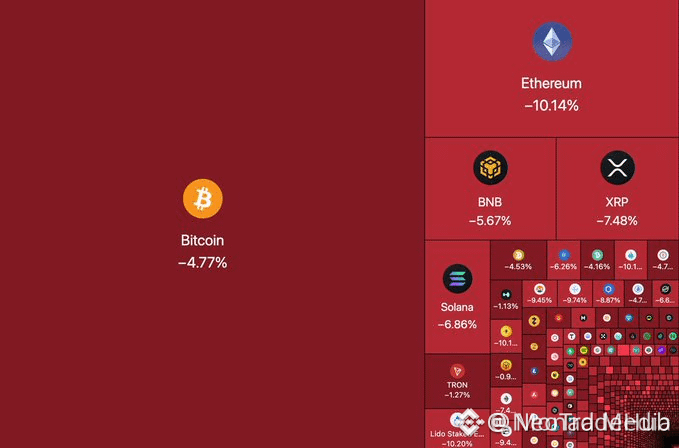

Bitcoin Sudden Drop Sends Shockwaves Through The Crypto Market...

Bitcoin has dropped sharply from its record high, shedding almost 38 percent of its value. It is currently trading around 77,000 dollars, causing worry in crypto markets worldwide. This decline marks the biggest pullback of the ongoing rally, leaving many investors wondering if this correction is a sign of market fatigue or a buying opportunity.

Market volatility increased rapidly as traders reacted to falling prices. Leveraged positions unwound across major exchanges, accelerating downward momentum. Short term sentiment shifted quickly from optimism to caution. Despite this pressure, long term holders continue to analyze broader structural signals within the crypto market cycle.

LATEST: 📊 Bitcoin's 38% drop from its all-time high to $77,000 could mark the deepest pullback of the current bull cycle, with a potential floor between $75,000 and $80,000, says analyst PlanC.

Why This Correction Stands Out From Earlier Pullbacks

Earlier drops in this bull run were mild and short-lived, with buyers quickly pushing prices back up. Now, however, selling has continued for weeks, wiping out substantial gains. This shows a noticeable change in how the market is behaving.

Analyst PlanC called this drop unusually large for a rising market. A 38 percent fall brings the correction close to record levels seen in past bull runs. These kinds of declines often remove excess leverage from the market and can set the stage for a healthier and more lasting recovery.

Analysts Highlight a Critical Price Range for Stabilization

PlanC identified a potential floor between 75,000 and 80,000 dollars. This area forms a well established Bitcoin support zone from earlier consolidation phases. Strong buying activity previously emerged at these levels. That history strengthens confidence in near term price stability.

On-chain data highlights the significance of this Bitcoin support area. Big holders have bought heavily here and usually protect key levels strongly. Their actions may help prevent prices from falling much further during this correction.

Market Structure Still Supports a Broader Bullish Trend

Even with the drop, the longer-term charts look positive. Bitcoin is still above major trend indicators, and the overall market cycle continues to form higher lows. These signs point to a likely continuation of the uptrend rather than a full breakdown.

Broader economic factors also play a big role in this view. Worldwide liquidity stress has eased compared to previous tightening periods. Risk assets tend to find stability in these situations, and Bitcoin has historically reacted well when liquidity conditions get better.

How Trader Behavior Is Changing During This Phase

This pullback has changed how traders think across the market. Earlier rallies were driven by too much leverage, which made the market more fragile. The recent drop has cleared out weaker positions, and after such resets, stronger and healthier participation usually emerges.

Retail sentiment has dropped sharply during this Bitcoin correction, with fear-driven selling dominating short-term moves. Historically, this kind of mood tends to show up near market lows, and seasoned investors often take the opportunity to buy during these emotional swings.

Impact on Altcoins and the Wider Crypto Ecosystem

Altcoins have also faced pressure as Bitcoin volatility increased. Capital has rotated back toward Bitcoin as traders seek relative safety. This shift reflects normal behavior within the crypto market cycle. Bitcoin dominance often rises during corrective phases.

Institutional participants continue monitoring price action closely. Many funds prefer structured entries instead of chasing rallies. A stable base within the Bitcoin support zone could attract fresh institutional demand. That inflow could support the next expansion phase.

What Future Price Action Could Look Like From Here

If Bitcoin stays above 75,000 dollars, it could enter a consolidation phase. Sideways trading often comes before another upward move, and similar patterns have been seen in past cycles. Patience is key during these periods.

If this support fails, Bitcoin could drop further, and analysts would turn to lower historical levels for guidance. For now, the data points to stabilization rather than a panic, suggesting this correction may be nearing its end.