I can recall the initial experience of a viral chain. It was as if a stadium was constructed to host a game but all people did was exchange tickets on the outside. The arena was present, the lights were up, but the action was never begun.

With Vanar Chain, the posture that continues to draw me in is another one. Not loud. Not pursuing the new fad with a new painting. It is more as a team who are going to quietly go about it, building deep rather than wide, and infrastructure first.

A large assertion in this space, and I would wish to base that. This article is targeted at the builders, product leads, and long term holders of the tokens who are less concerned about the noise factor and whether a chain can sustain genuine work.

I have come to learn that I should stick to the uninteresting figures, since they compel the story to remain truthful.

Towards the end of January 2026, VANRY is trading at approximately seven tenths of a cent, having a market capitalization of approximately fifteen million dollars and in circulation slightly more than 2.1 billion tokens. Single digit millions have been the daytime volume.

The latter figures are not on their own gospel. Because, to my mind, they primarily say the following: the market is not giving Vanar a free pass. To achieve utility, it must be obtained with shipped systems, constant tooling, and reuse.

Majority of blockchains are able to run code. The difficult thing is to convert that capability into something that acceptable teams can rely on.

Payments must be faster than just a speed. They require explicit regulations, information that accompanies the payment, and means of establishing what occurred in the post-factum. Assets which are tokenized require more than a mint button. Their records, documents and checks must be glued on rather than attached as an afterthought. Games require than low-pricing. They require a chain that can support bursts, tiny trades as well as user flows not resembling a science project.

The broader market is shifting towards such demands. The extent of use of stablecoins is increasing rapidly, and studies project very large onchain distances in the year 2025 and further buildup throughout the year 2026.

In several industry projections, tokenization is also being positioned as a multi-trillion dollar category in the coming few years. And predictions in blockchain gaming are not waning, which at least indicates that the need in high-volume, low-fee rails is not fading.

It is not that there is a deficiency of use cases. The issue is that even now the majority of the chains are regarded as a place to trade assets, not to operate systems.

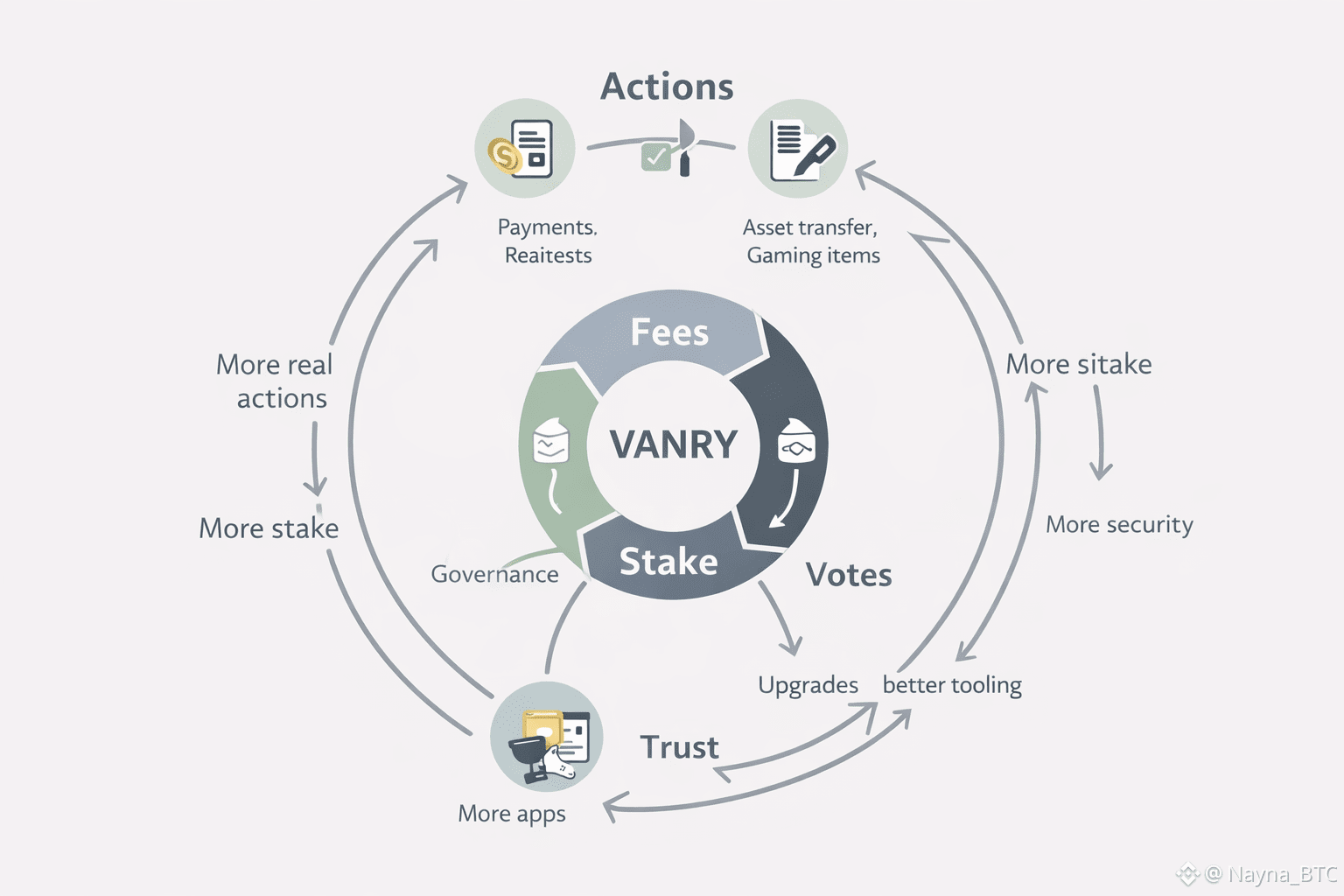

Slogans aside, VANRY has a clean job list within the network.

It is the activity gas on Vanar Chain. It is also associated to staking via a delegated proof of stake model in which stakers are able to stake and sponsor validators, and validators are compensated to win the chain.

VANRY is also described within the official documentation as being an aspect of governance and community decision making, which is important should Vanar expand into a chain that can transform without disruption of trust.

Another practical option that I observe in the treatment of liquidity and reach is by Vanar. VANRY is native on Vanar, and wrapped on other chains in an ERC20 form, where there is a bridge route between the two. Such an arrangement is not glitzy, and it is through which you reduce friction on groups that have assets and people in other places.

The token page is not the most telling to me about Vanar. It is how the chain is specified as a stack, with storage and reasoning being considered as first-class components to the system.

Vanar is a five-layered architecture, the bottom layer being Vanar Chain, then Neutron (a semantic memory layer) and Kayon (an onchain reasoning engine). The object is evident not to store and execute, but to store meaning, and then to reason about it.

You have ever been around payments or compliance which is why this matters. An out of context payment is money in motion. An unspinable tokenized asset that does not have a claim associated with it is a claim lacking a spine. Vanar attempts to have the chain possess the evidence, and have that evidence operational in the form of code.

According to them, Neutron is used to compress raw files into onchain objects that it calls Seeds which remain queryable and associated with meaning. Kayon is placed as the component that may query such objects and does logic, as well as checks prior to a payment flow.

I find myself going back to the same thought this is no longer a scramble to more apps. It is an urge to improved rails, constructed beneath the surface, thus applications can be more simple on top.

A chain might be designed excellently and not land. Therefore I seek indicators that the network is being utilized in areas where utility is not an option.

Vanar has been associated with brand-led digital goods, such as metaverse-style experiences, and entertainment. A Shelby American partnership related to a metaverse brand push was one of the examples discussed in the press, and it was developed with Vanar participating in the onchain aspect of the experience. Such a project is not art as the pure art. It verifies actual flows: mints, user access, item trading, and support ticket the occasions when everything fails.

The other indicator is the manner in which Vanar discusses PayFi and agent-like payment flows and the mention of work together with large payments companies.

I watch my word here, as most chains are all about payments. Nevertheless, it is the fact that Vanar makes payments and real assets the central, rather than the side quests that you know what they are constructing.

Networks attempt to impose token value through accomplishment of reasons to hold. That will disintegrate internally, as the token becomes the commodity.

The cleaner route pursued by Vanar is that, in case the chain becomes an environment where applications are of low costs and of dependability, and in case data-rich activity is the state of affairs, then gas demand and staking demand are more likely to be byproducts of consumption than of advertisement.

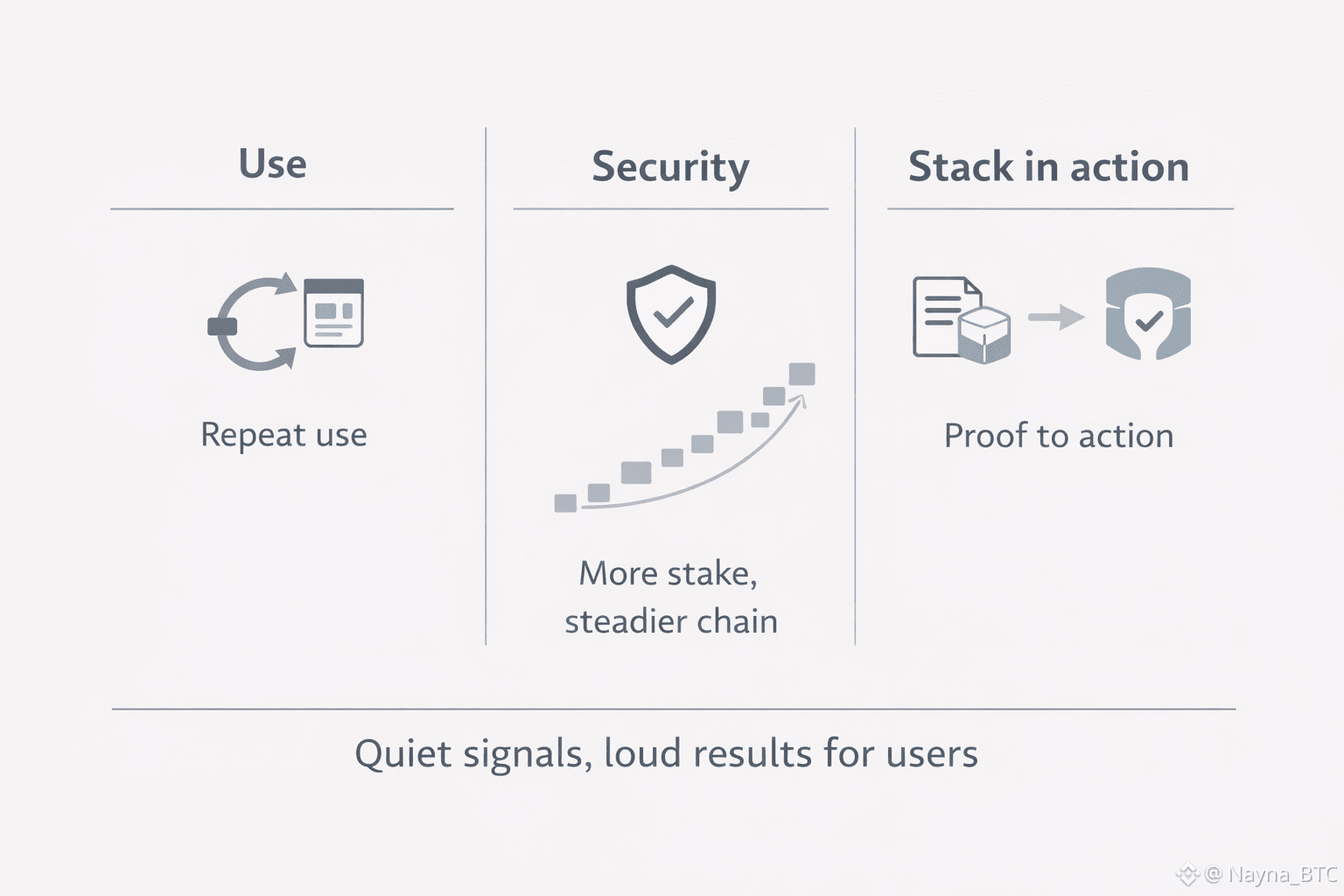

VANRY as gas is simple. Greater actual application, greater base demand. Staking in VANRY is also easy. Increased stake, increased security and teams who desire stable rails increase their trust.

What is less noticeable, but what is more critical is whether the data and reasoning layers created by Vanar save work to builders. When Neutron and Kayon allows a group to ship a thoroughly-proved application that has reduced moving components, that is when utility ceases being empty lip-reading.

My experience shows that utility is not the largest threat in my case, since the fees or TPS is not important. It is complexity. Bridges break. Indexers lag. The information exists offchain and some person contests what is real. Teams take months of wiring up basic stuff and when the product becomes rough, the users complain about the chain.

The style of Vanar comes in like a reply to that agony. Place more of the painful stuff upon the bottom stack. Prove information, and it is in the form that can be read by code. Get reason to be able to ask questions of that data, rather than to put tokens around.

Such is the type of work that does not trend easily. It is quietly building. It is under the surface. It is depth over breadth. And when it is done good, it puts all that is above it in the ordinary.

The second evidence points to me are not such announcements. They are predictable, monotonous messages.

Are other apps making use of VANRY on real flows, as opposed to a single-drop? Does the first launch mean that dev teams continue shipping on Vanar? Is the participation in the staking increasing in a gradual manner, indicating that individuals are viewing the network as a location to be secured.

On the stack side, I would monitor the occurrence of data objects in the form of Neutron and reasoning in the form of Kayon where evidence and audit trail are of interest.

Utility was the pledge all the chains made, just before utility became the marketing term. The angle of Vanar is different since it begins with the elements that are not in the focus of most teams: data, evidence, and the argument that lies between a record and an act.

Provided Vanar keeps silently developing that way, and provided VANRY remains deployed in the same fashion the docs have explained it, i.e. as gas, staking fuel and a path to governance, then the chain would have a legitimate chance to transform ticket trading into an actual match in blockchain.