Dusk Network has always felt like it was built for a very specific room: the room where finance actually lives. Not the loud part of crypto where everything is marketing and volume, but the quieter part where confidentiality, rules, and final settlement matter more than attention.

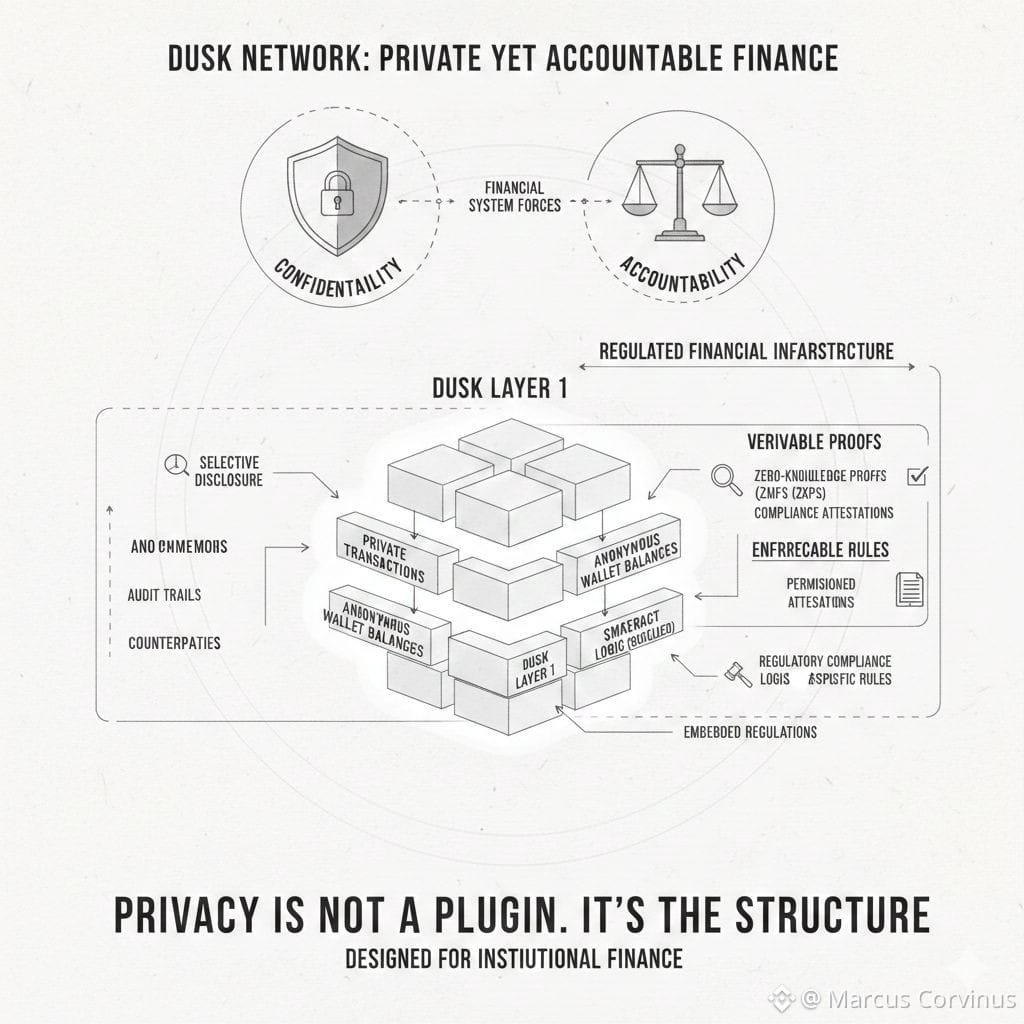

On most public chains, the “default setting” is exposure. Wallet balances, transfers, counterparties, and sometimes even the logic behind a transaction becomes something anyone can watch. That works for open experimentation, but it breaks down fast when you move toward real financial activity. Institutions can’t put portfolios, investor lists, private deals, and regulated assets on rails that broadcast everything to the world. Dusk is trying to fix that by building a Layer 1 where privacy isn’t a plugin — it’s baked into the structure — while still keeping the ability to prove correctness and compliance when it’s required.

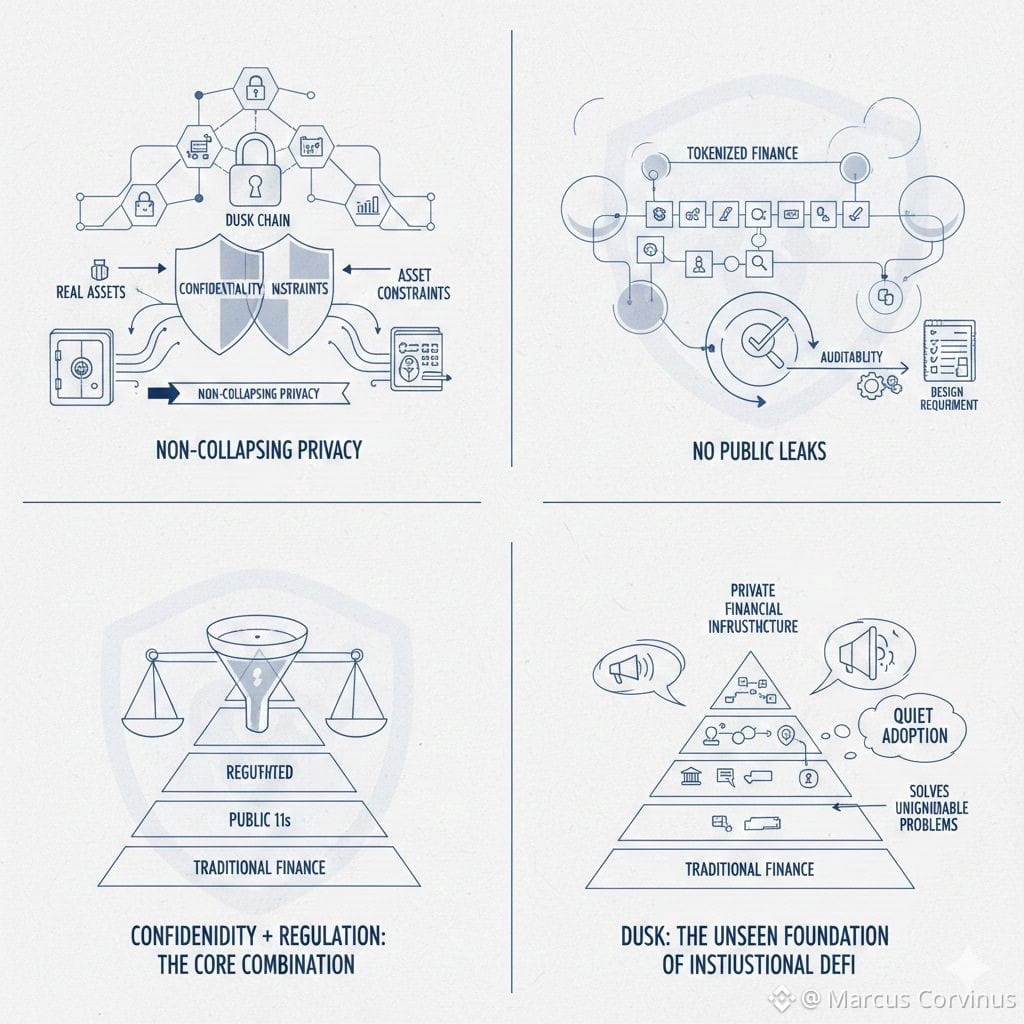

The reason this matters is simple: finance runs on two forces at the same time. Confidentiality protects counterparties, strategies, and sensitive positions. Accountability makes sure the system can be audited, regulated, and trusted. Public chains usually force a trade-off between those two. Dusk’s thesis is that you shouldn’t have to choose, and that a chain can be designed so private activity is normal, while verifiable proofs and enforceable rules still exist when the asset demands them. This is exactly the direction Dusk frames in its own documentation, where the system is presented as regulated financial infrastructure rather than a general-purpose “privacy coin narrative.”

Under the hood, Dusk is not built around one single feature. It’s a stack of choices that all point toward the same outcome: confidential state, enforceable asset behavior, and settlement that feels closer to financial infrastructure than an experimental sandbox

The first big building block is Phoenix, the transaction model Dusk uses to support privacy-first transfers and confidential execution. The Dusk whitepaper explains Phoenix as part of its privacy-preserving approach, where validity can be checked without putting sensitive details on public display.

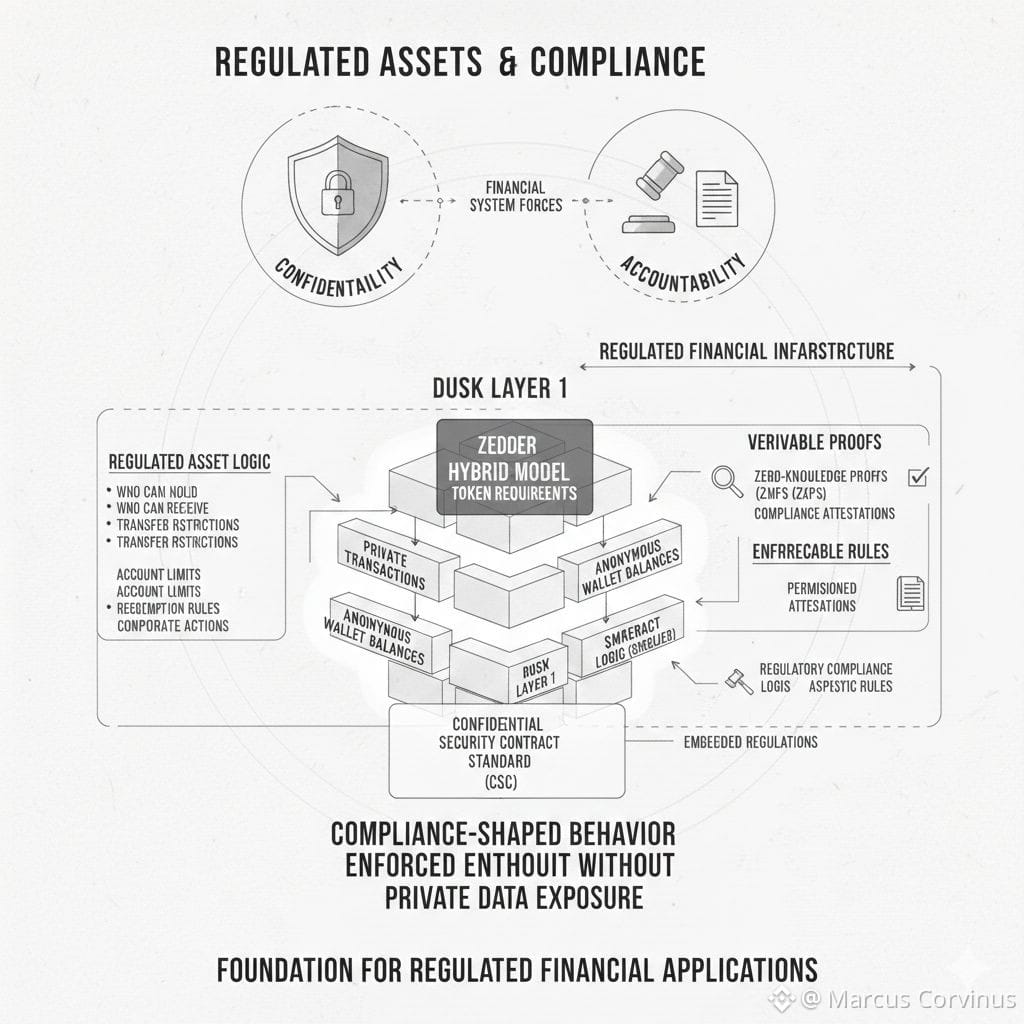

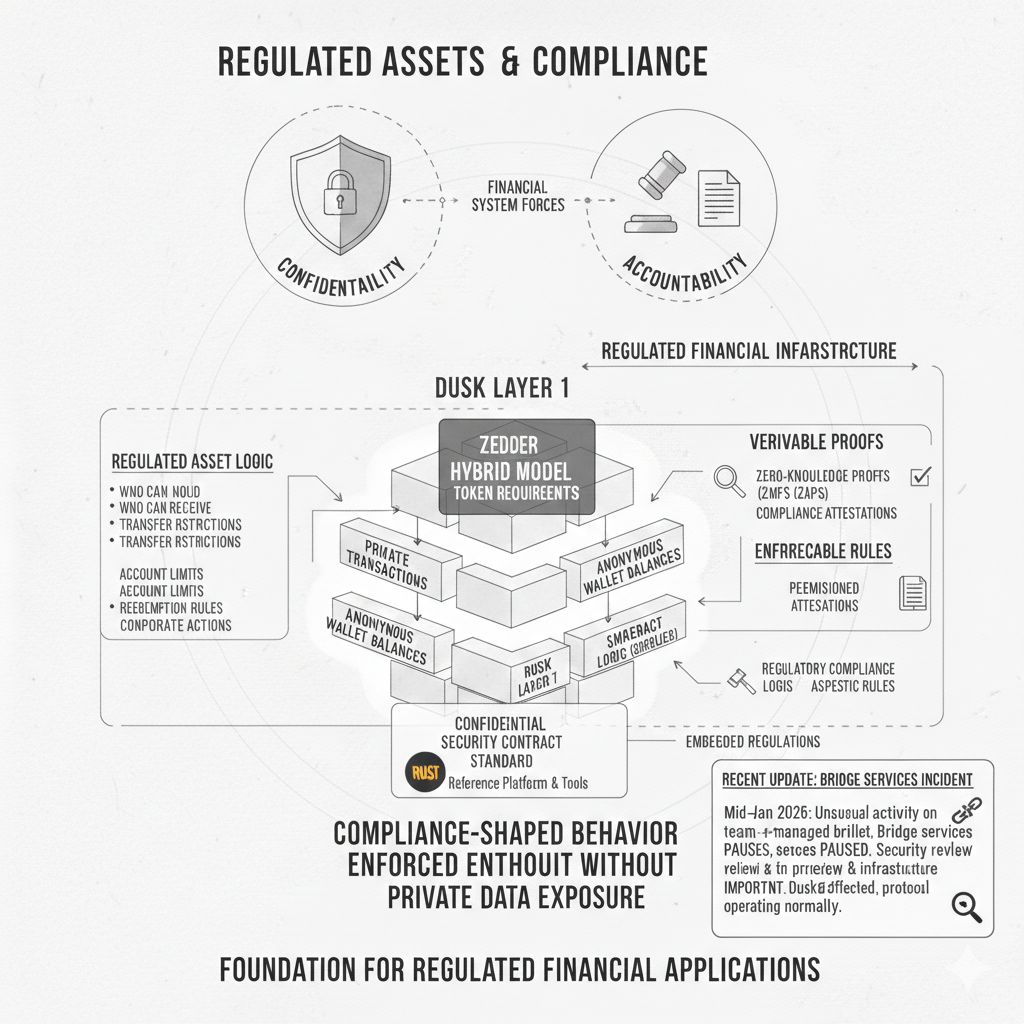

But the more interesting part is what comes next. Pure privacy systems often struggle the moment you introduce regulated asset logic. Regulated assets aren’t just “send from A to B.” They come with conditions — who can hold, who can receive, what restrictions apply, whether one person can create multiple accounts to bypass limits, how redemptions work, and how corporate actions or reporting can be produced. Dusk addresses that with Zedger, described as a hybrid model designed specifically for security-token requirements while preserving privacy, and positioned to support the Confidential Security Contract standard.

That’s where Dusk’s approach becomes very real. Instead of pretending compliance doesn’t exist, it treats compliance-shaped behavior as something that can be enforced without handing the world your private data. In the documentation around core components, Dusk frames these primitives as the foundation for regulated assets and financial applications, not just private payments.

Then there’s XSC, the Confidential Security Contract standard itself. In plain terms, it’s Dusk’s way of saying: if we’re going to represent real financial instruments on-chain, we need a contract and asset standard that can express rule sets and lifecycle actions without forcing full transparency. That includes the type of guardrails regulated markets expect, while keeping sensitive state protected.

On the execution side, the whitepaper also describes a WebAssembly-based environment (Rusk VM), with proof verification and the data structures needed for confidential state treated as native parts of the system instead of afterthoughts. This matters because privacy in finance isn’t only about “hiding transfers,” it’s about being able to run a full application flow — issuance, settlement, constrained transfers, and lifecycle events — while still maintaining confidentiality.

If you look at the engineering footprint publicly, you can also see how the project has evolved. The current node implementation and developer work is centered around the Rust-based Rusk codebase, which is presented as the reference platform implementation and tools.

Now, for the most recent meaningful project update that can be verified from official sources: the Bridge Services Incident Notice published mid-January 2026. Dusk reported unusual activity involving a team-managed wallet used in bridge operations, paused bridge services, and rolled out mitigations while a security review and infrastructure hardening process continued. They also stated that the DuskDS mainnet itself was not impacted and the protocol continued operating normally.

I’m mentioning this because it’s not “drama content.” It’s a real test of operational maturity. Any infrastructure project that wants to be taken seriously eventually gets measured by how it handles stress: do they freeze, do they hide, do they blame users, or do they slow down, lock down the surface area, and ship mitigations with a clear path to reopening? The notice reads like a team that chose caution over speed, which is exactly what finance expects from the rails it relies on.

When it comes to what’s next, the logic is pretty clean, and you don’t need to guess wildly. Based on that incident notice, bridge reopening is clearly tied to completing the review and hardening work. Beyond that, Dusk’s own positioning suggests the next phase is less about “new narratives” and more about expanding what builders can confidently deploy: regulated assets, compliant DeFi-like workflows, and tokenized real-world instruments where privacy is default but proofs exist when required.

The token story is also unusually straightforward, which I like. Dusk’s tokenomics documentation states an initial supply of 500,000,000 DUSK, with an additional 500,000,000 emitted over 36 years to reward stakers, for a maximum supply of 1,000,000,000 DUSK.

The same documentation also explains that DUSK exists as ERC-20 on Ethereum and as BEP-20, and that with mainnet live, users can migrate to native DUSK via a burner contract flow. That’s a typical path for projects that started with an external token representation and later moved into their own settlement layer, where staking and network-native utility become the center of gravity.

So what are the real benefits if Dusk keeps executing the way it’s designed? It’s the combination, not any single bullet point. Confidentiality that doesn’t collapse when real asset constraints appear. A system that treats regulated behavior as a first-class design requirement. A chain trying to become the place where tokenized finance can actually exist without turning every position and relationship into a public leak. That’s the bet.

My personal takeaway is that Dusk doesn’t feel like it’s competing to be “another L1.” It’s trying to own a narrow, difficult category: privacy for financial applications where rules and auditability still matter. That’s harder than building a normal smart-contract chain, but it’s also one of the few directions where the market still has a real missing piece. If Dusk succeeds, it won’t need to shout. It becomes the kind of infrastructure people use quietly because it solves a problem they can’t ignore.

About your “last 24 hours update”: from the official Dusk site sources I checked, I did not find a brand-new announcement clearly published within the last 24 hours. The most recent major official operational notice remains the bridge incident update from mid-January 2026.