DUSK continues to sit at an interesting intersection of market behavior and long-term infrastructure development. Recent price action has been relatively modest, marked by minor fluctuations rather than sharp moves. At the same time, institutional attention toward privacy-preserving and compliant real-world asset solutions is steadily increasing. This contrast between calm price movement and meaningful progress is not unusual for projects operating in regulated sectors.

To understand where DUSK stands today, it is important to separate surface-level volatility from the deeper signals emerging from its ecosystem. This article explores DUSK through three key lenses: institutional focus, recent protocol developments, and current technical conditions.

1. Institutional Focus And The Demand For Privacy In RWA

1.1 Why Institutions Care About Privacy And Compliance

Institutional participants approach blockchain adoption differently from retail users. Their priorities are clear: regulatory alignment, data confidentiality, and operational transparency. Public blockchains that expose transaction details by default create challenges for institutions that must protect sensitive financial information.

@Dusk DUSK addresses this gap by offering privacy-preserving infrastructure designed specifically for compliant real-world asset tokenization. Rather than framing privacy as a tool for anonymity, DUSK positions it as a requirement for regulated finance. This distinction is critical for institutional adoption.

Privacy in this context enables selective disclosure, allowing transactions to remain confidential while still meeting regulatory and audit requirements. This capability aligns closely with how traditional financial markets operate, making DUSK more approachable for institutions exploring on-chain asset issuance.

1.2 Institutional Interest As A Long Term Signal

Institutional interest rarely translates into immediate price appreciation. Large entities move cautiously, testing infrastructure before committing meaningful capital. Their involvement tends to show up first in partnerships, pilots, and technical collaboration rather than market speculation.

#dusk growing visibility among institutional players suggests confidence in its architecture and regulatory positioning. Over time, this type of engagement can lead to sustained demand driven by usage rather than trading activity.

2. Key Developments Strengthening The RWA Thesis

2.1 The Importance Of The DuskEVM Launch

One of the most notable recent milestones for DUSK is the launch of DuskEVM. This development expands the network's ability to support Ethereum-compatible smart contracts while maintaining its privacy and compliance-focused design.

EVM compatibility lowers the barrier for developers and institutions already familiar with Ethereum tooling. It enables faster experimentation and integration without sacrificing the core privacy features that differentiate DUSK.

This balance between accessibility and specialization is essential for RWA platforms. Institutions want familiarity, but they also require capabilities that generic execution layers do not provide.

2.2 NPEX Partnership And Real World Asset Tokenization

The partnership with NPEX represents another concrete step toward real world application. NPEX focuses on regulated asset trading, making it a natural fit for DUSK privacy preserving infrastructure.

This collaboration highlights how DUSK is moving beyond theory into practical deployment. Tokenizing real-world assets is not just about minting tokens. It involves compliance workflows, data confidentiality, and settlement mechanisms that mirror traditional finance standards.

Each such partnership strengthens the credibility of DUSK as an infrastructure layer rather than a speculative platform.

2.3 Development Over Headlines

These developments may not dominate headlines in a hype driven market, but they are precisely the kind of progress that matters for RWA adoption. Infrastructure designed for institutions grows through careful iteration, not rapid narrative shifts.

DUSK progress reflects this reality. The project is building quietly, focusing on readiness rather than publicity.

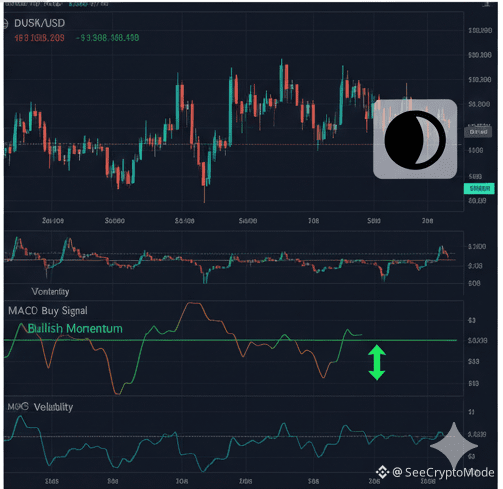

3. Mixed Technical Indicators And Market Volatility

3.1 MACD Bullish Momentum As An Early Signal

From a technical perspective, DUSK presents a mixed picture. The MACD indicator has recently shown bullish momentum, suggesting that selling pressure may be easing and that short-term sentiment could be stabilizing.

Bullish momentum during a volatile phase can indicate accumulation or reduced downside conviction. While this does not guarantee a reversal, it does highlight changing market behavior beneath the surface.

3.2 Price Downtrend And Ongoing Volatility

Despite positive momentum signals, DUSK price remains within a broader downtrend. This reflects continued uncertainty across the market and a cautious approach from participants.

For infrastructure projects tied to regulated adoption, price often lags behind progress. Volatility remains a feature rather than an anomaly, especially in periods where macro conditions dominate sentiment.

3.3 Interpreting Technicals In Context

Technical indicators are best used as complementary tools rather than decision drivers. In the DUSK case, the combination of bullish momentum and price weakness suggests a market in transition rather than in collapse.

Long-term value will depend less on short-term chart patterns and more on whether institutional adoption accelerates as RWA markets mature.

4. The Broader Picture For DUSK

operates in one of the most demanding segments of Web3. Privacy-focused, compliant RWA infrastructure requires precision, regulatory awareness, and trust. These qualities take time to establish and are rarely rewarded immediately by markets.

Minor price fluctuations reflect uncertainty, not failure. Institutional interest reflects long-term potential, not speculation. Recent developments demonstrate execution aligned with a clear vision.

When viewed together, these signals suggest a project focused on durability rather than short-term excitement.

5. Final Thoughts

DUSK's current market behavior tells only part of the story. Beneath modest price movements lies a network steadily aligning itself with institutional needs in real-world asset tokenization.

The combination of privacy-preserving compliance, meaningful partnerships, and ongoing technical upgrades positions DUSK as a serious infrastructure player. While volatility persists, the foundation being built is designed for longevity.

In a market often distracted by rapid cycles, DUSK represents a slower but more deliberate approach. Over time, this kind of discipline is often what separates lasting platforms from temporary narratives.