Today we are going to discuss about XPL Tokenomics Model. Let's gets started.

The world of cryptocurrency can feel overwhelming, but understanding how a token works doesn't have to be complicated. Today, we're breaking down XPL, the native coin of Plasma Chain, and exploring how its economic model is designed to create lasting value for everyone involved.

What Makes XPL Different?

When XPL launched, the team behind Plasma Chain knew they needed more than just another digital coin. They needed a system that would actually work for real people, not just early investors or large institutions. Think of tokenomics like the rules of a game if the rules are fair and well thought out, everyone has a chance to benefit.

The supply mechanism of XPL was built with a clear purpose. Unlike traditional currencies that governments can print endlessly, XPL has specific controls in place. The total supply was set from day one, meaning no one can suddenly create millions of new tokens out of thin air. This gives holders confidence that their investment won't be diluted overnight.

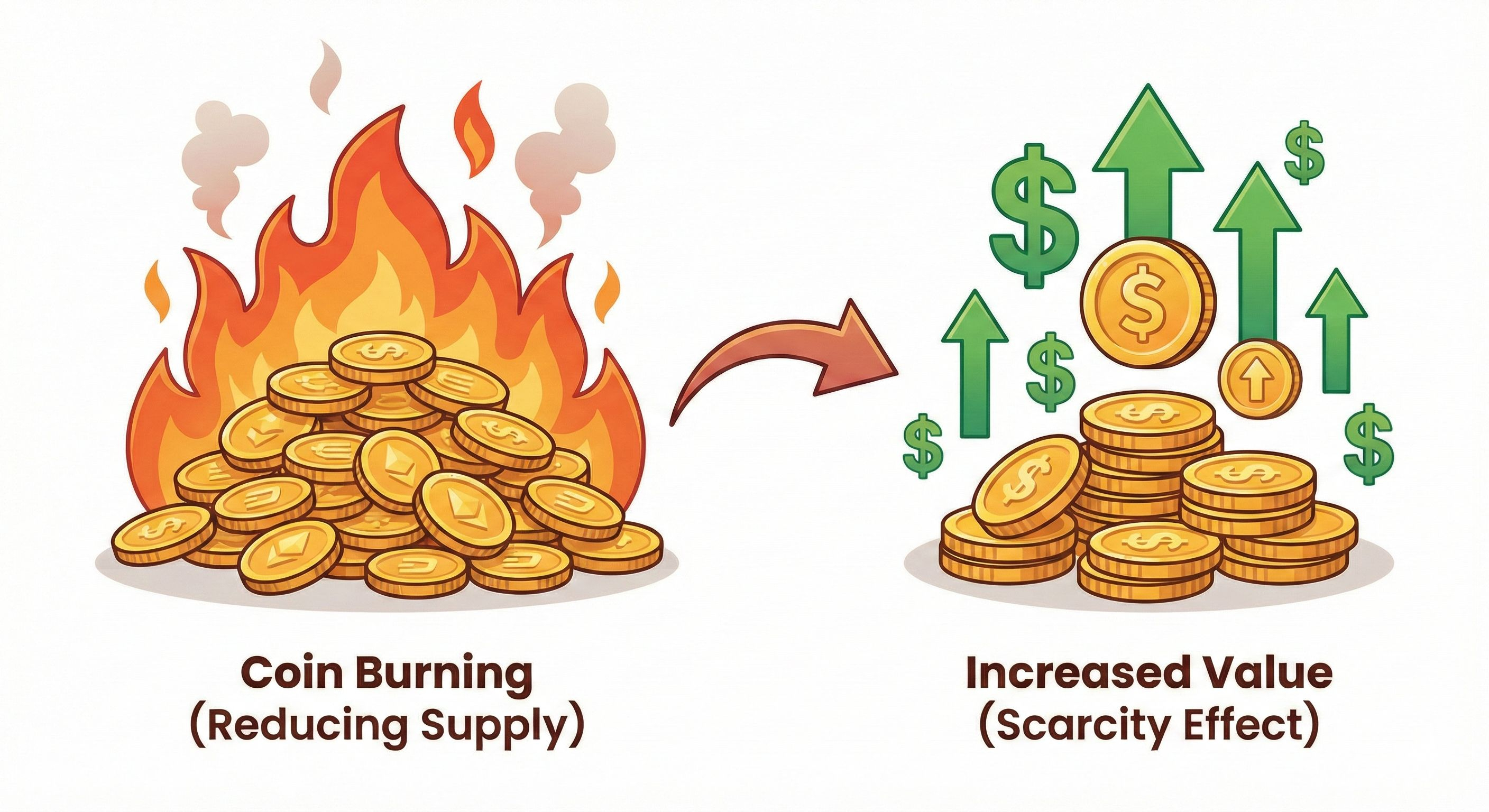

The Burning Strategy: Less is More

Here's where things get interesting. XPL uses something called a "burning strategy," which sounds dramatic but is actually quite simple. Periodically, a portion of XPL tokens are permanently removed from circulation they're "burned" and can never be used again.

Why would anyone destroy their own currency? It's basic supply and demand. When there are fewer tokens available, and people still want them, the value of each remaining token tends to increase. It's like owning a limited edition collectible the fewer there are, the more valuable each one becomes.

The burning happens through several methods. Every time someone makes a transaction on the Plasma Chain, a tiny fee gets burned. When the network generates revenue, a percentage goes to burning. This means XPL becomes more scarce naturally over time, just by people using the system.

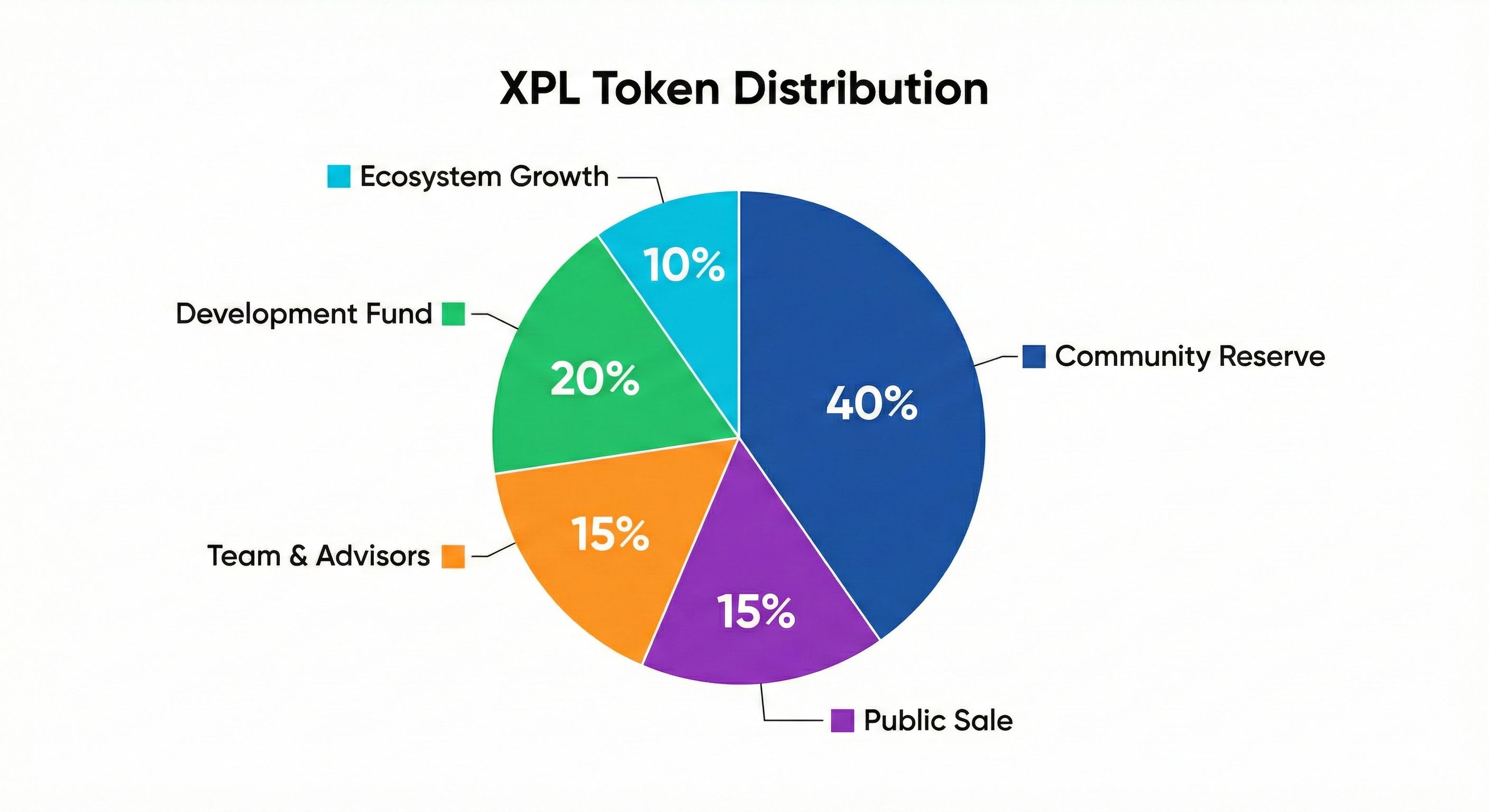

Distribution: Who Gets What?

Token distribution is where many crypto projects fail. If too many tokens go to the founding team or early investors, regular users feel left out. XPL took a different approach.

The majority of XPL tokens were set aside for the community. This wasn't just a nice gesture it's smart business. When everyday users hold more tokens, they have a real stake in the network's success. They become advocates, developers, and active participants rather than just spectators.

The development fund ensures the Plasma Chain can keep improving. Technology doesn't stand still, and having resources for upgrades means XPL won't become outdated. The team allocation had strict vesting periods, meaning founders couldn't just sell everything immediately and walk away. They're locked in for the long haul, just like everyone else.

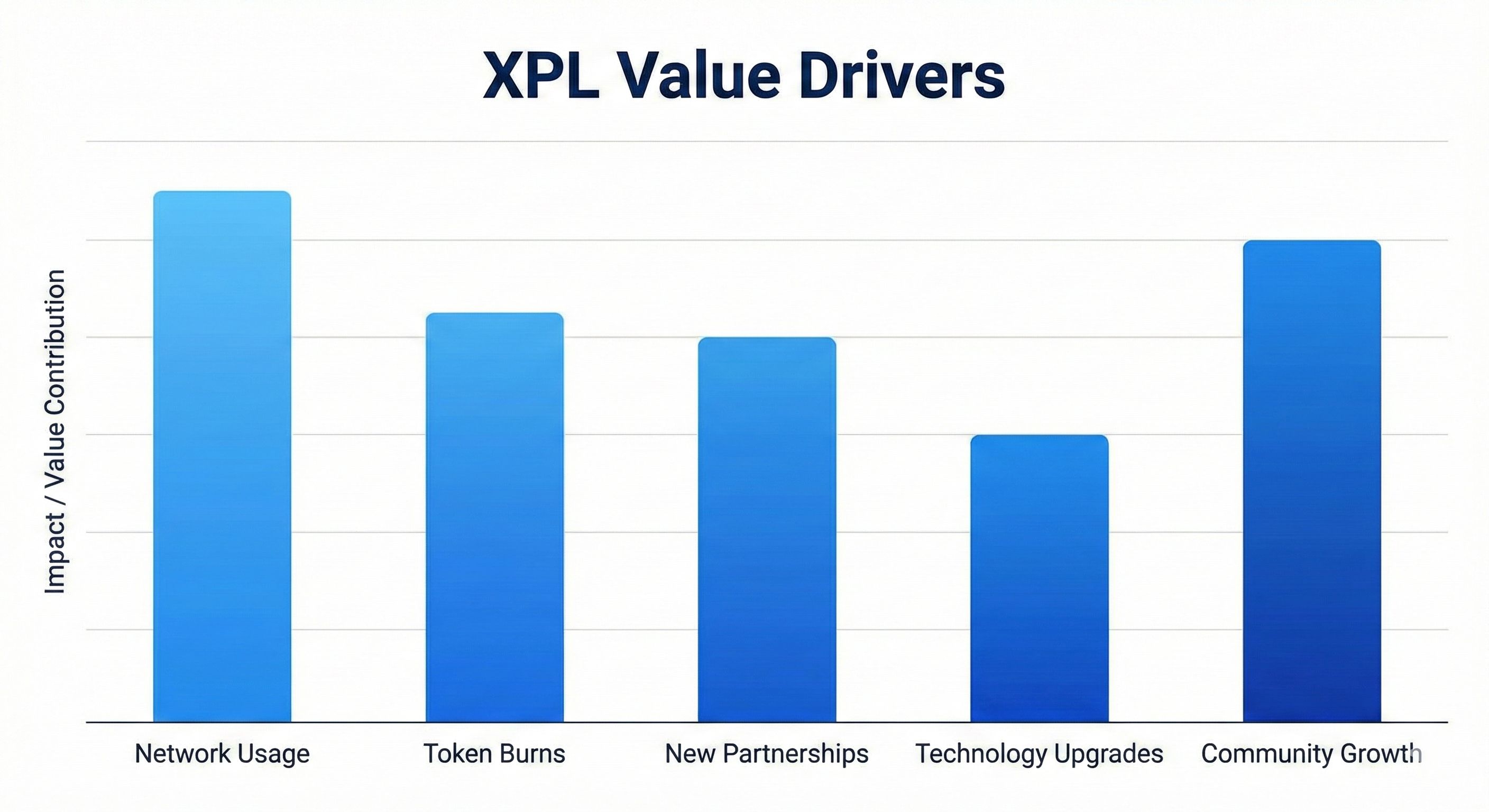

Long-Term Value Creation

So how does all this affect XPL's value over time? It's not just about price going up though that's certainly nice. Real value comes from utility and sustainability.

As more people use Plasma Chain for transactions, smart contracts, or building applications, demand for XPL increases. Each use case burns tokens, reducing supply. This creates a natural upward pressure on value that isn't dependent on hype or speculation.

The model also encourages holding rather than quick flipping. Users who stake their XPL to help secure the network earn rewards. This takes tokens out of active circulation and reduces sell pressure. It's a win win the network becomes more secure, and holders earn passive income.

Real-World Impact

Let's bring this home with a practical example. Imagine XPL when it first launched versus two years later. Initially, there might be 100 million tokens in circulation. After steady burning from transactions and network activity, that number could drop to 85 million. But during that same period, the number of active users tripled, and developers built dozens of applications on Plasma Chain.

Fewer tokens, more demand. The math is simple, but the impact is powerful. Early believers see their holdings appreciate. New users can still participate meaningfully. And the entire ecosystem grows stronger together.

The Road Ahead

XPL's tokenomics aren't set in stone forever. The beauty of blockchain governance means token holders can vote on changes. Want to adjust the burn rate? Propose it. Think distribution needs tweaking? The community decides together.

This flexibility, combined with strong foundational principles, positions XPL for long term success. It's not about getting rich quick it's about building something that lasts, something that creates genuine value for everyone involved.

The evolution from concept to reality shows that thoughtful design matters. XPL didn't just copy what others did. The team studied what worked, learned from others' mistakes, and created a model that balances all stakeholders' interests.

Disclaimer: This post is for informational purposes only. It is not financial or investment advice. Cryptocurrencies are volatile and risky. Always do your own research (DYOR) before making any decisions.