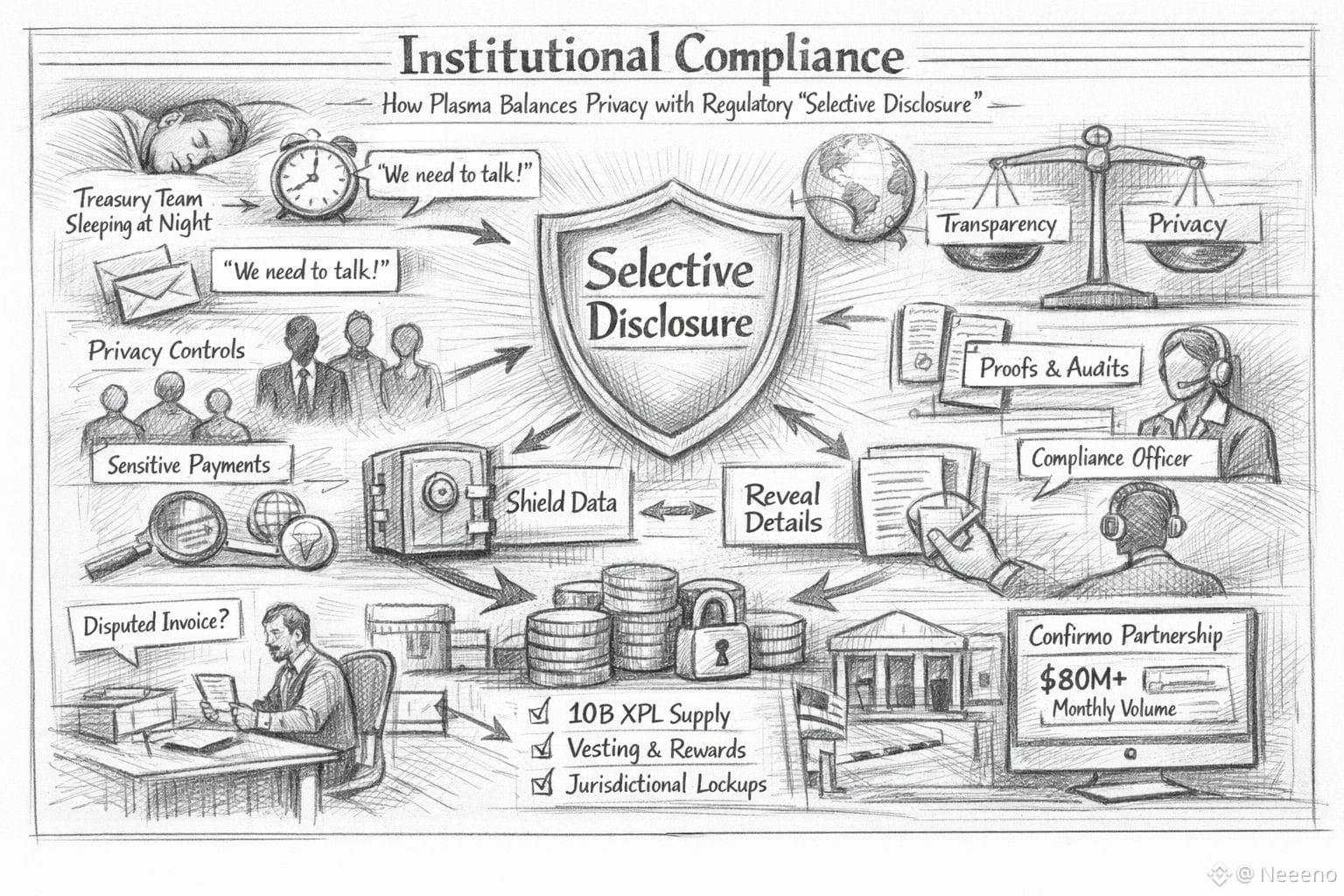

@Plasma The first thing people miss about compliance is that it isn’t a checkbox, it’s a mood. It’s the difference between a treasury team sleeping at night or waking up to a Slack message that begins with “we need to talk.” Plasma is being built in that emotional territory, where privacy isn’t a rebellious statement and transparency isn’t a virtue signal. It’s just the day-to-day reality of moving dollars through systems that have auditors, counterparties, sanctions lists, and human careers attached to them. When Plasma talks about selective disclosure, it’s admitting something most crypto products avoid saying out loud: the real world doesn’t want everything public, and it also doesn’t accept “trust me” as an answer.

If you’ve spent any time around institutional workflows, you learn that “privacy” is rarely about hiding wrongdoing. It’s about not advertising payroll data, not exposing supplier relationships, not showing competitors your cash cadence, and not turning every payment into a permanent, searchable map of who depends on whom. On most public networks, every transfer leaks a story: amounts, timing, counterparties, even patterns that are easy to interpret when markets get tense. Plasma’s docs say its privacy feature is simple and optional, and they’re clear that Plasma isn’t trying to be a full privacy-focused chain. That framing matters, because institutions don’t adopt absolutes. They adopt controls.

The control Plasma is reaching for is subtle: the ability to keep ordinary transfers ordinary, while giving users the option to shield sensitive details and then reveal only what’s necessary later, to the right party, for the right reason. In the Plasma docs, selective disclosures are described as optional, scoped, and controlled by the user, with verifiable proofs used when auditability or compliance requires it. That single sentence contains the practical compromise institutions have been begging for: you don’t have to make your entire financial life public to prove one payment was legitimate. You can produce a precise window into activity without handing over the whole house key.

Where this becomes real is in the messy moments, not the demos. A vendor disputes an invoice. A regulator asks why a payment crossed a border. A compliance officer needs to reconcile on-chain movement with off-chain documentation that is, inevitably, imperfect. This is where selective disclosure stops being a concept and turns into operational safety.

Plasma’s approach suggests a world where, when someone says “prove it,” an institution doesn’t have to choose between leaking private details and failing a compliance check. You can picture a calmer crisis call: less panic, less over-sharing, fewer things you can’t take back, because the system can show only what’s needed instead of everything. What feels most real in how Plasma talks is this: privacy is a choice you make on purpose, not a place you end up by accident.

The docs describe private-to-public movement without wrappers or new tokens, and they emphasize composability rather than isolation—again, not as a marketing claim, but as an admission that money doesn’t live in one box. Institutions will not tolerate funds getting trapped in a privacy corner they can’t unwind from when a policy changes or an investigation starts. Building confidentiality as an opt-in flow with an exit is a way of designing for regret, and regret is a constant in financial operations.

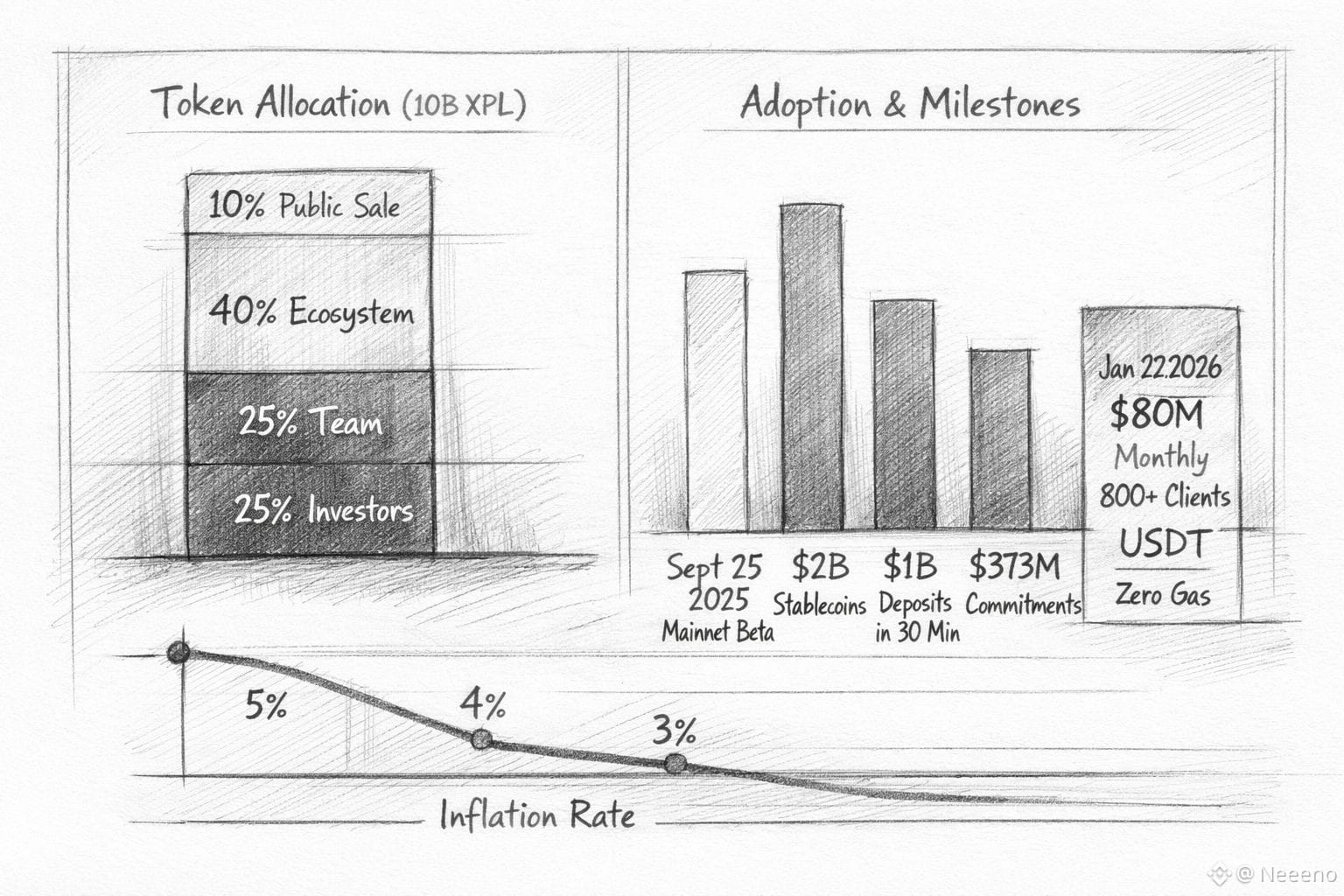

The other side of compliance is incentives, because policies are only as strong as the economic gravity beneath them. Plasma’s token, XPL, is positioned as the security anchor: an initial supply of 10,000,000,000 XPL at mainnet beta launch, with allocations that explicitly spell out who holds what and when those holdings become liquid. Ten percent—1,000,000,000 XPL—was allocated to the public sale, while 40% is reserved for ecosystem and growth, and 25% each to team and investors, with multi-year vesting mechanics. Those numbers aren’t just tokenomics trivia; they tell institutions whether the network’s incentives are likely to remain stable when the first real stress hits and people start reaching for liquidity.

Even the compliance-specific detail in the public sale unlocks is revealing. Plasma’s docs state that non-US public sale purchases are fully unlocked at mainnet beta launch, while US purchasers face a 12-month lockup, unlocking on July 28, 2026. You can read that as a constraint, but I read it as a signal: Plasma is shaping distribution around jurisdictional reality instead of pretending those lines don’t exist. The moment a network accepts that different participants live under different rulebooks, it becomes easier for compliance teams to imagine integrating it without constantly apologizing for it.

There’s also the quiet question of who pays to keep honesty expensive. Plasma outlines validator rewards beginning at 5% annual inflation, decreasing by 0.5% per year until reaching a 3% baseline, with the important caveat that inflation only activates once external validators and delegation go live. It also describes a fee-burning model designed to balance emissions over time. I’m not repeating these points to sound technical. I’m repeating them because compliance is downstream of security, and security is downstream of incentives. When a network can clearly explain how it funds validation without relying on constant excitement, it starts to resemble infrastructure instead of a mood swing.

The “recent updates” story around Plasma has been less about grand announcements and more about distribution and usage pathways that look institution-shaped. In late September 2025, Plasma said mainnet beta would go live September 25, 2025, and framed launch readiness in terms of stablecoin liquidity and deployment through partners, pointing to “$2B in stablecoins” active from day one and a deposit campaign that committed “more than $1B” in just over 30 minutes, followed by “$373M in commitments” for the public sale. Those are adoption-flavored data points: they’re about capital choosing to sit inside the system, which is a more serious signal than social engagement.

And then, in January 2026, you can see the institutional edge sharpen in practical integration. Confirmo—an enterprise payments platform—announced on January 22, 2026 that it processes $80M+ in monthly volume for 800+ enterprise clients and is partnering with Plasma to add a USD₮ payment rail with zero gas fees, while noting that services may be jurisdiction-limited. That last line is unglamorous, but it’s the kind of sentence compliance teams look for. It means someone is thinking about boundaries, not just throughput.

Here’s the uncomfortable part: selective disclosure only matters if it remains believable under pressure. In bull markets, everyone is fine with “privacy” as a vibe. In a crisis, the questions become sharp and unforgiving: who can see what, who can prove what, and how quickly can you answer without exposing everything else? Plasma’s approach—confidentiality as an opt-in module, selective disclosures as verifiable and scoped, and a system designed to remain auditable—reads like it was written by people who have sat through those tense meetings. It’s an attempt to make the truthful path the least painful path, because that’s what honest behavior often needs: not moral lectures, but lower operational cost.

XPL sits inside that same responsibility story. The supply numbers, unlock schedules, and reward mechanics are not just for traders. They’re for the people who have to explain why a network will still be there after the headlines move on, why validator participation won’t evaporate, why sudden dilution won’t turn governance into a scramble, and why the system won’t demand social trust when it should be delivering mechanical trust. Plasma is trying to make its economics legible—10B initial supply, defined allocations, multi-year unlocks, and a stated emissions curve—because legibility is a form of compliance too. It reduces fear, not by promising perfection, but by reducing surprises.

In the end, the most important thing Plasma is attempting with selective disclosure is not a new kind of secrecy. It’s a new kind of restraint. The restraint to hide what should remain private, to reveal what must be proven, and to do both without turning every transaction into either a public spectacle or a black box. That’s a quiet responsibility, and it rarely earns attention the way louder narratives do.In finance, hype is easy to get.In financial infrastructure, being noticed is cheap. Being dependable is rare. What lasts is what holds up when markets shake, when motives get messy, and when a counterparty wants verification—calm, precise, and private where it should be.