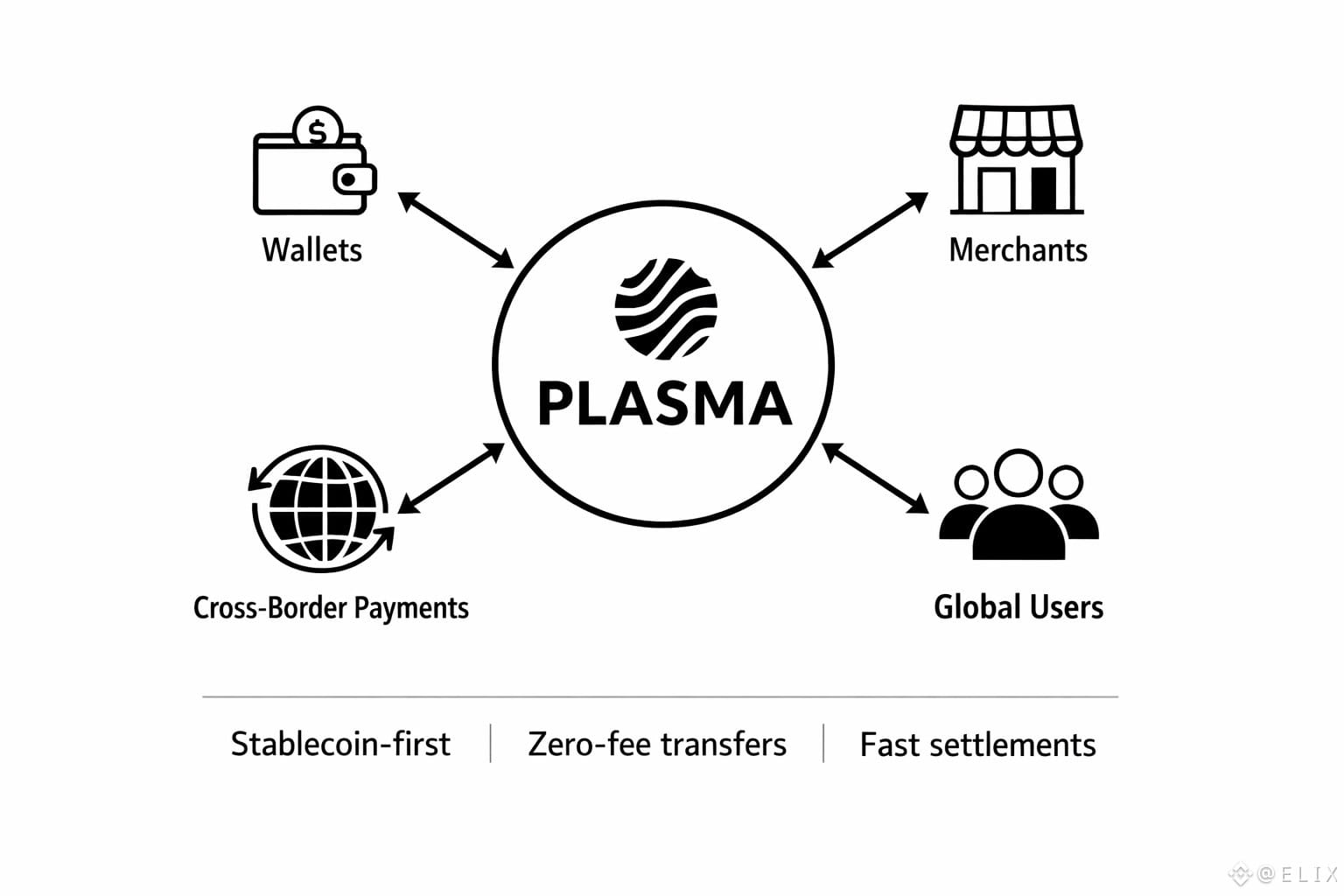

Most people associate blockchains with decentralized applications, NFT marketplaces, or speculative tokens. Plasma XPL charts a different course, creating a blockchain specifically designed as a settlement layer for stablecoins and a digital money infrastructure at internet scale. Unlike general-purpose networks, Plasma serves as the backbone for modern financial rails, enabling fast, reliable, and frictionless money transfers.

Stablecoins have become a cornerstone of the digital economy, powering payments, remittances, commerce, and cross-border flows, with hundreds of billions in circulating supply and trillions in monthly transactions. Yet most of these transactions occur on networks never optimized for stablecoins. Users must hold native tokens like ETH or TRX to pay gas, while congestion and latency make microtransactions cumbersome and costly. Plasma addresses this challenge with a simple but powerful principle: stablecoins are not an optional add-on—they are central to the protocol. To function as real money, stablecoins need an infrastructure that treats them as first-class economic assets, a philosophy that shapes every aspect of Plasma’s design, from consensus to tokenomics.

One of Plasma’s defining innovations is the ability to send USDT without paying fees. Gas costs are handled at the protocol level, eliminating the need for native tokens and making stablecoin payments simple and intuitive. By removing friction, Plasma makes onboarding easier for users who think in dollars rather than crypto, turning simplicity into a major adoption driver.

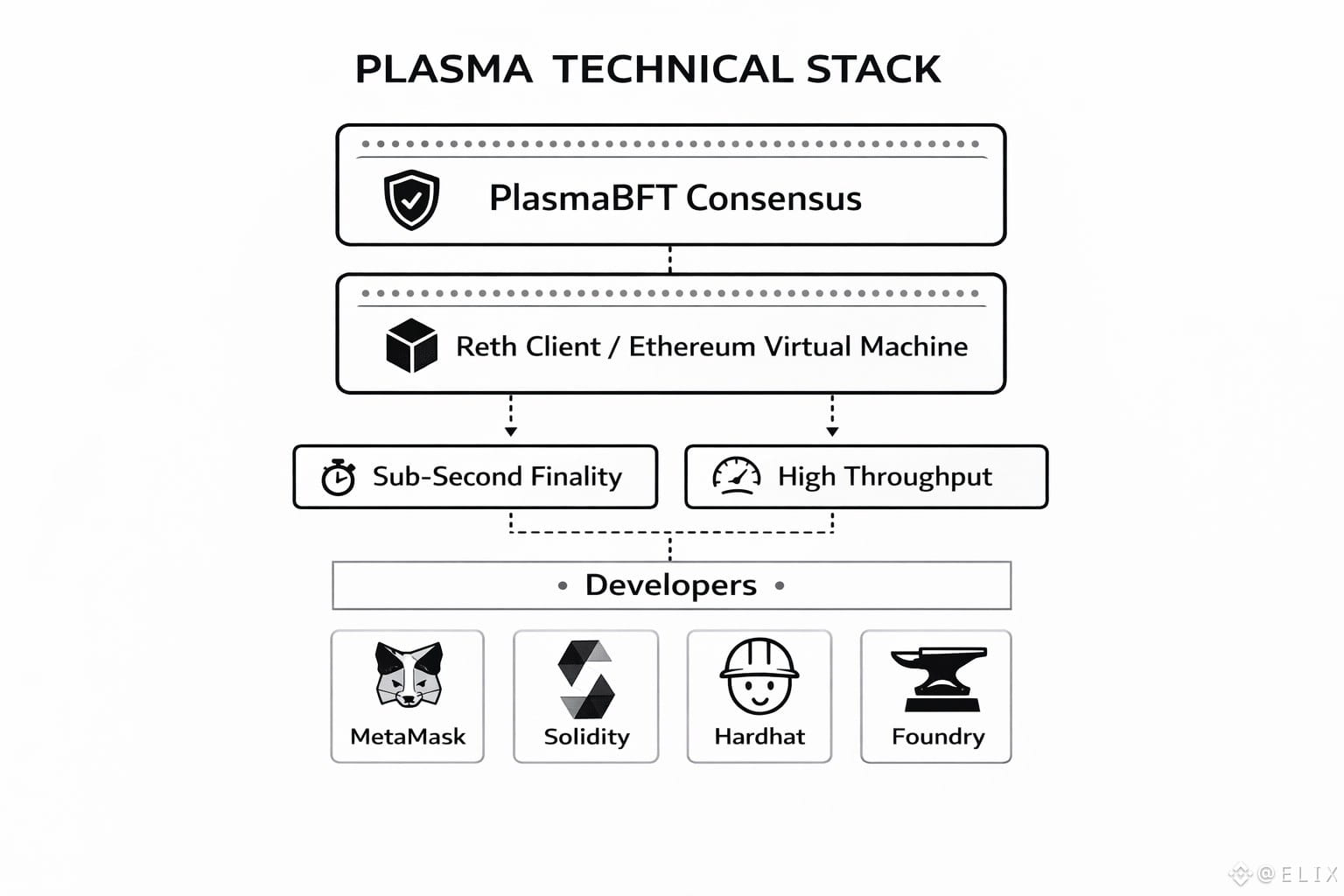

The network is built for scale and reliability, using PlasmaBFT, based on Fast HotStuff (F-BFT), to provide sub-second finality and high throughput, processing thousands of transactions per second. The Ethereum Virtual Machine (EVM) is implemented through the Reth client, allowing developers to leverage familiar tools such as MetaMask, Hardhat, Foundry, and Solidity contracts. This approach transforms Plasma from a stablecoin transfer network into a programmable money platform for issuers and DeFi developers alike.

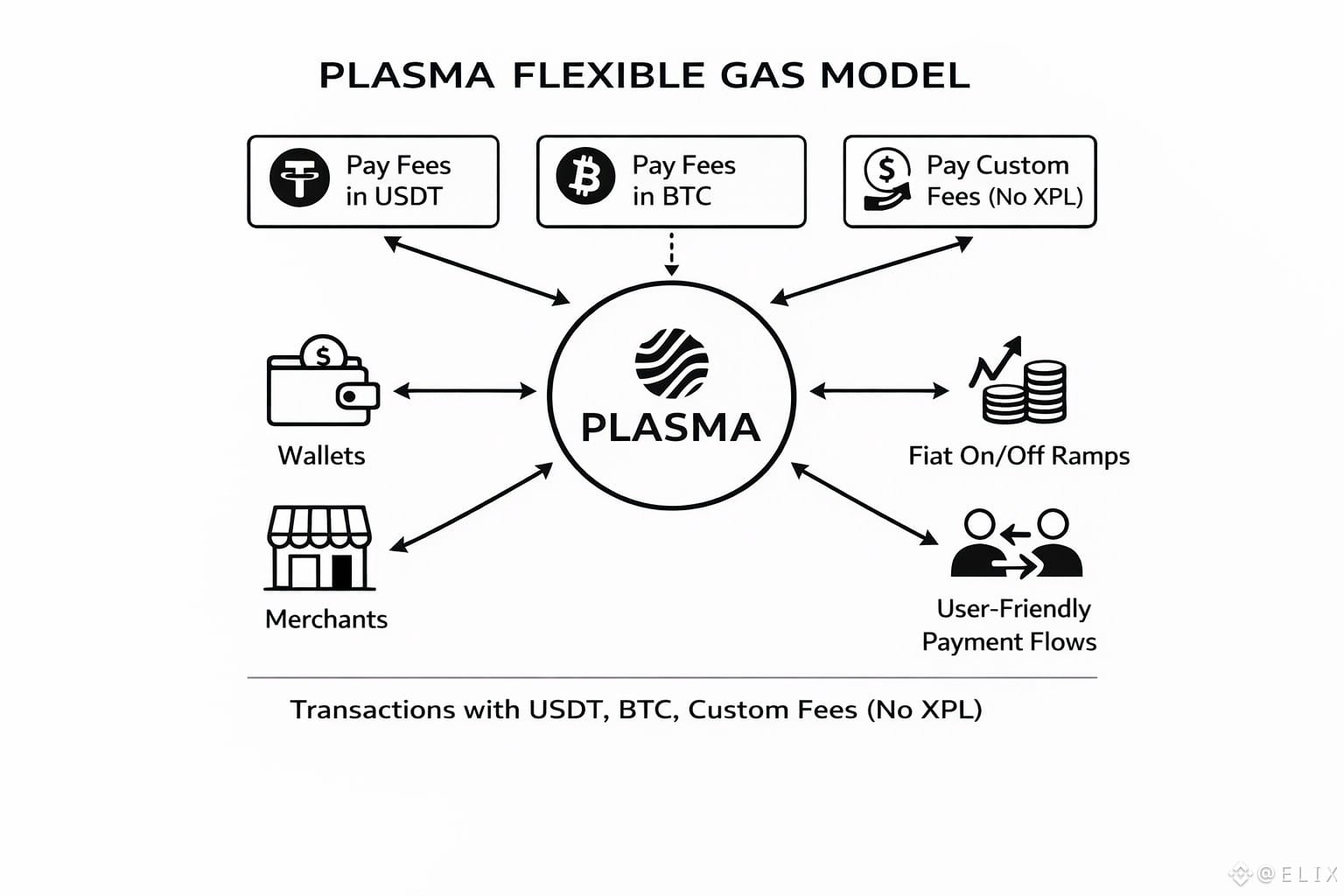

Plasma also introduces flexible gas models, allowing users to pay fees in whitelisted assets like USDT or BTC instead of XPL. This aligns with user priorities—people care about stablecoins, not speculative tokens—while simplifying wallet management, merchant integrations, and fiat on/off ramps. By designing for real-world use, Plasma bridges the gap between digital and traditional finance.

Security is strengthened through a Bitcoin-secured bridge, enabling tokenized Bitcoin (pBTC) representation and synchronizing state roots with Bitcoin regularly. Plasma inherits the robustness of the world’s most trusted blockchain while maintaining high performance. Unlike networks that prioritize decentralization as an end, Plasma focuses on durable trust, ensuring that stablecoins remain censorship-resistant, transparent, and reliable.

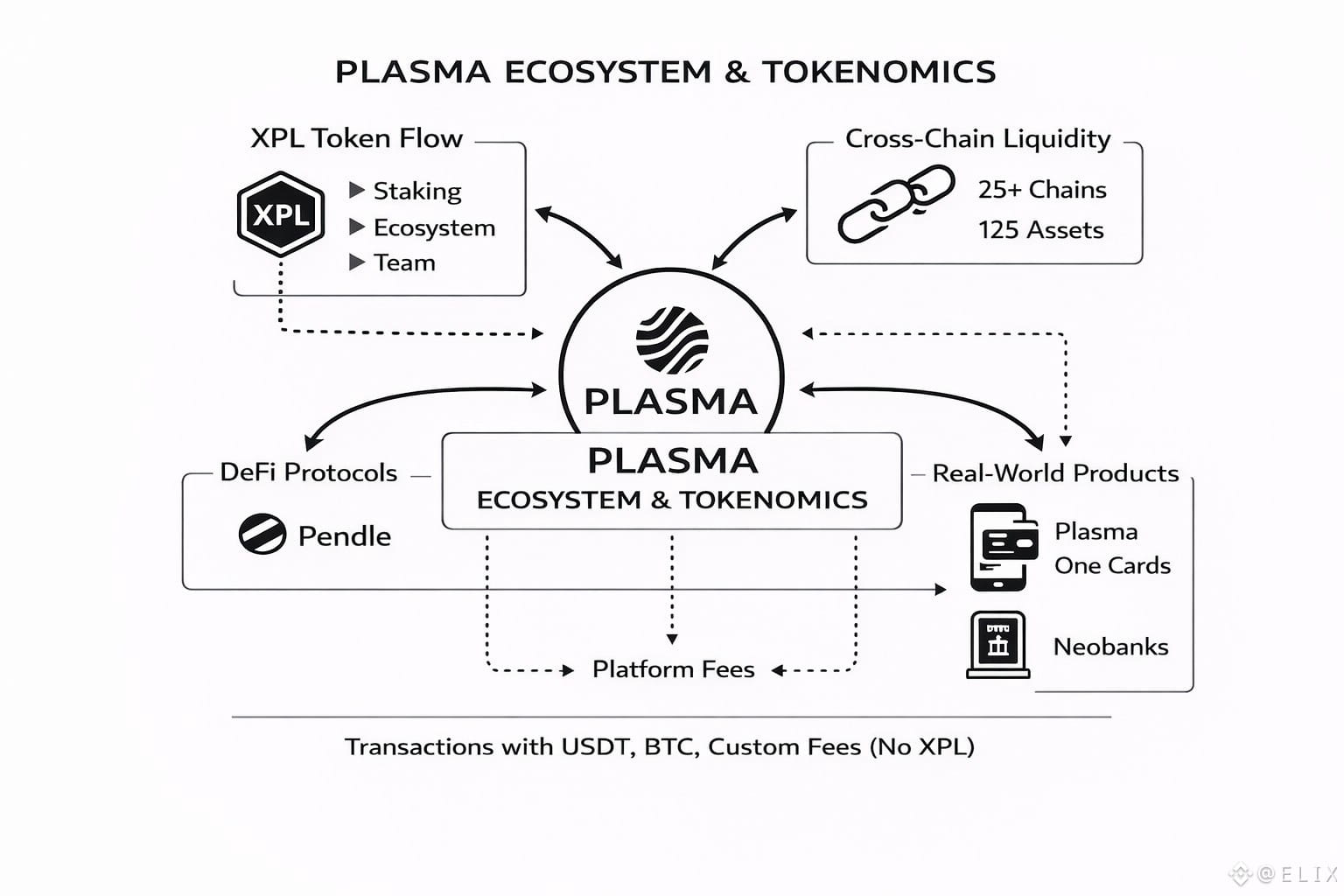

Plasma’s mainnet beta launched on September 25, 2025, with opening liquidity of 2 billion stablecoins, signaling exceptional demand. Cross-chain integrations like NEAR Intents connect XPL and USDT0 with a liquidity pool spanning over 25 chains and 125 assets, embedding Plasma into a larger global settlement network. DeFi protocols such as Pendle are now running on Plasma, providing yield strategies and fixed-income opportunities, extending the network’s value beyond payments into real financial services.

XPL, Plasma’s native token, underpins network security, ecosystem growth, and complex operations beyond simple transfers. With a starting supply of 10 billion tokens, half of which is allocated to ecosystem development and public sale, and the remainder distributed to the team and shareholders under vesting schedules, XPL incentivizes long-term engagement. Rewards and inflationary mechanisms are activated only through staking, ensuring that security scales with network participation. XPL is not a speculative asset—it is the coordination mechanism that keeps Plasma’s rails secure and resilient over time.

Plasma extends beyond digital rails with products like Plasma One, a suite of neobanks and debit cards that allow users to save, spend, and earn in digital dollars. Yield-bearing savings and cashback at international retailers demonstrate how Plasma transforms blockchain innovation into accessible, everyday financial infrastructure. By connecting stablecoins to real-world use, Plasma positions itself as a bridge between programmable finance and practical money.

Plasma’s ambition is as much economic and institutional as it is technical. It asks a fundamentally different question: what should a financial rail look like if designed for money, not markets? With zero-cost transfers, flexible gas logic, Bitcoin-backed security, and an ecosystem built for practical use, Plasma delivers a stablecoin infrastructure that is fast, predictable, accessible, and trustworthy. Its methodology—solving real user experience issues, aligning incentives, and linking programmable finance to everyday payments—marks a significant step in the evolution of blockchain.