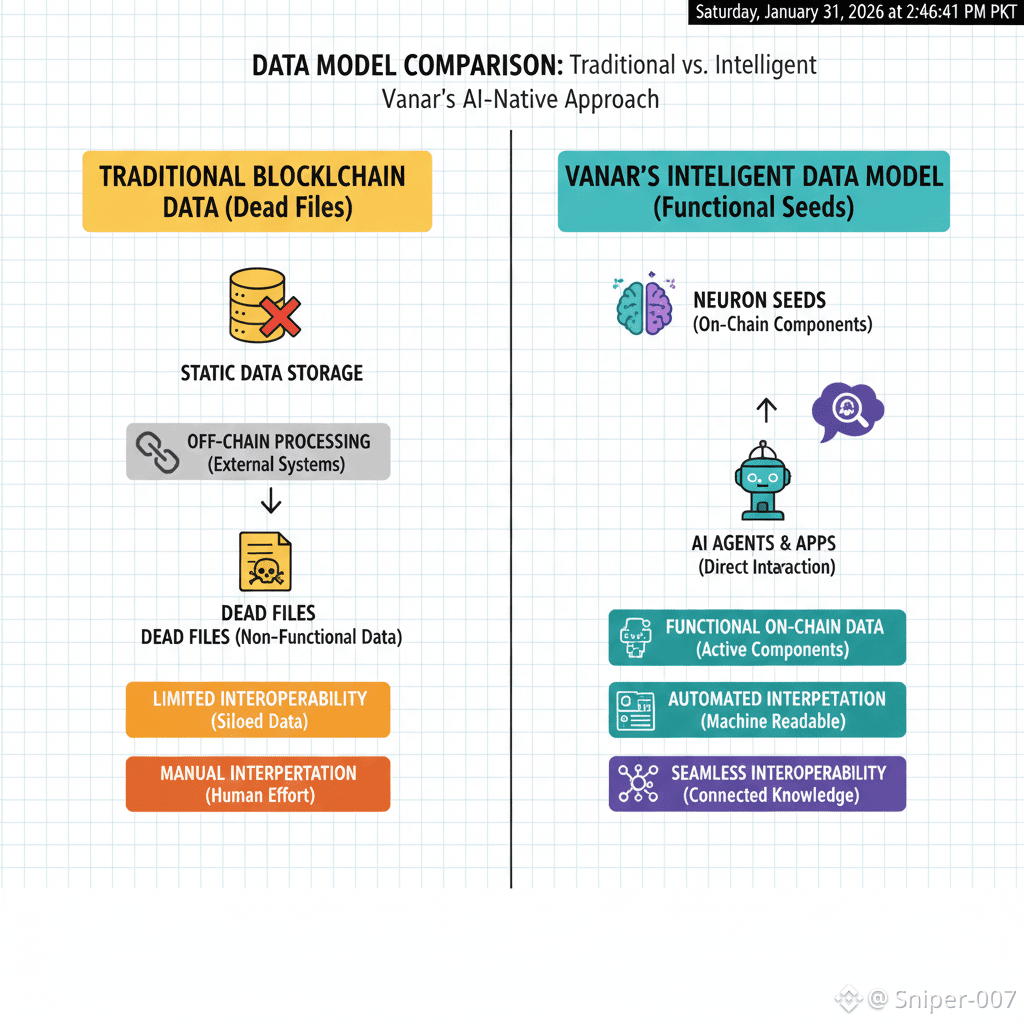

Most blockchains function like digital receipts. You can prove something was received, yet you cannot actually use it without pulling it off-chain and rebuilding the context by hand.

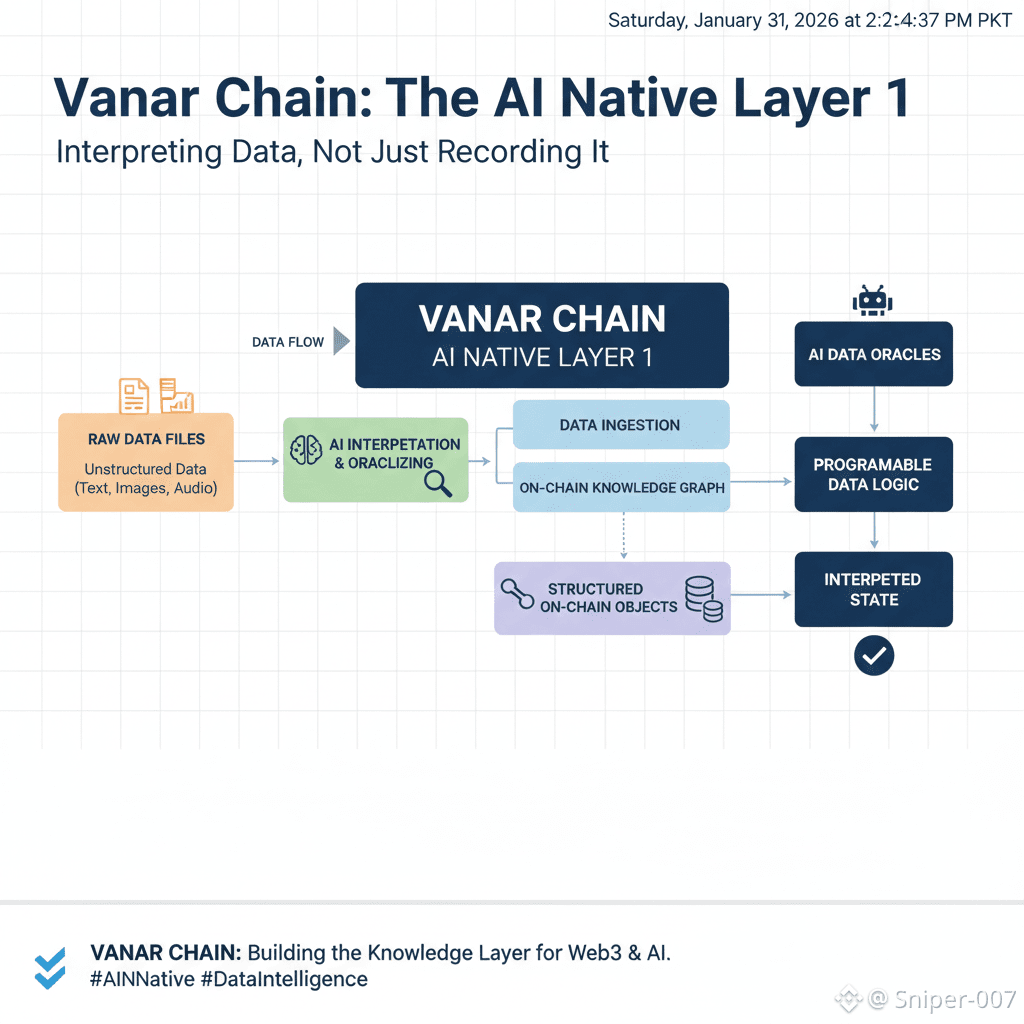

Vanar starts from a different assumption. As applications shift toward AI agents instead of humans clicking buttons, the chain must provide memory and reasoning, not only execution.

Vanar positions itself as an AI native Layer 1 built around PayFi and tokenized real world assets. Data is structured so machines can read it, understand it, and act on it directly.

The real problem Vanar focuses on is dead files and broken context.

Web3 values proof, but meaning is often missing. A PDF invoice on IPFS is permanent, yet it remains a raw blob. A hash proves integrity, but it cannot answer simple questions. Is the invoice paid. Does it meet compliance rules. Is the user allowed to access it. What changed since last month. These are meaning level questions, and most chains were never designed to answer them.

Vanar assumes the next wave of applications will not depend on users signing every transaction. AI agents will operate at scale. They will review documents, check rules, settle payments, and update state. For this to work, the chain must make data queryable and ready for decisions.

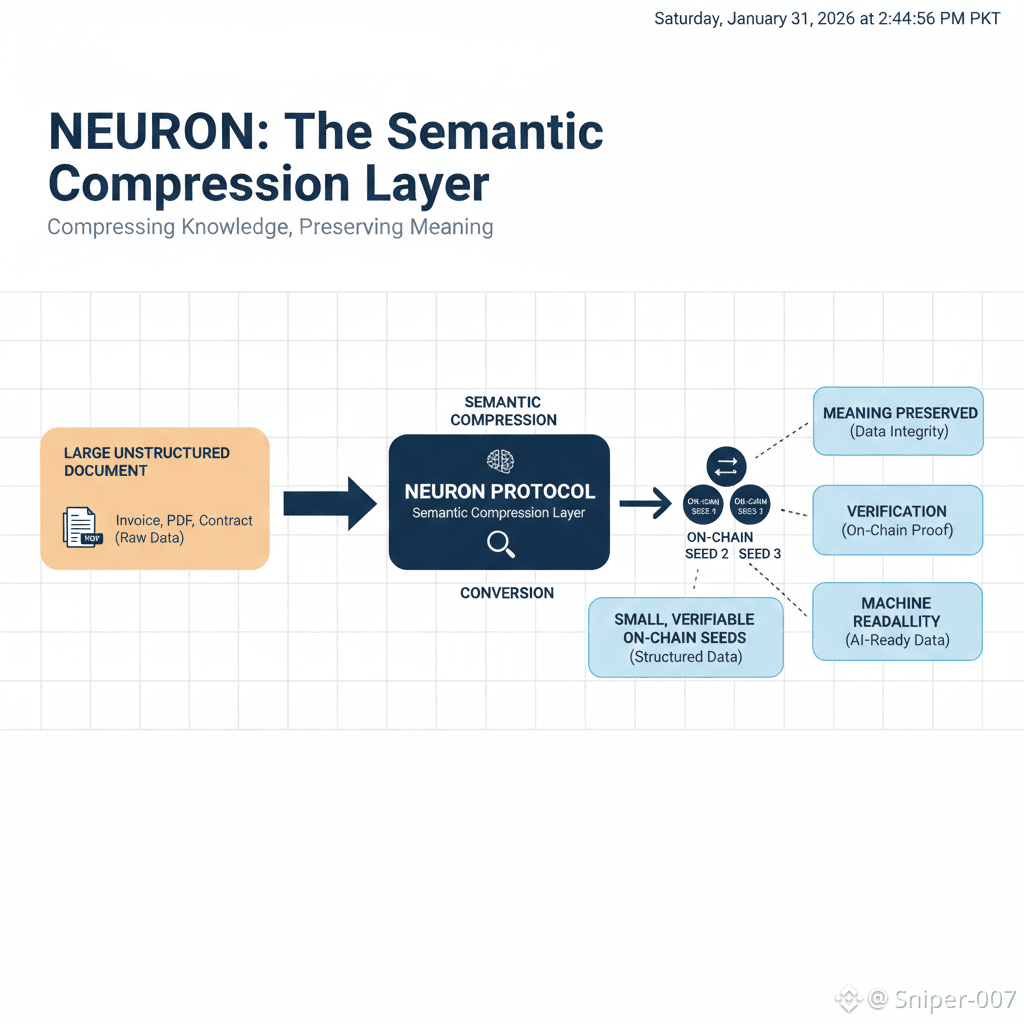

Neutron converts real files into compact units called Seeds that can be verified and validated.

Neutron acts as a semantic compression layer. It does not store entire files. It breaks unstructured data into small Seeds that preserve meaning while becoming much smaller and verifiable.

According to Vanar, semantic, heuristic, and algorithmic layers allow Neutron to compress a 25MB file down to roughly 50KB. These Seeds live fully on-chain and are directly usable by applications and agents.

This reflects a major shift in thinking. If it works, Neutron becomes a data to object pipeline. Raw documents turn into structured objects that programs can access without intermediaries. This changes what can be automated. Instead of reading a PDF off-chain, an application can query a Seed and respond instantly.

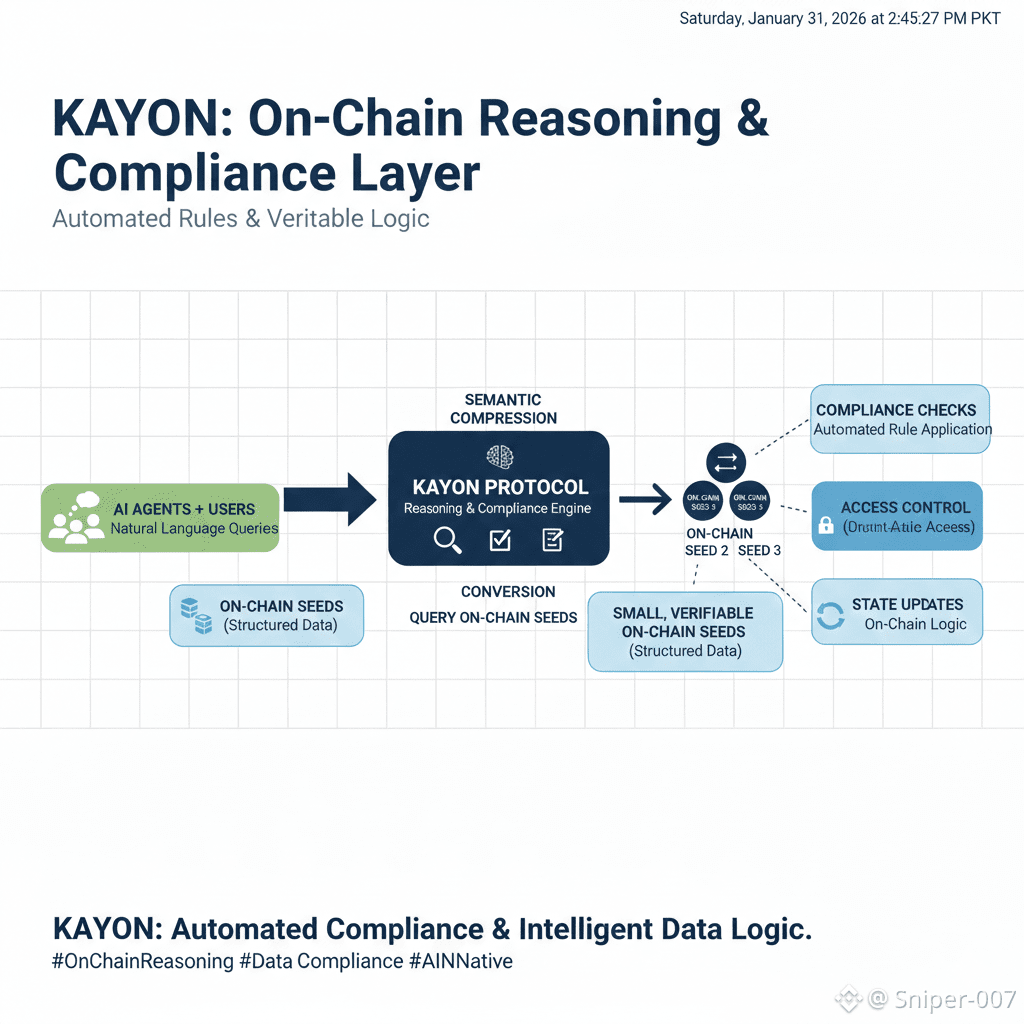

Kayon brings reasoning and compliance into the core of the chain.

Making data smaller is not the end goal. Kayon is an on-chain reasoning layer that enables natural language queries, contextual understanding, and automated compliance across Neutron and related systems.

Vanar describes Kayon as contextual AI reasoning for Web3 and enterprise backends.

This matters because most projects simply attach AI to blockchains. Vanar embeds AI into the stack itself. Logic goes beyond basic if then rules. Context aware checks analyze data and apply rules automatically.

Vanar documentation shows Neutron being used through Kayon as a business intelligence style assistant. It connects with standard platforms and converts raw data into insights using natural language.

In simple terms, Vanar treats the chain as a place where data is understood and acted upon, not just referenced.

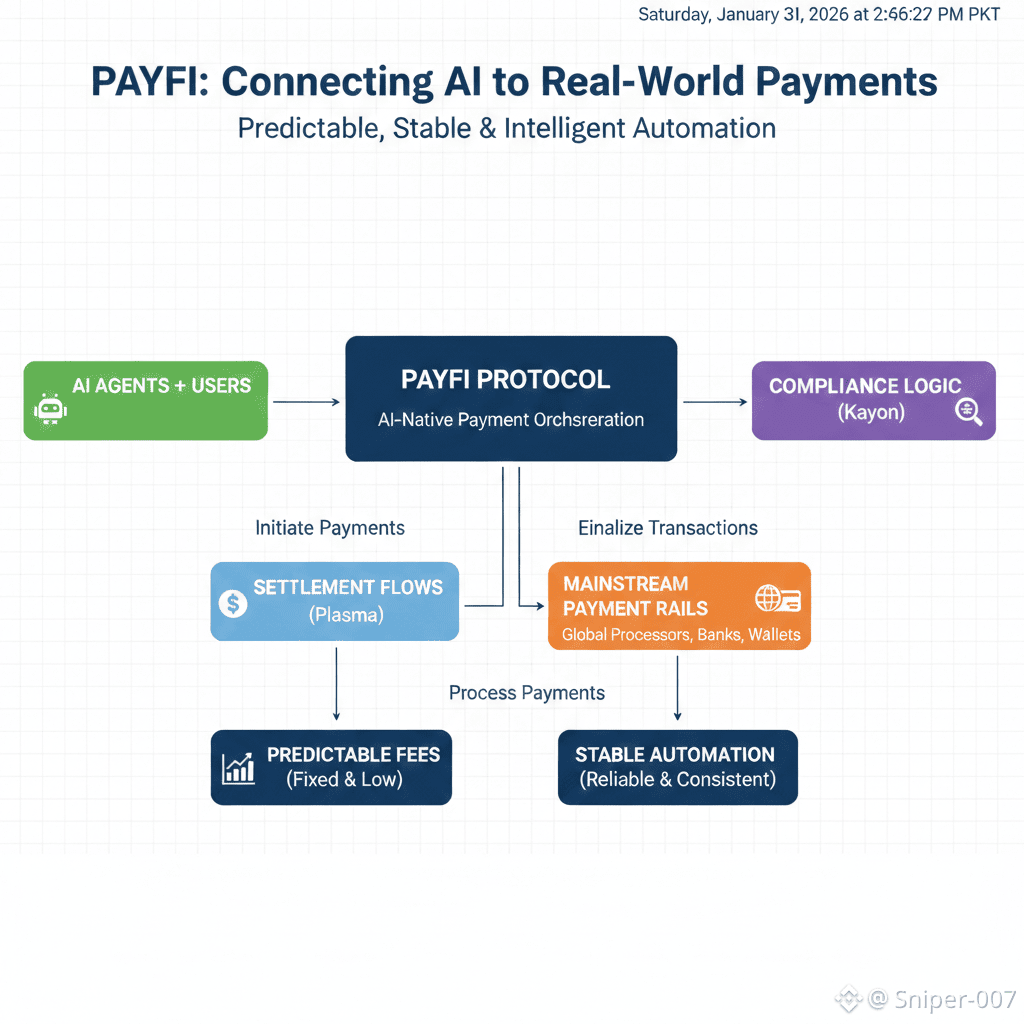

PayFi defines the distribution path through payments.

Many AI and blockchain narratives remain abstract. Vanar grounds its story in payments, settlement, and real commerce.

A key signal is the collaboration announced between Vanar and Worldpay, a global payments provider that processes trillions of transactions across many countries.

This collaboration aims to push Web3 payments through existing mainstream payment rails.

Payments expose friction immediately. If Vanar can make the flow clear, crypto in, compliance checks, settlement, and fiat out when needed, that delivers more real value than another claim about speed.

PayFi serves as a serious distribution channel even without any token price discussion. It pushes the chain toward reliability, predictable fees, and built in compliance logic.

Agent driven systems depend on stable and low costs.

Vanar presents its base layer as fast and inexpensive. Its messaging highlights predictable pricing, including fixed fee models referenced alongside Worldpay.

Cost predictability matters more in an agent driven future than most expect. Volatile fees break automation when agents execute thousands of small actions like verification, checking, settlement, and updates.

A fixed low fee model may not excite social media, but it matches the needs of real payment systems that demand consistency and trust.

The shift from TVK to VANRY explains the rebrand.

Vanar did not originally launch as VANRY. The project migrated from TVK through a one to one token swap. Major exchanges supported the change and the migration portal confirmed the ratio.

This marked the start of a strategic pivot. The focus moved from the earlier identity to a chain first narrative built on AI native infrastructure.

Whether you like rebrands or dislike them, this one aligns closely with the new stack. Neutron, Kayon, and PayFi define the direction.

It is not just a new name. It is a reinvention around a specific future. Intelligent applications, document grade data, and integrated payment rails.

The overlooked angle is Vanar’s attempt to make data behave like software.

Most chains treat data as archives. Vanar treats data as functional components. Small, testable, queryable, and usable by other programs without leaving the chain.

Their language reflects this view. Data does not merely exist. It operates.

Neutron Seeds are defined as semantic objects for agents and applications.

If this idea takes hold, it changes what on-chain actually means.

Instead of storing proof and computing elsewhere, meaning is stored and decisions are computed on-chain.

This is why Vanar cannot be compared to traditional storage networks.

It aligns more with building an intelligent data layer where compliance, finance, and real world documents directly feed automated settlement and business logic.

If you assess Vanar as a speculator rather than a builder, watch specific signals.

Ignore buzzwords. Focus on execution. Are Neutron and Kayon usable developer tools. Are legal and financial documents truly inserted as Seeds. Can agents retrieve them reliably. Does compliance automation reduce steps or add complexity. Do PayFi integrations shorten real checkout and settlement flows.

If these signals turn positive, Vanar’s positioning becomes clear. It is a chain designed for a moment when blockchains move beyond being programmable and become intelligent at their core.