Is Web3 the “Didi” or the “SF Express”?

A Deep Dive into BNB Greenfield — an Underrated Storage Public Chain

Disclosure: I hold BNB and participate in the BNB Chain ecosystem. This is an objective analysis, not investment advice.

Most public-chain discussions feel repetitive:

• Layer 1 = higher TPS

• Layer 2 = lower fees

• Endless technical competition with diminishing differentiation

Today, let’s shift perspective.

BNB Greenfield isn’t trying to replace Uniswap, nor compete in GameFi.

Its goal is far more focused: to become the “data-native layer” of Web3.

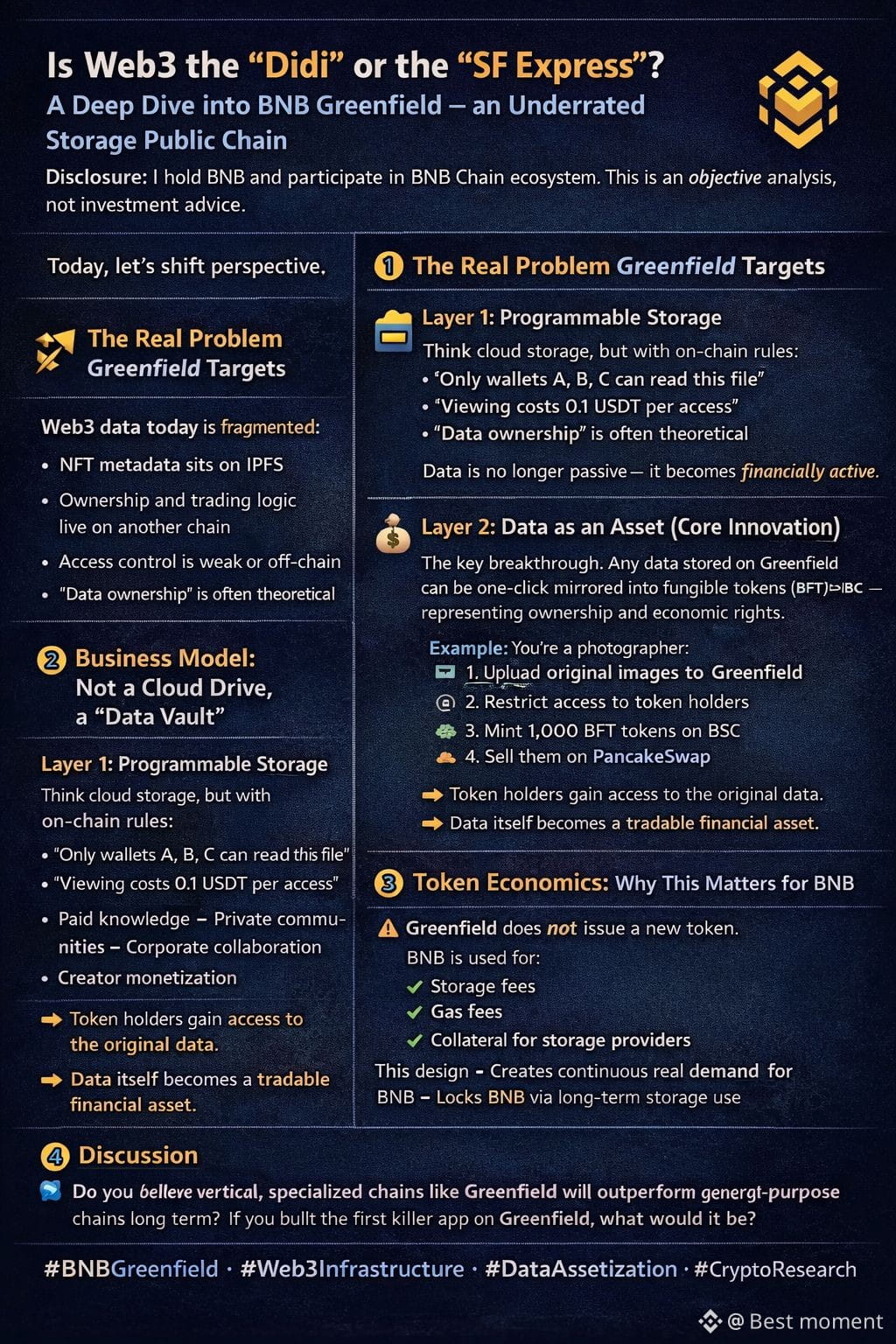

1️⃣ The Real Problem Greenfield Targets

Web3 data today is fragmented:

• NFT metadata sits on IPFS

• Ownership and trading logic live on another chain

• Access control is weak or off-chain

• “Data ownership” is often theoretical

Greenfield’s idea is simple but powerful:

👉 Store data, manage permissions, and enable monetization — all natively on one chain.

Every file becomes programmable from birth:

Who can read it

Who can download it

Whether access is free or paid

Data is no longer passive — it becomes financially active.

2️⃣ Business Model: Not a Cloud Drive, a “Data Vault”

🔹 Layer 1: Programmable Storage

Think cloud storage, but with on-chain rules:

“Only wallets A, B, C can read this file”

“Viewing costs 0.1 USDT per access”

This unlocks new use cases: • Paid knowledge

• Private communities

• Corporate collaboration

• Creator monetization

🔹 Layer 2: Data as an Asset (Core Innovation)

This is the key breakthrough.

Any data stored on Greenfield can be one-click mirrored into a fungible token (BFT) on BSC — representing ownership and economic rights.

Example:

You’re a photographer:

Upload original images to Greenfield

Restrict access to token holders

Mint 1,000 BFT tokens on BSC

Sell them on PancakeSwap

👉 Token holders gain access to the original data.

👉 Data itself becomes a tradable financial asset.

🔹 Layer 3: Binance Full-Stack Integration

Inside the Binance ecosystem, the puzzle fits perfectly:

• Wallet: Binance Web3 Wallet

• Trading: BFT tokens on PancakeSwap

• Infrastructure: Storage demand benefits BNB stakers & validators

Greenfield fills the missing link:

📌 Data assetization, allowing Binance to expand beyond pure financial trading into digital creation and ownership.

3️⃣ Token Economics: Why This Matters for BNB

Greenfield does not issue a new token.

BNB is used for: • Storage fees

• Gas fees

• Collateral for storage providers

This design: ✔ Creates continuous, real demand for BNB

✔ Locks BNB via long-term storage use

✔ Avoids gas-token fragmentation

BNB becomes fuel for digital property rights, not just a trading asset.

4️⃣ Risks & Challenges

No innovation comes without friction:

• Cold start problem: needs early creators & storage providers

• UX & cost: must compete with AWS-level convenience

• Regulatory gray zones: data monetization may face compliance challenges

Greenfield is early — adoption is not guaranteed.

5️⃣ Final Takeaway

Greenfield isn’t a short-term hype narrative.

Its real value is introducing a new Web3 primitive:

Data that can be programmed, owned, combined, and traded like DeFi.

If even a few native applications (social networks, creator platforms, enterprise tools) succeed on it, Binance’s ecosystem support could turn into a long-term moat.

This is not a FOMO stage — it’s a learning stage.

Try the testnet, upload files, set permissions, mint tokens.

You’ll understand Web3 data ownership far better than reading headlines.

💬 Discussion

Do you believe vertical, specialized chains like Greenfield will outperform general-purpose chains long term?

If you built the first killer app on Greenfield, what would it be?

#BNBGreenfield #Web3Infrastructure #DataAssetization #CryptoResearch