Bitcoin faced a sharp selloff today, dropping to the $83,000 zone, marking its lowest level in over two months. The move erased last week’s optimism and caught many traders off-guard, as multiple macro and crypto-specific pressures hit the market at the same time.

🔻 BTC Breakdown: What Happened?

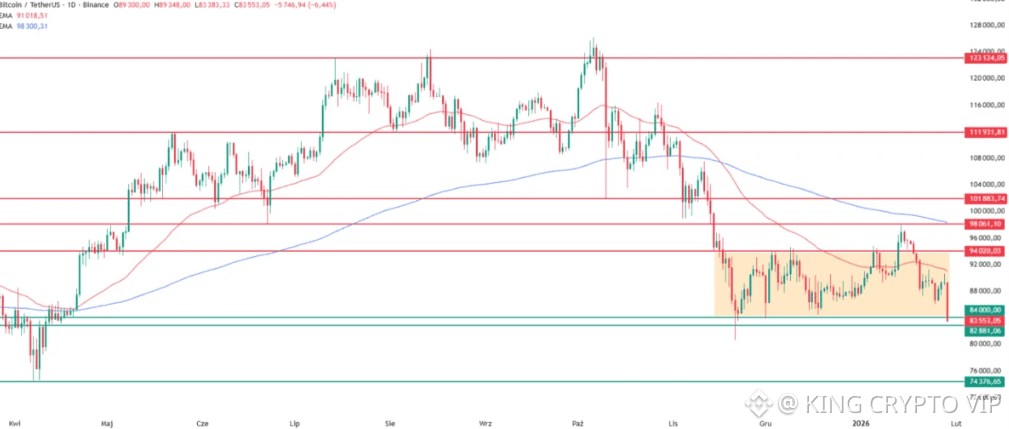

Bitcoin fell more than 6% intraday, slipping from the $90K region into the low $83K range. The decline wasn’t isolated—nearly 90% of top cryptocurrencies followed BTC into the red. Trading volume spiked sharply, signaling forced exits and leveraged position unwinding rather than calm selling.

Key Reasons Behind Today’s Bitcoin Crash

1️⃣ Massive Bitcoin ETF Outflows

Spot Bitcoin ETFs recorded over $1.1 billion in net outflows this week, the largest since early January. Selling pressure was heavily concentrated among large institutional funds, pointing to strategic reallocation rather than retail panic. When big money steps back, price reacts fast.

2️⃣ Capital Rotating Into Gold & Commodities

While crypto struggled, gold and silver surged to new highs, attracting risk capital away from digital assets. With BTC underperforming commodities and major indices, investors are temporarily favoring assets seen as safer in uncertain macro conditions.

3️⃣ Fed Uncertainty Keeps Pressure On

The Federal Reserve kept interest rates unchanged, but failed to signal aggressive future cuts. That “wait-and-see” stance strengthened the US dollar and bond yields—historically negative for risk assets like Bitcoin.

4️⃣ Geopolitical & Trade Tensions

Fresh concerns around rare earth tariffs and global trade restrictions reignited volatility across markets. These headlines increase uncertainty, pushing traders to reduce exposure to high-beta assets such as crypto.

5️⃣ Bearish Options & Liquidations

Nearly 97% of short-term BTC call options are set to expire worthless, while put options surged in activity. This shift in derivatives positioning accelerated downside momentum.

As prices dropped, a liquidation cascade wiped out ~$319 million, with over 96% coming from long positions—clear evidence bulls were caught on the wrong side.

📉 Technical View: Critical Zone

BTC is now testing the lower boundary of its multi-month consolidation range. The $82K–$84K area is a crucial support zone. A clean bounce could stabilize sentiment, but failure to hold may open the door to deeper retracements.

🔍 What Traders Are Watching Next

ETF flow reversal or stabilization

Fed Chair developments & policy clarity

BTC reaction around key support levels

Short term: stay cautious, avoid heavy leverage

Mid-to-long term: volatility may offer strategic accumulation opportunities for high-conviction holders

Is this a panic dip—or the start of a deeper correction? 👀

#Bitcoin #BTC #CryptoNews #MarketCorrection #ETF