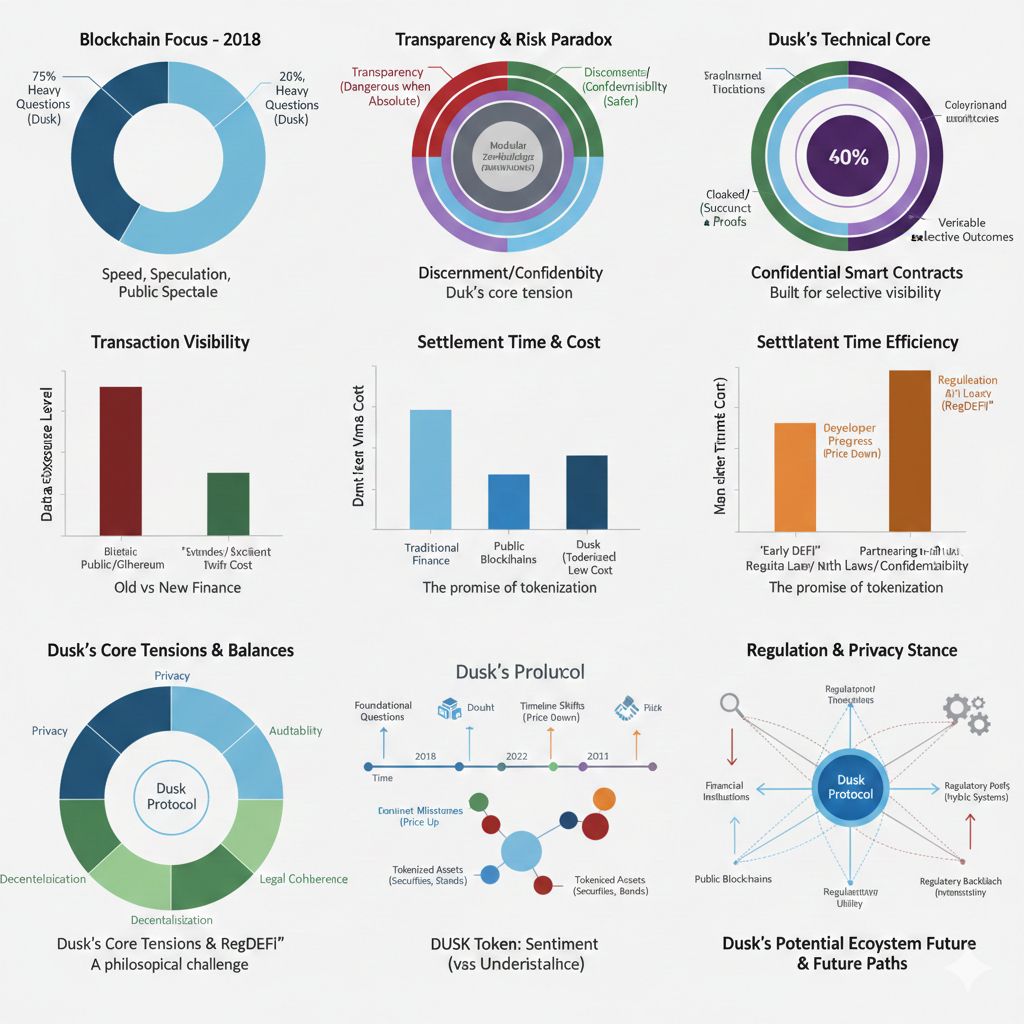

At first glance it looked like nothing a cluster of screens in a modest Amsterdam workspace, lines of code scrolling past like rain on glass, coffee cooling beside keyboards but beneath that ordinariness was a restlessness that felt almost architectural, as if a new kind of building were being designed without ever being shown to the public. In 2018, when most of the blockchain world was intoxicated with speed, speculation, and public spectacle, a smaller circle of engineers, cryptographers, and former financiers began asking a slower, heavier question: what if the future of finance did not need more visibility, but more discernment about what should remain hidden? They were not trying to construct a shadow economy, nor were they trying to romanticize secrecy; instead, they were wrestling with a paradox that haunts modern markets that transparency, while virtuous in theory, can become dangerous when it is absolute. Out of that tension emerged Dusk, not as a loud revolution but as a careful reconsideration of how power, trust, and information should move in a digital age.

In those early days, the team studied existing blockchains the way urban planners study cities: admiring the innovation, but noticing the structural flaws. Bitcoin had shown that value could move without intermediaries, yet it left a glass trail behind every transaction. Ethereum had turned money into programmable logic, but in doing so had made every contract a public drama. For banks, exchanges, and asset managers, this was not liberation it was exposure. Positions could be tracked, strategies inferred, and clients indirectly revealed. What Dusk’s architects began imagining was less a new currency and more a new kind of financial terrain, one where institutions could walk without casting long, compromising shadows. They spoke in terms of selective visibility: a ledger that could prove compliance without publishing its inner life, a system that could satisfy regulators without humiliating counterparties.

The technical answer they built grew gradually, like a bridge assembled piece by piece over deep water. At its core was a modular Layer 1 blockchain wrapped in zero-knowledge cryptography, a mathematical technique that allows one party to prove something is true without revealing the underlying data. Instead of transactions being naked on a public ledger, they would be cloaked in succinct proofs tiny, elegant attestations that said, in effect, “this movement of value obeyed the rules,” without ever saying who sent what to whom. To make this work at scale, the team leaned on PLONK, a modern proving system that balanced speed with flexibility, letting developers design confidential smart contracts that could operate on encrypted information while still producing verifiable outcomes. The result was a network that felt less like a billboard and more like a sealed vault with transparent walls only for those with proper authority.

Yet Dusk was never purely a cryptographic experiment; it was also a negotiation with the real world. Every line of code carried an implicit conversation with regulators, auditors, and legal frameworks that predated blockchains by decades. The founders understood that institutions would not migrate to a system that simply replaced old risks with new ones. So they built mechanisms for auditability alongside privacy ways for regulators to request specific disclosures, ways for firms to demonstrate compliance through formal proofs, and governance structures meant to prevent the network from becoming either an anarchic free-for-all or a rigid surveillance machine. In boardrooms and legal offices, the idea slowly gained credibility: perhaps privacy, properly engineered, could be a partner to regulation rather than its enemy.

As development continued, Dusk’s identity sharpened around tokenized real-world assets securities, bonds, and other financial instruments that today crawl through layers of intermediaries before settling. The promise was subtle but profound: near-instant settlement without sacrificing confidentiality, a marketplace that could move with the efficiency of software but the discretion of traditional finance. In theory, this could shrink costs, reduce errors, and make global capital markets feel less like a labyrinth. In practice, it meant persuading conservative institutions to trust cryptography as much as they trusted paperwork, a cultural leap as much as a technical one.

Inevitably, the project attracted both enthusiasm and skepticism. Supporters saw in Dusk a mature vision of “RegDeFi,” a version of decentralized finance that respected laws instead of evading them. Critics worried that any privacy layer, no matter how well designed, could be exploited by bad actors or abused by powerful ones. There were also deeper anxieties: if compliance could be reduced to mathematical proofs, would regulators lose the human judgment that sometimes tempers enforcement? Would courts understand cryptographic evidence? Would selective disclosure become a tool for both accountability and manipulation? These questions lingered like weather over the network’s bright technical horizons.

Meanwhile, the DUSK token began to take on its own life, trading on exchanges, reacting to announcements, and reflecting the market’s alternating moods of hope and doubt. Price charts flickered upward with mainnet milestones and dipped when timelines shifted a reminder that financial speculation and infrastructural progress rarely move at the same pace. Yet beneath that volatility, developers kept refining the protocol, improving proof efficiency, hardening consensus, and trying to make the system not just clever but dependable.

What made the project feel different was its temperament. Where many blockchains shouted about disruption, Dusk spoke about compatibility. Where others celebrated radical transparency, it defended the necessity of discretion. In laboratories and online forums, engineers debated polynomial commitments and randomness beacons with a craftsman’s patience, knowing that even a small flaw could undermine the entire promise of confidentiality. Their work was less glamorous than moonshot slogans, but more likely to endure.

Looking ahead, Dusk’s trajectory remains uncertain in the most interesting way. One future imagines a world where confidential blockchains become the quiet plumbing beneath regulated markets, invisible to most but indispensable to many. Another sees regulatory backlash, with governments demanding more visibility than cryptography can safely provide. A third envisions hybrid systems where public proofs sit atop private negotiations, blending old institutions with new technology in unpredictable ways. The outcome will depend as much on politics, law, and human trust as on mathematics.

In the end, Dusk feels like an experiment in translation between code and law, between secrecy and transparency, between innovation and caution. Its greatest challenge is not merely technical but philosophical: can a system be both private and accountable, both decentralized and legally coherent? Watching it evolve is like watching a cathedral being built with algorithms instead of stone, light passing through patterns only certain eyes can read. Whether it becomes a cornerstone of future finance or a brilliant but flawed footnote, it has already shifted the conversation about what a blockchain can be. And in that quiet shift less spectacle, more substance lies its most compelling legacy.