Plasma is a Layer 1 blockchain based on the rather original idea that stablecoins should act, feel, and move like real money instead of like risky crypto assets. Plasma specifically focuses on stablecoin settlement, payments, and financial rails while most blockchains aim to maximize for everything at once. This design decision influences every financial and technical decision underlying the network, from agreement through gas mechanics and security anchoring.

Plasma is fully EVM compatible and is driven fundamentally by a modern Ethereum execution client design. This lets developers reuse established tools, leverage existing Ethereum smart contracts with minimal effort, and add liquidity without changing their technical setup. Plasma does not urge developers to embrace a new coding approach; rather, it matches the execution environment with the needs of stablecoin-based applications including payroll, on-chain settlement, payments, and remittances.

Fast-finality consensus mechanism One of Plasma's unique features is PlasmaBFT. PlasmaBFT is designed for low-latency and high-throughput environments. It is perfect for real-world payment streams when waiting ten of seconds is just too long. It aims for near-instant confirmations. In traditional finance, settlement speed is a competitive advantage. Plasma tries to include that mindset on-chain, therefore enabling transactions that feel quick instead of probabilistic.

Stablecoins on Plasma are regarded as top-tier citizens. Unlike most blockchains where users need to own a volatile native token only to move value, Plasma offers stablecoin-centric gas systems. Built-in tools let users pay fees or abstract supported stablecoins without personally managing gas tokens. Fees can also be paid with stable assets. This greatly lowers onboarding friction and aligns the user experience with how people already view money for non-crypto-native customers.

This layout is especially relevant in high-adoption locations when stablecoins already serve as a dollar substitute for remittances, savings, and daily payments. Plasma offers not just speculative activity as framework for these real-world financial activities. This translates for retailers, fintech firms, and payment processors into less UX challenges and more regular costs.

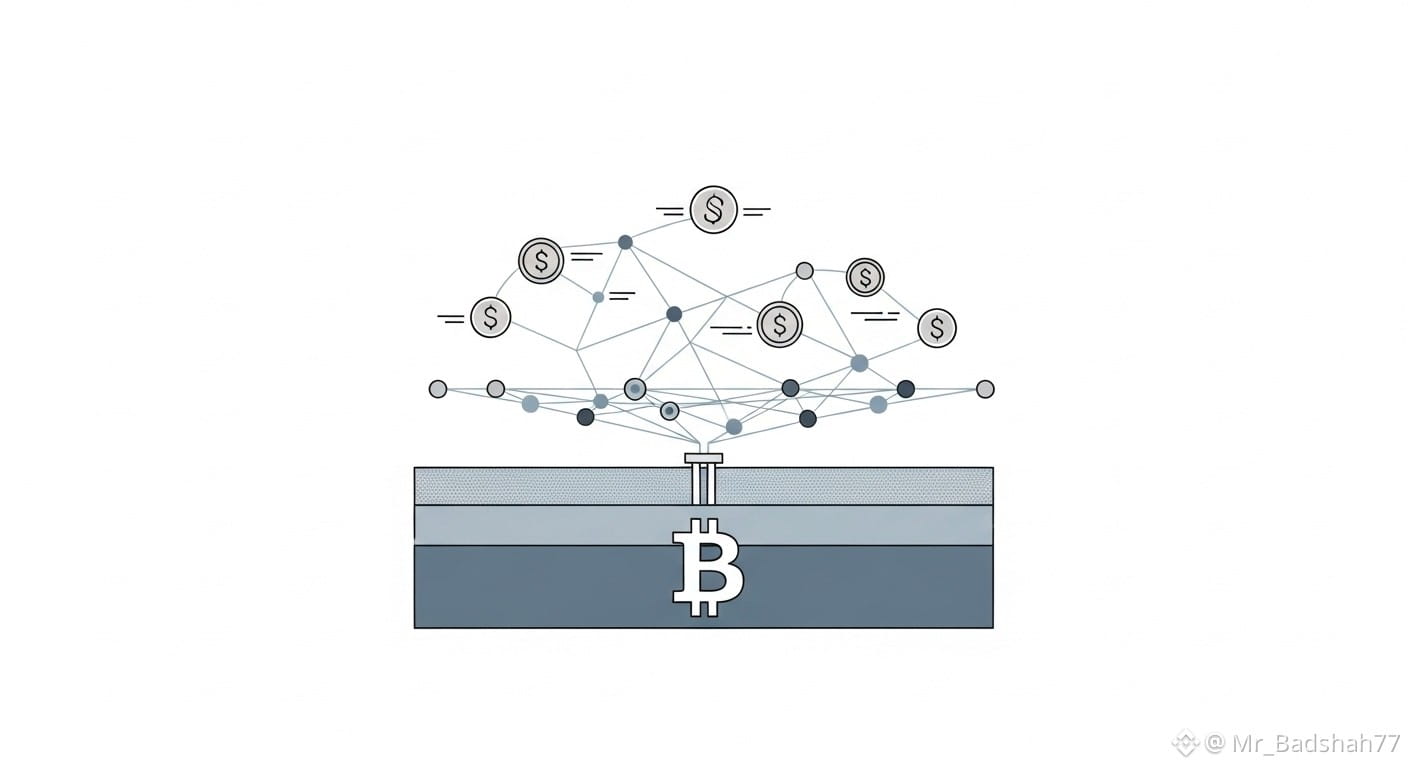

Plasma's Bitcoin-anchored architecture addresses impartiality and security. Plasma bases its status on Bitcoin instead of just relying on its own validator set for historical correctness. This borrows Bitcoin's long-term security projections as a distant guidepost to reach that goal. Though Plasma is not a Bitcoin Layer 2, institutional users who value settlement guarantees will find that this anchoring approach helps to raise the price of historical tampering or censorship and enhance confidence.

The Plasma token aids rather than guides the environment. Most of its applications are protocol-level incentives, network security, and validator staking. Plasma's more overarching idea that the network helps to efficiently transport stable value rather than to expose individuals to speculative risk aligns with this. Real transaction demand—rather than only inflation-driven incentives—should drive long-term sustainability.

Plasma is interacting with wallets, payment businesses, and stablecoin issuers from an ecological perspective. The emphasis is on mundane but crucial financial infrastructure rather than on showy DeFi concepts. Cross-border payments, on-chain treasury management, B2B settlements, consumer-facing payment apps, and uses all fall under this category. Blockchain clearly excels in cost, speed, and user experience (UX) even if traditional networks sometimes come up short due to these constraints.

Plasma's technique has certain disadvantages. Sponsored transactions and gas abstraction provide more levels of coordination that have to be skillfully handled to avoid centralization issues. Stablecoin-heavy settings are also influenced by regulatory demands and issuer-specific risks. Plasma does not address these issues; instead, it openly revolves around them rather than trying to ignore them.

Plasma is unique mostly because of its consistent design rather than any one creative component. Every component seeks to help real people and real companies utilize stablecoins at scale in real-world financial environments. Plasma stands out by emphasizing depth over width in a field rife with common-purpose chains and narrative-driven films.

Stablecoins have to have infrastructure that knows money, not only crypto, if they are to drive the upcoming wave of worldwide payments. Plasma predicts that settlement rather than conjecture will define the course of blockchain acceptance going forward. Whether that gamble pays off will rely on execution, acceptance, and regulatory navigation; nevertheless, Plasma is addressing a quite genuine issue.

Plasma is thus not aiming to change money. It aims to enable digital currency to at last match the expectations of society.