company Plasma stablecoin blockchain project is being built around a very specific thesis: stablecoins have already won product-market fit as digital money, but the rails they move on are still fragmented, expensive, and operationally complex. Instead of expanding horizontally into every narrative, Plasma has doubled down on vertical execution—optimizing for fast finality, predictable costs, and institutional-grade settlement flows. Recent updates reinforce that focus. The integration of NEAR Intents brings intent-based, cross-chain liquidity routing into Plasma’s core, allowing stablecoins to move across ecosystems without users needing to understand bridges, paths, or underlying chains. This is not a cosmetic upgrade; it directly addresses one of the biggest blockers to stablecoin adoption at scale—liquidity fragmentation and routing friction.

company Plasma stablecoin blockchain project is being built around a very specific thesis: stablecoins have already won product-market fit as digital money, but the rails they move on are still fragmented, expensive, and operationally complex. Instead of expanding horizontally into every narrative, Plasma has doubled down on vertical execution—optimizing for fast finality, predictable costs, and institutional-grade settlement flows. Recent updates reinforce that focus. The integration of NEAR Intents brings intent-based, cross-chain liquidity routing into Plasma’s core, allowing stablecoins to move across ecosystems without users needing to understand bridges, paths, or underlying chains. This is not a cosmetic upgrade; it directly addresses one of the biggest blockers to stablecoin adoption at scale—liquidity fragmentation and routing friction.

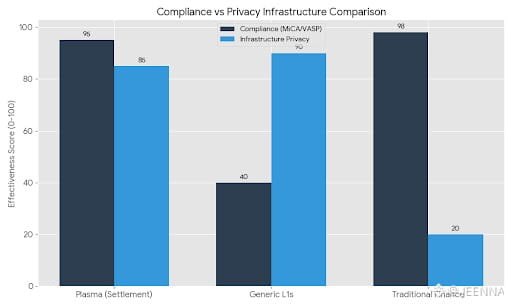

At the same time, Plasma’s regulatory expansion in Europe signals a deliberate shift toward real-world deployment rather than purely crypto-native experimentation. Securing a VASP license and establishing an operational presence in Amsterdam positions the network to operate within emerging MiCA frameworks, which matters for payment processors, fintechs, and enterprises that cannot interact with unlicensed infrastructure. This compliance-first posture differentiates Plasma from many Layer-1 networks that remain technically impressive but operationally incompatible with regulated financial environments. It also reframes Plasma less as a speculative platform and more as backend payment infrastructure—something users may never think about, but rely on daily.

Exchange integrations and token distribution events further anchor Plasma into existing market structure. Participation in major exchange programs provides liquidity, accessibility, and discoverability, but more importantly, it creates the conditions for real transaction flow rather than isolated on-chain activity. Liquidity alone does not create utility, but without it, settlement networks fail to scale. Plasma appears to be sequencing these components deliberately: liquidity access first, interoperability second, compliance third, and application-level adoption last. That order matters if the goal is durability rather than short-term attention.

What stands out most is what Plasma is not doing. There is no aggressive narrative pivoting, no over-promising around consumer apps before rails are ready, and no attempt to market itself as a universal solution. The product direction suggests an understanding that payment infrastructure succeeds when it is boring, reliable, and invisible. Stablecoins already move hundreds of billions of dollars annually; the opportunity is not to invent new money, but to make existing digital dollars move faster, cheaper, and with fewer failure points.

Plasma’s trajectory so far reflects this mindset. Cross-chain intent routing reduces complexity at the protocol level. Regulatory alignment reduces friction at the institutional level. Exchange integration reduces barriers at the market level. Together, these are not flashy milestones, but they are compounding ones. If adoption follows infrastructure—as it usually does—Plasma’s relevance will be measured less by headlines and more by volume quietly settling through its network.

In an environment where many blockchain projects compete on narrative velocity, Plasma is competing on execution discipline. Whether that approach scales into meaningful market share will depend on real usage, enterprise integrations, and sustained liquidity, but the direction is coherent. This is infrastructure being built for how stablecoins are actually used today, not how crypto hopes users might behave tomorrow.