Stablecoins such as USDT and USDC are no longer in a niche of crypto. Hundreds of billions of dollars of supply and trillions of annual transaction volume are attributed to them to-day. Systems of transporting them, Ethereum, Tron, Solana, and so on, have never been geared towards stablecoins in the first place. The smart contracts and speculation had been the focus of these blockchains, rather than the speedy, inexpensive, and predictable transfer of money. Plasma shifts redefine a paradigm by building a blockchain, in which the core part is filled with stablecoins.

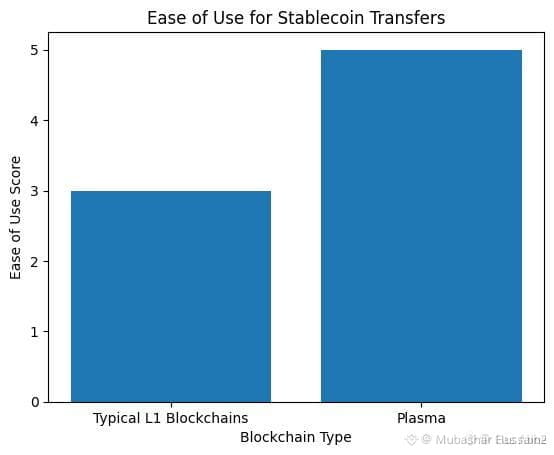

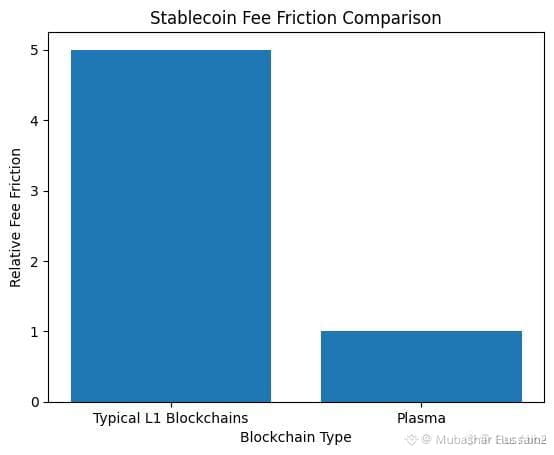

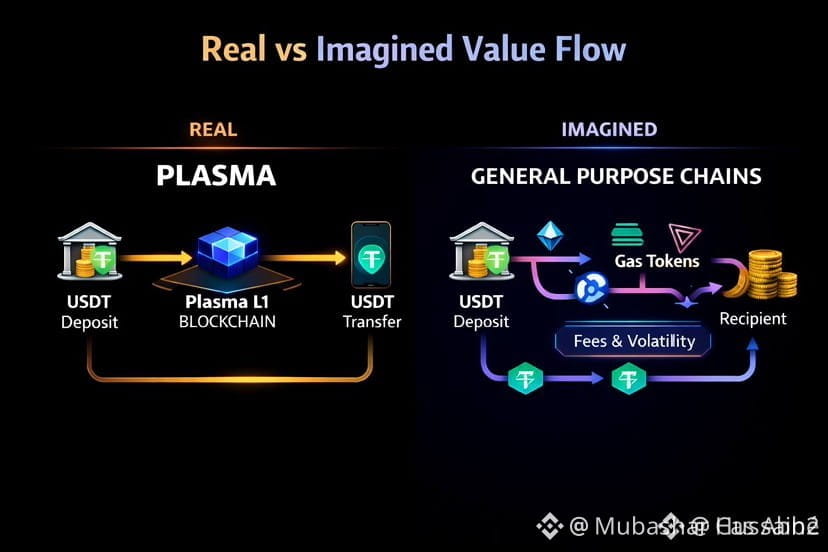

Plasma is a Layer-1 blockchain designed to ensure that the stablecoins act as cash in our daily lives. The majority of chains make them save and pay gas in a native currency (ETH, SOL, etc.), which in effect compels one to purchase a speculative asset simply to transfer dollars. The friction is removed by plasma. It provides free transfers of USDT on default based on a protocol-level infrastructure allowing gas to be sponsored on transfers of stablecoins, meaning that transferring USDT by default can be easy as sending a text message.

Why That Matters

Imagine the world where companies can withdraw payrolls, traders can accept online dollars in real-time, and cross-border remittance does not incur huge charges, and the sender does not control unstable tokens. Plasma is not only meant to be used in experimenting with crypto in the real world. It does not want to be Ethereum and more; it has a point: stablecoins first, full stop.

This interest is reflected in the network design:

1- PlasmaBFT Consensus - a modified, high-speed consensus protocol, which provides sub-second finality, confirms transactions nearly instantly and can support thousands of transactions per second, which is critical to make stablecoins to act like money.

2- EVM Compatibility - a developer who is knowledgeable of Ethereum tools (MetaMask, Hardhat, etc.) can use Plasma with no additional knowledge, reducing the cost of building a real financial application.

3- Gas Abstraction - users are able to pay fees in stablecoins or pegged Bitcoin tokens accrued through bridges, not having to pay XPL in order to use simple functionality.

Six Sigma More Than Just Payments-The Growing Ecosystem.

Although the first application, Plasma was initially based on the ability to transfer stablecoins, the vision has been expanded:

Cross Chain Liquidity through NEAR Intents.

On January 23, 2026, Plasma became the first liquidity protocol based on NEAR Intents, which links more than 25 blockchains and 125+ assets. This implies that the USDT and XPL of Plasma can now be swapped and routed across significant networks with ease to further increase real utility and liquidity depth, more than that of Plasma own chain.

This is important since liquidity is the blood on financial networks. It allows large settlements, volume trading and real commercial activity without bottlenecks.

Minimized Bitcoin Bridge based on Trust.

Stablecoins are not the only type of plasma. It presents a trust-minimized Bitcoin bridge which allows users to deposit BTC and be awarded a one-to-one wrapped form (pBTC) which exists on Plasma. This token wrapped can be transmitted in DeFi, collateral, or payments without a centralized custody and the utility of Plasma as a larger financial rail is enhanced to connect the largest asset in crypto to programmable money flows.

Under Development: Confidential Payments.

Plasma is also exploring a privacy layer that lets do confidential transactions- protecting amounts and participants- without compromising compliance or compatibility with the existing wallets and apps. This is with the objective of satisfying actual financial applications like payroll and treasury flows.

Neobank (Stablecoin) Plasma One.

Plasma, which is a stablecoin-based neobank, is pre-launched, and was presented as Plasma One, which includes zero-fee transfers, virtual cards and multi-country rewards. This implies that Plasma refers to products that people and businesses can use, not only chains and blocks.

The Role of XPL--Not another Token.

Most blockchains have their native token, yet the native asset of Plasma, XPL, has its intended and reasonable uses:

1- Network Security -Validators Stake XPL in order to safe the blockchain and get rewards.

2- Gas to Complex Operations and Simple Operations Same as basic transfers of stablecoins, advanced smart contracts and actions triggering still require XPL or other whitelisted assets.

3- Governance and Growth XPL holders are also involved in the governance and guide the direction of the network in the long run.

This is what makes XPL the foundation of the long-term stability of Plasma people are not coerced into purchasing this product in order to utilize the system.

Where Plasma Stands in 2026

Plasma is a moving field: According to research, Plasma is developing actively:

The major integrations such as NEAR Intents are broadening the cross-chain functionality.

There is actual consumer orientation in product extensions like neobanking.

Technical capabilities include secret transactions and Bitcoin connecting, which are underway or operational and enhance applicability.

Conclusion- Why Thesis of Plasma Matter

Historically in blockchain, platforms have only been successful after they fulfill real needs, such as messaging was solved by email, information access by the web, etc. The thesis presented by Plasma is simple; money must flow like data and cheaply. The most common kind of crypto asset is already represented by stablecoins. The simple question posed by plasma is: Why not treat them like real money by infrastructure?--and then gives it the answer in technology, partnerships and products.

In a globalized context where the global finance is being redefined, the Plasma approach is not simply doing everything but doing money movement right. And that’s a big deal.