How Immigration, Culture, Stablecoins, and Bitcoin Intersect in the CLARITY Act Debate

At first glance, artists speaking out against ICE at the Grammy Awards appears completely unrelated to crypto, stablecoins, or Bitcoin. But beneath the surface, these events belong to the same structural narrative: how societies respond to control, and how neutral financial infrastructure emerges as a consequence. Crypto does not grow in calm environments.It grows where social friction exists.

ICE represents one of the most visible expressions of state enforcement through border control, surveillance, and coercive authority. When enforcement intensifies, it often triggers broader concerns about government overreach, privacy erosion, and the limits of individual freedom. The earliest reactions to this pressure rarely come from legislation. They emerge first through culture. Artists and creators are often the most sensitive to shifts in social mood, and what appeared on the Grammy stage was less a single protest than a cultural signal reflecting deeper unease.

As trust in institutions weakens, societies naturally begin to search for systems that feel neutral, permissionless, and independent of identity, nationality, or formal approval. This is where crypto enters the picture, not as an ideology, but as infrastructure. Bitcoin, stablecoins, and blockchain-based payment rails do not ask who you are, where you come from, or whether you are authorized. They simply execute. That neutrality is not political by design, but it becomes especially attractive during periods of political and social tension.

Within this framework, stablecoins function as the quiet bridge between abstract ideals and real-world utility. They are the least ideological layer of crypto, yet arguably the most practical. In reality, stablecoins already operate as cross-border payment rails, remittance tools, and financial access points for populations excluded from traditional banking. For migrants, global freelancers, and users in emerging markets, stablecoins solve problems that conventional financial systems either cannot or choose not to address. This helps explain why stablecoin adoption tends to accelerate long before comprehensive regulation is in place.

While stablecoins handle everyday financial utility, Bitcoin plays a different role. Bitcoin behaves less like a payment instrument and more like a long-term indicator of macro and social stress. When viewed over long time horizons, Bitcoin’s price has tended to trend upward during eras characterized by declining institutional trust, expanding state control, and rising monetary or regulatory uncertainty. The point is not that Bitcoin reacts to individual headlines or events, but that it reflects broader cycles of confidence and systemic risk. Bitcoin does not price the news; it prices the environment.

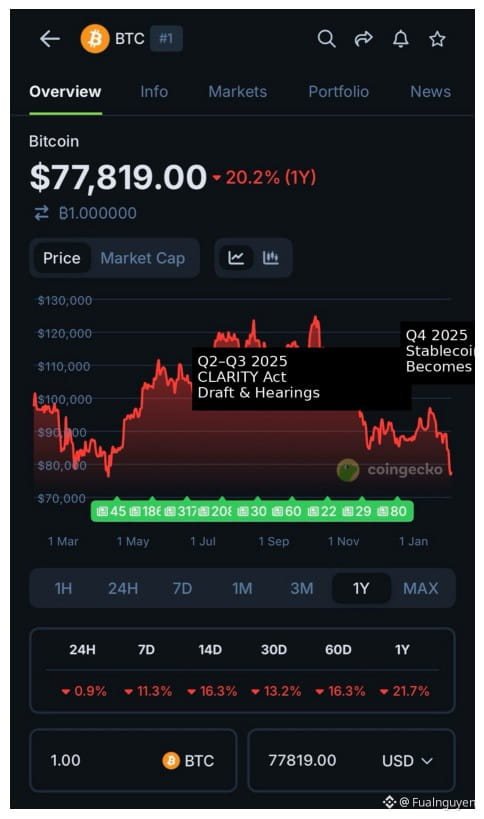

Against this backdrop, the ongoing debate around the CLARITY Act becomes easier to understand. It exists not because crypto failed, but because crypto reached sufficient scale to demand a response. Once stablecoins and digital assets became systemically relevant, regulators were forced to confront fundamental questions about issuance, oversight, and classification. CLARITY is not an attempt to promote crypto freedom, but an effort to bring crypto within a regulatory perimeter. This does not make the law inherently negative. It simply confirms that regulation is reacting to reality rather than shaping it in advance.

What CLARITY can offer is legal clarity, reduced uncertainty, and a pathway for institutional participation. What it cannot do is resolve social inequality, ease migration pressures, or suppress cultural backlash. Those forces exist upstream, beyond the reach of financial regulation. Crypto, at its core, is not born solely from speculation, but from structural tension between centralized control and individual autonomy.

For investors, this context matters. None of this constitutes a short-term bullish catalyst or a trading signal. Instead, it reinforces crypto’s role within a broader societal framework, where adoption follows social friction and regulation follows adoption. Markets may move on liquidity, but crypto endures on narrative, and narratives are formed long before they appear on price charts.

ICE protests, stablecoin regulation, Bitcoin adoption, and the CLARITY Act are not isolated developments. They are different expressions of the same underlying theme: when control tightens, neutrality becomes valuable. That is the environment in which Bitcoin and crypto continue to exist, adapt, and expand.

#Fualnguyen #LongTermAnalysis #LongTermInvestment