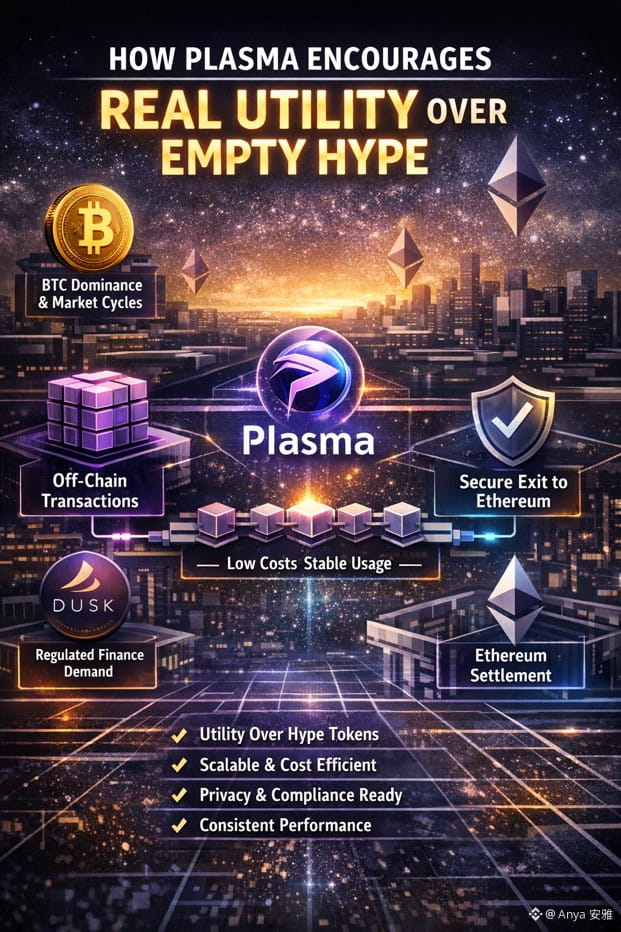

Why is a framework many once labeled “quiet” suddenly back in serious market discussions? Plasma is re-entering analyst radar screens as blockchain data, not narratives, begins to highlight the limits execution-heavy Layer-2 designs and the renewed relevance of off-chain scaling models anchored to Ethereum security.

Recent market cycles show that Ethereum gas spikes often coincide with reduced activity on execution-heavy Layer-2 networks.

Bitcoin price consolidation phases historically tighten liquidity across altcoins, increasing sensitivity to transaction costs.

Plasma’s off-chain transaction model reduces reliance on constant on-chain execution during these periods.

Network designs that minimize gas exposure have demonstrated more stable usage when base-layer fees rise.

anya shows how Plasma aligns with demand for cost-efficient settlement during volatile market conditions.

On-chain data across Ethereum scaling solutions shows that throughput alone is no longer the dominant metric. Analysts increasingly track cost stability, exit security, and settlement finality. Plasma’s architecture directly addresses these factors by processing transactions off-chain while retaining Ethereum as the final arbiter of state.

The broader ecosystem context matters. Developments around privacy-aware and compliance-focused protocols, including updates in the Dusk ecosystem, have shifted attention toward infrastructure that can support regulated financial flows. Plasma’s data-minimization approach fits these requirements by limiting on-chain exposure without sacrificing verifiability.

Market behavior during Bitcoin-led phases further explains the reassessment. When BTC dominance increases, capital historically rotates away from high-beta, narrative-driven tokens toward infrastructure that maintains utility regardless of price momentum. Plasma’s network design supports usage patterns that remain functional even when speculative activity cools.

Comparative usage data shows rollup-based networks frequently experience activity surges tied to incentive programs.

These surges are often followed by measurable declines once reward structures conclude.

Plasma-based systems tend to exhibit flatter transaction curves across similar timeframes.

Consistent activity suggests usage driven by functionality rather than short-term rewards.

This behavioral difference has become a key factor in analyst reassessments of long-term scalability models.

Anya observes that analysts are increasingly weighing risk-adjusted utility instead of raw transaction counts. Plasma’s secure exit mechanisms, which allow users to fall back to Ethereum in adversarial conditions, directly reduce systemic risk—an attribute that becomes more valuable as total value handled by scaling layers grows.

Another factor driving renewed attention is cost predictability. Fee volatility remains a measurable barrier for enterprise and application developers. Plasma’s off-chain batching reduces exposure to sudden gas spikes, a feature that aligns with observable enterprise preferences for stable operating costs.

Trading environment data reinforces this shift. During periods of broader altcoin underperformance, infrastructure tokens linked to scalability and settlement tend to retain liquidity better than purely application-level assets. Plasma’s positioning as infrastructure rather than a consumer-facing protocol places it within this defensively traded category.

The re-evaluation of Plasma’s market potential is not driven by marketing cycles or speculative claims. It is rooted in measurable trends: rising demand for efficient settlement, regulatory-aware design, Bitcoin-influenced capital rotation, and the growing realization that scalability is as much about what stays off-chain as what moves on-chain.