Before decentralized finance became a consumer-facing phenomenon, the financial industry was already wrestling with a quieter but more persistent problem: how to move, store, and audit sensitive data in shared systems without exposing it to unnecessary risk. Traditional financial infrastructure solved this through permissioning, legal contracts, and trusted intermediaries. Public blockchains challenged that model by removing intermediaries, but in doing so they introduced a new tension. Full transparency, while useful for verification, becomes a liability when real money, regulated entities, and reputational risk are involved. Transaction histories, asset positions, and even operational metadata are exposed by default, making many blockchain systems impractical for institutions that must manage confidentiality alongside accountability.

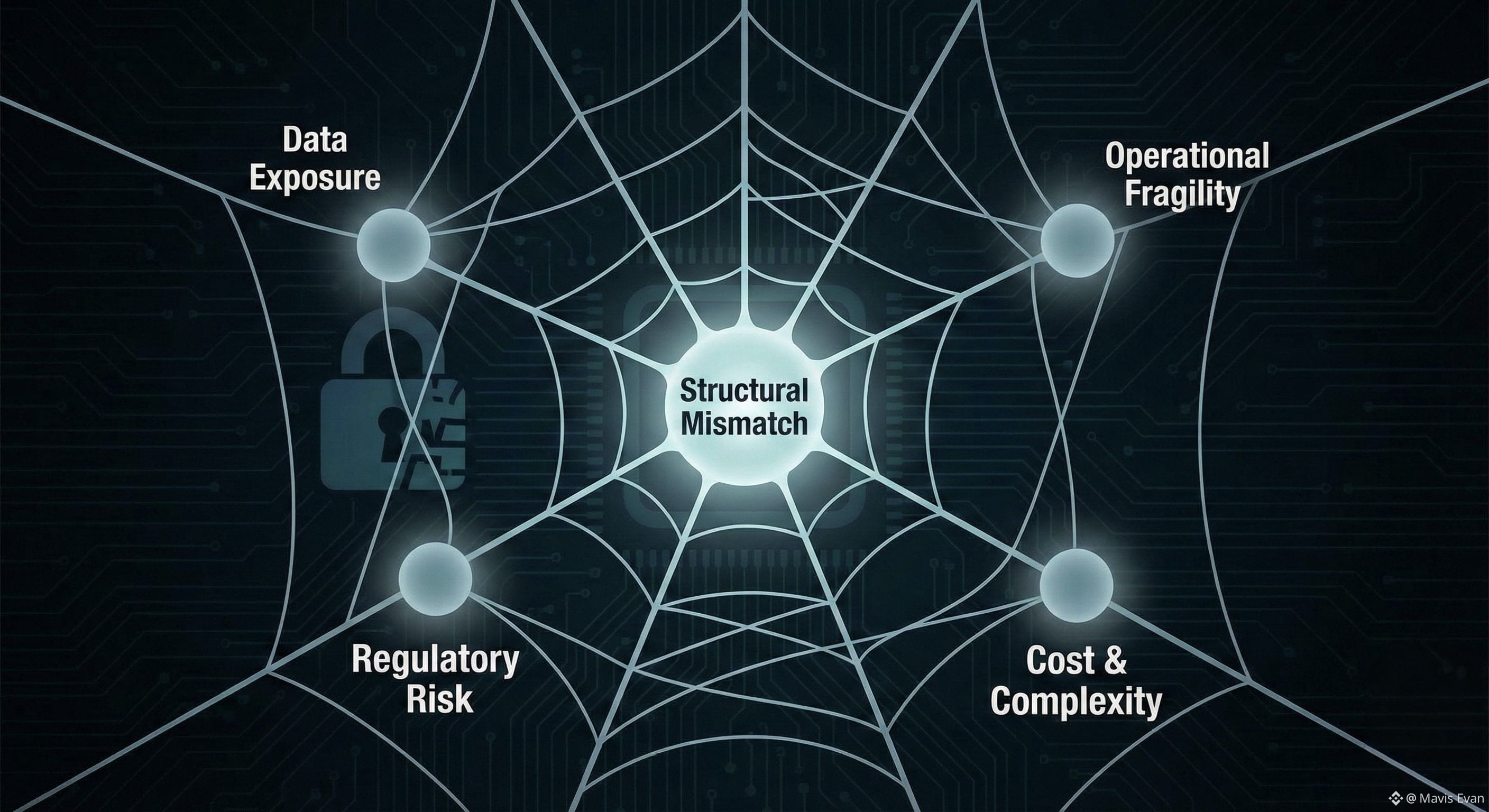

This gap is not theoretical. Asset managers handling private placements, funds coordinating internal governance, or enterprises storing proprietary datasets cannot rely on systems where every interaction is globally visible and permanently indexed. Attempts to patch this problem have often fallen short. Layered privacy tools are frequently bolted on after the fact, creating complexity and operational fragility. Centralized storage solutions, even when paired with blockchain settlement, reintroduce trusted points of failure and censorship risk. The result is an ecosystem where decentralization exists in principle, but practical usage remains constrained by off-chain dependencies and legal exposure.

The Walrus Protocol positions itself as a response to this structural mismatch rather than a wholesale reinvention of finance. Its design starts from a narrow but consequential observation: decentralized systems need a way to handle large volumes of data and sensitive transactions without forcing participants into an all-or-nothing choice between transparency and secrecy. Instead of treating privacy as an ideological goal, Walrus approaches it as an operational requirement that must coexist with auditability, cost control, and long-term reliability.

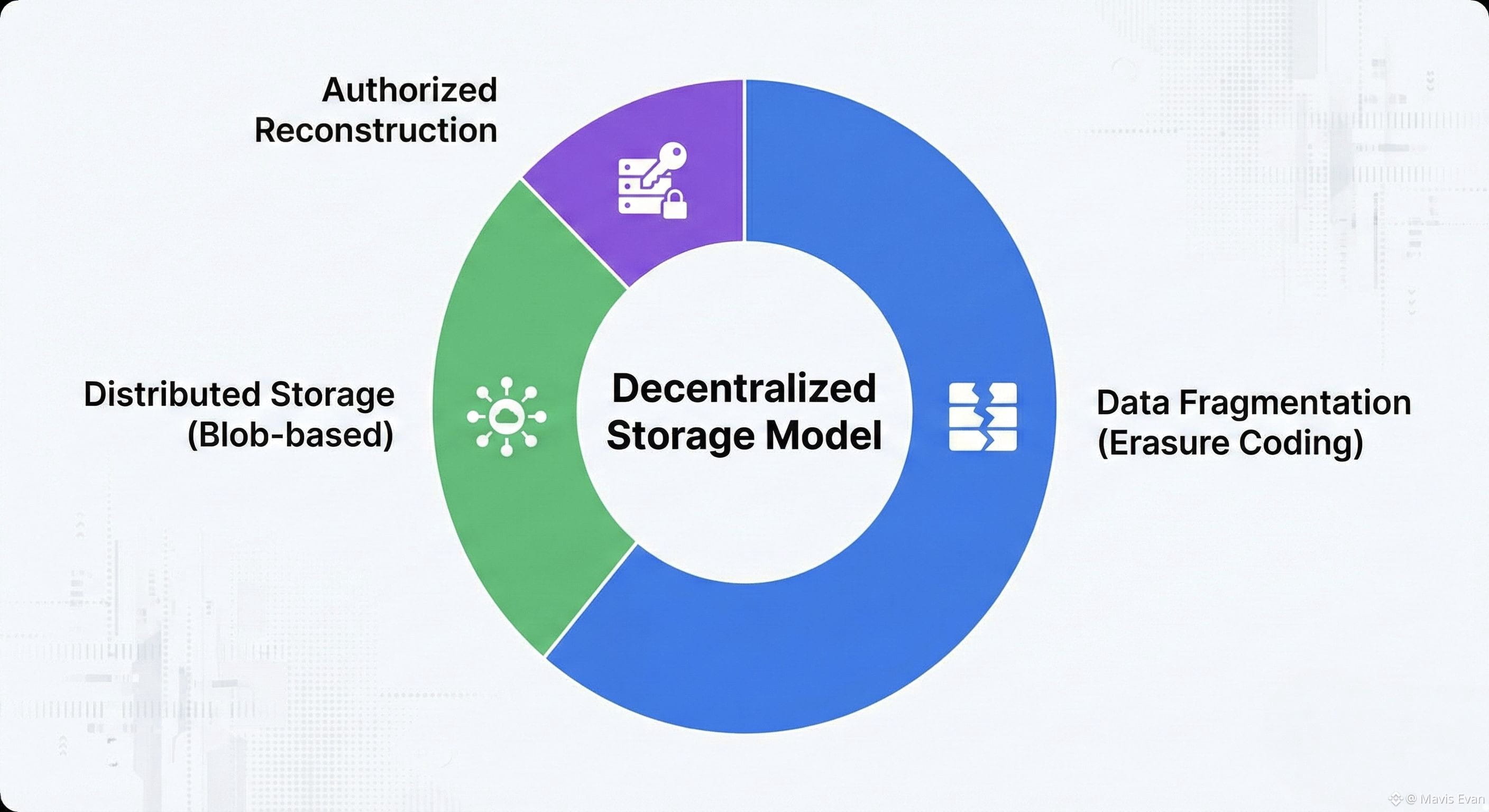

At a conceptual level, the protocol separates the question of verification from the question of exposure. Rather than assuming that all data must be publicly replicated in full, Walrus uses a decentralized storage model that distributes large data objects across the network in fragments. Through erasure coding and blob-based storage, no single participant holds a complete, readable version of the data, yet the system as a whole can reconstruct it when authorization and protocol rules allow. This design acknowledges a basic constraint of decentralized systems: global replication is expensive, and unnecessary replication of sensitive data increases both cost and risk.

Operating on the Sui blockchain, Walrus benefits from a base layer optimized for parallel execution and object-based data handling. Conceptually, this allows storage and transaction logic to scale with usage rather than bottlenecking around global state updates. For real-world users, the significance is not throughput metrics but predictability. Costs remain more stable, and performance does not degrade sharply as data volumes grow, which matters for institutions planning multi-year deployments rather than short-term experiments.

Consider a regulated fund issuing a confidential financial instrument to a limited set of counterparties. The lifecycle of that asset involves issuance, updates, reporting, and eventual settlement, all of which generate data that must be preserved for audits while remaining inaccessible to the public. In many blockchain systems, this data either lives off-chain in centralized repositories or is exposed on-chain with complex cryptographic wrappers that auditors struggle to interpret. Walrus offers an alternative path. Data can be stored in a decentralized manner, referenced and verified on-chain, yet revealed only to parties with legitimate access. The blockchain provides coordination and integrity, while the storage layer absorbs the bulk of sensitive information without broadcasting it indiscriminately.

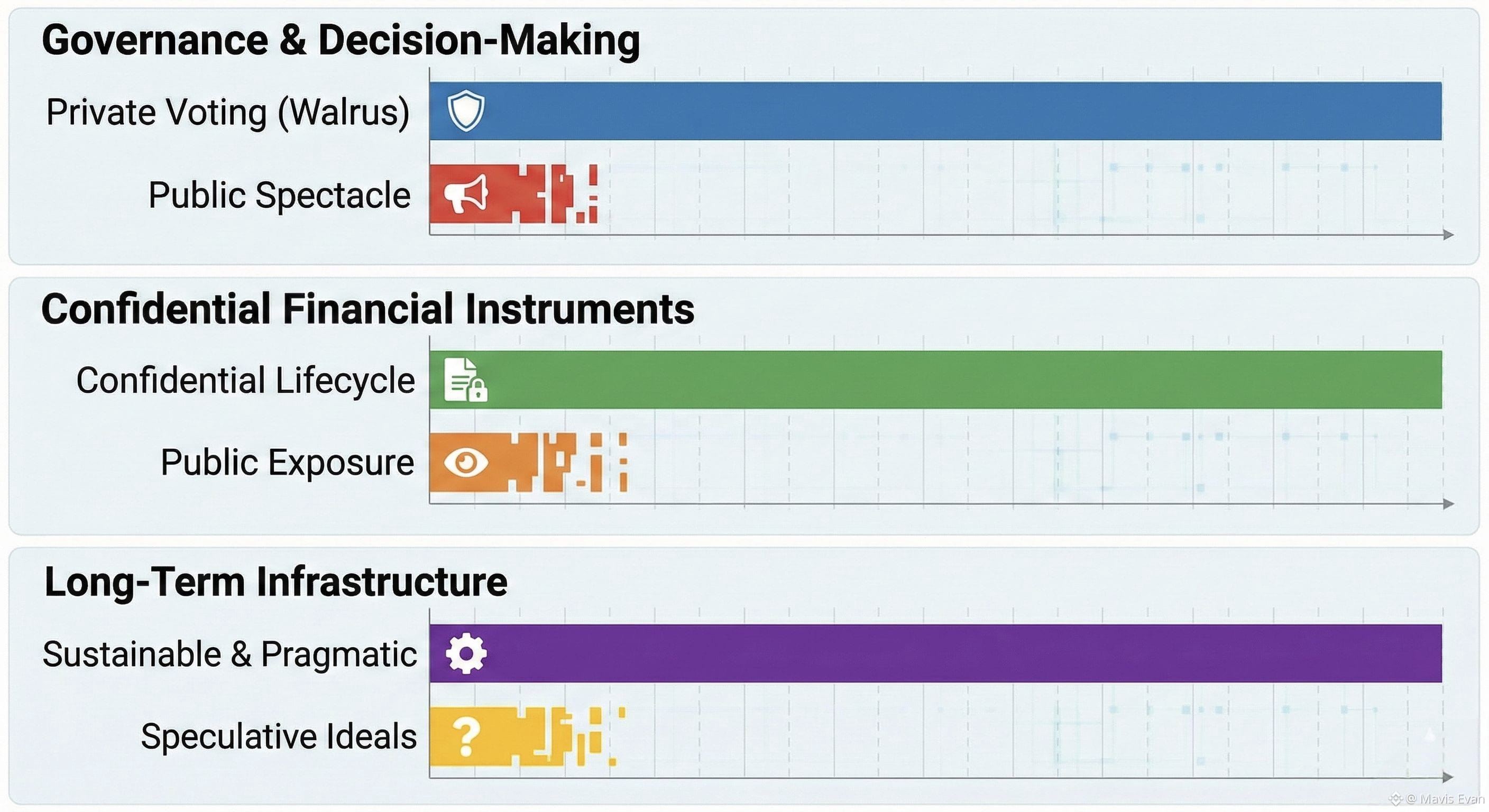

Governance presents a similar challenge. Decentralized governance is often framed as radically open, but real organizations rarely operate that way. Votes may need to be confidential, deliberations private, and records retained for compliance. Walrus supports governance workflows where participation and outcomes can be validated without turning internal decision-making into a public spectacle. This aligns more closely with how corporate and institutional governance already functions, reducing the cultural and operational friction that often blocks adoption.

The WAL token fits into this system as a functional component rather than a speculative centerpiece. It is used to pay for storage and network services, to align incentives among participants who maintain and validate data availability, and to coordinate governance decisions within the protocol. Its role is to sustain the economic behavior required for the network to function reliably over time, not to serve as a proxy for the project’s perceived success.

In the broader context of market evolution, Walrus reflects a maturation of decentralized infrastructure thinking. Early blockchains proved that trust-minimized settlement was possible. The next phase involves making those systems usable for environments where mistakes are costly and discretion is mandatory. Walrus does not claim to replace existing financial systems or to redefine decentralization in moral terms. Instead, it occupies a pragmatic middle ground, acknowledging that privacy, cost efficiency, and regulatory reality are constraints to be engineered around, not obstacles to be dismissed.

Over time, projects that endure are rarely those that chase maximal ideals. They are the ones that fit into how finance actually operates, absorbing its constraints while gradually extending its capabilities. Walrus, by focusing on durable data handling and privacy-preserving coordination, positions itself as infrastructure that can remain relevant as decentralized systems move from experimentation toward sustained, institutional use.