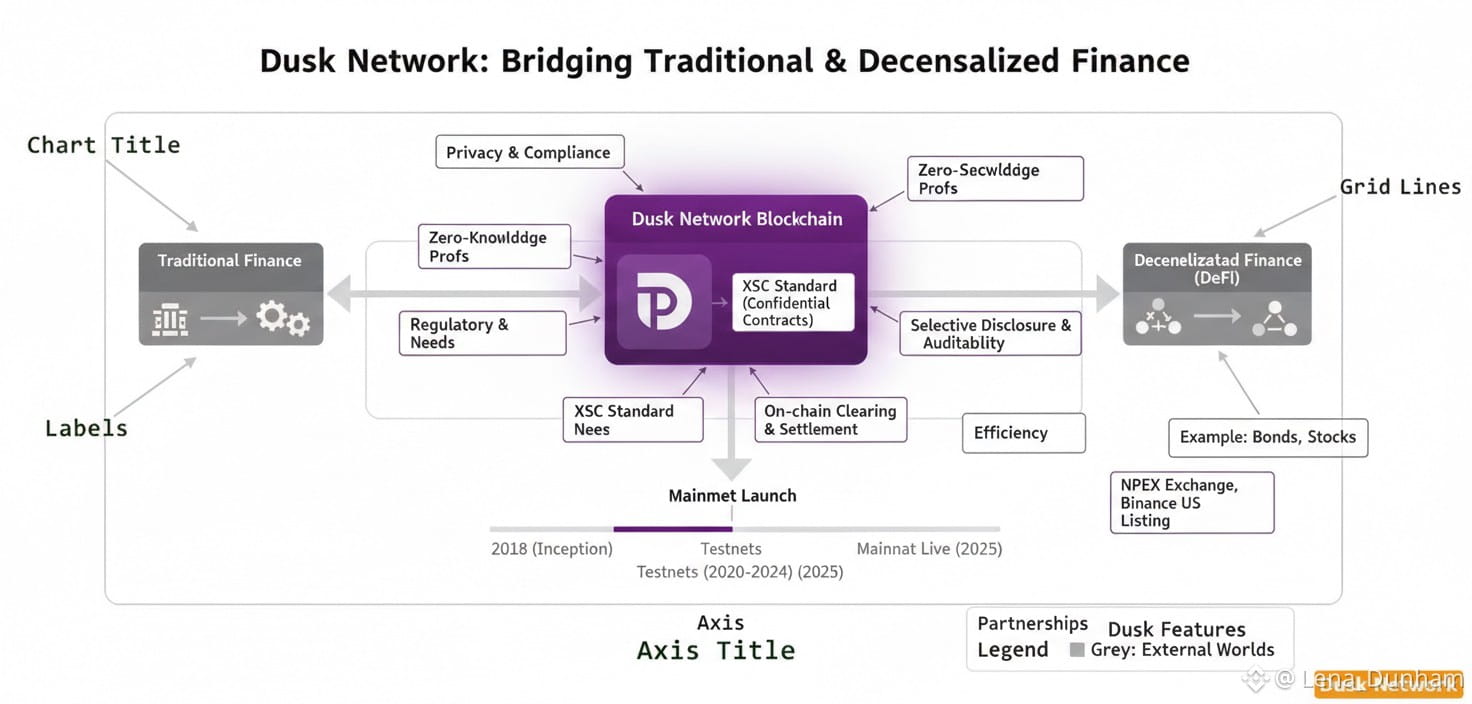

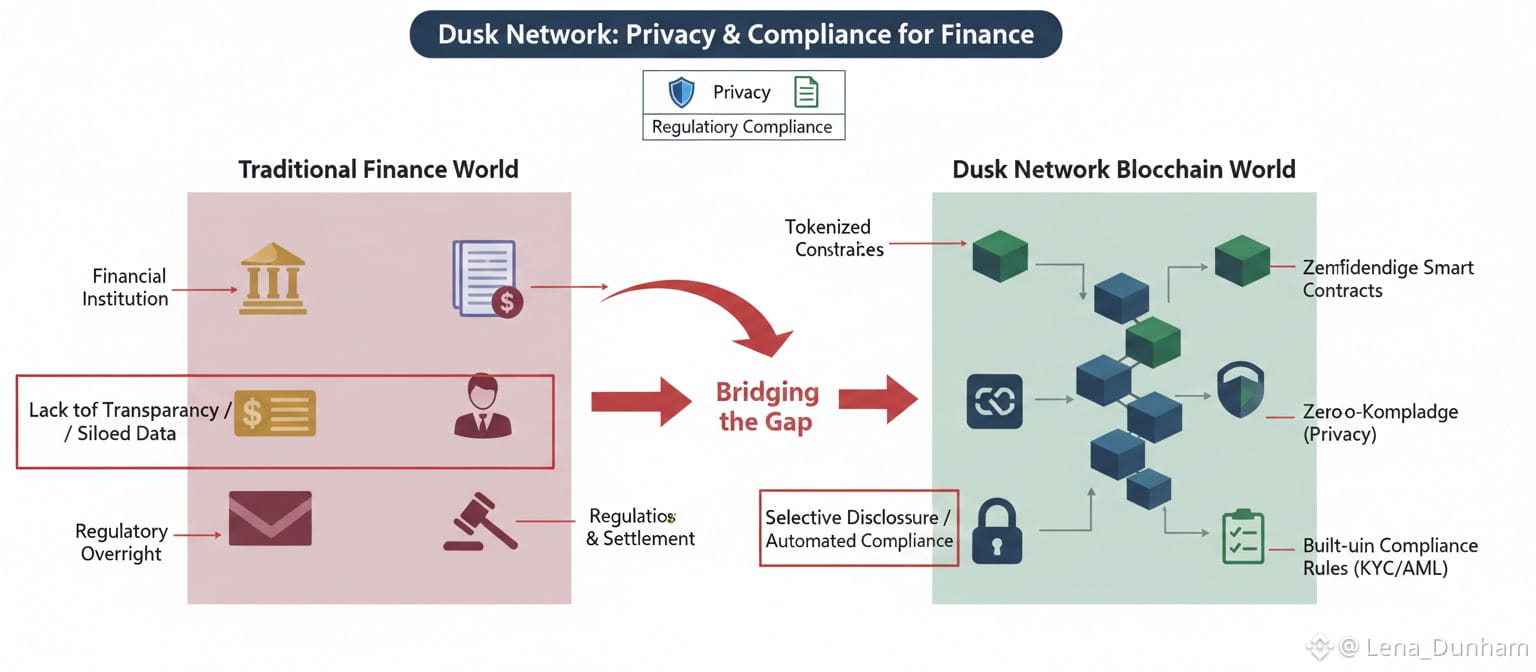

Dusk Network is a layer1 blockchain specifically built for regulated finance. It is not just another smart contract platform like Ethereum or Solana. Dusk was created to solve one of the biggest problems preventing serious financial players from adopting blockchain technology: privacy and regulatory compliance. Traditional public blockchains are fully transparent by design. Every transaction, every address balance, every token flow is visible to anyone. That is a great feature for decentralized finance (DeFi) enthusiasts, but it makes real finance nervous. Financial institutions like banks, broker-dealers, stock exchanges and asset managers work with extremely sensitive data. They cannot put their client lists, portfolio holdings, trading flows or risk exposures on a public ledger for the world to see. This has been one of the biggest blockers for real-world adoption of blockchain.

Dusk changes that. It is designed to let institutions issue, trade, clear and settle tokenized financial assets such as bonds, stocks, and other securities on-chain, while still obeying rules like know-your-customer (KYC), anti-money-laundering (AML), reporting requirements, eligibility rules and more. The network makes it possible to do this with privacy where needed and transparency where required, solving a real practical need rather than chasing a theoretical ideal.

In simple language, Dusk wants the blockchain world and the traditional financial world to finally be able to talk to each other. For the first time, regulated assets and regulated markets can exist side by side with decentralized technology. This is why the mainnet launch is a big deal.

The Mainnet Launch: A New Phase for Dusk

The launch of the Dusk mainnet marks a new chapter in a project that began in 2018. After years of research, development, testnets and refining its technology, Dusk’s mainnet is now live. This transforms the network from a testing environment into a live, decentralized, public blockchain where real users can interact with real financial applications.

This is important for several reasons:

Technology moves from theory to reality. With mainnet live, developers, institutions and partners can build real applications that will operate on the blockchain.

Privacy and compliance are no longer concepts but practical tools. Users can now launch tokenized products with privacy-preserving features and still meet regulatory standards.

Institutions can test and adopt blockchain in a serious way. Banks and asset managers have been waiting for infrastructure that meets their needs, not just infrastructure that traders or retail users like. Dusk delivers that.

In everyday language, the mainnet launch means that what used to be future potential is now actual present capability.

Privacy Meets Compliance: How Dusk Balances Two Opposite Worlds

One of the toughest challenges in blockchain is privacy. Public blockchains give everyone perfect visibility into every detail of every transaction. That is fine for many things, but not for regulated finance. Dusk solves this using zero-knowledge proofs.

Zero-knowledge proofs are cryptographic tools that let someone prove something without revealing the underlying data. In Dusk’s case, this means an institution can prove to a regulator that a transaction met compliance standards without revealing all transaction details to the public. This approach is called selective disclosure and it is what makes Dusk so unique and powerful.

In simple terms:

If a regulator needs to confirm that transactions follow KYC/AML rules, they can be shown the relevant proof.

If the public does not need to see transaction details, they remain hidden.

Sensitive data stays private, but accountability remains intact.

This was something that traditional financial institutions have been asking for. They want blockchain benefits like automation, settlement efficiency and transparent rules, but they also need privacy for clients and trade secrets.

Another innovation that Dusk brings is its support for confidential smart contracts and a special token standard called XSC (Confidential Security Contracts). These are designed for the regulated issuance and trading of tokenized securities. They allow confidentiality while still ensuring legal and audit requirements are met.

Put plainly, Dusk lets you have privacy where it matters, and transparency where it is legally required.

Built for Real Financial Markets

Dusk is not just privacy tools glued onto a blockchain. It was built from the start to meet real financial market needs like issuance, clearing, settlement, corporate actions and regulatory reporting. These are the core services that modern financial markets require.

The architecture of Dusk makes it possible for:

Native issuance of tokenized securities (stocks, bonds, etc.) that behave like real financial instruments.

On-chain clearing and settlement, removing layers of intermediaries and reducing costs and settlement times.

Compliance with regional regulations like MiFID II, MiFIR, MiCA, GDPR and others.

Real-time transaction certainty, because transactions are final once settled on Dusk’s consensus.

These are not small improvements. They are fundamental changes to how financial markets operate.

By embedding rules directly into the blockchain, Dusk makes financial processes faster, cheaper, and more secure. It also means that traditional players do not have to build separate systems to meet regulatory requirements—these become a part of the network itself.

Real World Adoption and Partnerships

Dusk is not working alone. Over the years, it has built relationships and partnerships with real financial institutions that are already testing the technology. These partnerships demonstrate that real players are paying attention, not just crypto traders.

One example is the collaboration with NPEX, a licensed Dutch stock exchange. Together they aim to tokenize real European assets and bring them on-chain. This means real securities could soon be traded using Dusk’s compliant infrastructure.

Dusk has also joined privacy initiatives like the Leading Privacy Alliance, in which it collaborates with other Web3 projects to promote privacy integration in digital ecosystems.

These developments matter because they show the project is not building in a vacuum. It is working with organizations that have a stake in legal, regulated markets. When real markets start to adopt blockchain technology, the effects can be transformative.

DUSK Token and Market Access

The native token of the Dusk Network is DUSK. It plays a central role in the network’s operation. It is used to pay fees, secure the network through staking, and power smart contract activity.

Recently DUSK received a major boost by being listed on Binance US, one of the largest and most regulated cryptocurrency exchanges. This listing opened access for US traders and institutions to participate in a compliant and regulated blockchain ecosystem.

Binance US listing matters because it connects the project with one of the biggest pools of liquidity and participants in the world. For a project focused on real world assets and regulated markets, this kind of exposure and accessibility is significant.

In addition to Binance US, the token has also expanded its accessibility on other major exchanges such as KuCoin. This broad market access makes it easier for developers, investors, and institutions to engage with the platform and support its growth.

Why This Moment Is So Significant

The timing of Dusk’s mainnet launch could not be more relevant. Worldwide, regulators are increasingly demanding infrastructure that can support tokenized securities and digital assets without sacrificing compliance. Traditional blockchains often fall short in this area because they lack privacy and controls that institutions legally require.

Regulators want auditability, reporting, eligibility controls, KYC/AML rules, and proof of compliance. Dusk delivers these tools at the protocol level, meaning they are baked into the blockchain itself. This removes the need for costly add-ons or separate compliance layers.

At a time when governments and financial regulators are debating how to handle digital assets, having infrastructure that can meet both the technical and legal requirements of financial markets is a huge step forward. In simple words, Dusk might finally give the old financial world a reason to adopt blockchain in a serious way.

What Comes Next

With the mainnet now live, the next phase for Dusk will involve real deployments, pilots and live applications. Here are some things to watch:

Tokenized securities trading on regulated venues enabled by Dusk.

Institutional adoption of privacy-preserving finance on chain.

DuskEVM development, which will let developers deploy EVM-compatible smart contracts with privacy options.

Growth of the ecosystem of compliant applications as new projects build on the mainnet.

Further exchange listings and market integration expanding accessibility of DUSK.

The road ahead is full of potential. Dusk is no longer a project in development. It is now a working, live platform with real technical advantages and real use cases.

Conclusion

The launch of the Dusk Network mainnet is more than a milestone for one project. It is a signal that blockchain technology is finally ready to serve real financial markets. After years of talk, regulation, compliance issues and technical limitations, there is now an infrastructure capable of balancing privacy, transparency, decentralization, and compliance.

What makes this moment important is not just the technology itself, but its relevance to the real world. Regulators are demanding compliant infrastructure. Institutions want privacy and legal certainty. Markets need efficiency and transparency. Dusk offers all of this in a single platform.

For anyone paying attention to how blockchain will be adopted by regulated industries, this mainnet launch is a moment worth noting. Dusk is not just another crypto project. It is a quietly built, deeply engineered infrastructure aiming to bridge the gap between traditional finance and decentralized technology. And now that the mainnet is live, it can finally prove its value in the real world.