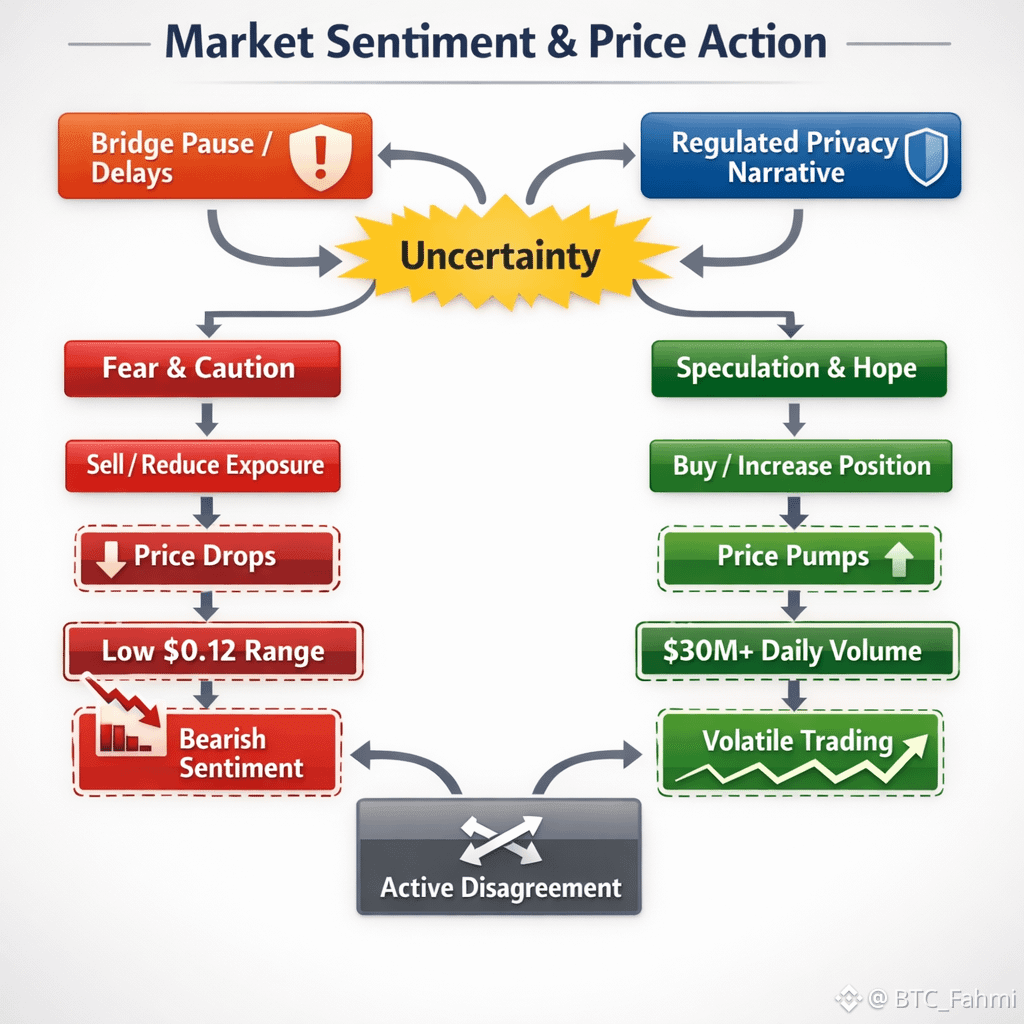

If you’re looking at DUSK right now, the first thing you notice isn’t some slow grind higher. It’s the chop and the mood. DUSK is sitting around the low $0.12s after a nasty 24h drawdown, with roughly ~$30M+ in daily volume on a ~$60M-ish market cap. That’s not “nobody cares” activity. That’s traders actively disagreeing on what this thing is worth.

Sentiment Check: The Narrative’s Strong, Patience Is Weak

Here’s my read on the sentiment: the market wants to believe the “regulated, privacy-preserving rails” narrative, but it’s tired of waiting for the moment where usage is obvious on-chain instead of implied in blog posts. And when there’s any operational wobble, it hits harder because DUSK isn’t priced like a blue-chip. The recent bridge incident notice and the explicit language about pausing bridge services until review completion, plus “resuming the DuskEVM launch,” is the kind of thing that makes spot holders defensive and makes perp traders smell blood.

The Core Bet: Privacy by Default, Disclosure by Design

Now here’s the thing. Dusk’s core bet is actually pretty specific, and that’s a positive if they execute. They’re not trying to be the chain for everything. They’re trying to be the settlement layer where privacy exists by default, but can be selectively revealed when it has to be. Think of it like a bank vault with a viewing window that only opens for the right people, instead of a vault that’s either fully see-through or fully opaque. That “privacy when you need it, transparency when required” framing is central to how they describe the network, and it’s exactly the wedge that could matter for real-world financial assets that can’t live on a purely anonymous rail.

What Traders Should Actually Care About: Hedger + Compliance-Ready Privacy

The tech piece that matters for traders isn’t “zero-knowledge proofs” as a buzzword. It’s what they’re using it for. Hedger is their pitch for bringing confidential transactions to an EVM execution layer while keeping them audit-friendly, and they explicitly talk about compliance ready privacy rather than hiding everything. If this works in practice, it’s the difference between “cute cryptography demo” and “something institutions can actually touch.”

Why the Market’s Twitchy: Infra Narratives Live or Die on Reliability

So why is the market still twitchy? Because the timeline and the plumbing are the whole story here. When your big narrative is regulated finance infrastructure, reliability is the product. A bridge pause and a delayed launch, even if justified, translates to one simple trade: reduce exposure until uncertainty clears.

Supply Reality: Emissions Mean Demand Has to Show Up

And it’s not like the token is scarce in the short run. Circulating supply is basically ~497M already, max supply is 1B, with another 500M emitted over decades for staking rewards. That’s not automatically bad, but it means demand has to show up over time to offset steady emissions.

Tokenomics Trap: Staking Yield Isn’t “Free”

Tokenomics wise, DUSK is pretty straightforward: 500M initial supply, then long-dated emissions to reward stakers, pushing toward that 1B cap. The trap traders fall into is treating staking yield like “free money.” It’s not. It’s dilution paid to participants. If real usage fees and real demand don’t grow into the emissions schedule, staking yield just becomes a slow leak on price. If you’ve traded L1s before, you already know this movie.

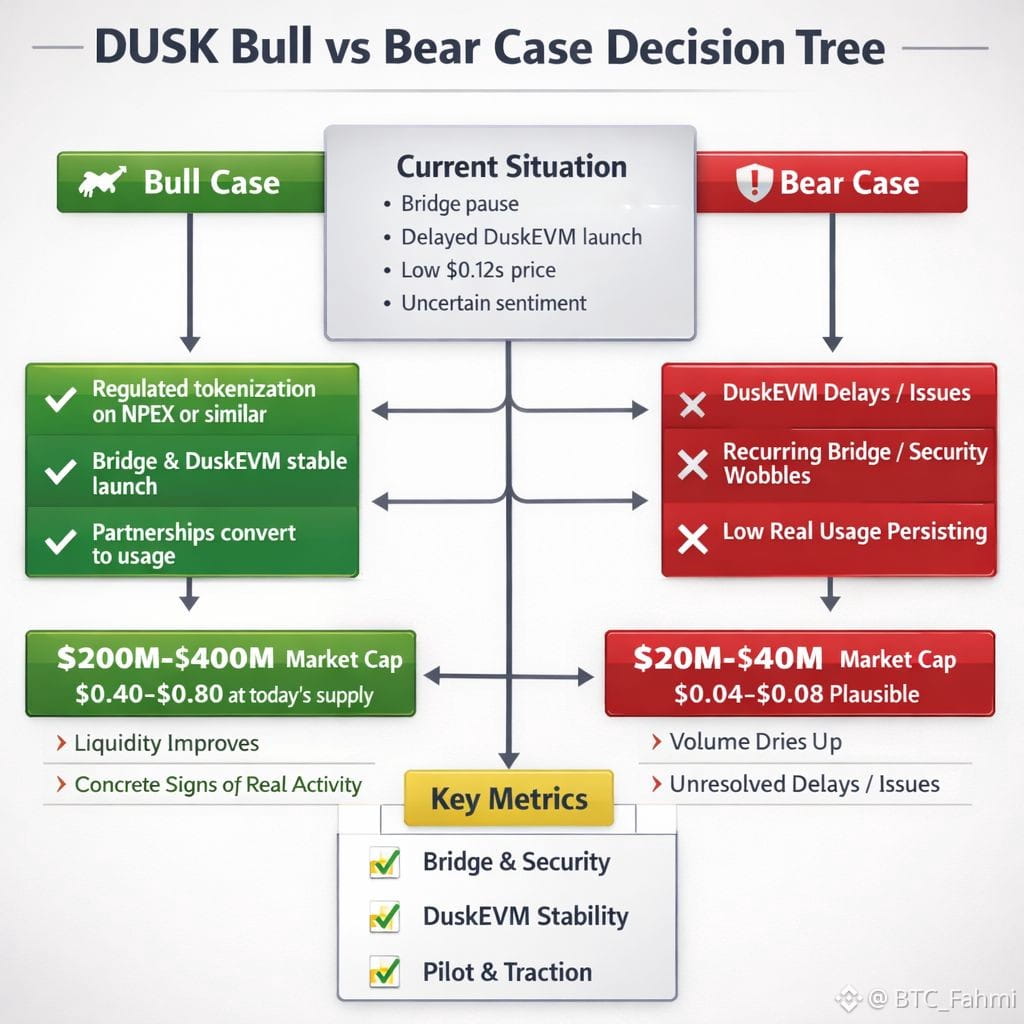

Bull Case: From Announcements to On-Chain Habit

The bull case is not “DUSK goes back to ATH because vibes.” The bull case is: Dusk actually becomes a credible venue for compliant tokenization and trading flows, and the ecosystem proves it can attract regulated counterparties. The Chainlink partnership post, tied to bringing listed equities and bonds on-chain with NPEX mentioned as a regulated Dutch exchange, is the kind of narrative catalyst that can turn into real transaction demand if it moves from announcement to production usage.

Upside Math: What a Re-Rating Looks Like

If that happens, it’s not crazy to see a re-rating from ~$60M market cap to, say, $200M–$400M as liquidity improves and the story gets validated. At today’s supply, that’s roughly $0.40–$0.80. Not a promise, just the math of what “people finally care” can look like when the base is small.

Bear Case: Delays + Fragile Plumbing = Slow Bleed

But I’m not ignoring the bear case, because the bear case is clean and it’s why traders fade these rallies. If DuskEVM timelines keep slipping, if bridges and onboarding stay clunky, and if “auditable privacy” ends up being a hard sell to both regulators and developers, then you get the classic slow bleed: volume dries up, the market stops giving the benefit of the doubt, and DUSK trades like an underutilized infra token with emissions.

Downside Math: What Capitulation Could Price In

In that world, a $20M–$40M market cap is plausible, which is roughly $0.04–$0.08, especially in a risk-off tape.

What I’m Watching: Clear Triggers, Not Hope

So what would change my mind in either direction? For bullish confirmation, I’m watching for concrete signs that the “regulated rails” thesis is turning into measurable activity: bridge reopening with no drama, DuskEVM actually shipping and staying stable, developer traction that isn’t just hackathon noise, and partnerships converting into live pilots with recurring transaction patterns.

For bearish confirmation, it’s more of the same: delays without clear delivery, security or bridge issues repeating, and market structure telling you there’s no real spot bid under the token once momentum traders leave.

Zooming Out: The Category Is Real Execution Decides the Token

Zooming out, Dusk sits in a category that’s getting more relevant: privacy that can coexist with compliance, especially if tokenized assets and regulated on chain settlement keep growing. The market doesn’t pay you for the idea forever, though. It pays you when the idea becomes a habit for real users. If you’re trading this, treat it like what it is today: a narrative that’s close to proving itself, with execution risk still priced in.