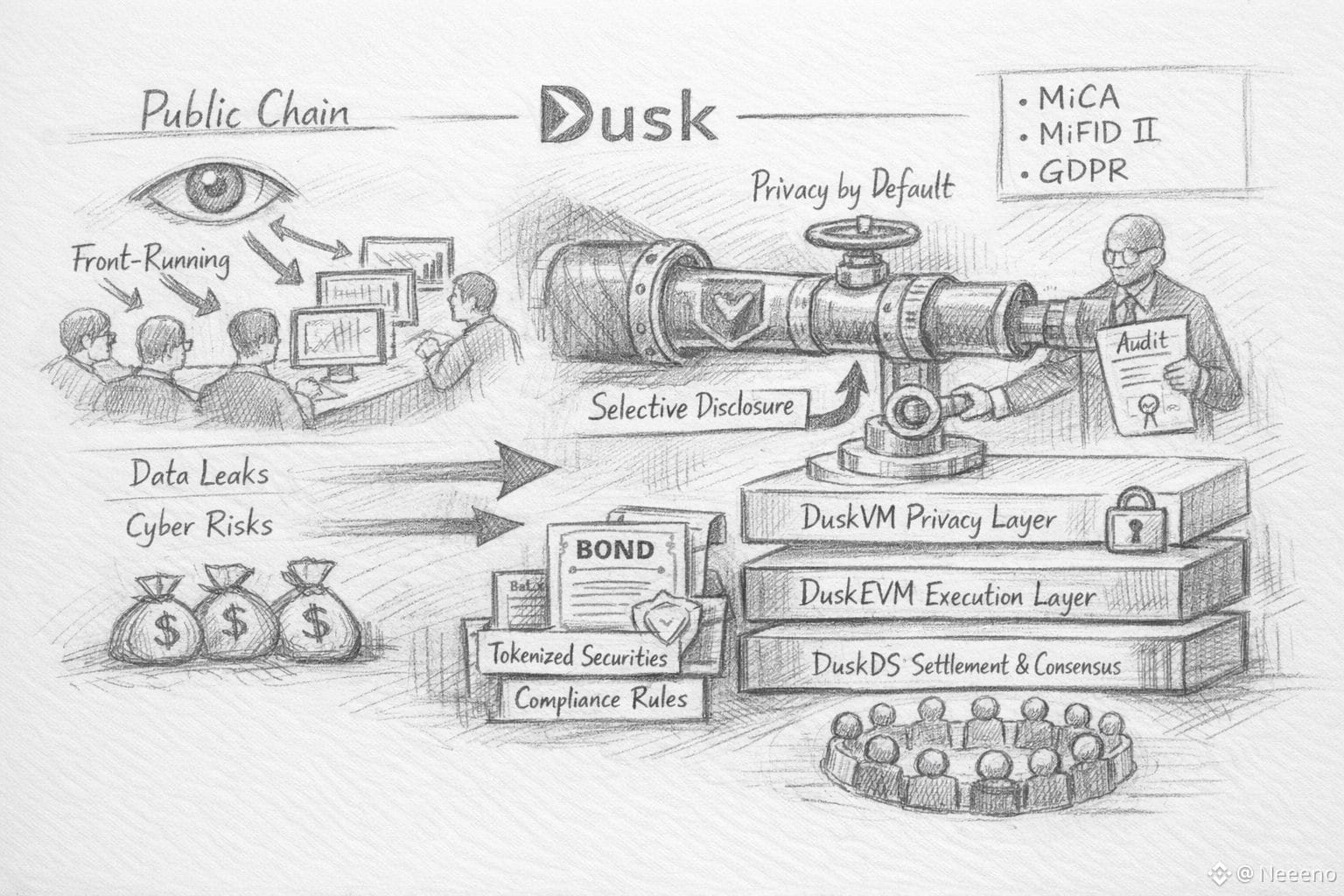

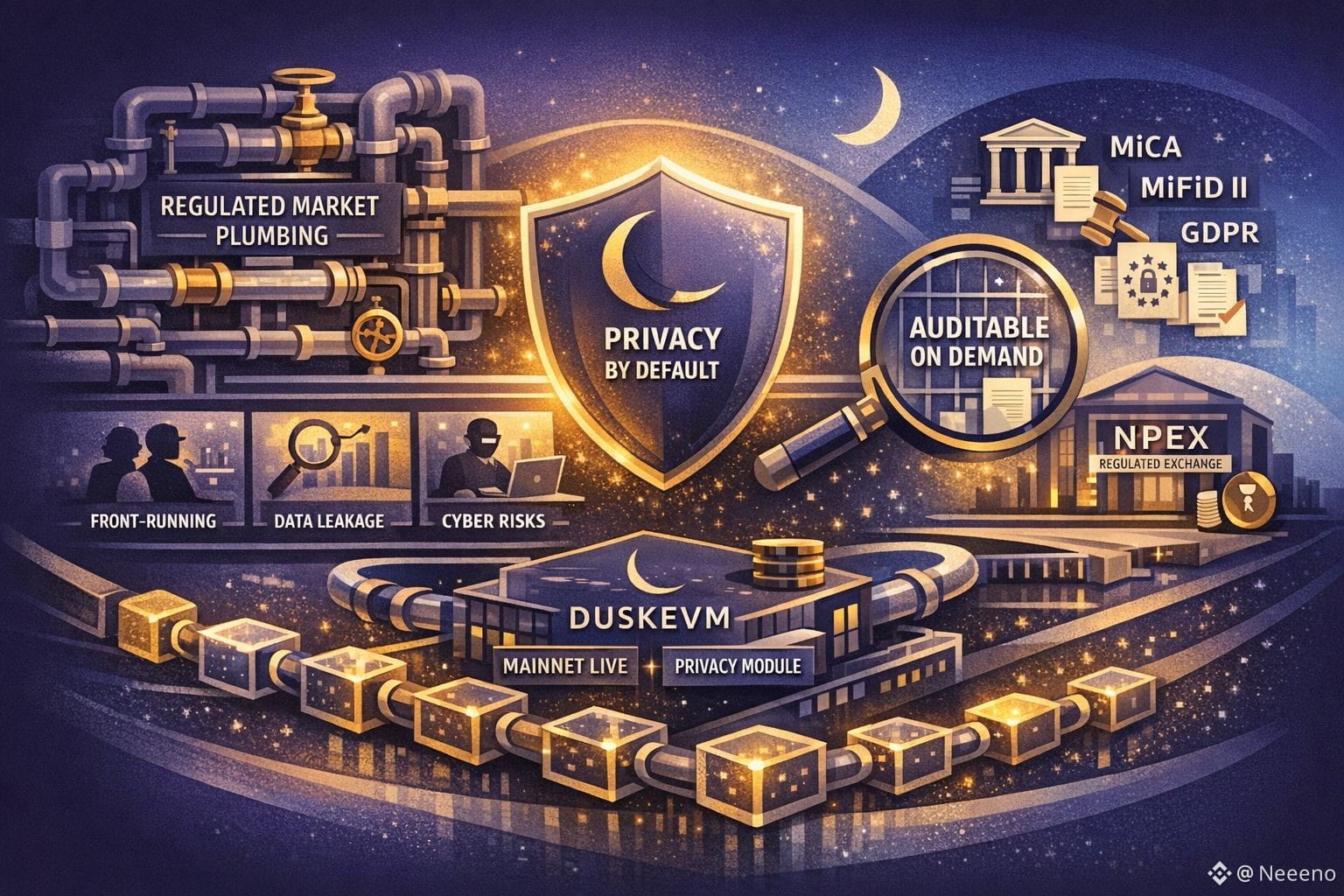

@Dusk Regulated markets are not built on the assumption that every participant should see everything, all the time. They are built on controlled disclosure: identities are known to the right parties, positions are reported on specific schedules, and sensitive information is shared under rules that can survive audits, disputes, and courtrooms. In that context, the default posture of most public blockchains—global visibility, permanent traceability, and an obsession with “proof” as spectacle—can look less like accountability and more like an operational hazard. Dusk’s central wager is that privacy is not a luxury feature for finance. It is the entry point. The goal is not to hide markets from oversight, but to build market plumbing where confidentiality is normal and verifiability is available on demand.

In plain terms, Dusk Network is a privacy-first Layer 1 designed for regulated finance. The idea is simple enough to say in one breath: transactions can be confidential by default, yet still provable to auditors, regulators, and other authorized parties when required. In the Dusk framing, privacy is not an escape hatch from compliance; it is a way to reconcile legal obligations with the realities of competitive markets. Their documentation is explicit about the “privacy by design, transparent when needed” orientation, including both shielded and public transaction models on the same network.

To understand why that matters, it helps to be honest about what full transparency does in real markets. Public ledgers turn routine behavior into broadcast signals. Strategy leakage becomes a design property. If a market maker, treasury desk, or fund rebalances on-chain, counterparties can infer risk appetite, timing preferences, and position sizing. Even when the wallet is pseudonymous, clustering and off-chain linkages can collapse that pseudonymity in practice. The result is not just discomfort; it can be direct cost. You invite front-running and copycat behavior. You reveal inventory and hedging patterns. You expose flows that, in traditional venues, are deliberately mediated through brokers, reporting delays, and disclosure thresholds. For tokenized securities and other real-world assets, the situation is sharper: you are not only revealing trade intent, you may be revealing regulated relationships—who can hold what, under which restrictions, in which jurisdictions. That is competitive intelligence with a legal aftertaste.

Then there is the cyber dimension. Global transparency doesn’t merely inform rivals; it helps adversaries. If holdings and movements are plainly legible, it becomes easier to identify high-value targets, pressure points in custody, or moments of operational vulnerability. Institutions spend a fortune reducing that attack surface in legacy systems. A chain that publishes everything globally, instantly, and forever asks them to widen it again. Dusk’s pitch resonates because it treats this as a structural mismatch, not an onboarding problem.

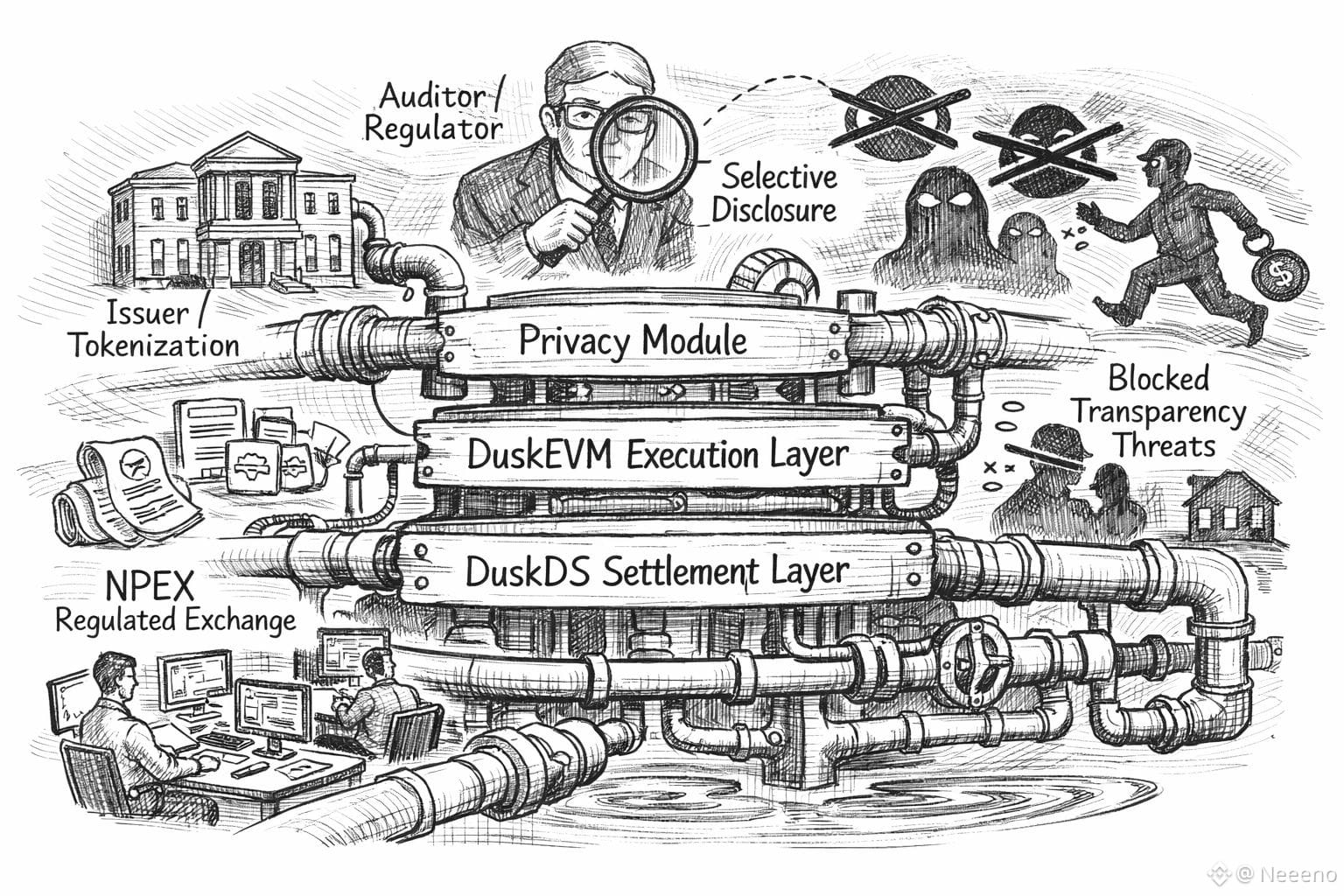

The phrase that captures their approach is “auditable privacy.” In one sentence, it means using zero-knowledge cryptography to hide sensitive details—like participants and amounts—while still allowing a party to prove specific facts about a transaction when required. The proof is cryptographic evidence rather than a promise, and it can be scoped: reveal the minimum necessary to satisfy a rule, without leaking the rest of the story. Dusk’s own materials describe selective disclosure and zero-knowledge compliance as a way to meet regulatory requirements without exposing personal or transactional details to the entire world.

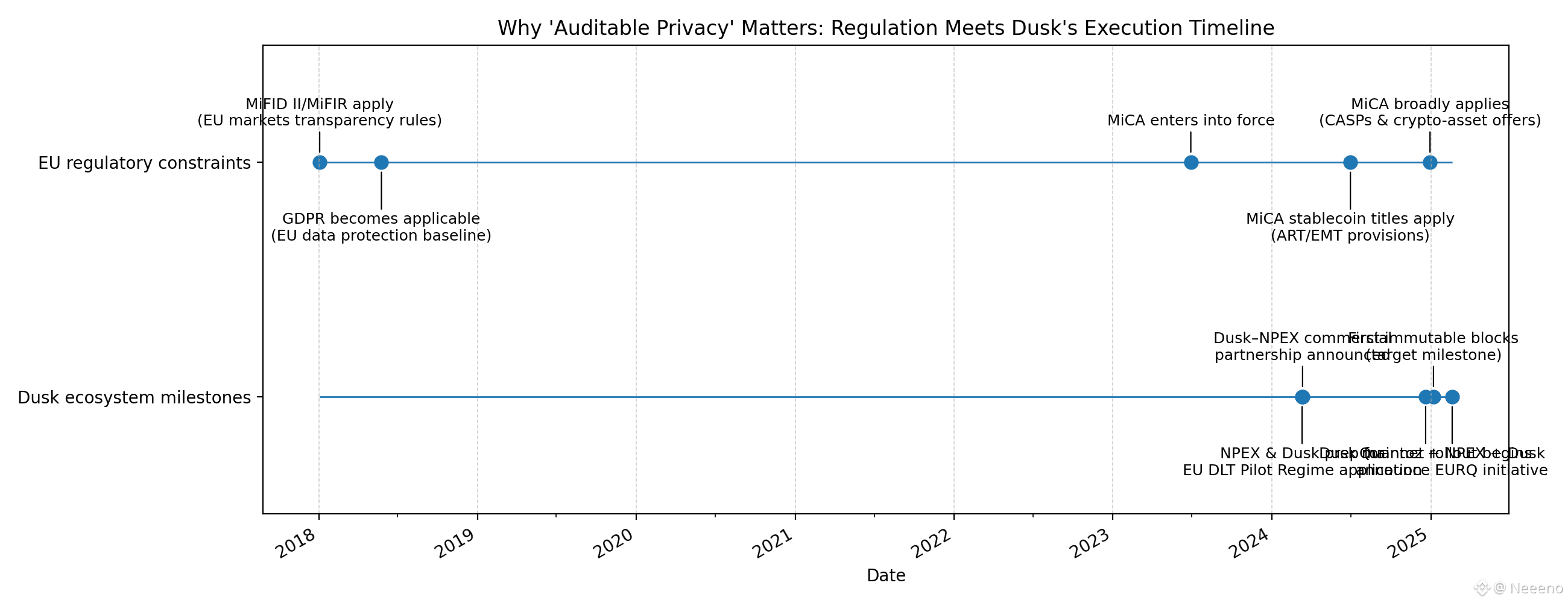

This is where “legal reality” stops being a talking point and becomes a constraint that shapes architecture. Think of MiCA and MiFID II as the EU’s operating manuals for markets. They come with deadlines, oversight, and enforcement. MiCA became effective in 2023, and key parts of the regime for crypto service firms took effect on December 30, 2024, pushing companies to be ready and compliant. MiFID II/MiFIR set the “who reports what, and who publishes what” rules for trading—especially how trades get disclosed after they happen. That structure exists because transparency has to be balanced: enough to support fair pricing and trust, but not so much that it damages how markets function or makes them easier to exploit. Data protection rules add another pressure. It’s not about where the data sits; it’s about what you do with it. If you collect, store, share, or use personal data, GDPR duties follow—no matter the system. That creates an immediate tension with globally replicated ledgers: once sensitive data is written in a broadly accessible form, “who is the controller,” “who can erase,” and “who has lawful basis” become more than academic questions. The cleanest answer is to avoid placing personal data on a public substrate in the first place, or to structure systems so that what’s globally visible is not personally identifying, while still permitting legitimate oversight pathways. Auditable privacy is, at minimum, a coherent attempt to meet that design brief.

Tokenization is where these constraints converge. In the retail imagination, tokenization is often reduced to “putting assets on-chain.” In regulated finance, tokenization is closer to rewriting the asset lifecycle: issuance, eligibility, transfer restrictions, disclosures, corporate actions, reporting, settlement finality, and the operational interfaces that make an asset legally and commercially usable. Dusk’s narrative focuses on tokenized securities, bonds, and debt instruments, and it emphasizes the idea that regulatory logic should be embedded before issuance rather than bolted on after.

Practically, it means the asset can carry its compliance behavior with it: ownership limits, transfer restrictions, and checks on who can receive it, plus a way to produce the disclosures regulators need—without turning the entire market into a fully transparent feed. Dusk’s point is that these controls belong in the foundation of the system, not as optional app features that may be implemented inconsistently.

And maturity is important because, in finance, “it works in theory” isn’t enough. A live mainnet and clear rollout steps are the evidence that the rails are becoming real infrastructure. Dusk’s mainnet rollout began in late 2024, with the project explicitly targeting the first immutable block on January 7, 2025—language that reads more like a migration plan than a marketing countdown.Since then, the project has pushed a modular architecture story: a settlement and data layer (DuskDS) and an execution environment for EVM developers (DuskEVM). Their documentation describes DuskEVM as an EVM-compatible execution environment built using the OP Stack approach and EIP-4844-style blobs, settling to DuskDS rather than Ethereum. The institutional significance of EVM compatibility is easy to understate. It is not about chasing Ethereum culture; it is about lowering integration friction. If a regulated team can reuse tooling, auditing practices, and developer muscle memory, the conversation shifts from “new chain risk” to “workflow adaptation.”

The privacy story also becomes more modular. Dusk’s documentation describes dual transaction models—public and shielded—coexisting on the same settlement layer, which effectively admits something many privacy debates avoid: regulated finance needs more than one privacy posture. Some flows must be openly auditable by default; others must be confidential by default; both must settle with predictable finality.That is less ideological than practical. It acknowledges that markets contain multiple participant types and multiple disclosure regimes, and a single visibility setting rarely satisfies all of them.A grounded example helps make this less abstract. NPEX, a regulated Dutch stock exchange, has been publicly discussed as a partner in bringing aspects of issuance and trading of regulated instruments on-chain with Dusk, including tokenization ambitions and integration work described in announcements and partner posts. This does not prove mass adoption, and it should not be treated as such. But it does signal something important: regulated entities are at least willing to explore architectures where privacy and compliance are designed into the base layer, rather than treated as external paperwork. For market structure thinkers, that is the thin end of a larger wedge, because it suggests the conversation is moving from prototypes to the question that actually matters: can you run a regulated workflow end-to-end without leaking everything, and without asking supervisors to accept blind trust?

Under the hood, Dusk also tries to align consensus and settlement properties with institutional expectations. The network describes its consensus as a committee-based proof-of-stake design—Succinct Attestation—where randomly selected provisioners participate in proposing and ratifying blocks, aiming for fast deterministic finality that better matches the needs of settlement than probabilistic reorg risk. For institutions, the technical details matter less than the operational consequence: finality is not a philosophical virtue; it is what allows you to define when a trade is done, when collateral can be released, when reporting clocks start, and when disputes have an unambiguous record. The other subtle point is neutrality. A design that avoids dependence on a small fixed set of large actors is not just “decentralization” as ideology; it is a governance risk control. If market infrastructure becomes too beholden to a narrow operator set, regulated participants will worry—quietly but persistently—about censorship, preferential treatment, and the fragility of informal power.

None of this removes the hard part, which is adoption. Regulated finance does not move at the pace of developer excitement.Regulators won’t sign off just because the cryptography is strong. They also need proof that the system can be audited, that outages or attacks are managed properly, that data is retained in a controlled way, and that accountability is clearInstitutions integrate slowly because they are bound to custody models, reporting systems, legal agreements, and internal controls that are themselves regulated artifacts. Interoperability, in this world, is not only about bridges and standards; it is about aligning chain behavior with how assets are booked, how ownership is recognized, and how compliance evidence is produced and retained. That is socio-technical work as much as engineering, and it is where many “promising” infrastructures go quiet.

Dusk is a bet that the future rails of finance will look less like a public social feed and more like a well-run utility: privacy where confidentiality is vital, and visibility only where it’s necessary.