For many crypto users, the biggest challenge isn’t finding the next moonshot it’s growing assets safely without unnecessary risk. This is where stablecoins and Binance Earn come in. By combining predictable value with passive income tools, Binance offers one of the most practical ways to earn consistently, even during volatile markets.

Why Stablecoins Matter

Stablecoins like USDT, USDC, FDUSD, and USD1 are designed to maintain a stable value, usually pegged to the US dollar. This makes them ideal for users who want to:

Preserve capital during market volatility

Avoid large price swings

Earn yield without speculative trading

Instead of leaving stablecoins idle, Binance allows users to put them to work.

What Is Binance Earn?

Binance Earn is a suite of passive income products that let users earn rewards simply by holding assets. For stablecoin holders, it offers a low-risk alternative to active trading.

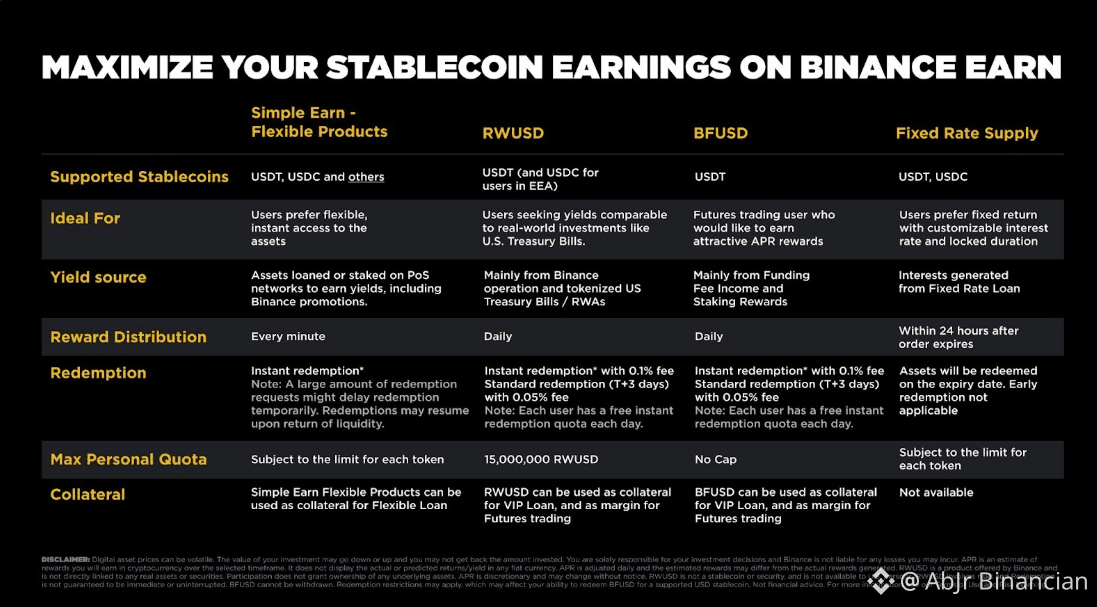

Popular options include:

Simple Earn (Flexible & Locked): Earn daily interest while keeping full or partial liquidity

Auto-Subscribe: Automatically reinvest rewards for compounding growth

On-Chain Earn: Earn yields directly from blockchain protocols, powered by Binance

These products are beginner-friendly and designed for users who value consistency over speculation.

Why Stablecoin Earn Is Considered Low Risk

Unlike volatile crypto assets, stablecoins reduce exposure to price drops. When paired with Binance Earn:

No need to time the market

No leverage or liquidation risk

Predictable daily rewards

Full transparency on APR and lock-up periods

This makes stablecoin earn strategies ideal for long-term planners, conservative investors, and newcomers.

Bonus Opportunity: USD1 / WLFI Airdrop Campaign

Binance has taken stablecoin utility one step further with the USD1 / WLFI airdrop campaign, rewarding users simply for holding USD1 on the platform.

Key highlights:

$40 million WLFI airdrop

Weekly distributions

No trading required

Rewards credited automatically to Spot Wallet

Users holding USD1 across supported wallets (Spot, Funding, Margin, or Futures) qualify based on snapshot balances. Consistent holders benefit the most, reinforcing the idea that stablecoins can now earn twice yield + airdrops.

How Stablecoin Earn Fits a Smart Crypto Strategy

In 2026 and beyond, crypto is no longer just about high-risk bets. Smart users balance their portfolios by:

Holding Stablecoins for capital protection

Earning passive income via Binance Earn

Participating in ecosystem incentives like airdrops

Staying liquid and ready for opportunities

Binance makes this approach accessible by integrating earn products, rewards, and security in one place.

Final Thoughts

Stablecoin Earn on Binance proves that you don’t need to chase volatility to grow your crypto assets. With reliable tools, transparent rewards, and added incentives like the USD1 / WLFI airdrop, users can earn steadily while staying protected.

In a fast-moving market, sometimes the smartest move is the simplest one.