Over the past year, I’ve shared probabilistic analysis on gold, silver, and macro markets not predictions, not certainties.

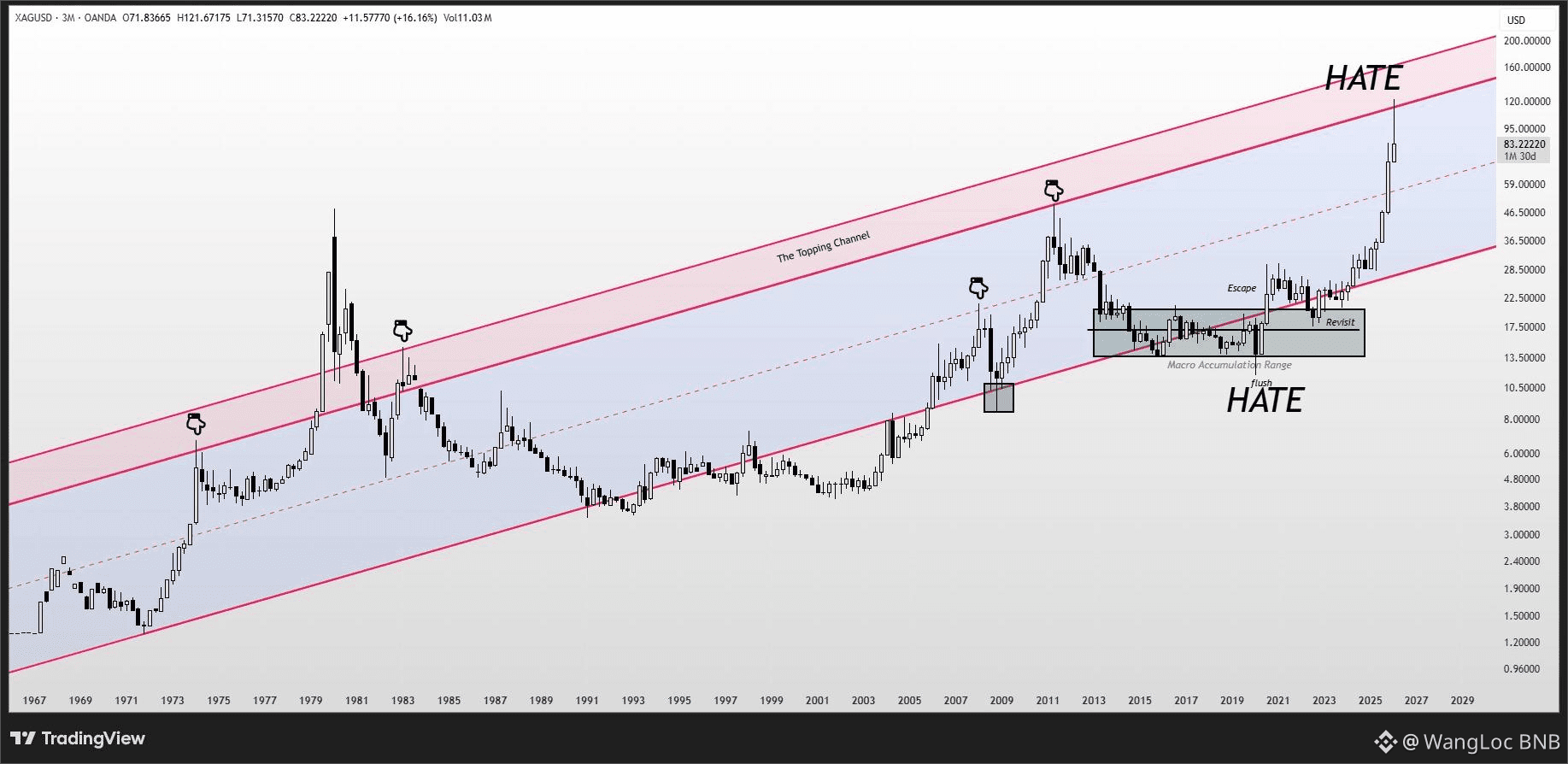

Recently, when gold and silver approached the upper boundary of a long-term channel, I highlighted the risk of a major reaction, not because I was “certain”, but because the risk-reward had shifted.

Shortly after, silver sold off nearly 40% in a single day.

I made one brief note acknowledging the reaction no celebration, no exaggeration. That’s how serious analysis should be treated.

Markets are not about being right publicly.

They’re about preparing for multiple outcomes and positioning when probabilities align.

Over the past year, I’ve also called several major bottoms with solid structure behind them. Public feedback has often been quiet but private messages from traders who benefited meant far more than likes or comments.

That said, consistently explaining foundational concepts, debating with people who haven’t done the work, or engaging with dismissive noise has gradually reduced the value of posting publicly.

After careful consideration and similar advice from analysts and members I respect I’ll be scaling back public posts and focusing on execution within smaller, aligned communities.

I’ll continue sharing until March 31st, marking one year since my first post here. At that point, I’ll publish a final summary of insights from building an account from zero and tracking its evolution.

The work doesn’t stop. It simply becomes quieter and more focused.

Click and Trade $XAG