Plasma is one of those projects that makes more sense the longer you sit with it. It isn’t trying to be “the chain for everything.” It’s trying to be the chain that makes stablecoins feel like a normal payment tool — fast, cheap, predictable, and simple enough that people don’t have to learn crypto just to move money.

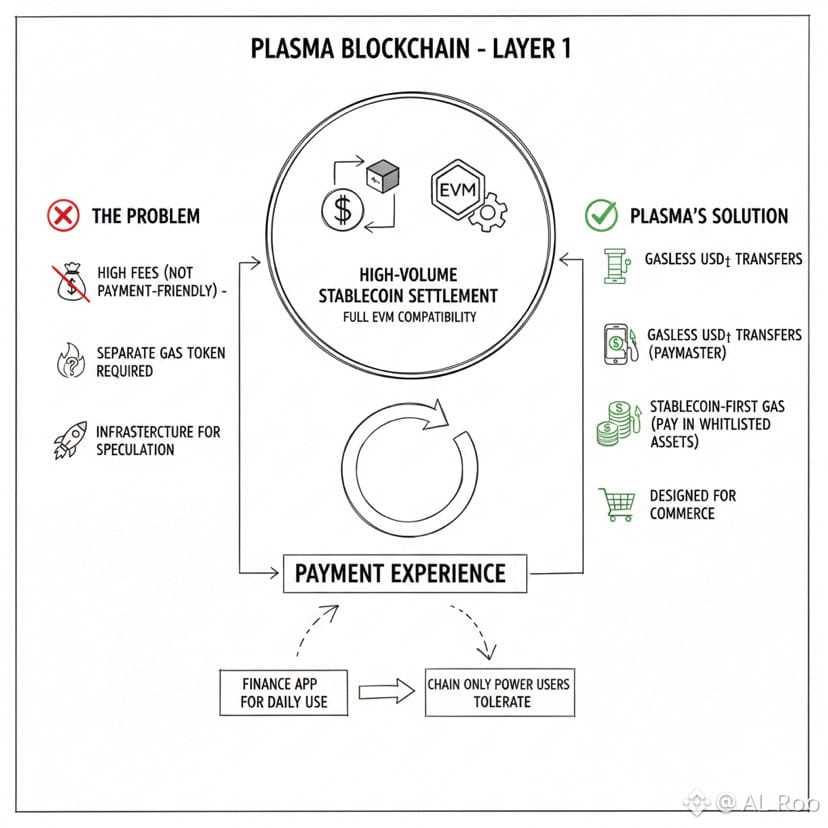

At the core, Plasma is building a Layer 1 designed specifically for high-volume stablecoin settlement, while staying fully EVM compatible so developers can ship with familiar tooling. The reason this angle stands out is because stablecoins are already doing real work globally, but the onchain experience still has friction baked in: fees that don’t feel “payment-friendly,” the constant need to hold a separate gas token, and settlement behavior that sometimes feels like you’re using infrastructure built for speculation rather than commerce. Plasma’s direction is basically: if stablecoins are the product, then the chain should be designed around stablecoins from day one.

What Plasma keeps emphasizing is the payment experience itself. They talk about gasless USD₮ transfers through a paymaster-style approach (so sending a stablecoin can be closer to “tap and send”), and they push the idea of stablecoin-first gas where the network can support paying fees in whitelisted assets instead of forcing every user into the same gas-token workflow. That might sound like a small UX tweak, but it’s the difference between “a finance app someone can use daily” and “a chain only power users tolerate.”

Under the hood, Plasma presents itself as a modular stack: fast-finality consensus plus a modern EVM execution client approach, with the structure designed so the network can keep improving without breaking what developers build on top. They’ve framed the chain around sub-second finality goals and stablecoin throughput expectations, which is exactly the kind of language you’d expect from a settlement network that’s aiming for payments, not just onchain activity for its own sake.

The other part people miss is how much “boring work” Plasma is openly leaning into. Payments at scale is not just code; it’s distribution, compliance realities, licensing, partnerships, and operational trust. Plasma has publicly discussed building toward regulated reach and licensing their payments stack, including steps like establishing regulated footholds and building compliance capacity. Whether you love regulation talk or hate it, this is usually the wall projects hit when they try to move from crypto-native users to real-world payment flows. Plasma is basically saying that wall is part of the plan, not an afterthought.

Then there’s the long-term security and neutrality story: Plasma repeatedly ties its credibility narrative to Bitcoin anchoring and a native Bitcoin bridge direction. What’s important here is that their own documentation is careful about rollout — the bridge system is described as under development and not something that simply flips on at the earliest stage. That’s actually a good sign in a world where projects often promise everything immediately. They’re framing it as a staged build: first make the chain work as a stablecoin settlement layer, then expand the Bitcoin-linked security and bridging architecture as it hardens.

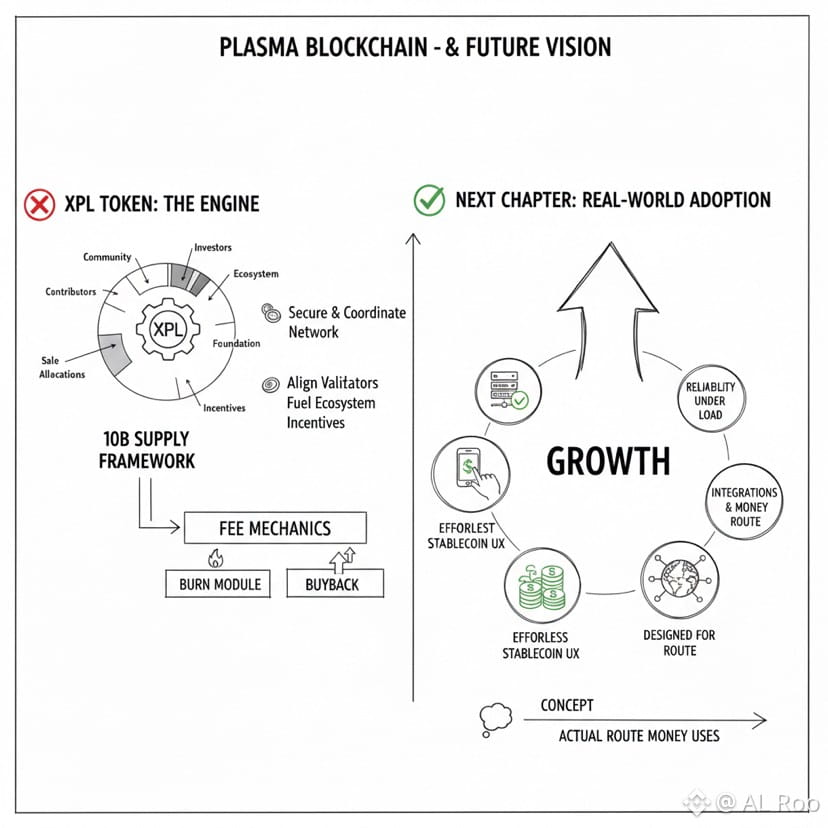

On the token side, Plasma’s story is straightforward: XPL is meant to secure and coordinate the network, align validators, and fuel ecosystem incentives — basically the engine that helps the chain grow into real usage rather than staying as a concept. Their official docs outline a 10B supply framework and a distribution structure across community, ecosystem, contributors, foundation, investors, sale allocations, and incentives, along with fee mechanics (including burn/buyback style modules described in their materials).

So when you ask “what’s next,” the honest answer is that Plasma’s next chapter is less about flashy feature announcements and more about proving the same thing every serious payments rail has to prove: reliability under load, stablecoin UX that feels effortless, liquidity that stays deep after incentives cool, and integrations that turn the chain into an actual route money uses — not just a place money visits.

My takeaway is simple: Plasma is aiming for a category win, not a narrative win. If they execute, the value won’t come from hype cycles. It will come from something much stronger and much rarer in this space — people using it because it’s the easiest, cleanest path to move stablecoins at scale.