The Bitcoin market is riding a rollercoaster right now. While retail investors are sweating over the sea of red hitting both BTC and Gold, the institutional "whales" seem to be playing an entirely different game.

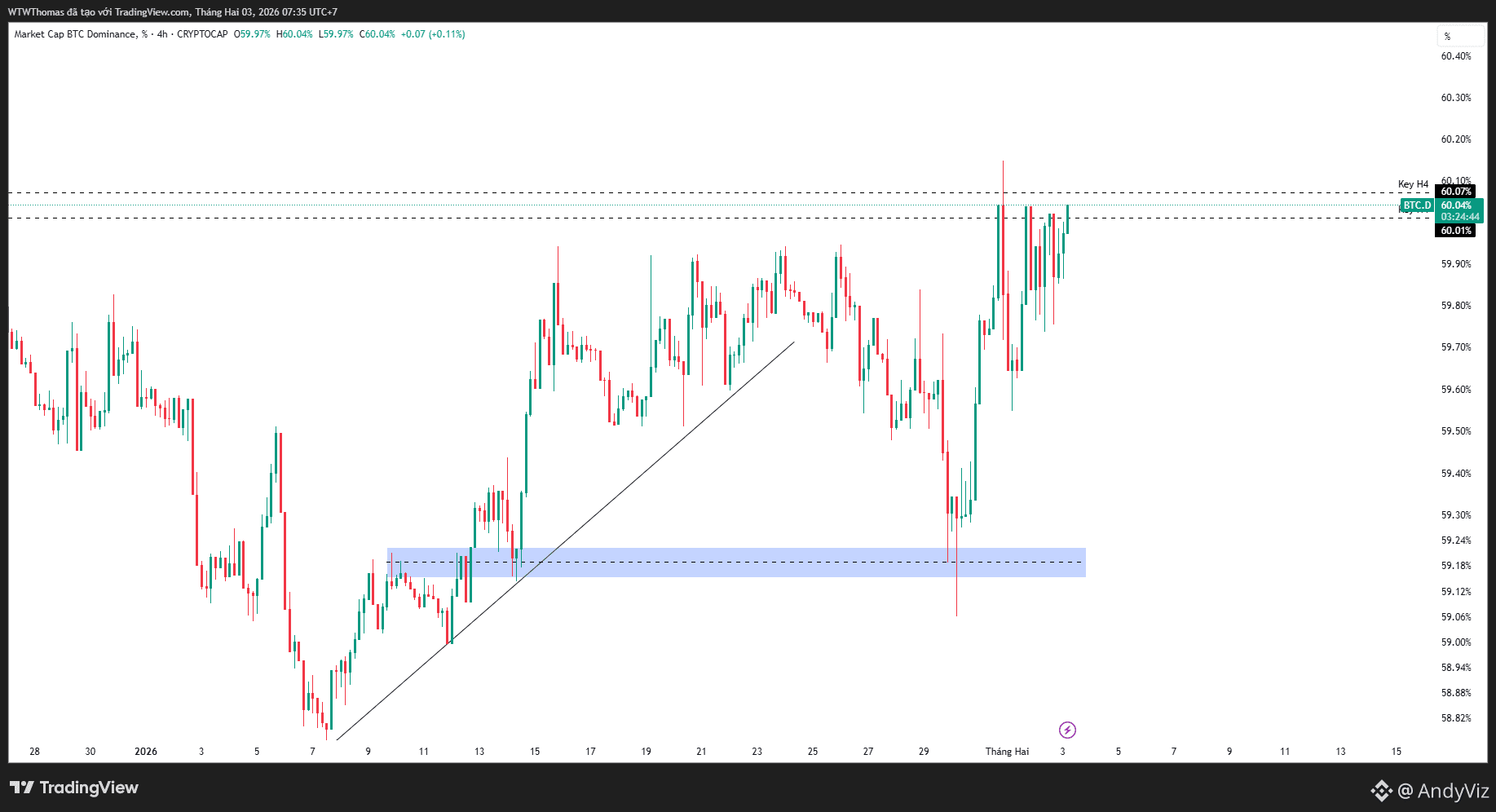

📊 Market Snapshot (03/02/2026)

BTC Price: Hovering around $81,500 (seeing a slight bounce off support).

Fear & Greed Index: 16 (Extreme Fear)

Key Levels: Solid support at $74,600; immediate resistance at $84,000.

BTC Plan 3/2

🔥 The Spotlight: What are the Whales doing while everyone else panics?

While retail is shaking, the big boys are executing massive accumulation plays. Here is the breakdown:

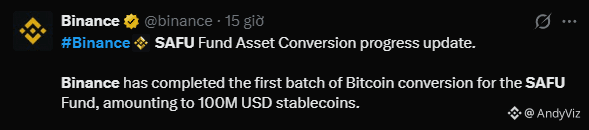

1. Binance SAFU Fund – A $1 Billion Power Move

Binance just confirmed the first $100 million (approx. 1,315 BTC) deployment to convert their SAFU insurance fund from stablecoins to Bitcoin. Historically, this fund was held in USDC and USDT for liquidity. By moving 100% of the fund (roughly $1B total) into BTC, Binance is making a massive statement: Bitcoin is now liquid and safe enough to outclass digital fiat.

The Play: This is just the first step in a total $1 billion conversion.

The Takeaway: When the world’s largest exchange swaps stablecoins for BTC as its primary reserve, it’s a massive vote of confidence in Bitcoin’s long-term value.

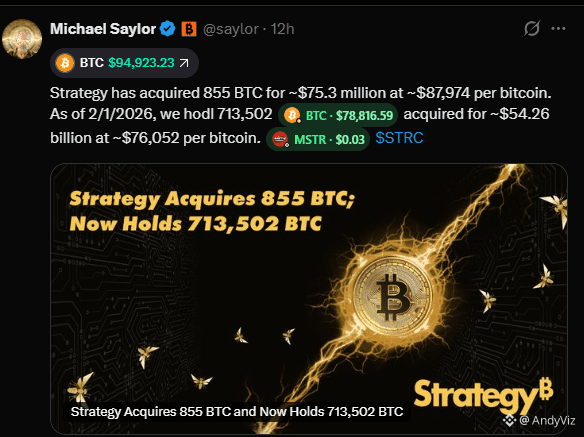

2. MicroStrategy – The HODL Machine Won’t Stop

Michael Saylor is at it again, scooping up another 855 BTC (~$75.3M). Interestingly, they aren't just using cash; they’re issuing Preferred Equity to fund the buys. This allows them to stack sats without the crushing weight of debt during market corrections.

Total Holdings: Now north of 713,500 BTC.

The Goal: They aren't just buying Bitcoin; they’re turning it into the global corporate reserve standard.

Strategy has acquired 855 BTC for ~$75.3 million at ~$87,974 per bitcoin

3. The Rising Powerhouses:

Tether (The Liquidity King): Tether continues to siphon 15% of its quarterly profits into BTC. They now hold over 96,000 BTC. Look out for their "Lucky Number 8" strategy—they’ve been hitting the "buy" button for exactly 8,888.88 BTC per clip. They’ve become an automated "Bitcoin vacuum," regardless of price.

Metaplanet (Asia’s MicroStrategy): This Tokyo-listed firm is aggressively raising capital to buy the dip below $85k. They just crossed the 35,000 BTC mark as a hedge against the weakening Yen. Their goal? Owning 1% of the total BTC supply by 2027.

Twenty One Capital: Backed by Cantor Fitzgerald and SoftBank, this group has quietly amassed 43,500 BTC. This is "smart money" from traditional investment banks choosing direct ownership over ETFs.

TMTG (Trump Media): Reports suggest they’ve added Bitcoin to their strategic reserves, with estimates sitting around 11,500 BTC.

💡 Analysis: When BTC and Gold bleed, why are funds buying?

It boils down to Restructuring and Buying the Dip. Instead of panic selling, the big players are:

DCA (Dollar Cost Averaging): Snagging assets at a discount.

Capital Rotation: As traditional hedges like Gold face pressure, money is flowing into Bitcoin—the higher-alpha asset for this growth cycle.

Long-term Positioning: They don't care about the 1-hour or 4-hour candles. They are trading the yearly chart.

📉 Final Word & Strategy

The market might remain shaky for a bit, but the "buy walls" from the likes of Binance SAFU and MicroStrategy are creating a massive floor for BTC.

The Advice: Don’t let short-term volatility shake you out of a solid position. Watch what the giants do, not what the headlines say.

What do you think about Binance moving $1B of SAFU into BTC? Is this the signal for the next "Moon Mission"? Let’s hear your thoughts below! 👇

#Bitcoin #Binance #SAFU #MicroStrategy #CryptoNews #BTC2026 #SmartMoney #WhaleWatch