are already a dominant asset class in crypto. Funding and strategic support have helped the project accelerate infrastructure, partnerships, and liquidity workstreams that matter for real payments adoption, and public commentary around Series A backing signaled to market participants that a payments-centric layer could draw institutional interest. Those early financial endorsements and the visible engineering progress have helped framing Plasma not as an experiment but as an operational piece of plumbing being built for direct integration with existing payments flows

Practical adoption will ultimately hinge on interoperability, developer tools, and integrations with exchanges, wallets, and custodial partners. Plasma’s decision to maintain full EVM compatibility lowers the barrier for developers who already know Ethereum tooling, and integrations with major infrastructure providers further shorten the path to production. For enterprises and fintech operators, the ability to deploy existing smart contracts while benefiting from low-cost, instant stablecoin settlement creates an attractive TCO (total cost of ownership) comparison with other rails. Over time, that ease of integration could be the decisive factor that moves real rails from pilot deployments into mainstream payment flows.

There are, of course, open questions. Regulatory scrutiny of stablecoins and cross-border payment flows remains intense in many markets, and success will require careful compliance, custody partnerships, and clear operational playbooks. The long-term neutrality and adoption of a settlement chain also depend on liquidity distribution and on-ramps that make native stablecoins broadly usable without fragmentation. Still, by aligning technical design with the practical needs of payments, Plasma reduces many of the engineering frictions that previously held back stablecoin rails and offers a pragmatic path toward making digital dollars function like the money they represent.

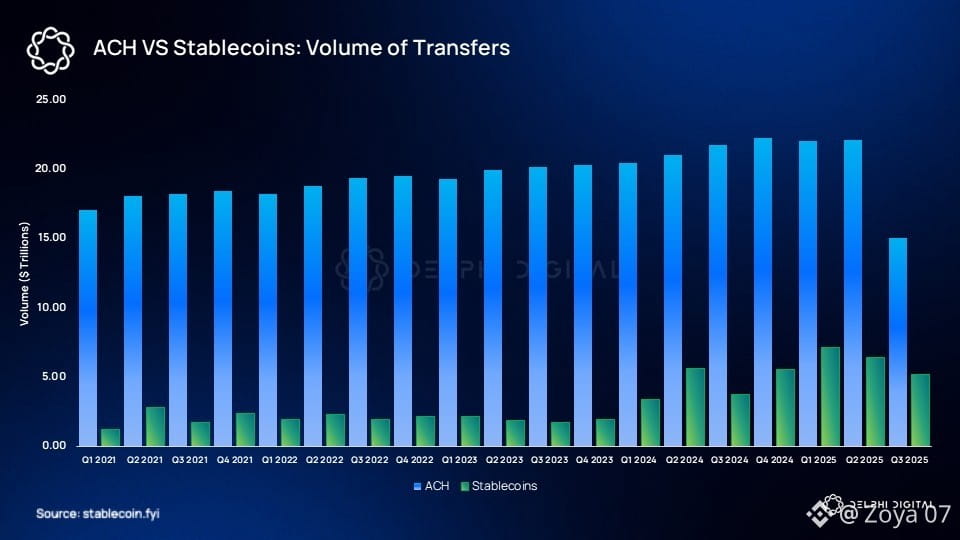

As the industry looks for infrastructure that can support trillions in annualized stablecoin throughput, Plasma’s approach build for settlement first, secure with conservative anchors, and make the developer experience familiar reads like a reasonable, market-driven experiment in rebuilding payment rails for the digital age. If the promise holds, the consequence will be subtle but powerful: fewer questions for end users, more predictable costs for businesses, and a set of settlement primitives that let traditional finance and crypto native rails speak the same language. For anyone watching the evolution of money on-chain, Plasma is an instructive example of what specialization at the base layer can unlock for real-world adoption. @Plasma #plasma $XPL