Bitcoin slipped toward the $81,000 level today, extending its recent downtrend and pushing market sentiment into deep fear territory. The move marks Bitcoin’s weakest price action in weeks and comes amid heightened volatility, forced liquidations, and broad risk reduction across the crypto market.

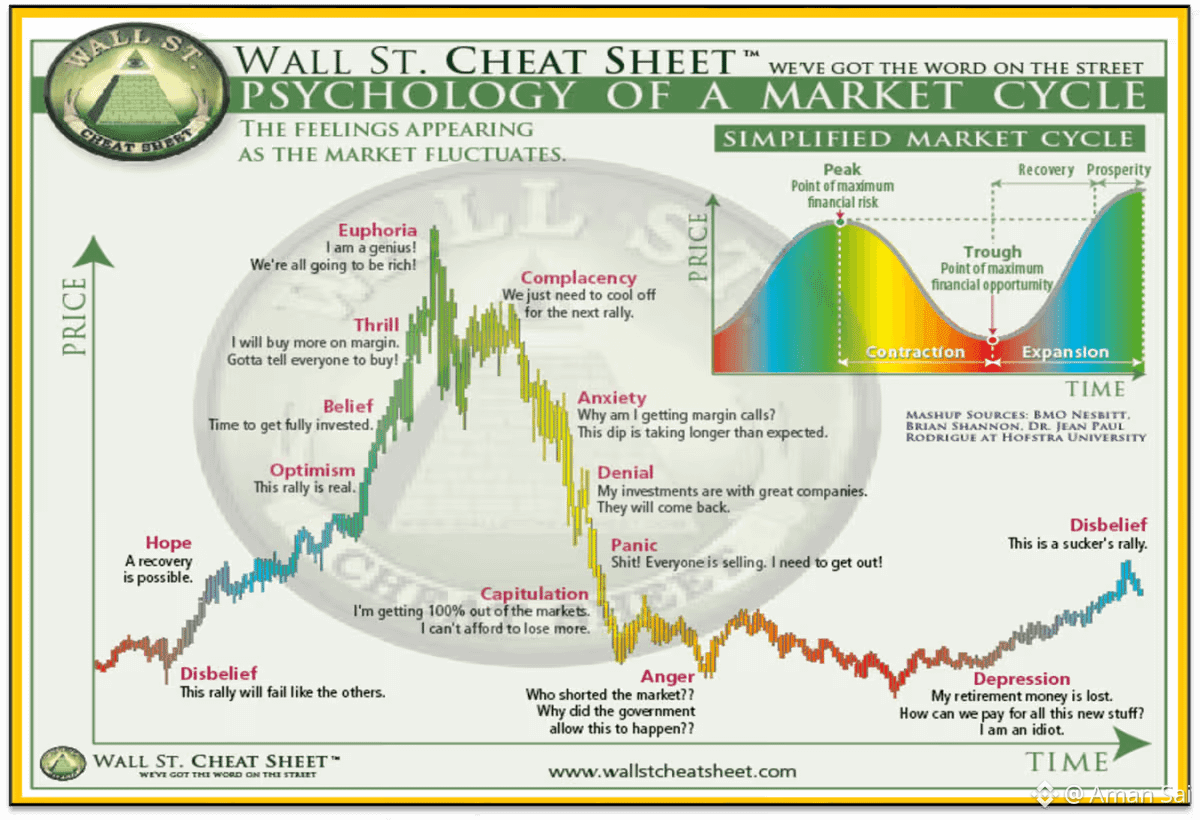

As BTC broke below key short-term support levels, selling pressure accelerated, triggering a wave of stop-losses and leverage unwinds. The decline has once again highlighted how quickly sentiment can shift in a market driven by positioning and emotion.

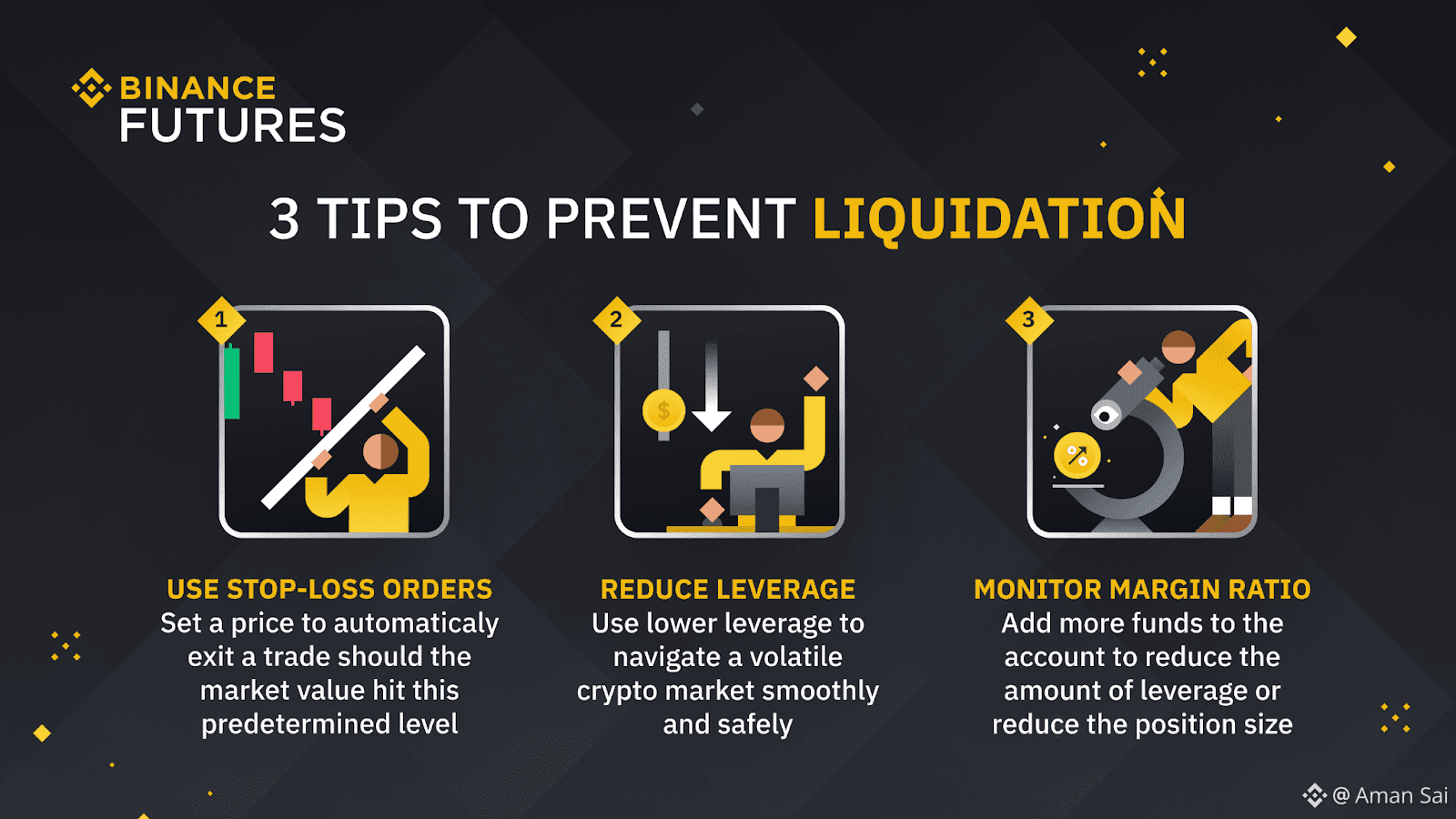

Leverage Unwinds Drive the Selloff

Market data suggests the drop was largely fueled by leveraged positions being unwound, rather than a sudden deterioration in fundamentals. As prices moved lower, traders using borrowed capital were forced to close positions or meet margin requirements, amplifying downside momentum.

This cascading effect is typical during sharp corrections, where price declines feed on themselves until excess leverage is flushed out of the system.

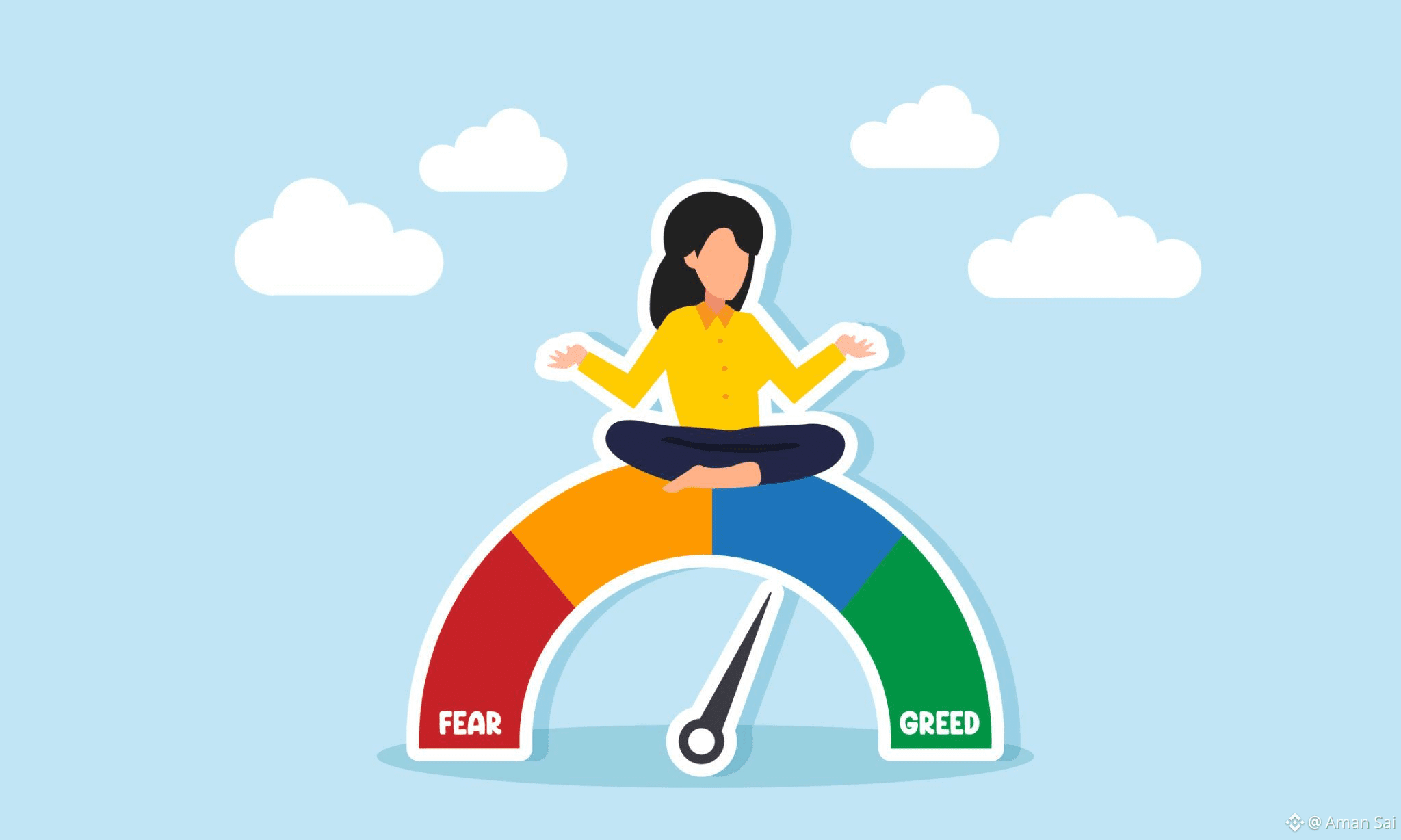

Fear Reaches Extreme Levels

Sentiment indicators show fear climbing to some of the highest levels seen this year. Social commentary around bitcoin has turned sharply negative, reflecting growing anxiety among short-term traders and late sellers.

Historically, such fear spikes often appear near capitulation phases, when selling pressure begins to exhaust itself. While this does not guarantee an immediate rebound, it can signal that markets are approaching an emotional inflection point.

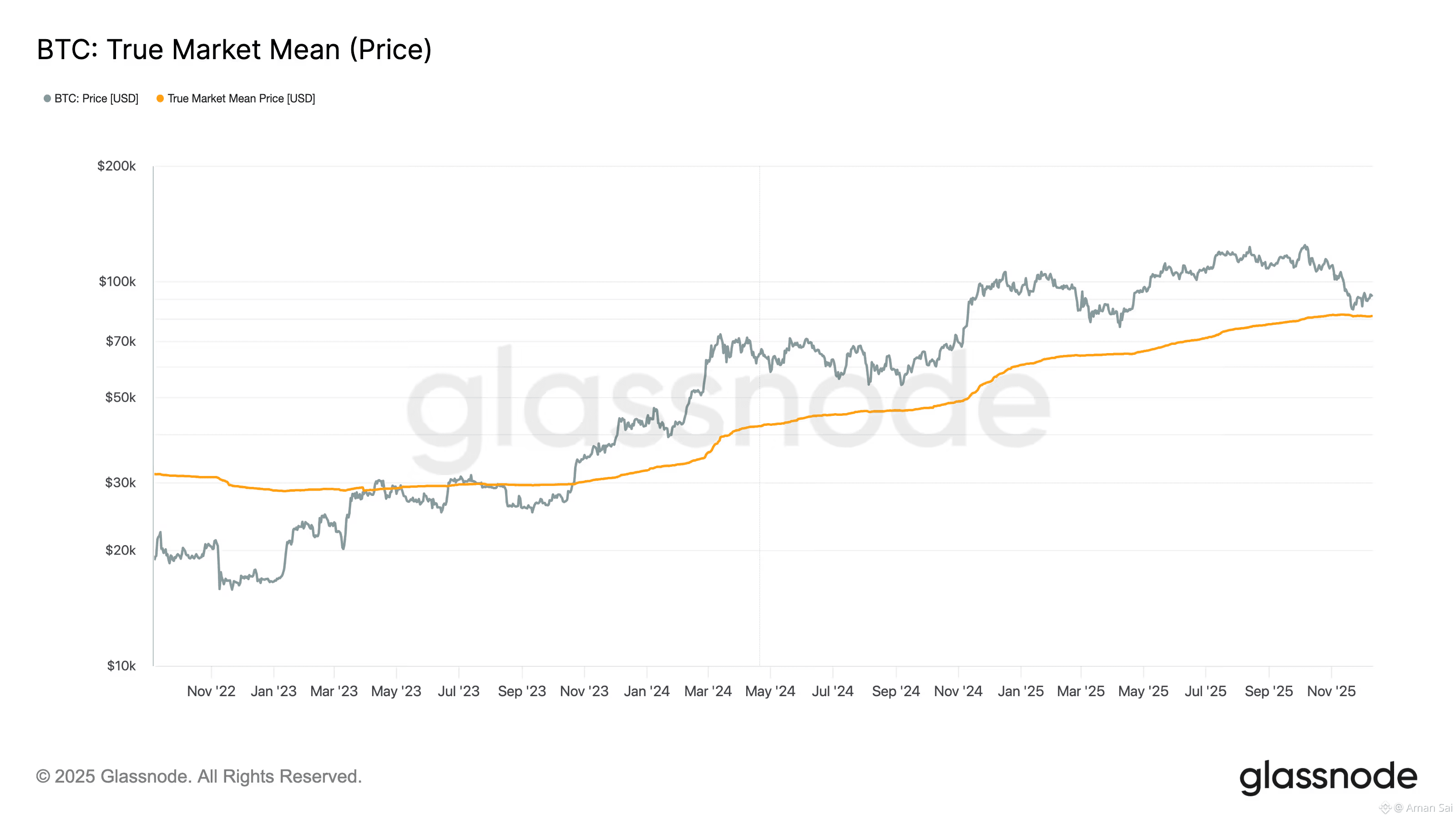

Key Levels the Market Is Watching

Traders are now focused on the $80,000–$81,000 zone as a critical support area. Holding above this range could allow bitcoin to stabilize and consolidate. On the upside, reclaiming the $85,000–$90,000 region would be needed to ease short-term bearish pressure.

Until then, price action is likely to remain choppy as liquidity conditions tighten and risk appetite stays fragile.

A Market Driven by Emotion, Not Headlines

Bitcoin’s slide to $81,000 underscores how sentiment and leverage continue to dominate short-term price action. While fear is prevalent today, history shows that markets often turn when pessimism becomes widespread and forced selling subsides.

Whether this move proves to be a temporary washout or the start of a deeper correction will depend on how bitcoin behaves around current support levels in the coming sessions.

For now, the crypto market remains volatile, emotional, and highly sensitive to positioning , conditions that call for patience and disciplined risk management.