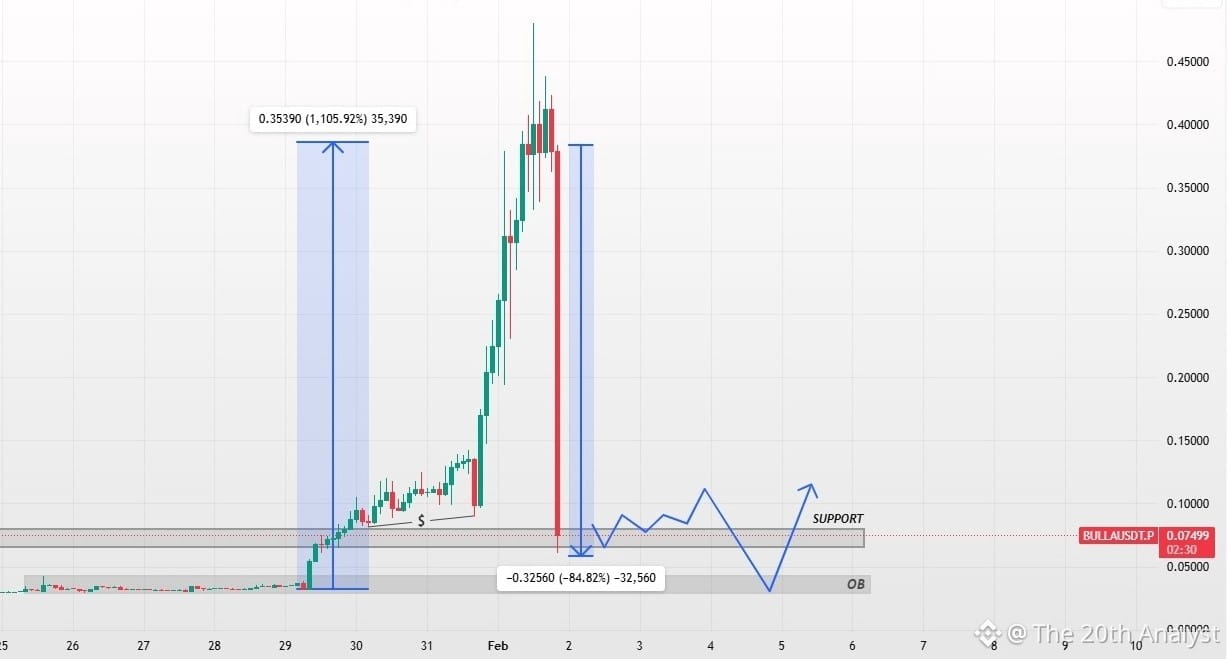

$BULLA BULLA’s recent price action reflects a textbook distribution-to-displacement cycle.

Once upside liquidity was fully absorbed, the market shifted aggressively to the downside.#BullaDump

🔻 Why the decline happened so fast:

1. Overextended price structure

The rally occurred without healthy pullbacks, creating an unstable market imbalance.

2. Resistance & profit distribution zone

As price entered premium territory, large holders initiated heavy sell orders.

3. Stop-loss cascade effect

When support failed, leveraged long positions were forced to exit, accelerating the drop.

4. Liquidity reversion to value area

Markets naturally return toward high-volume demand zones after extreme expansions.

📚 Professional Market Lesson:

Sharp rallies built on momentum — not structure — usually end with equally sharp corrections.

Price does not fall randomly.

It falls when:

• Buy-side liquidity is exhausted

• Premium levels are reached

• Institutions rebalance positions

Volatility is a function of liquidity, not emotion.

⚠️ Educational analysis only — not financial advice. #MarketCorrection