There’s a macro pattern crypto has never escaped.

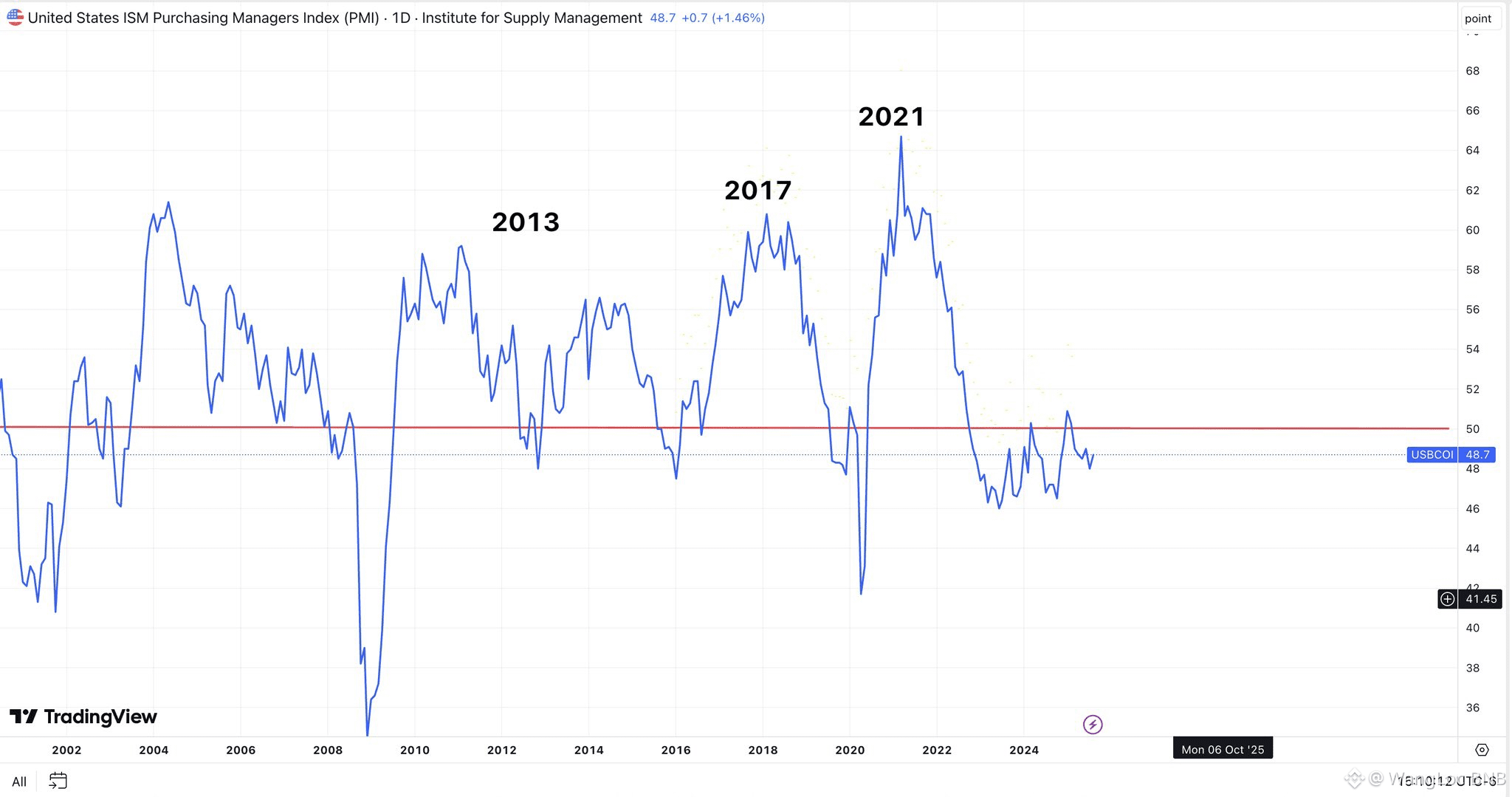

Every major bull run 2013, 2017, 2021 began only after the ISM Manufacturing Index moved above 50.

Not before.

Not during contraction.

Only after expansion resumed.

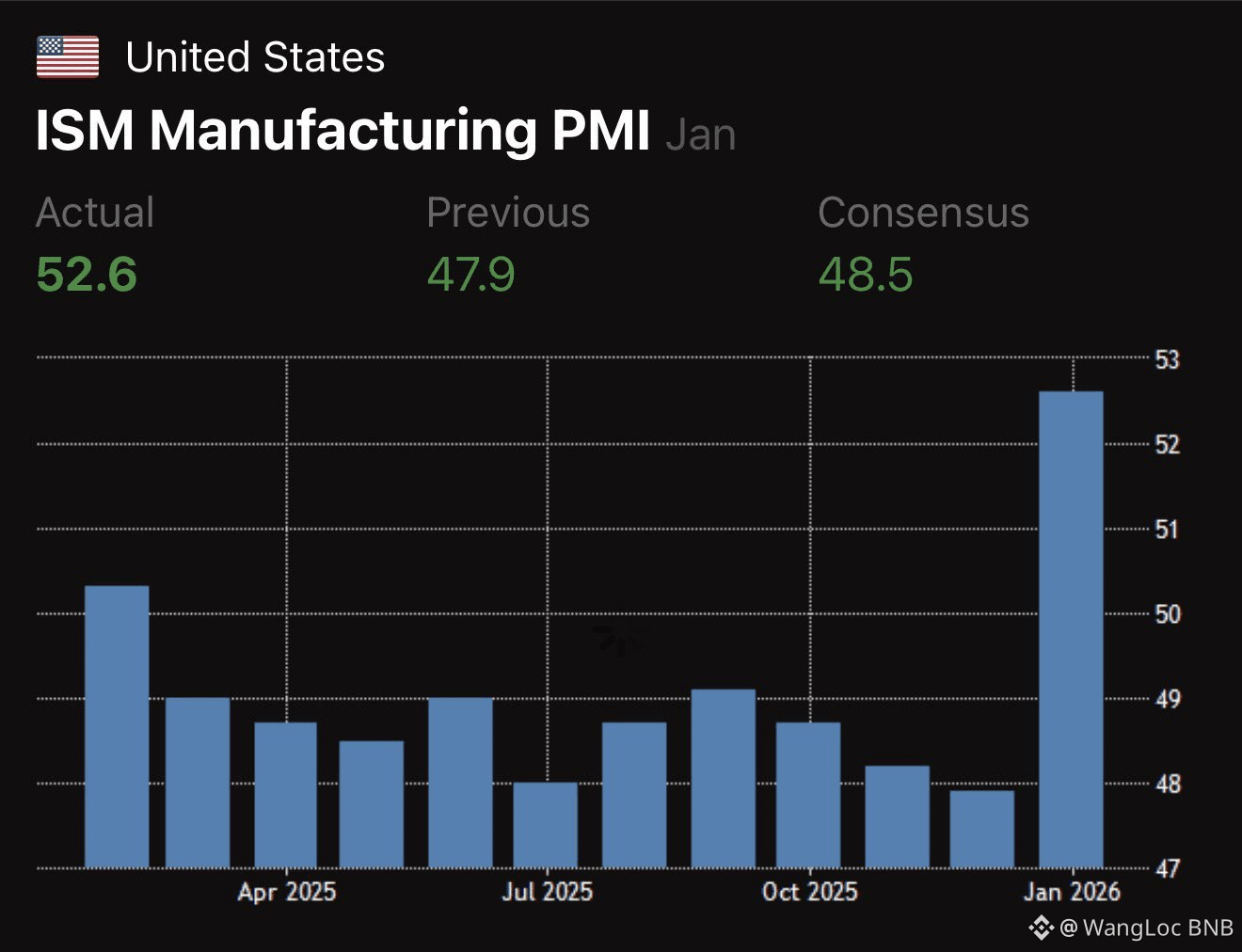

Today, ISM printed 52.6.

Let that sink in.

Why ISM > 50 actually matters

ISM above 50 signals economic expansion:

Corporations increase spending

Risk appetite returns

Liquidity stops hiding and starts moving

Crypto doesn’t lead this shift. It amplifies it.

That’s why, historically, once ISM crosses and holds above 50, risk assets don’t just bounce they reprice.

Since 2021, this entire cycle has lived below 50.

Only brief, weak blips above the line

No follow-through

No sustained expansion signal

This move is different. 52.6 is the strongest upside expansion print of the cycle so far.

Not noise. Not a fake-out by default.

It’s the first time macro has meaningfully leaned with risk instead of against it.

This is not a timing indicator.

It doesn’t mean straight up. It doesn’t cancel volatility or pullbacks.

What it does mean:

The macro backdrop has shifted from headwind to potential tailwind

Corrections are more likely to be structure-building, not cycle-ending

Playing permanent defense becomes more dangerous than selective aggression

Markets don’t repeat scripts forever. They evolve.

And when a condition that has preceded every single historical crypto bull market quietly turns back on… Ignoring it is a choice.

Run it hot but run it informed, not emotional.

Do you treat this as just another data point or as the first real regime shift since 2021?