$SENT The future analysis of the SENT coin (primarily associated with the Sentinel Network and Sentient projects) suggests a period of consolidation followed by potential recovery, driven by the growth of the Decentralized Physical Infrastructure Networks (DePIN) and AI-integrated blockchain sectors.

Future Analysis of SENT Coin

Market Sentiment & Trend:

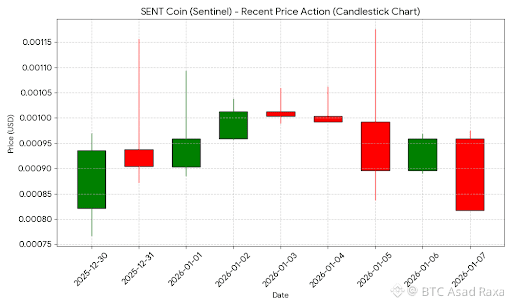

Short-term Outlook: SENT has recently experienced high volatility, retreating from a January 2026 high of $0.001175 to a support level around $0.0008. The immediate trend is bearish-to-neutral as it tests major psychological support zones.Recovery Potential: Analysts anticipate a potential rebound if broader market conditions stabilize. A 30–40% upside is projected for late Q1 2026, with price targets returning to the $0.0012–$0.0015 range.

Fundamental Drivers:

DePIN Adoption: As a pioneer in decentralized VPN (dVPN) services, Sentinel’s future value is tied to the adoption of privacy-focused infrastructure. Increased demand for censorship-resistant internet could drive utility-based buying.

AI & Compute Integration: Some variants of SENT (like Sentient) are shifting focus toward decentralized AI infrastructure. The crossover between AI and blockchain is expected to be a major growth catalyst in 2025-2027.

Key Risk Factors:Competition: The space is becoming crowded with projects like Helium and various Cosmos-based privacy protocols.

Liquidity: Trading volume remains relatively low ($150k–$300k daily), making it susceptible to sharp "pump and dump" cycles.

Candlestick Chart: SENT/USD Price Action

The chart below illustrates the recent daily price action for SENT, showing the rejection at the $0.0011 resistance and the current consolidation near $0.0008.

#StrategyBTCPurchase #FedHoldsRates