Vanar feels like it’s chasing a very specific finish line: not “another chain,” but a chain that can actually carry mainstream products without breaking the user experience.

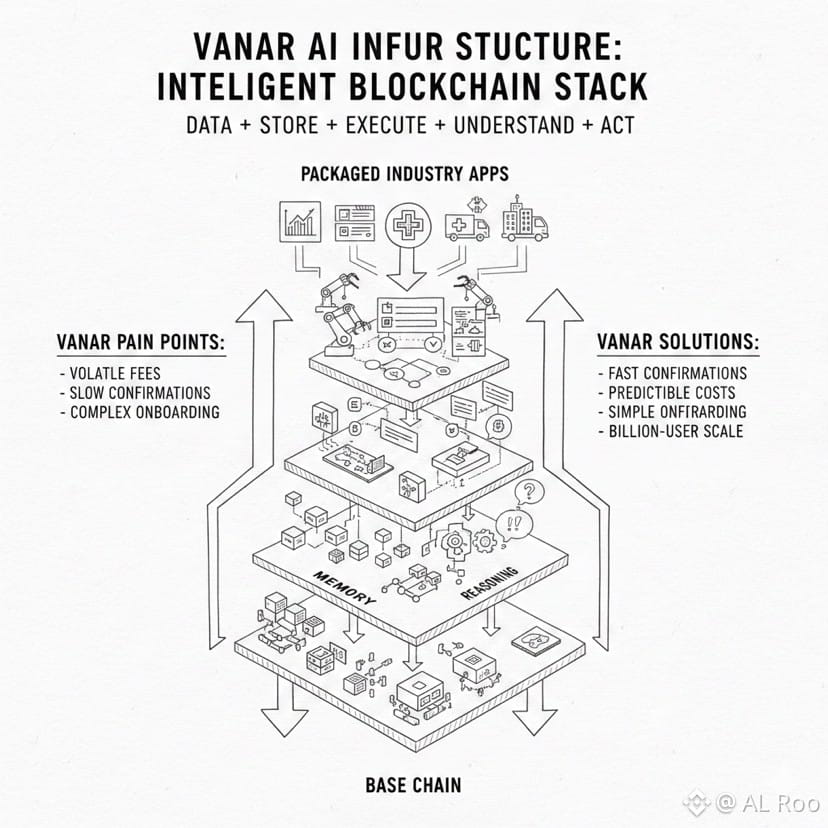

When you read Vanar’s own materials, the pain points they’re targeting are clear: fees that swing all over the place, confirmation speeds that don’t match real apps, and onboarding that still feels like a barrier for anyone outside crypto. Their whitepaper frames the mission around solving those adoption blockers head-on—fast confirmations, predictable costs, and smoother onboarding at a scale that can handle billions of users.

What makes Vanar interesting is that it isn’t only talking about performance. The newer positioning on the website leans hard into “AI infrastructure,” and the way they explain it is simple: data shouldn’t just sit somewhere as a dumb link, and blockchains shouldn’t just store + execute… they should be able to understand what’s stored and act on it. That’s why the whole stack is shown as a layered system where data flows upward, from base chain → memory → reasoning → automation → packaged industry apps.

Under the hood, their base layer is still designed for practical shipping. The whitepaper is explicit about the kind of targets they care about: transaction costs reduced to around $0.0005 and block times capped around 3 seconds, because anything slower becomes a UX problem the moment you try to build real consumer products on it.

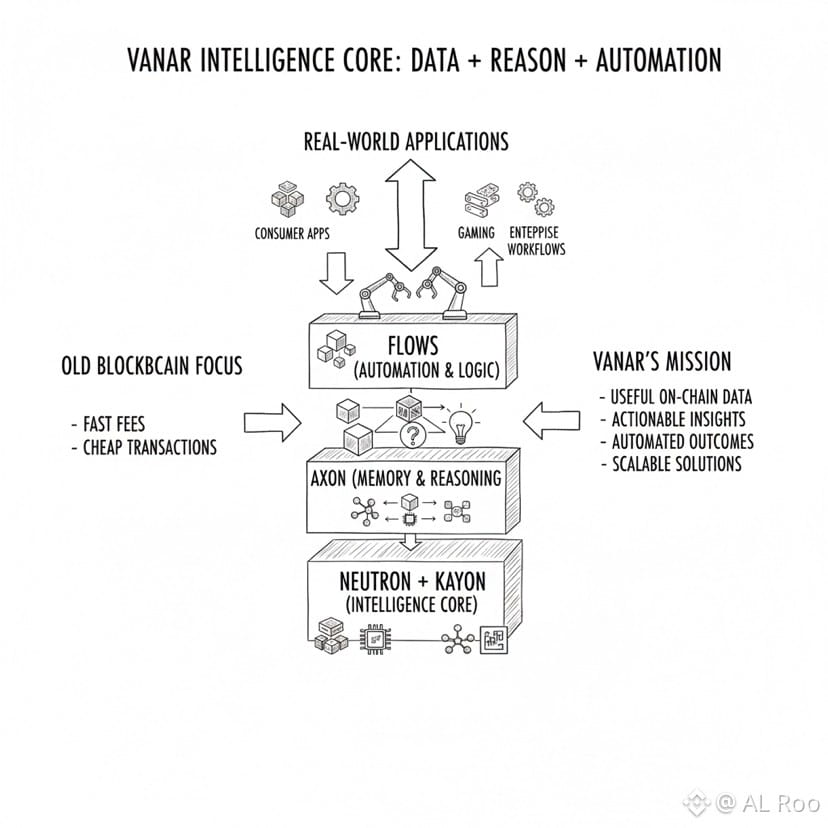

Now the “behind the scenes” part that really defines Vanar’s current direction is the intelligence stack:

Neutron is described as the layer that turns raw files and information into compact, queryable “Seeds” that are light enough for on-chain storage, but structured enough to be used as active knowledge. Vanar’s own wording leans into the idea that this is how you move from dead files to usable on-chain logic.

Kayon is positioned as the reasoning layer. The simplest way to understand it is: Neutron stores structured knowledge, Kayon makes it queryable and useful. Vanar highlights natural-language querying, contextual reasoning, and “compliance by design” style monitoring as core capabilities, plus the ability to connect into explorers and enterprise backends through their APIs.

Then you see the “what’s next” clearly in the same stack diagram: Axon (automation) and Flows (industry applications) are explicitly labeled as coming next. So the roadmap signal is pretty loud—store meaningful knowledge (Neutron), reason over it (Kayon), then turn it into repeatable automation and packaged workflows (Axon + Flows).

That matters because it’s not the usual “let’s add AI somewhere” angle. Vanar is trying to make intelligence a built-in primitive, not a marketing layer. If they execute it well, it gives builders something closer to a full product stack instead of a base chain + a pile of external tools.

The token story fits into that “utility-first” narrative. In the whitepaper, Vanar explains that it evolved from the Virtua project and introduced a 1:1 swap design where the prior token supply (1.2B) maps into 1.2B VANRY minted at genesis, then the rest is distributed through block rewards under a capped maximum supply of 2.4B.

They also spell out how the additional 1.2B is allocated: 83% for validator rewards, 13% for development rewards, 4% for airdrops/community incentives, and they explicitly state no team tokens in that allocation.

The same section also mentions a long issuance timeline where the remaining minting is structured over an extended period (they describe it as paced over about 20 years).

What VANRY is “for” is equally direct across the docs and whitepaper: it’s the native gas token used for transaction fees, plus it supports staking/validator incentives under their delegated proof-of-stake approach.

Where the token exists today is also practical and easy to verify. Vanar’s own docs confirm an ERC-20 deployment used as a wrapped version for interoperability, and they list the Ethereum contract address you shared (the same address is shown on their documentation page).

That “wrapped on major ecosystems + bridge back to native” approach matters because it reduces friction for users who already operate on established networks, while keeping the long-term “home” of the token aligned with Vanar’s own chain narrative.

Now, on the “latest updates” side, I want to be transparent: Vanar’s site has a blog index and a post page titled “The Intelligence Layer Becomes the Product,” but the content itself didn’t load in the text extraction view I can access (it appears heavily template/JS-rendered in the captured output), so I’m not going to pretend I can quote the recap details from it.

What I can verify cleanly is the current product positioning and feature claims because those are published directly on their core product pages (Vanar Chain / Neutron / Kayon) and docs, and those pages clearly show the five-layer stack and the AI-native direction.

For the “last 24 hours” pulse, the most reliable public signals are market + on-chain activity on the ERC-20 side:

On Etherscan’s token overview for the VANRY contract, you can see the current holder count and the 24h transfers metric (it shows 261 transfers in the last 24h at the time of capture), which gives a simple activity snapshot.

So if you’re asking “what’s new in the last 24 hours,” the honest answer is: I can confirm the activity and the market pulse through those live dashboards, but I cannot confirm a specific official announcement posted in the last 24 hours from Vanar’s own blog pages based on what I can access in extracted text. The strongest “fresh” signal that is fully verifiable is that their public positioning right now is centered on Neutron + Kayon as the intelligence core, with Axon + Flows clearly presented as the next layers.

If I boil Vanar down into one clean takeaway: they’re not just trying to be “fast and cheap.” They’re trying to make on-chain data useful and actionable at the base level—store it as structured memory, reason over it, and then automate the outcomes. That’s the kind of design that can actually support real consumer apps, gaming economies, and enterprise workflows without everything collapsing into off-chain glue.

And what’s next is pretty clear from their own stack map: once Neutron + Kayon are established as “memory + reasoning,” the pressure shifts to shipping Axon (automation) and Flows (ready industry apps). If those land the way they’re being positioned, Vanar stops being “a chain with features” and starts looking like a full product platform with a unique identity.