Many crypto projects begin with bold promises: open from day one, fully permissionless, instantly decentralized. In theory, it sounds ideal. In practice, those claims often collapse the moment a network faces real-world demands—payments, uptime guarantees, regulatory pressure, and business-grade reliability. Vanar Chain takes a more grounded route. Instead of chasing instant decentralization, it prioritizes early stability and gradually increases decentralization over time.

This approach may lack the romance of crypto maximalism, but it mirrors how critical systems actually scale. The internet, cloud infrastructure, and modern fintech didn’t emerge fully decentralized overnight. They earned trust first, then expanded participation. Vanar is applying the same logic at the protocol level.

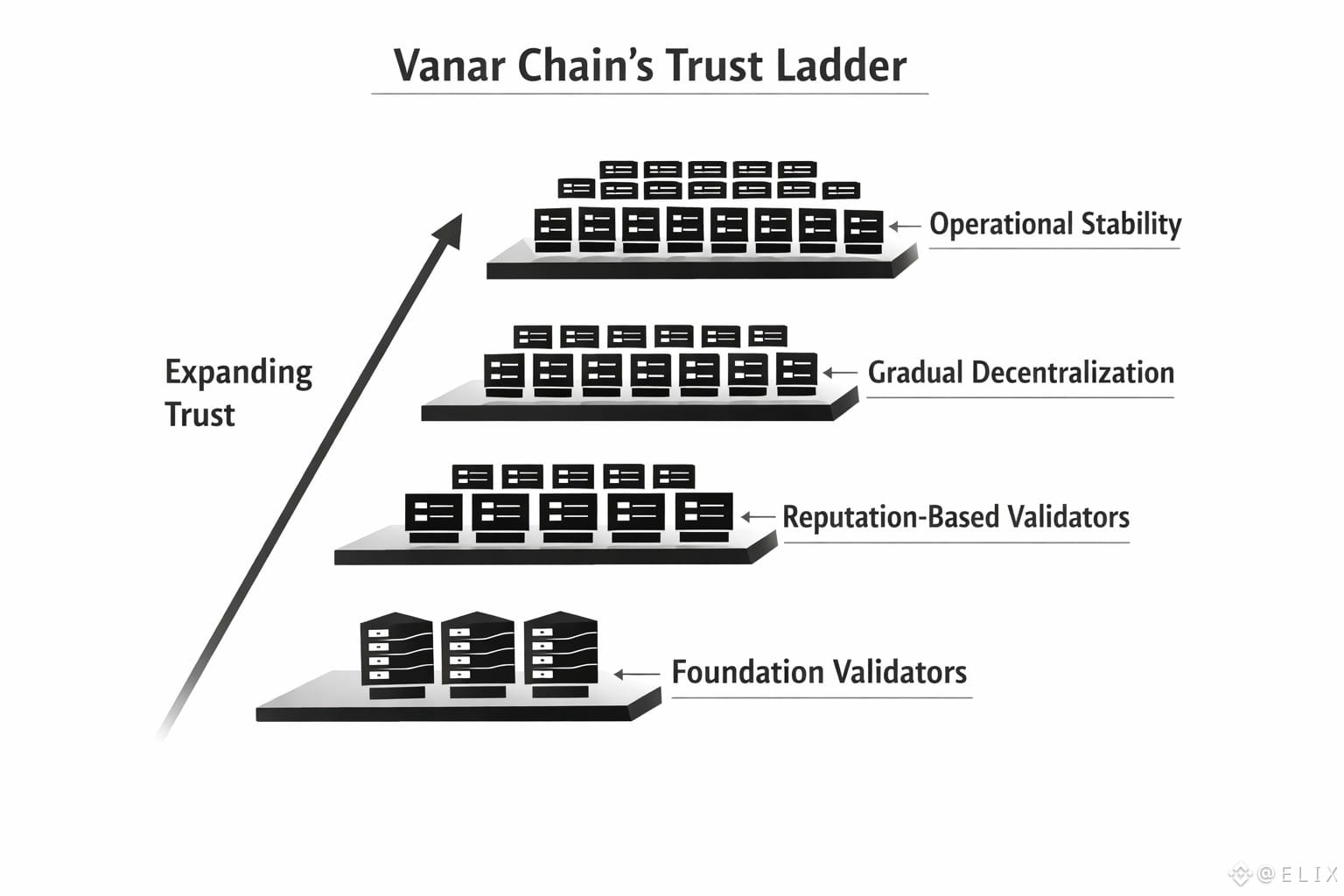

The Trust Ladder: Decentralization as a Process, Not a Claim

At the core of Vanar’s architecture is what it openly calls a trust ladder. The network launches with a limited set of known, reliable validators distributed globally. These participants undergo evaluation, demonstrate operational discipline, and build a measurable track record. Over time, as performance and reliability are proven, validator access expands.

Many chains talk about “progressive decentralization.” Vanar embeds it directly into its consensus design. The distinction matters. Decentralization is not treated as marketing—it’s treated as an outcome earned through consistent behavior.

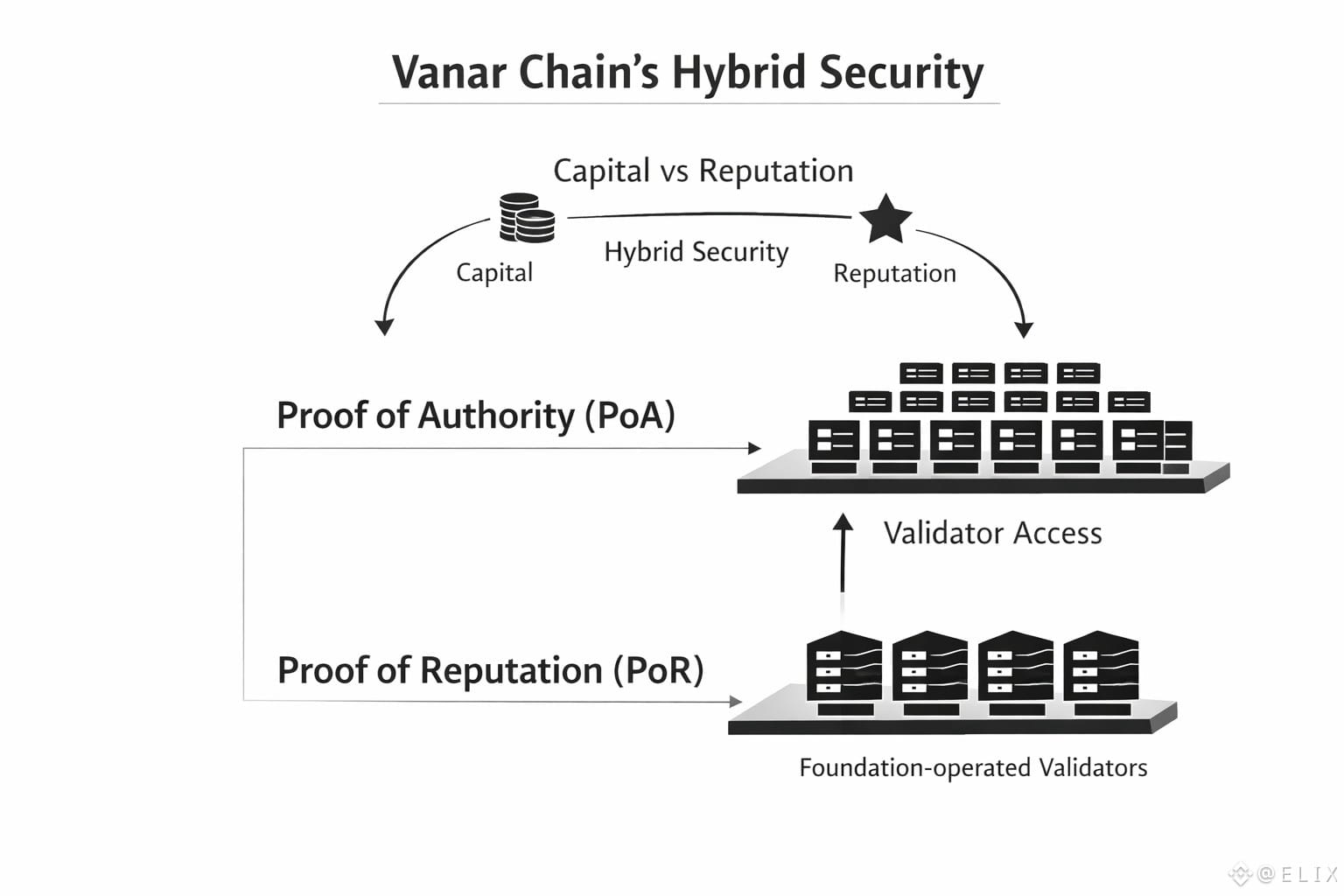

Security Beyond Capital: Why Vanar Doesn’t Bet Solely on Stake

One of Vanar’s most overlooked design decisions is its refusal to equate security with capital alone. Most blockchains reduce validator influence to a single metric: how much value is locked. Vanar instead adopts a hybrid model that combines Proof of Authority (PoA) with Proof of Reputation (PoR).

In the early phase, validators are operated by the Vanar Foundation. As the network matures, external validators are introduced—but entry is governed by reputation, not just capital. The underlying question shifts from “Who can buy the most influence today?” to “Who has consistently demonstrated responsible behavior over time?”

This doesn’t claim moral superiority. It’s a practical attempt to reduce common failure modes such as short-term capture, rented stake, or validators that enter briefly without accountability. Reputation becomes a second security primitive alongside capital.

Why a PoA–PoR Path Makes Sense for Payments and Business

When building systems meant for real economic activity, the biggest risks aren’t ideological—they’re operational. Downtime, unpredictable finality, and erratic validator behavior break trust far faster than philosophical debates about permissionlessness.

Proof of Authority has long been criticized in crypto circles for being too restrictive, yet it offers something young networks desperately need: stability. Vanar’s documentation makes its intent clear—begin with foundation-run validators, then progressively introduce a wider validator set governed by reputation.

PoA is not framed as an end state, but as scaffolding. The objective is enterprise-grade reliability while the network grows, aligning with Vanar’s payments-focused positioning and real-world partnerships.

Compatibility as a Growth Strategy, Not an Afterthought

Web3’s graveyard isn’t filled with failed chains—it’s filled with wasted developer time. Even the most advanced technology struggles if teams must abandon their existing tools to adopt it.

Vanar takes a compatibility-first approach. Rather than forcing developers to learn an entirely new stack, it allows teams to bring what they already use and gradually adopt Vanar’s advanced capabilities. This lowers friction, accelerates deployment, and encourages real applications rather than experimental prototypes.

If Vanar’s AI and data layers are the long-term differentiators, compatibility is the short-term gateway that enables adoption.

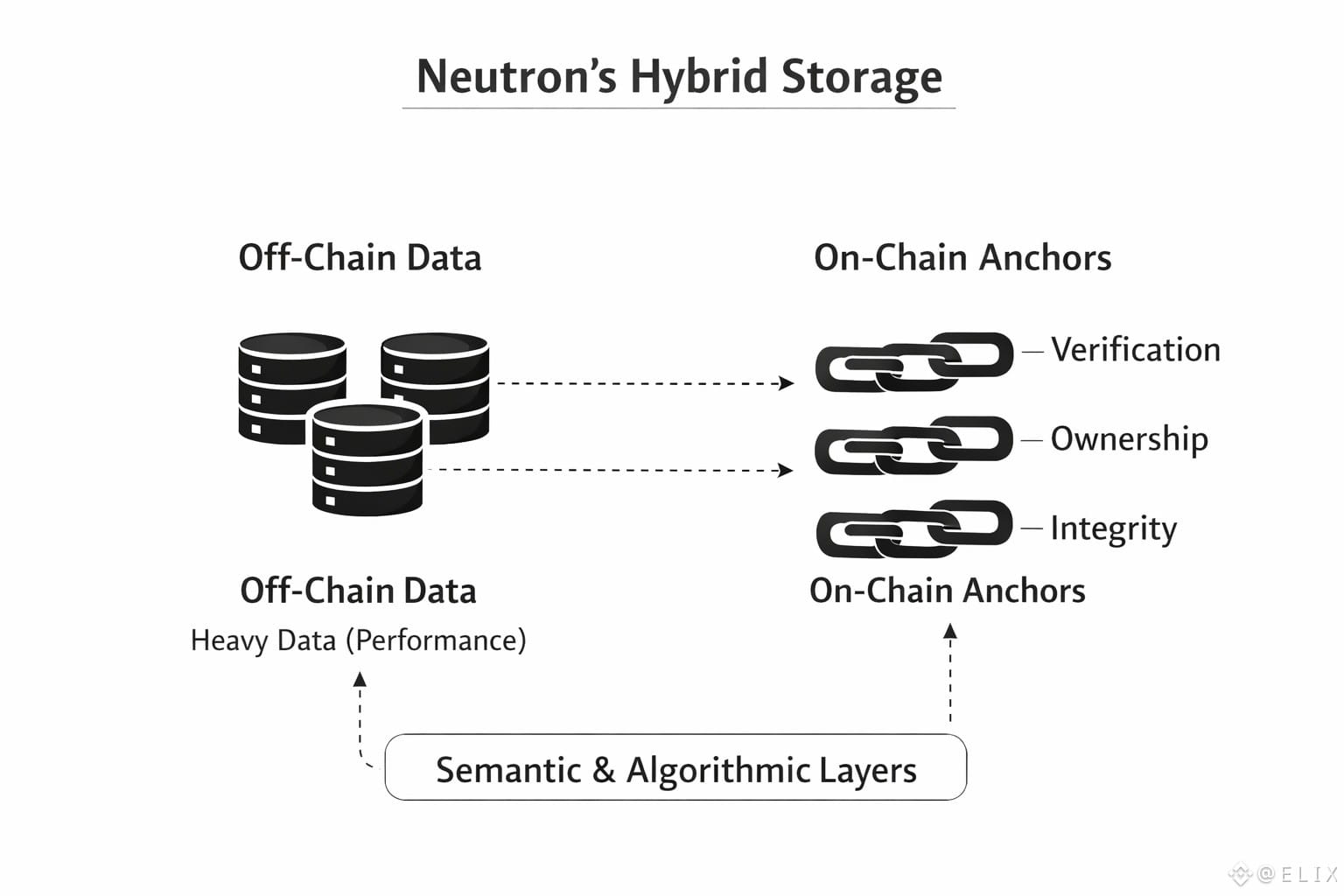

Neutron’s Real Innovation Lies in Its Storage Model

Neutron is often described as a programmable on-chain seed system capable of compressing large datasets—from tens of megabytes to kilobytes—using semantic, heuristic, and algorithmic layers. But the more interesting detail sits deeper in the architecture.

Neutron seeds are stored off-chain for performance and flexibility, while cryptographic anchors are written on-chain to ensure verification, ownership, and integrity. This design choice signals a clear philosophy: Vanar is not chasing on-chain purity for its own sake. It’s building a pragmatic system that balances performance with trust.

Heavy data moves where it’s efficient. Critical proofs live on-chain. The result is a hybrid model that’s far easier to adopt than an everything-on-chain approach that ignores real-world constraints.

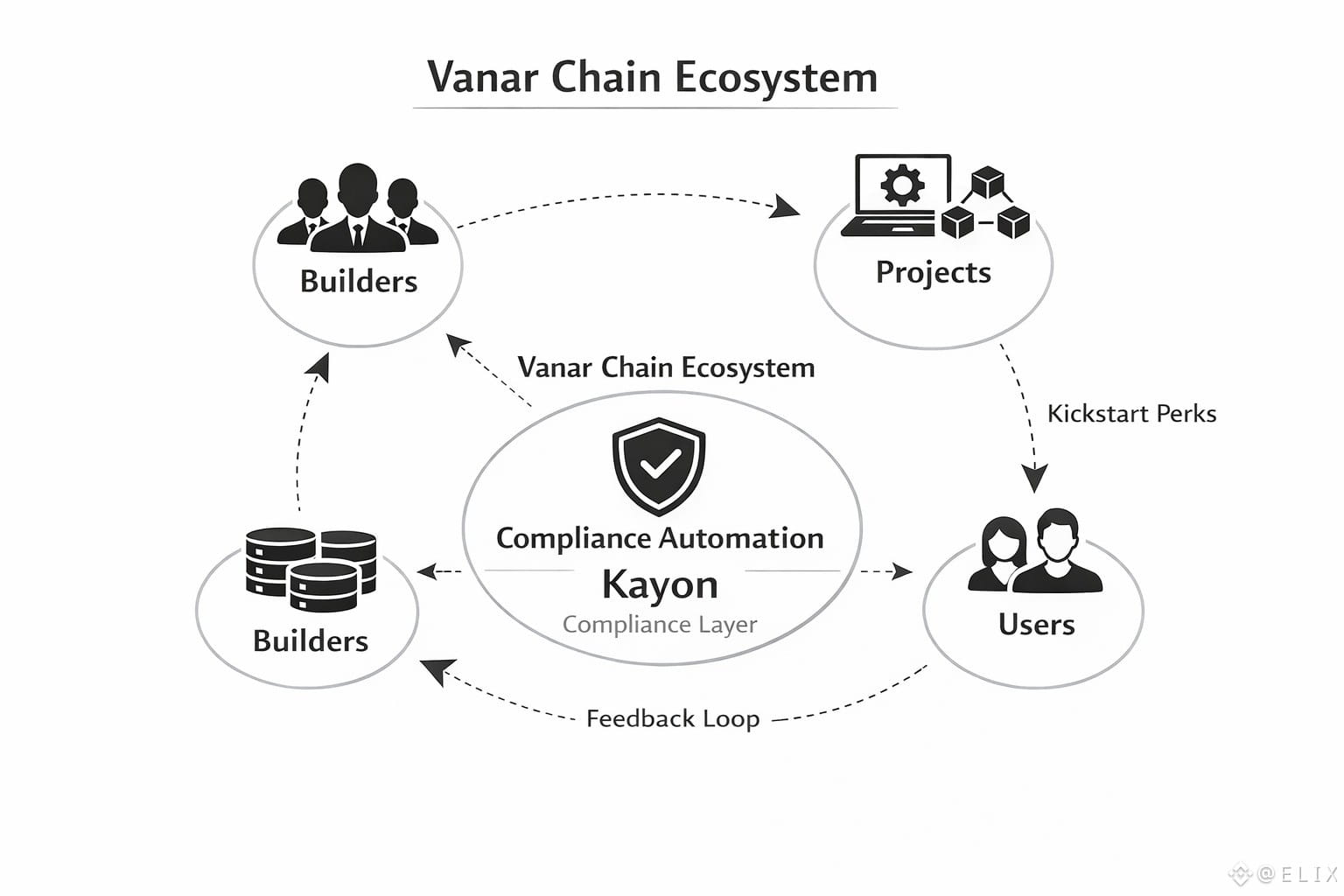

Compliance as Software, Not Paperwork

Kayon, Vanar’s reasoning layer, connects Neutron, blockchains, and enterprise systems through natural-language queries, discovery, and automated compliance logic.

The key insight here is subtle but powerful: Vanar treats compliance as something that can be encoded, queried, and replayed. In most systems, compliance is manual—checklists, audits, and human workflows. Vanar aims to make compliance emergent from structured, verifiable, and queryable data.

This isn’t just “AI on-chain.” It turns governance, verification, and reporting into programmable surfaces. If successful, its impact will be felt in unglamorous but high-value areas like audits, dispute resolution, payment validation, and enterprise reporting. Boring is good—budgets live there.

Staking as Security, Not Just Yield

Vanar’s staking model is presented clearly: stake to support the network, strengthen security, and earn rewards. Familiar, understandable, and intentionally boring.

The deeper implication is that staking may eventually become one of several signals feeding into reputation-based validation. Over time, validator access could reflect not just capital, but consistency, uptime, and long-term contribution. If executed well, staking shifts from capital dominance to sustained reliability.

Ecosystem Growth Through Builders, Not Noise

Every chain claims to be building an ecosystem. Few make it easy for builders to actually ship. Vanar’s Kickstart initiative focuses on practical support—projects, incentives, and tooling that lower the barrier to launch.

Infrastructure succeeds not by perfection, but by enabling others to create value on top of it. Strong ecosystems form through feedback loops: builders deploy, users arrive, real usage strengthens credibility, and the network improves through demand.

Systems That Can Explain Themselves

Both crypto and AI suffer from a trust deficit. Combined, that problem doubles. Vanar’s architecture is explicitly designed to answer “why” questions: Why was a payment approved? Why did a rule trigger? Why is a document valid?

These explanations aren’t optional in real-world systems—they’re the difference between a demo and deployable infrastructure. Organized data, reusable logic, and verifiable reasoning turn trust from an assumption into something inspectable.

The Real Bet Vanar Is Making

Vanar is betting that the next phase of Web3 won’t look like speculative experimentation. It will resemble invisible infrastructure—predictable validation, readable data, compliant logic, and tooling that builders can actually use.

The right way to evaluate Vanar isn’t by asking whether it sounds exciting. It’s by asking whether it reduces friction in real systems. Step by step, Vanar is constructing a chain of trust—and in a market driven more by ideals than engineering, that’s a rare and deliberate choice.

@Vanarchain #vanar #Vanar $VANRY