The blockchain sector in 2026 is witnessing a paradigm shift toward compliant decentralized finance, where Dusk Foundation plays a central role through its innovative architecture and strategic initiatives. With the DuskEVM mainnet operational since January 2026, developers now have access to an EVM-compatible environment that integrates zero-knowledge proofs for privacy while ensuring on-chain auditability. This setup addresses a key barrier for traditional institutions: balancing confidentiality with regulatory compliance, such as adherence to frameworks like the EU's MiCA or the US's evolving digital asset regulations.

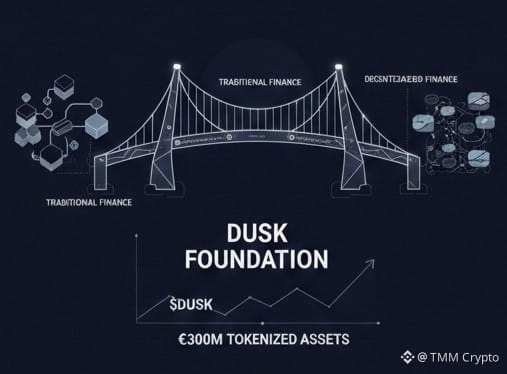

Dusk's emphasis on real-world asset tokenization aligns seamlessly with current market trends. Industry analyses indicate that tokenized assets could exceed $2 trillion in value by 2030, driven by institutional interest in fractional ownership and enhanced liquidity. For instance, partnerships like Dusk's collaboration with NPEX, a licensed Dutch exchange, aim to bring over €300 million in small and medium enterprise securities on-chain. This not only democratizes access to illiquid assets but also introduces crypto-native features, such as automated compliance checks and programmable yields, which traditional tokenization efforts often overlook.

Recent market dynamics further underscore Dusk's potential. In January 2026, DUSK surged over 120 percent in a single day, propelled by heightened trading volumes and inclusion in high-yield campaigns on platforms . This rally, amid a broader privacy token resurgence, highlights investor optimism in Dusk's utility.

As banks and asset managers increasingly internalize blockchain for payments and stablecoin onramps, Dusk's modular Layer 1 could facilitate hybrid models that merge decentralized finance with traditional systems. Predictions suggest that by mid-2026, with clearer US regulatory guidelines under acts like the GENIUS framework, compliant DeFi projects like Dusk may see accelerated adoption, potentially driving DUSK toward a good range if tokenization pipelines mature as anticipated.

Dusk's Hedger protocol exemplifies forward-thinking design in privacy solutions. By enabling auditable yet confidential transactions, it positions the network as a preferred choice for sectors like private credit, where tokenized loans are emerging as a high-growth asset class. Institutional-grade features, including verifiable identity integration without centralized KYC, ensure that Dusk meets the rigorous standards of risk-averse allocators. As decentralized finance enters a mature phase, with total value locked projected to double this year, Dusk's focus on sustainable tokenomics and interoperability could foster long-term ecosystem growth.

Dusk Foundation represents a bridge between the decentralized ethos of blockchain and the structured demands of regulated finance. For stakeholders eyeing the convergence of traditional and decentralized worlds, Dusk offers compelling transformation in this landscape.