Vanar is one of those names that keeps popping up in trader circles, not because it’s ripping faces off, but because the tape is telling you something. As of January 30, 2026, VANRY is sitting around the $0.007 area after a sharp down day (roughly -9% over 24h), and the part that matters is the activity around it, not the number itself. When a ~$15–$17M asset is printing multi million daily volume, that’s a market that can move fast in either direction, and it usually means there are enough eyes on it for catalysts to actually matter.

The “Make the Chain Invisible” Positioning

Here’s my read: Vanar is trying to make the chain stop being the main character. If you’ve been around long enough, you’ve seen what happens when a project leads with tech slogans and the user experience is an afterthought. Traders might pump it for a week, but users don’t stick. Vanar’s positioning is more “let builders ship consumer stuff without making the user care about wallets, gas, and all the ceremony.” Whether they execute is the whole game, but the intent is clear in how they describe the network: an EVM L1 aimed at entertainment and mainstream use, with low fixed costs and brand-friendly onboarding.

Usage First, Not Narrative

Now here’s the thing. Narratives are cheap. I want to see a chain that is actually being used. Vanar’s own explorer shows ~193.8M total transactions, ~8.94M blocks, and ~28.6M wallet addresses. Those are big lifetime numbers for a small-cap token, and they at least tell you the chain isn’t a ghost town. The skeptical question is the obvious one: how much of that is real, sticky usage versus spammy activity, incentives, or repeated automated behavior? Still, you don’t get to hundreds of millions of transactions by accident.

Supply and Dilution: Less “Unlock Fear,” More Demand Focus

Token side, the supply picture is basically “most of it is already out.” CoinMarketCap shows ~2.25B circulating out of a ~2.4B max, plus ~11K holders. That matters because a lot of small caps are landmines where the real unlocks are still ahead of you. Here, the dilution story looks more limited than average, which shifts the conversation toward demand and retention instead of “what’s the next unlock schedule doing to me.”

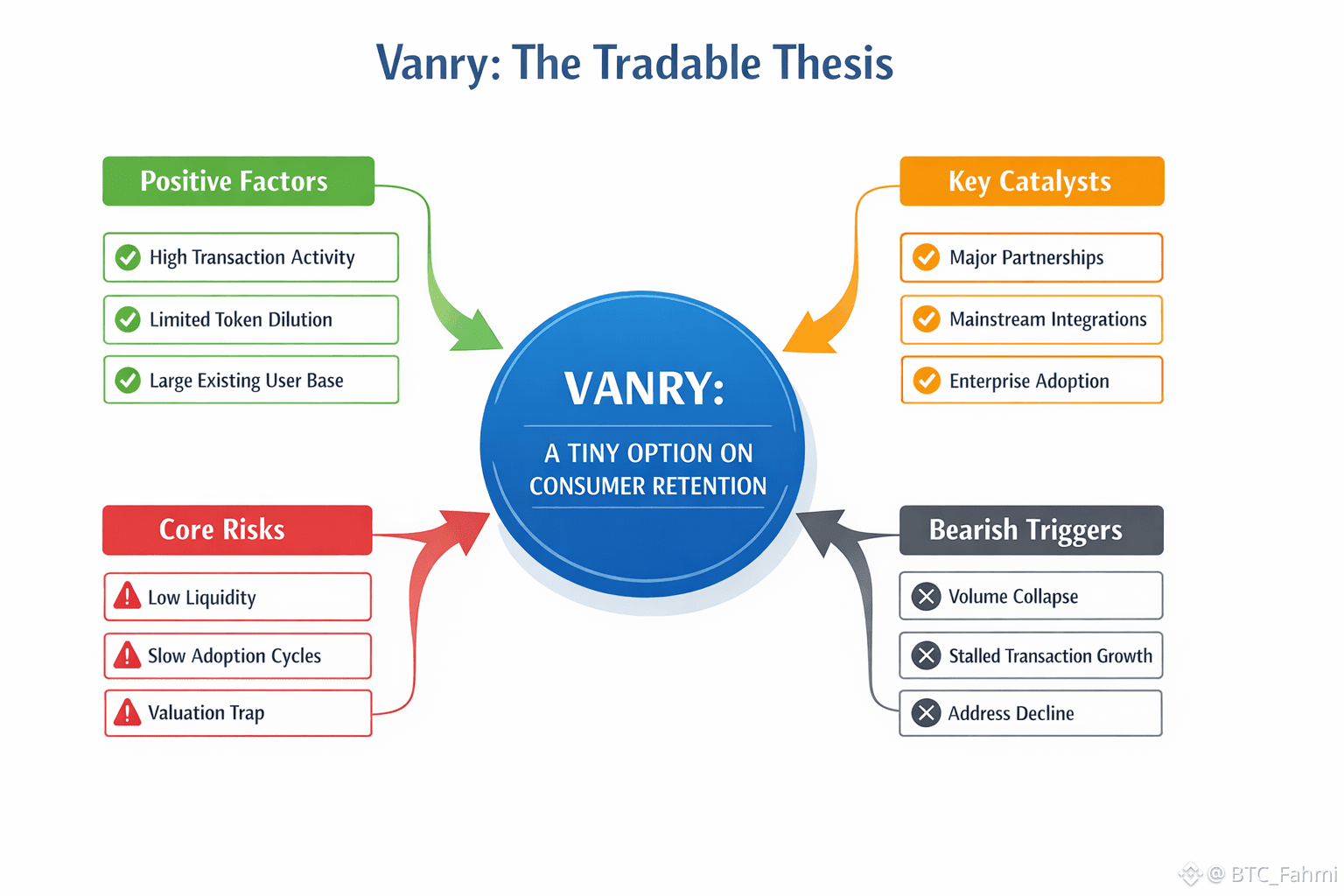

The Tradable Thesis: A Tiny Option on Retention

So what’s the tradable thesis? For me it’s this: VANRY is priced like a tiny option on whether Vanar can convert “consumer-friendly chain” into actual consumer activity that persists. And the market is not great at pricing retention early. It prices headlines. It prices listings. It prices a green candle. Retention shows up later, quietly, in address activity that doesn’t collapse after incentives, in apps that keep generating transactions when nobody is tweeting, and in volume that holds up even when price chops.

Catalysts That Matter: Distribution and Follow-Through

A concrete catalyst angle is partnerships and distribution. Vanar’s own press page highlights activity with major payments branding, like an appearance with Worldpay at Abu Dhabi Finance Week tied to “agentic payments.” That kind of thing can be fluff, or it can be the start of real pipes getting built. Traders should treat it as a “watch for follow-through” item, not as proof by itself. The only version that matters is the one where you see product usage later, not just stage photos.

Risk Map: Where This Breaks

Let’s talk risks, because there are plenty. First, valuation can be a trap at this size. A $15–$17M market cap feels “cheap,” but cheap things can always get cheaper, especially if liquidity thins out or a few wallets control the flow. Second, DeFi depth looks limited. Third party trackers that estimate DEX liquidity put it in the hundreds of thousands of dollars, which is not nothing, but it’s also not the kind of liquidity that absorbs panic well. If you’re trading size, you care about that. Third, the big strategic risk: if the chain is really targeting entertainment and brands, adoption cycles are slow. Studios and brands move at corporate speed. That means long periods where the chart can bleed while builders “make progress.”

What Flips Me Bearish

What would make me change my mind in a bearish way? Two things. One, if those on chain totals stop translating into ongoing activity, like if transaction growth stalls and new addresses flatten while the team keeps pushing only marketing. Two, if volume collapses relative to market cap and VANRY starts trading like a forgotten microcap. High volume on a small cap can be a gift, but when it disappears, exits get ugly.

Scoreboard Math: Market Cap Scenarios

Now the grounded bull case. Don’t think in “price targets” first, think in market cap scenarios and do the math. If circulating supply is about 2.25B, then a move to a $100M market cap implies roughly $0.044 per VANRY (100,000,000 ÷ 2,250,000,000). A $250M cap implies about $0.11. Those numbers aren’t predictions, they’re just the scoreboard if adoption actually shows up and the market re rates it from “tiny option” to “credible network with usage.” The bear case is simpler: it chops lower, liquidity dries up, and it stays a sub $20M story because usage never becomes visible enough to force re-pricing.

The Mental Model: Make the Rails Boring

If you’re looking at Vanar as a trader, I’d frame it like this: you’re not betting that “blockchain tech wins.” You’re betting that Vanar can make the blockchain boring, so the apps get to be the point. Think of it like payment rails. Nobody cares what rails Visa runs on, they care that the card works everywhere. If Vanar gets even a small version of that dynamic inside its target niches, the token stops trading purely on hype cycles and starts trading on usage expectations.

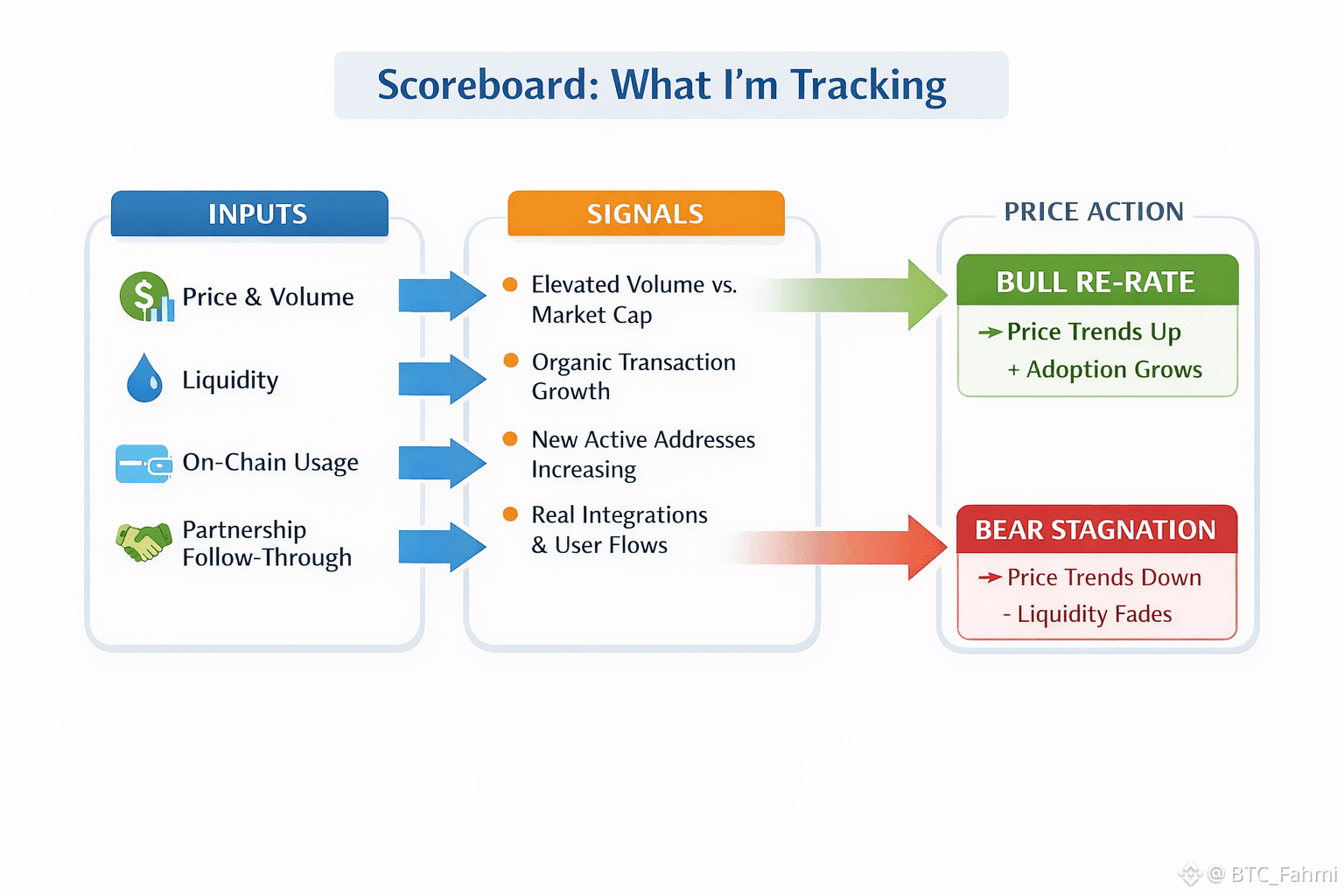

What I’m Tracking From Here

What I’m tracking from here is pretty straightforward. Does daily volume stay elevated relative to market cap, or does it fade? Do transactions and addresses keep climbing in a way that looks organic, not just bursts? Do we see real follow through from the payments and enterprise facing narrative, meaning actual integrations and user flows, not just announcements? And does liquidity improve, even modestly, so the market can handle volatility without turning into a slip and slide?

If Vanar pulls that off, VANRY won’t need to be the star. And ironically, that’s when the token usually starts acting like it deserves attention.