Markets are not breaking, they are being reprogrammed.

Trump’s political signals are triggering a global repricing of risk across stocks, bonds, and crypto, faster than macro data can explain.

What most investors call chaos is simply capital relocating under pressure.

Key Market Signals Right Now

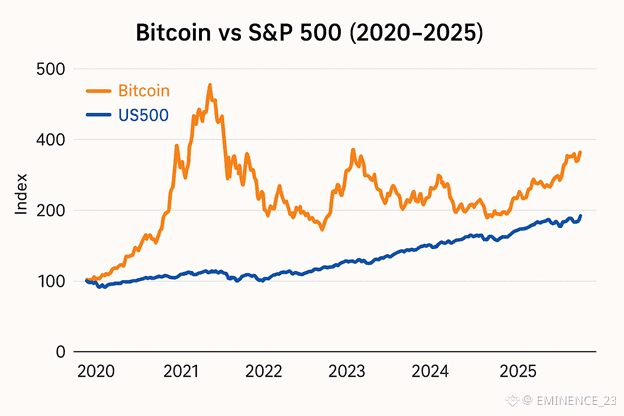

S&P 500 volatility: +25% in the last 2 weeks (risk-off spike)

BTC market cap: $1.05T+, maintaining resilience despite macro turbulence

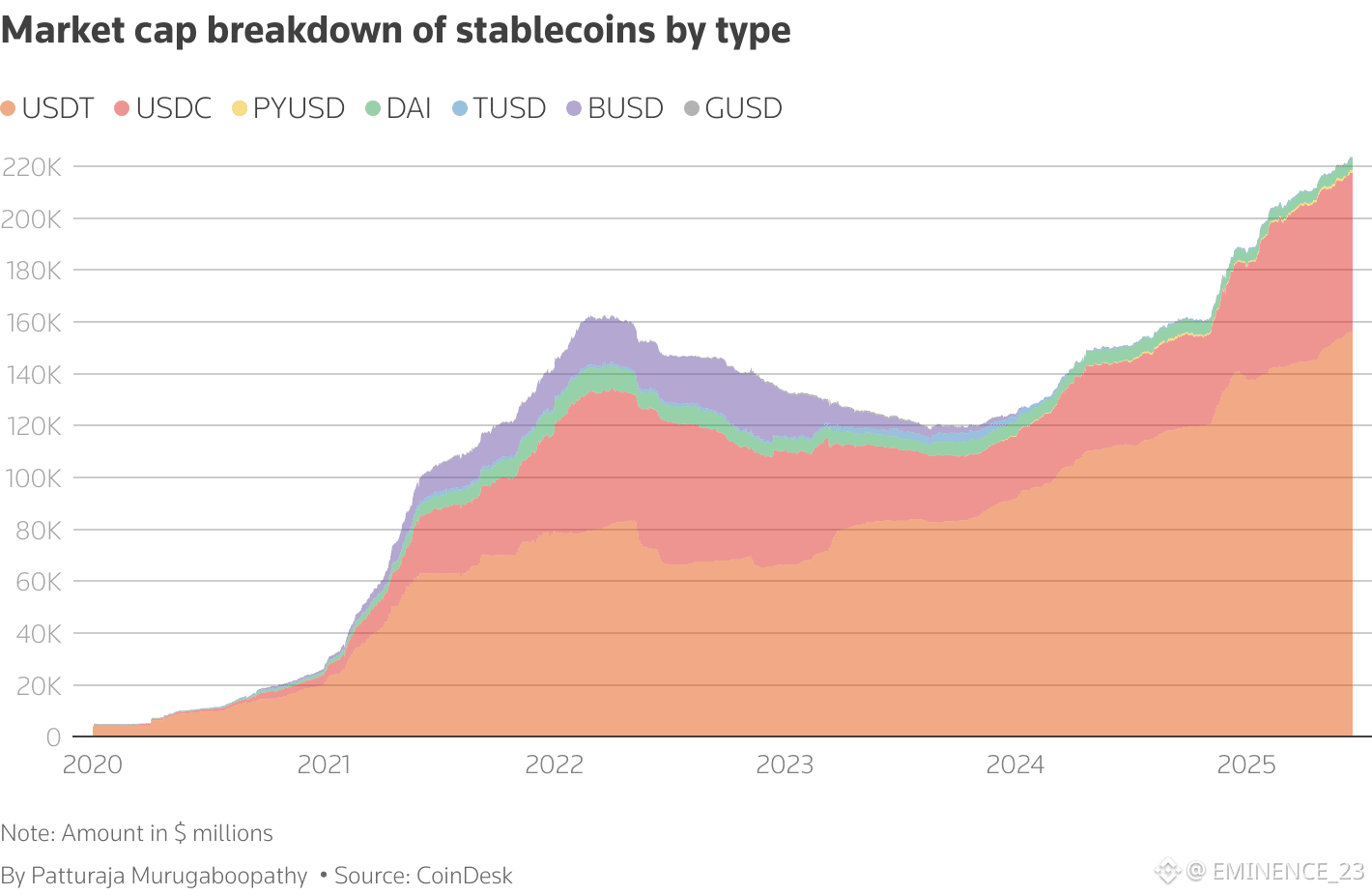

Stablecoin supply: $180B+, acting as liquidity buffer for rapid capital rotation

US 10Y yield: Fluctuating ±15bps with political news, showing sensitivity to Fed uncertainty.

Capital Rotation in Action

Out of long-duration assets → into defensive sectors & crypto

Crypto acts as macro hedge and “fast liquidity” tool

Market behavior shows capital migrating, not disappearing

Trump-style policies amplify:

Trade fragmentation

Fiscal stress & debt concerns

Institutional credibility risk

Crypto benefits by being outside traditional political constraints, but it’s still sensitive to liquidity cycles.

Capital adapts:

Tokenization accelerates globally Bitcoin increasingly treated as macro asset. Stablecoins & blockchain infrastructure adoption grows Political shocks are accelerators, not creators of these trends.

This is not about Trump. It’s about trust. When institutions weaken, capital adapts, and crypto is part of that adaptation. Ignore the signal, and the market will move without you.

#Bitcoin #GlobalMarkets #Liquidity #volatility #RiskManagement