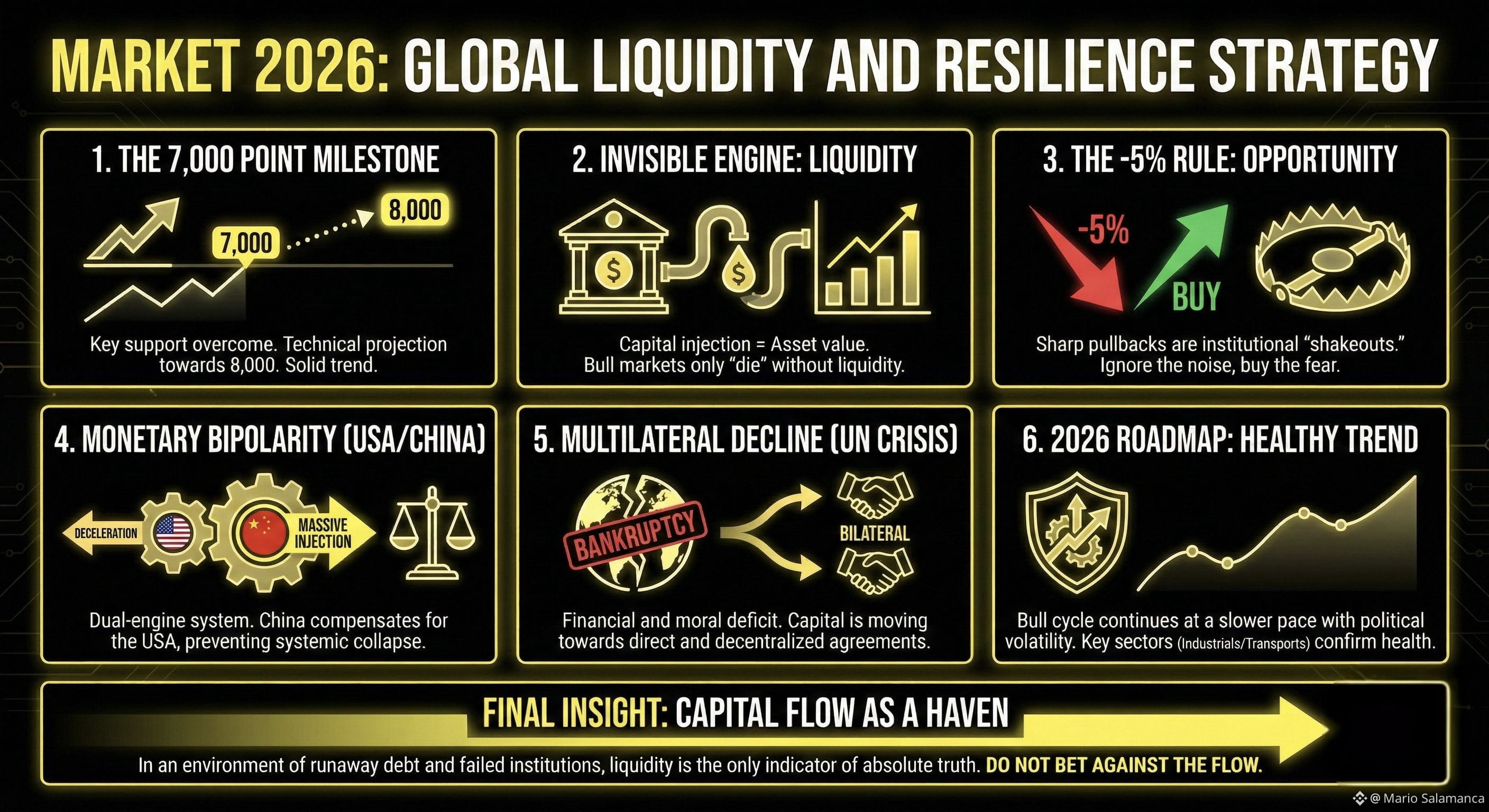

The S&P 500 has finally crossed the psychological 7,000-point mark. To the casual observer, this looks like a signal of extreme euphoria or the prelude to an imminent collapse. However, if we analyze the internal structure of the market and global capital flows, what we see is not a "glass ceiling," but rather the continuation of a paradigm shift that began in 2008 and is reaching its critical maturity phase here in 2026.

To understand where we are headed, we must stop looking at corporate earnings as the primary driver and start looking at the only indicator of absolute truth in the modern era: systemic liquidity.

The Myth of the "Expensive Market" and the Reality of Flow

Since the lows of Spring 2025, we have witnessed a vertical recovery that has left skeptics in the dust. Many analysts predicted a recession that never materialized in asset prices. Why? Because bull markets do not die of valuation or "old age"; they die of suffocation. As long as central banks and governments remain trapped in a spiral of fiscal irresponsibility, suffocation is not a viable political option.

Since 2009, the S&P 500 has experienced over thirty pullbacks exceeding 5%. On each of these occasions, the media consensus screamed "recession," but the reality was consistently the same: buying opportunities. These movements are not bugs in the system; they are "shake-outs" designed to transfer assets from weak hands (panicked retail investors) to strong hands (institutions that understand capital flow).

The Dual-Engine System: Balancing Washington and Beijing

One of the most common errors in current financial analysis is observing Federal Reserve policy in isolation. In the context of 2026, we live in a dual-traction system.

While the United States may attempt to moderate the growth of its money supply (M2) to curb inflation or manage its debt, the People’s Bank of China is operating in the opposite direction. Massive liquidity injections from Asia act as a global counterweight that sustains risk appetite. This monetary bipolarity is what prevents a multilateral systemic collapse; when one engine loses power, the other compensates for the load.

Therefore, betting against the market based solely on the data of a single central bank is to ignore the interconnectedness of global liquidity. Capital does not disappear; it simply flows toward conditions that allow for its expansion.

Financial Bankruptcy and the End of Multilateralism

Beyond stock prices, we are witnessing a much deeper bankruptcy: that of the institutions that defined the 20th-century order. The financial deficit of organizations like the UN is not just a matter of unpaid dues or suspended contributions by powers like the US, Russia, or China. It is a symptom of a loss of moral authority.

When international institutions abandon their purpose of defending universal values to adopt centralized political agendas that fail to inspire trust in the average citizen, capital reacts. Money is, ultimately, a communication system for trust. If there is no trust in the referee, the players eventually leave the field.

We are transitioning from a multilateral world (governed by central bodies) to a bilateral and decentralized world. In this new environment, agreements are signed directly between nations or executed through protocols that do not require a questionable "moral authority" to function.

Implications for the Strategic Investor

What does this mean for our 2026 roadmap?

Resilience in Volatility: We should expect sharp corrections. In an environment of runaway debt, volatility is the tool central banks use to "induce fear" and prevent excessive overheating, but the underlying trend remains bullish as long as net liquidity is positive.

Sector Confirmation: It is not just the S&P 500 leading the way; the Dow Jones Industrials and Transports are confirming structural health. This is not a speculative move by a single sector, but a massive shift of capital toward real and productive assets.

The Refuge of Scarcity: Faced with the financial bankruptcy of traditional institutions, capital will seek refuge in assets that cannot be diluted by bureaucratic decisions. This reinforces the thesis for digital assets and hard commodities as the true pillars of value in this decade of fiscal irresponsibility.

Final Reflection: The Market as the Last Bastion

The path to 8,000 points will not be a straight line. It will be littered with alarmist headlines and institutional crises. However, we must understand that in a world where international organizations are financially exhausted and morally questioned, the financial market becomes the most efficient mechanism for wealth preservation.

Liquidity is the fuel, and institutional distrust is the catalyst. If you understand that the current system cannot afford a massive drainage of capital without collapsing its own debt structure, you will understand that the bullish trend is not an anomaly, but a necessity for the system's own survival. Do not bet against the flow; learn to navigate it.