I’ve been watching Dusk Network with a different kind of attention lately, because it isn’t trying to win the market by being loud. It’s trying to win by becoming useful in the one place crypto still struggles the most: real finance.

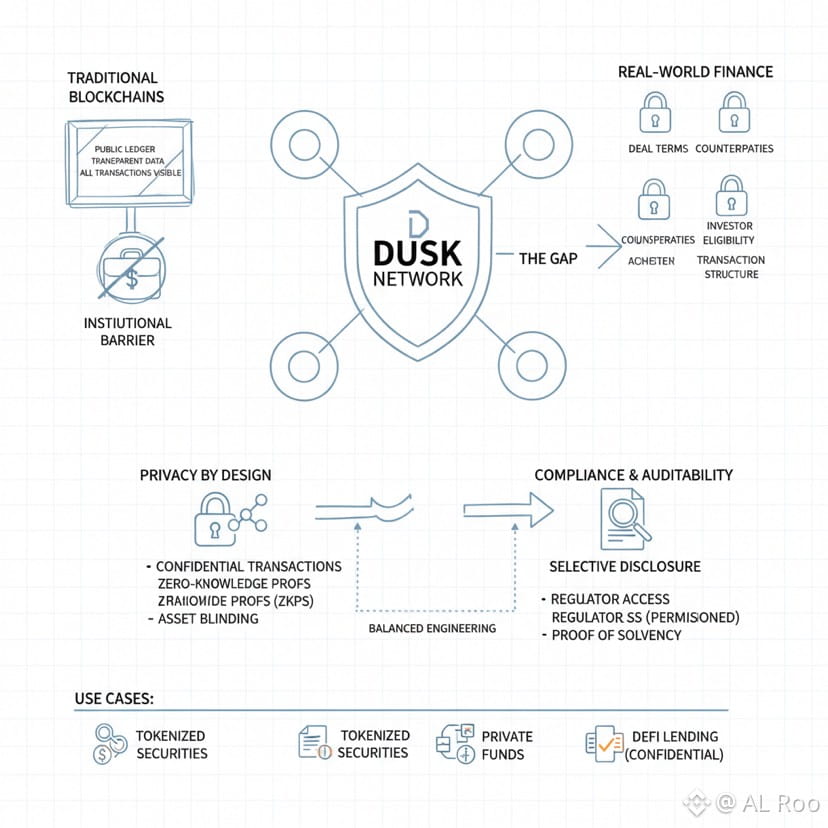

Most chains are built like public billboards. Every move, every balance change, every interaction gets written in a way that anyone can read forever. That works for simple assets, but it breaks the moment you try to copy how financial markets actually operate. In real markets, confidentiality isn’t optional. Deal terms are private. Counterparties are private. Investor eligibility is private. Even the structure of a transaction can be sensitive. If you expose all of that on a public ledger, you don’t get “transparent finance,” you get a system that institutions cannot touch.

This is the gap Dusk is trying to fill. The project describes itself as a Layer-1 designed for privacy-focused financial applications, where privacy isn’t a feature you toggle on later, it’s part of the base design. Their documentation and project overview keep circling one central idea: make a public network that can still protect sensitive financial data, while staying compatible with auditability and compliance needs. That sounds simple, but it’s one of the hardest combinations to engineer properly.

What I like about Dusk is how “finance-native” the architecture feels. Instead of treating settlement and application execution as one giant blob, the project talks about a modular structure: a settlement layer that focuses on finality and integrity, and an execution layer that gives developers an EVM environment to build on. In finance, that separation matters because settlement is where risk concentrates. You don’t just want transactions to be fast, you want them to be final and dependable, so the system behaves like real rails instead of a probabilistic game.

Then you get to the heart of Dusk’s identity: confidentiality. You mentioned Phoenix and Zedger, and that’s really the story. Phoenix is presented as a transaction model built to support private transfers and privacy-first behavior at the transaction layer, not as an optional wrapper. Zedger expands that concept into a model designed specifically for security-token style requirements, where privacy exists alongside structured rules and controlled participation. This is important because regulated assets are not meant to behave like anonymous cash. They have constraints, eligibility, and lifecycle requirements. Dusk is basically saying: “We can keep data confidential, but still design for how regulated assets are supposed to work.”

And then there’s the bridge between “privacy research” and “developer reality,” which is where the project’s direction becomes more practical. Dusk’s EVM layer is where builders can actually ship apps without reinventing their whole toolchain. But bringing confidentiality into the EVM world is the hard part, and that’s why the project talks about Hedger: a privacy engine meant for confidential computation inside the EVM environment, framed around cryptographic approaches like homomorphic encryption and zero-knowledge techniques. In plain words, the intention is: let contracts operate on private values, and still allow the system to prove that things were done correctly when it’s needed. That’s exactly the kind of confidentiality model finance can respect.

The token story is also worth understanding properly, because people get confused when they look at DUSK across different representations. The Ethereum token contract you linked is the ERC-20 representation, and that page is where you can track holders, transfers, and supply stats for that contract address. The broader Dusk ecosystem talks about longer-term economics and emissions on the network side, which is why you’ll sometimes see different supply narratives depending on where you’re reading. The clean way to think about it is: the ERC-20 contract is a representation, but the project’s long-term network economics are defined by the chain’s own issuance logic and roadmap evolution.

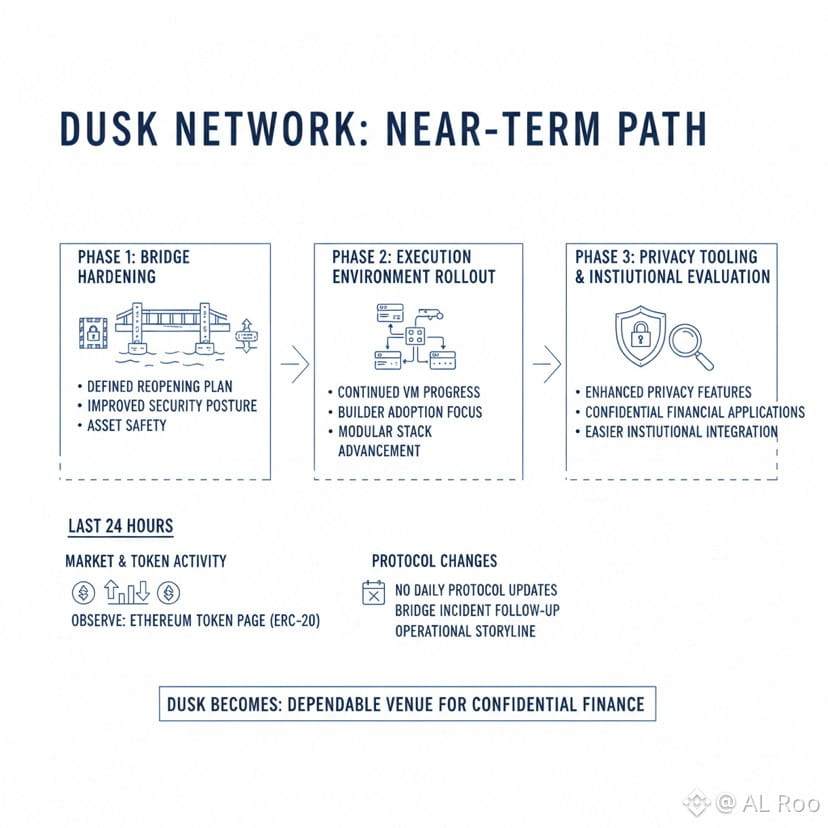

Now, for the “latest updates” part, the most meaningful project-level signal near your timeframe is not a hype announcement. It’s operational. Dusk published a bridge services incident notice dated January 17, 2026, describing unusual activity involving a team-managed wallet used in bridge operations, stating the core network wasn’t impacted at the protocol level, and confirming bridge services were paused while mitigations and hardening steps were implemented. This matters because it tells you what the team prioritizes when pressure hits: protect users, pause risk, ship mitigation, then reopen only when confidence is rebuilt. This isn’t glamorous, but it’s what real infrastructure teams do.

So when you ask “what’s next,” the answer isn’t guesswork. The near-term path is strongly implied by their own messaging: bridge hardening and a defined reopening plan, then continuing the rollout of the execution environment and the privacy tooling around it. If the modular stack keeps progressing, Dusk becomes easier for builders to adopt and easier for institutions to evaluate, because the chain stops being a concept and starts behaving like a dependable venue for confidential financial applications.

In the last 24 hours specifically, what you’ll mostly see publicly is market movement and token activity, because true protocol changes don’t usually happen daily in a way that shows up instantly. The Ethereum token page you linked is still the best place to observe live transfer activity and holder movement on the ERC-20 representation. If your definition of “what’s new arrived” is “what changed today on the project side,” then the most concrete recent project communication remains the bridge incident and the follow-up hardening posture, which is still the biggest operational storyline shaping rollout momentum right now.

My takeaway is simple: Dusk isn’t built for people who want everything public, forever. It’s built for financial systems where confidentiality is a requirement, but credibility still depends on provable correctness. That’s a narrow lane, but it’s a valuable lane. If Dusk keeps executing on confidential computation inside the EVM experience, and if it keeps proving operational discipline around infrastructure risks, the project has a real chance to become the chain that regulated finance can actually live on.