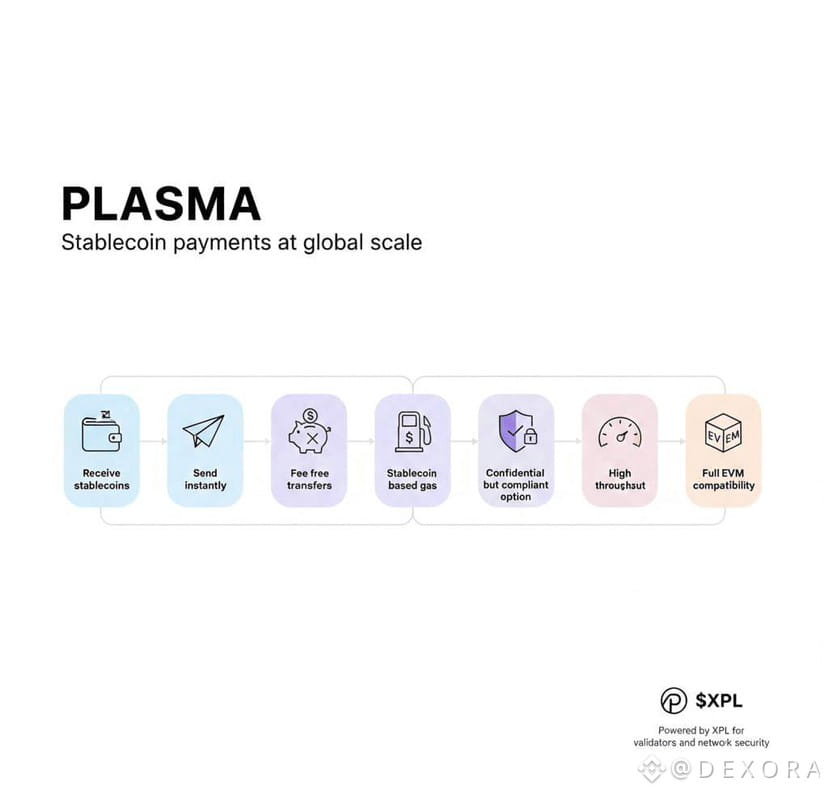

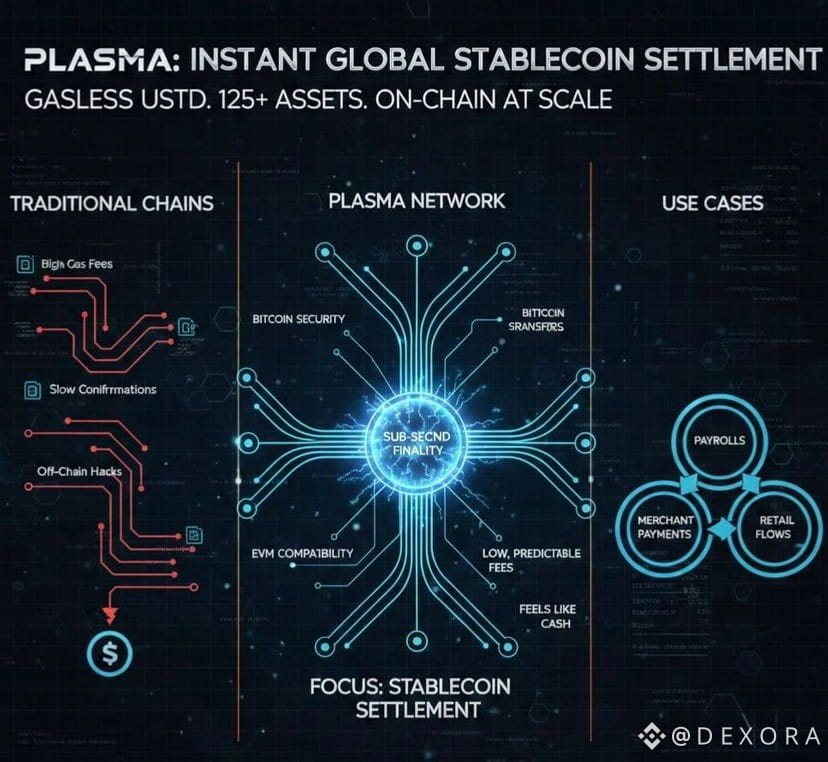

Most blockchain projects build infrastructure then search for applications to prove utility. Plasma reversed this sequence by designing financial product first then constructing blockchain specifically to power it. This approach means every technical decision from consensus mechanisms to gas abstraction directly serves concrete user need rather than theoretical capability. I’m describing strategy where neobank application called Plasma One determines infrastructure requirements, forcing blockchain layer to solve actual payment friction that billions experience daily rather than chasing theoretical transaction throughput that nobody uses. They’re building banking product for people who go to Istanbul’s Grand Bazaar weekly to convert earnings into digital dollars because local currency can’t be trusted, then engineering blockchain capable of supporting that specific behavior at global scale.

The September 22, 2025 announcement of Plasma One revealed vision extending far beyond typical blockchain launch where technology gets deployed and teams hope somebody builds something useful. The stablecoin-native neobank promises users can pay directly from stablecoin balance while earning ten percent plus yields, receive up to four percent cash back when spending with physical or virtual cards, and access coverage in over one hundred fifty countries at more than one hundred fifty million merchants. These aren’t arbitrary features selected because they sound impressive but rather direct responses to feedback gathered from actual users and merchants in target markets where stablecoin adoption already exists but fragmented experience limits utility.

The Vertical Integration Philosophy Behind First Customer Approach

The decision for Plasma to serve as its own first customer represents unusual strategy in blockchain space where most projects build infrastructure hoping external developers will create applications demonstrating value. By launching consumer-facing neobank while simultaneously deploying blockchain powering it, Plasma creates rapid feedback loop where problems discovered in real-world usage immediately inform infrastructure improvements. The vertical integration across blockchain, payment rails, and end-user application allows optimization impossible when these layers operate independently under different organizational control.

This approach means when Plasma One encounters friction around international card acceptance, that insight directly informs how blockchain handles cross-border settlement. When users struggle with onboarding complexity, those pain points shape how wallet integration works at protocol level. The company explicitly stated they want to test, scale, and expand payment stack with quick feedback loop, ensuring infrastructure gets proven under global demand rather than just in controlled demo environments. We’re seeing strategic recognition that building payments infrastructure without operating actual payment product risks creating technically impressive system that fails addressing real user needs.

The Rain partnership providing card issuance infrastructure demonstrates how Plasma combines building core technology with leveraging established financial rails. Rain previously issued the Avalanche Card and brings operational experience running card programs across multiple blockchain networks. This partnership allows Plasma to focus on what makes their approach unique around zero-fee stablecoin transfers and yield generation while utilizing proven infrastructure for card network connectivity and regulatory compliance that would take years to build independently.

The Localized Strategy Targeting Emerging Market Realities

The emphasis on cities like Istanbul, Buenos Aires, and Dubai reveals understanding that stablecoin adoption looks dramatically different across geographic regions. In Istanbul’s markets, exporters visit cash shops weekly to source USDT because they want earnings in currency they trust rather than Turkish lira vulnerable to inflation. These aren’t crypto enthusiasts making ideological choices about decentralization but rather merchants making practical business decisions about preserving value. Plasma One addresses this existing behavior by eliminating need to visit physical cash shops, enabling direct digital dollar access through application designed specifically for these use cases.

The Buenos Aires context highlights different problem where store owners pay staff in USDT because stablecoin rails move money faster than Argentine banking system. Traditional banks in Argentina face capital controls, currency restrictions, and operational inefficiencies making them unreliable for payroll. Business owners discovered that sending USDT to employees’ wallets provides certainty that traditional payment methods can’t match. Plasma One builds on this existing practice by adding yield generation where employees earn returns on balances while waiting to spend, transforming stablecoin holdings from simple medium of exchange into productive assets generating passive income.

The Dubai use case focuses on commodity traders requiring efficient cross-border transaction capabilities where traditional banking wire transfers take days and impose substantial fees. These traders discovered that USDT enables nearly instant settlement at fraction of traditional costs, fundamentally changing how international trade operates. Plasma One extends this by adding global spending capability where same stablecoins used for business transactions can be spent at merchants worldwide through card that works wherever Visa acceptance exists.

The On-Chain Yield Generation Model Creating Passive Income

The promise of ten percent plus yields on stablecoin balances without lockup requirements requires explanation of where those returns originate and whether they’re sustainable. Plasma’s approach generates yield through opportunities existing within on-chain ecosystem rather than relying on external lending or speculative trading. The blockchain’s architecture creates efficient environment for DeFi strategies around non-volatile assets where cheap USDT borrow rates enable profitable arbitrage and yield farming that would be uneconomical on networks with expensive transaction fees.

The integrated approach where Plasma controls both blockchain infrastructure and end-user application means yield optimization happens at protocol level rather than requiring users to manually navigate multiple DeFi platforms. Traditional yield farming requires moving assets between lending protocols, understanding complex risks, monitoring liquidation ratios, and paying gas fees for each transaction. Plasma One abstracts this complexity where users simply hold USDT in application and automatically participate in highest-yielding strategies that protocol algorithms identify as optimal based on current market conditions.

The sustainability question depends on whether DeFi ecosystem on Plasma generates genuine economic value beyond token incentives that eventually end. The focus on non-volatile assets and cheap borrowing costs suggests structural advantages creating durable yield sources. When protocols can borrow USDT at low rates and deploy that capital into productive activities generating returns, resulting profits can be shared with depositors creating sustainable model. If it becomes dependent on unsustainable token emissions or speculative leverage that unwinds during market stress, yield rates will necessarily decrease from current double-digit levels.

The Four Percent Cashback Mechanics and Economic Model

The promise of up to four percent cash back on purchases represents substantial reward compared to traditional credit cards offering one to two percent. Understanding how Plasma finances these rewards reveals whether model is sustainable or simply customer acquisition subsidy that will decrease once user base grows. The cashback likely comes from combination of interchange fees that card networks charge merchants, yield generated on stablecoin float before transactions settle, and potentially XPL token emissions subsidizing early adoption phase.

Interchange fees in traditional card networks typically range from one point five to three percent of transaction value where card issuer receives portion for taking fraud risk and managing payment infrastructure. Plasma’s model potentially captures these fees while having lower operational costs than traditional banks that maintain physical branches and legacy systems. The margin between interchange revenue and operational costs creates pool that can fund cashback rewards making them economically viable rather than pure marketing expense.

The stablecoin float represents additional revenue source where funds sit in Plasma One accounts earning yield before users spend them. Traditional banks profit from float by investing customer deposits into higher-yielding assets while paying minimal or zero interest on checking accounts. Plasma applies similar principle but shares larger portion of returns with users through both yield on balances and cashback on spending. This creates economic model where both user and platform benefit from stablecoin deposits rather than extractive relationship where banks capture all value.

The Localization Requirements Beyond Simple Translation

The feedback Plasma gathered from merchants and users in target markets revealed that merely translating interface into local languages doesn’t address real barriers preventing stablecoin adoption. The challenge involves building peer-to-peer cash networks enabling users to convert between local currency and stablecoins without relying solely on centralized exchanges that many people find intimidating or inaccessible. In many emerging markets, cash remains dominant payment method where people trust physical currency more than digital alternatives they don’t understand.

Plasma’s approach involves deploying localized teams with ground-level presence in target cities who understand specific cultural and operational realities of their markets. These teams can establish relationships with local money changers, retail outlets, and informal financial networks that already facilitate currency exchange. By integrating with existing cash infrastructure rather than trying to replace it entirely, Plasma lowers adoption barriers where users can deposit cash with trusted local partner and receive USDT in Plasma One application, creating bridge between traditional and digital finance.

The emphasis on trust and easy onboarding reflects recognition that technical superiority doesn’t matter if people won’t use product. Many previous stablecoin initiatives failed because they assumed if you build it they will come, launching globally without considering that person in Buenos Aires has completely different needs and concerns than user in San Francisco. Plasma’s strategy inverts this by starting with deep understanding of specific market needs then customizing experience accordingly rather than imposing one-size-fits-all solution.

The Developer Infrastructure Strategy Around Battle-Tested Technology

The vertical integration serves dual purpose where Plasma One acts both as consumer product and as proof-of-concept demonstrating infrastructure capabilities to external developers. The strategy aims at eventually offering wallets, banks, and fintech applications foundation that has been validated under real-world global demand rather than just in experimental environments. This creates compelling pitch where developers considering which blockchain to build on can see actual payment product processing real transactions at scale rather than theoretical capabilities described in whitepaper.

The EVM compatibility means developers familiar with Ethereum tooling can deploy on Plasma without learning new programming languages or frameworks. Standard tools like Hardhat, Foundry, and Remix work directly without modification, dramatically lowering switching costs that typically prevent developers from trying new platforms. The architecture optimization for plug-and-play experience recognizes that developers won’t invest time learning custom systems unless compelling reason exists, so maintaining compatibility with established tooling removes friction that kills adoption regardless of technical merits.

The shared node infrastructure provided through partners like Crypto APIs enables developers to start building immediately without running own validator nodes or managing blockchain infrastructure. This accessibility matters enormously for small teams and individual developers who lack resources to operate production-grade node infrastructure but want to build applications leveraging Plasma’s stablecoin-optimized features. The maintenance-free access to network accelerates time-to-market where developers can focus on application logic rather than devops complexity.

The Regulatory Positioning Within Evolving Compliance Framework

The launch timing coincides with increasing regulatory clarity around stablecoins where frameworks like the US GENIUS Act seeking to formalize oversight and EU’s MiCA regulation mandating reserve requirements create backdrop of growing legitimacy for stablecoin infrastructure. Plasma’s positioning emphasizes compliance and regulatory cooperation rather than operating in gray areas that characterized earlier crypto projects. The focus on vertically integrated products with clear jurisdictional targeting demonstrates sophistication around navigating complex regulatory landscape.

The geographic selectivity where Plasma One rolls out in stages prioritizing specific markets allows tailored regulatory approach rather than attempting global launch that might run afoul of restrictions in certain jurisdictions. This measured expansion enables team to work closely with local regulators, obtain necessary licenses, and establish proper compliance infrastructure before entering each new market. The patience to launch incrementally rather than everywhere simultaneously reflects maturity recognizing that regulatory missteps can be fatal even if technology works perfectly.

The partnership with established financial infrastructure providers like Rain and integration with traditional card networks creates regulatory buffer where Plasma benefits from partners’ existing compliance frameworks and banking relationships. These partnerships mean Plasma doesn’t need to independently navigate entire regulatory stack from scratch but rather plugs into proven infrastructure that already handles know-your-customer verification, anti-money-laundering monitoring, and card network compliance requirements that take years to establish independently.

Confronting The Sustainability Questions Around Promised Returns

The most critical question facing Plasma One concerns whether economic model can sustain promised yields and cashback rates as user base scales. The mathematics must work where revenues from interchange fees, DeFi yields, and potential XPL token value capture exceed costs of providing returns to users plus operational expenses of running global neobank. Early-stage projects often subsidize user acquisition with unsustainable economics hoping to achieve scale that enables eventual profitability, but many fail when subsidies end and users leave.

The transparency around yield sources matters enormously for building trust where users understand that returns come from productive economic activity rather than Ponzi-like schemes paying existing users with new deposits. Plasma’s emphasis on DeFi strategies around non-volatile assets and efficient borrowing markets provides plausible mechanism for generating genuine returns. However, the double-digit yields considerably exceed what traditional financial institutions offer, suggesting either Plasma discovered profound efficiency advantages or current rates reflect temporary market conditions that won’t persist indefinitely.

The vertical integration could provide structural advantages where Plasma captures value at multiple layers that typically get fragmented across different companies. Traditional finance splits value between banks holding deposits, payment networks processing transactions, and merchants accepting cards. Plasma potentially consolidates these revenue streams while having lower costs than legacy institutions maintaining physical infrastructure. If this efficiency gain is real and sustainable, sharing portion with users through yields and cashback becomes viable long-term strategy rather than temporary promotion.

The Future Where Infrastructure Meets Everyday Reality

Looking several years forward, success means person in any country downloading Plasma One application, accessing digital dollars, earning competitive yields, tapping card at local store, and sending money to family members instantly without fees. Success means merchant in Buenos Aires choosing Plasma One for payroll because it’s genuinely superior to alternatives rather than accepting it reluctantly because customers demand it. Success means developer building payment application on Plasma because infrastructure has been proven at scale under real-world conditions rather than taking risk on unproven technology.

The vertical integration strategy could create moat where Plasma’s simultaneous control of blockchain, tooling, and consumer application enables optimization impossible for competitors lacking end-to-end integration. However, this approach also concentrates execution risk where failure at any layer threatens entire stack. If it becomes that blockchain layer has technical problems, consumer application suffers. If consumer product fails to achieve adoption, infrastructure value proposition weakens. The interdependence creates both opportunity and vulnerability where everything must work together to succeed.

The ground-up approach starting with deep market understanding rather than technology searching for problems represents refreshing contrast to typical blockchain project lifecycle. Whether this translates into sustainable business depends on questions that only time and user adoption can answer. The technology exists to enable vision. The partnerships provide necessary infrastructure. The funding ensures runway to execute. What remains uncertain is whether millions of people in emerging markets will trust Plasma One with their savings and choose it over alternatives when the moment comes to actually move money that matters.