The story of Vanar begins with a simple observation that would eventually reshape the entire project. Back in 2017, when most blockchain projects were chasing financial applications and enterprise solutions, a team led by Jawad Ashraf and Gary Bracey decided to build something different. They created Virtua, a digital entertainment platform where people could collect NFTs, attend virtual concerts, own digital land, and participate in exclusive gaming communities. The TVK token powered this ecosystem, and for several years, thousands of users explored virtual worlds, traded digital collectibles, and built communities around shared interests. But it was what they learned from these entertainment-focused users that would eventually birth an entirely different blockchain.

The entertainment community taught them something profound. People didn’t want to learn about blockchain. They didn’t want to understand gas fees, manage seed phrases, worry about network congestion, or calculate transaction costs before buying a digital item. They just wanted things to work. When someone tried to purchase a limited-edition NFT during a concert event and the transaction failed because gas prices spiked, they didn’t appreciate the technical explanation. They simply felt frustrated that the experience broke at the crucial moment. When a new player tried to join a game and spent twenty minutes setting up a wallet before they could even start playing, most never came back. The blockchain wasn’t adding value to their entertainment experience. It was actively destroying it.

This wasn’t just user feedback. It was a fundamental revelation about how mainstream adoption actually happens. Every entertainment platform that had succeeded over the past few decades, from Netflix to Spotify to mobile gaming, had done so by making the underlying technology completely invisible. Nobody streaming a movie thinks about content delivery networks, codec optimization, or bandwidth management. They press play and it works. The Virtua team realized they’d been building on infrastructure that made invisibility impossible. No matter how much they optimized their smart contracts or improved their user interfaces, the fundamental constraints of existing blockchains kept surfacing in user experiences. High costs during peak demand. Slow confirmation times when networks got congested. Complex wallet management that required technical knowledge. These weren’t problems they could design around. They were structural limitations of the infrastructure itself.

The Decision That Changed Everything

By late 2023, the team faced a choice. They could continue building entertainment experiences on existing blockchain infrastructure, accepting the limitations and hoping users would eventually become more technically sophisticated. Or they could build the infrastructure they wished existed. They chose the harder path. In November 2023, Virtua became Vanar, and the TVK token transformed into VANRY through a one-to-one swap. But this wasn’t just a rebranding. They were building an entirely new Layer One blockchain from scratch, designed specifically for the kind of applications they now understood were necessary for mainstream adoption.

The technical requirements were clear from years of running entertainment applications. Transactions needed to cost fractions of a cent, not dollars. Confirmation times needed to be measured in seconds, not minutes. The network needed to handle massive spikes in activity when popular events launched without degrading performance or increasing costs. Users needed to interact with applications without ever seeing wallet confirmations, transaction hashes, or blockchain explorers. Developers needed to build applications where the blockchain was completely abstracted away, just infrastructure that powered experiences rather than something users needed to understand.

They started with consensus. Most blockchains use Proof of Work or Proof of Stake, where validators are selected based on computational power or token holdings. Vanar introduced something different called Proof of Reputation. The Vanar Foundation selects validators based on their corporate reputation rather than just their financial stake. They’re looking at market position, customer reviews, industry certifications, operational history, transparency, and community feedback. The philosophy is that established companies have more to lose than just the financial penalty of misbehaving. If a validator acts maliciously or performs poorly, the damage to their broader business reputation exceeds any direct financial consequence.

This creates interesting dynamics. A company that’s spent decades building trust in their industry isn’t going to risk that reputation to gain a small advantage in block production. They’ve got customers, partners, regulators, and stakeholders who would all see that behavior. It’s reputational capital working as security, similar to how established financial institutions operate under constant scrutiny that shapes their behavior more than rules alone ever could. Validators still need to stake 100,000 VANRY tokens and maintain serious computational resources, network connectivity, and operational security. But the selection process considers factors beyond just who can afford the largest stake.

Building Intelligence Into The Foundation

The architecture they built goes beyond just making transactions cheap and fast. They created five distinct layers, each handling different aspects of what they now call an AI-native blockchain. The base Layer One provides the scalable, secure foundation with that Proof of Reputation consensus. But it’s the layers above that reveal their actual ambitions.

Neutron is their intelligent data storage system. Traditional blockchains store data as raw bytes without understanding what that data means. Neutron stores data in a way that understands semantic meaning. When you store a document, it’s not just saved as a file. It’s indexed, understood, and made queryable in ways that let smart contracts and applications reason about its contents. This matters enormously for the kinds of applications they envision. If you’re storing legal documents on-chain, you don’t just want them saved. You want smart contracts that can read those documents, understand their terms, verify compliance, and execute transactions based on what they contain.

Kayon is their reasoning engine, built into the protocol level. This is where things get particularly ambitious. Most blockchains execute code deterministically. You write a smart contract that says if condition A is true, then do action B. Kayon adds reasoning capabilities that go beyond simple conditional logic. It can process complex queries, understand context, make inferences, and handle the kind of intelligent decision-making that typically requires external AI systems. They’re embedding AI capabilities directly into the consensus layer rather than requiring developers to integrate external services.

Axon and Flows are still in development, but they represent the next evolution. Axon aims to provide agent-ready smart contracts where autonomous AI agents can interact with blockchain applications intelligently. Flows will handle automated workflows that respond to complex conditions and execute multi-step processes without constant human intervention. The vision is a blockchain where intelligence isn’t something you add on top through integrations. It’s fundamental to how the system operates.

The Economics Of Giving Things Away

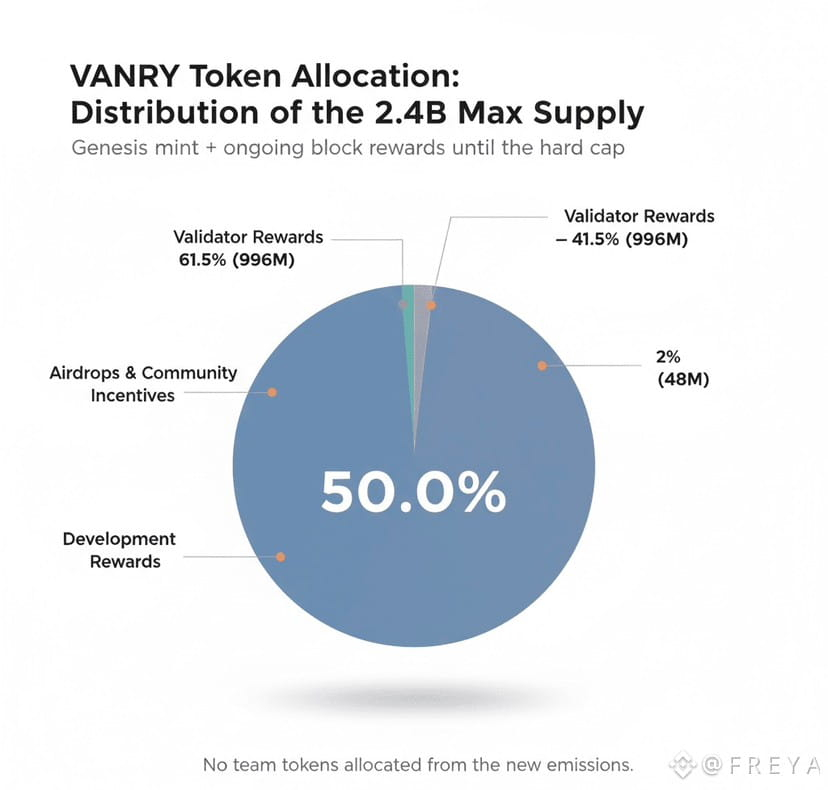

The token economics reveal how seriously they’re thinking about long-term sustainability. The maximum supply is 2.4 billion VANRY tokens. Half of that, 1.2 billion, was minted in the genesis block to maintain continuity from the TVK token during the migration from Virtua. The remaining 1.2 billion will be distributed as block rewards over twenty years. That’s an extremely long emission schedule compared to most blockchain projects, creating predictable supply dynamics that won’t flood the market in the early years.

Token holders can stake their VANRY through a delegated system. The minimum stake is 1,000 tokens, and you can choose staking periods from 30 days to 365 days. The annual percentage yield ranges from eight to fifteen percent depending on how long you lock up your tokens. When you want to undelegate, there’s a 21-day waiting period. This creates interesting economics because validators need community support. They’re not just staking their own large holdings. They’re competing for delegation from the broader community, creating accountability through economic relationships beyond just the Foundation’s oversight.

Validators themselves need to stake 100,000 VANRY tokens, maintain serious computational infrastructure, and provide continuous monitoring and operational security. Poor performance doesn’t just hurt their reputation with the Foundation. It costs them the delegated stake from community members who will move their tokens to better-performing validators. There’s no slashing where misbehavior destroys your capital. Instead, you lose revenue opportunity. For institutional validators, this is actually more appealing. They’re not risking catastrophic loss of capital from a mistake or external attack. They’re competing on performance and reliability.

The blockchain itself needs to generate revenue to sustain operations over decades. They’ve introduced a subscription model called myNeutron where developers and enterprises pay for enhanced access to the AI-native features. This creates direct revenue streams beyond just transaction fees. It’s recognition that if you’re building infrastructure that’s genuinely valuable for commercial applications, some of those applications will pay for premium access, support, and capabilities. The question isn’t whether the blockchain can survive on transaction fees alone. It’s whether they can build services valuable enough that enterprises choose to pay for them.

The Invisible Carbon Question

One of their partnerships reveals how they’re thinking about positioning for institutional and enterprise adoption. BCW Group operates a validator node running on Google Cloud infrastructure, specifically emphasizing renewable energy data centers. This creates measurable carbon-neutral claims rather than relying on questionable carbon offset credits purchased after the fact. Google Cloud is working toward carbon-free electricity 24/7 by 2030, and they provide detailed reporting on power usage, routing efficiency, and data center operations.

For brands and enterprises considering blockchain integration, environmental impact has become a critical factor. They’re not just asking whether something works technically. They’re asking whether using it creates reputational risk around climate commitments. Vanar’s positioning lets brands calculate the actual power consumption of their blockchain activities and either use it directly as a carbon-neutral operation or factor it into their broader environmental accounting. It’s the kind of practical consideration that matters more to corporate decision-makers than technical performance metrics.

The environmental positioning also connects to their broader strategy around mainstream adoption. They learned from entertainment that people care about experiences and values, not technical architecture. Telling someone your blockchain uses Proof of Reputation consensus means nothing to them. Telling them their digital collectibles or AI applications run on carbon-neutral infrastructure they can verify through Google Cloud reporting gives them something concrete they can understand and potentially care about.

What Actually Works Today

The challenge with evaluating any blockchain project is separating vision from reality. They’ve built the Layer One blockchain. It’s running. Validators are operating. Transactions are processing. The Neutron intelligent storage system exists and functions. What’s less clear is whether the AI-native capabilities they’re describing are fully operational or still partially aspirational. Many blockchain projects announce grand technical architectures where some components are working, some are in development, and some are more theoretical than real.

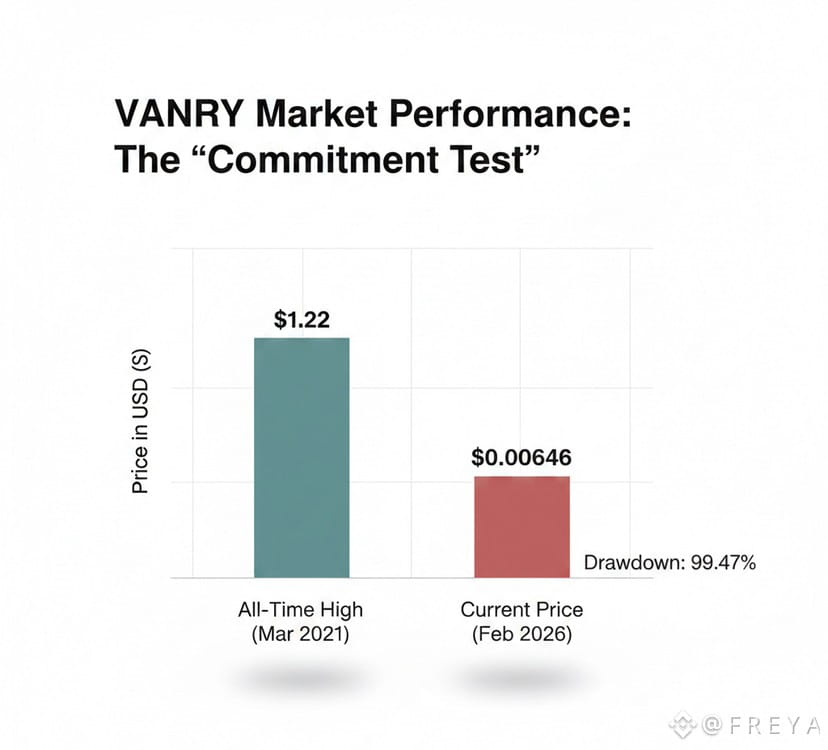

The token price tells part of the story. VANRY trades below one cent despite a market cap around $100 million. That’s not necessarily negative. It might reflect that the project is still early, that the market hasn’t yet recognized what they’re building, or that investors are waiting to see actual adoption before valuations increase. But it also might reflect skepticism about whether the technical capabilities translate into commercial success. A blockchain can be technically impressive and still fail to attract meaningful usage.

They made a deliberate decision to build a Layer One blockchain rather than a Layer Two solution on top of Ethereum or another established network. This gives them complete control over performance, costs, features, governance, and the security model. For their use cases around gaming and microtransactions where users are unwilling to pay any fees, this makes sense. You need extreme cost-effectiveness that’s hard to achieve on general-purpose blockchains. But it also means they’re competing for developer attention, liquidity, and ecosystem development against networks with much larger communities and resources.

The developer experience matters enormously here. If they’ve made their blockchain technically sophisticated but difficult to build on, developers will choose simpler alternatives. If they’ve made it easy to deploy applications but the performance doesn’t match the promises, projects will launch elsewhere. The success of any blockchain infrastructure ultimately depends on whether developers choose to build on it and whether those applications attract users. Everything else is just potential.

The Industries They’re Actually Targeting

Beyond gaming and entertainment, they’re positioning for PayFi and real-world asset applications. The idea is that legal documents, property deeds, compliance certificates, and similar materials get stored as Neutron Seeds on-chain in AI-readable formats. Smart contracts can then query these documents, verify claims, check compliance, and execute transactions based on what they contain. A property transfer might automatically verify that all permits are in order, compliance requirements are met, and legal documentation is valid before executing the transaction.

This is genuinely ambitious because it requires not just technical capability but integration with existing legal, regulatory, and commercial frameworks. Blockchains don’t exist in isolation. If you want to handle real-world assets, you need bridges to traditional legal systems, regulatory approval in relevant jurisdictions, cooperation from existing institutions, and mechanisms for handling disputes when things go wrong. The technology might be ready. The world might not be.

The AI-native positioning is fascinating because it’s addressing a real trend. Every company is trying to integrate AI capabilities into their products and services. Most are doing it through external integrations with providers like OpenAI, Anthropic, or Google. If Vanar can provide AI reasoning capabilities at the protocol level, applications built on their blockchain get those capabilities automatically without managing additional integrations or API costs. That’s potentially valuable. But it also requires that their AI capabilities are actually competitive with what specialized AI companies provide.

Where This Could Actually Lead

Let me paint two very different futures that both seem plausible given what we know today. In the optimistic scenario, we’re sitting in 2028 and Vanar has become invisible infrastructure powering millions of daily interactions. People are using AI-powered applications for entertainment, commerce, professional services, and personal productivity. They don’t know those applications run on blockchain. They don’t care. The applications just work. They’re fast, reliable, and cost-effective. Major brands have deployed customer-facing applications on Vanar because the environmental credentials check out, the costs are negligible, and the AI-native features let them build experiences that weren’t possible on traditional infrastructure.

The entertainment origins prove strategic. Gaming companies, streaming platforms, and digital content creators adopt Vanar because they understand that these teams actually get entertainment. They’ve built applications themselves. They know the pain points. The AI capabilities evolve into genuine competitive advantages as applications get deployed that simply couldn’t work on other blockchains without expensive external integrations. The twenty-year token emission schedule creates stability. The community grows steadily rather than exploding and collapsing. Validators compete on performance and reputation. The ecosystem develops organically.

In the pessimistic scenario, Vanar joins the hundreds of technically impressive blockchain projects that never achieve meaningful adoption. The AI-native features solve problems that don’t exist. Developers find the learning curve steeper than anticipated and choose more familiar platforms. The entertainment background, rather than being strategic insight, proves limiting because mainstream brands don’t want to associate with gaming and NFT communities. The environmental positioning gets scrutinized more carefully, and carbon-neutral claims through cloud providers face skepticism. The token price remains depressed because revenue from myNeutron subscriptions never materializes at scale.

The actual future probably lives somewhere between these extremes. Some aspects work better than expected. Others disappoint. Some use cases find strong product-market fit while others never gain traction. The interesting question isn’t which extreme future arrives. It’s which specific pieces of their vision prove correct and which need revision.

The Lesson That Started It All

What makes Vanar’s story worth understanding, regardless of how successful they ultimately become, is the lesson that birthed the entire project. Entertainment taught them that mainstream adoption requires invisibility. The best technology is the technology you don’t notice. When that lesson emerged from gaming communities and virtual concert attendees, it revealed something profound about blockchain’s fundamental challenge.

The technology has spent years being loudly visible. We’ve celebrated technical features, promoted token economics, and educated users about how everything works. But most people don’t want education. They want solutions. They don’t want to understand blockchain any more than they want to understand TCP/IP protocols when they browse websites. If blockchain is going to matter beyond speculation and niche applications, it needs to disappear completely into experiences people actually want.

Whether Vanar achieves that invisibility remains unknown. But they’re asking the right question. They learned it from people who just wanted to enjoy digital entertainment without the technology getting in the way. That lesson might prove more valuable than any technical architecture, because it’s the lesson the entire industry needs to learn if blockchain is going to become genuine infrastructure rather than just another technological curiosity that never quite escaped its experimental phase.