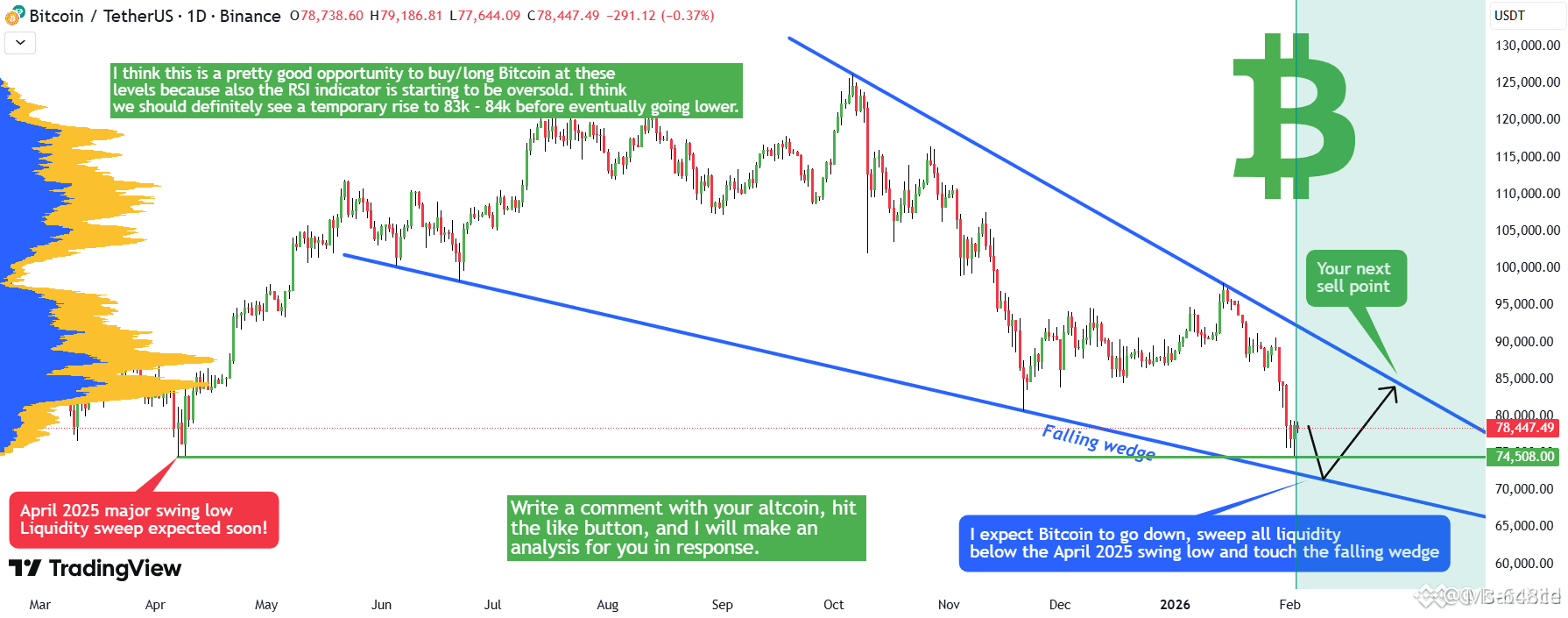

At the time of writing, Bitcoin ($BTC ) is trading around $78,000. Based on current market structure and liquidity dynamics, I expect a short-term move lower toward the $71k–$72k zone 📉 before any meaningful continuation higher.

Why a Pullback Is Likely

There are several strong technical and structural reasons supporting this view:

1. Liquidity Below the April 2025 Swing Low

Large players — whales, banks, and institutions — have not yet swept liquidity below the April 2025 swing low. This area is packed with retail stop losses 🎯.

Historically, Bitcoin tends to hunt liquidity first before initiating a sustained move upward.

2. Falling Wedge Structure

Price action remains inside a downward-sloping falling wedge. A retest of the lower trendline aligns perfectly with the $71k–$72k support zone, making this area a high-probability reaction point.

Why $71k–$72k Is a Strong Buy Zone

While a short-term dip is expected, this zone represents a very attractive long opportunity 🟢:

RSI is approaching oversold conditions, signaling downside exhaustion

Strong technical confluence with structure support

Ideal area for smart money accumulation

Before any deeper move lower, I expect a relief rebound toward $83k–$84k 📈.

The key question will be whether bulls can break out of the falling wedge — price action will confirm.

My Trading Plan Going Forward 🔍

Short term: Expect a drop toward $71k–$72k

Next: A strong rebound toward $83k–$84k

Later in the year: Bitcoin could still move significantly lower, potentially below $60k, depending on macro conditions and liquidity shifts

What About Altcoins?

At this stage, I am not recommending buying altcoins ❌.

While short-term bounces are possible, mid-term structure remains bearish across most alts.

A more favorable accumulation window for altcoins may emerge around October 2026, though this bias will require further confirmation as more data becomes available.

💬 Comment your favorite altcoin and hit the like button — I’ll reply with a personalized analysis just for you.

Trading isn’t hard when you have the right guidance.

Thank you, and I wish you disciplined and successful trades 🚀📊