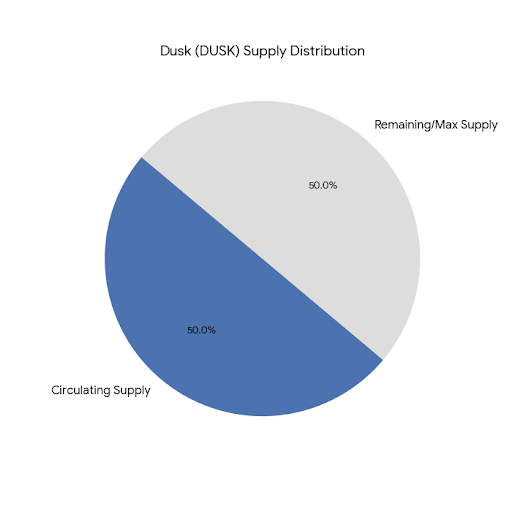

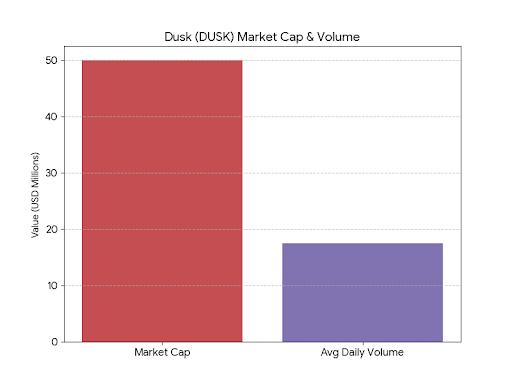

Dusk (DUSK) is sitting around $0.10, which puts it at roughly a $50M market cap with just under 500M tokens circulating out of a 1B max supply. Daily volume usually floats between $15–20M, so it’s liquid enough to trade but still small enough that price can move fast in either direction. This is not a sleepy mega-cap — positioning matters here.

What keeps Dusk in the conversation isn’t hype or social buzz, it’s where it’s aiming. It’s a Layer 1 built specifically for regulated financial use cases, which already filters out most of crypto’s usual audience. Dusk isn’t trying to be the next general-purpose chain for NFTs or meme coins. It’s assuming that if real institutions ever move on-chain in size, they’ll want privacy, compliance, and auditability baked in — not bolted on later.

That assumption feels more relevant now than it did a few years ago. Between AI, automated trading systems, and tokenized real-world assets, there’s growing demand for data that can be verified without being fully exposed. Public blockchains are great for transparency, but they’re terrible if you’re a bank that doesn’t want competitors or clients watching every move in real time. Dusk is essentially betting that finance on-chain will look more like regulated infrastructure and less like an open social network.

From a technical standpoint, Dusk keeps things fairly clean. It separates execution from settlement, which is a bit like separating order matching from clearing and custody in traditional markets. That structure makes it easier to enforce rules, audit activity, and upgrade systems without breaking the whole chain. Privacy is handled through zero-knowledge proofs, but not in a “hide everything forever” way. The idea is selective disclosure — private by default, but auditable when required.

That detail matters, because full anonymity is a non-starter for institutions. What they want is control. Who can see what, when, and under what conditions. Dusk is built around that reality rather than fighting it.

Some of the partnerships reflect this mindset. Work with regulated players like NPEX and Quantoz isn’t flashy, but it’s relevant. If things like a MiCA-compliant euro stablecoin (EURQ) actually get used for settlement on Dusk, that’s the kind of boring, repeatable activity that infrastructure chains need. Chainlink integrations for compliant data feeds also point toward real-world use rather than retail speculation.

That said, this is where traders need to stay grounded. Partnerships and pilots don’t equal adoption. Institutions move slowly, compliance cycles take time, and a lot of “institutional blockchain” projects never make it past the demo stage. Right now, DUSK is priced like a promise, not like a protocol throwing off cash flows.

The upside case is pretty clear, though. If tokenized securities and regulated DeFi actually scale over the next few years, a chain purpose-built for that niche could matter. Even modest issuance and trading volume could justify a valuation higher than today’s, especially if the token captures fees or staking demand in a meaningful way. A few hundred million market cap isn’t crazy if real usage shows up.

The downside is just as real. Adoption might never arrive, competitors might win the mandates, or institutions might stick with permissioned ledgers that don’t need a public token at all. In that scenario, DUSK risks becoming another well-designed chain with not enough economic gravity to sustain value.

So the real question isn’t whether the tech is solid — it mostly is. The question is whether anyone actually uses it. The signals to watch are boring but important: real assets being issued, real settlement volume, real institutions running infrastructure. If those don’t materialize, the narrative eventually fades.

From a trading perspective, DUSK feels less like a momentum coin and more like a thesis bet. Liquidity is thin enough that volatility cuts both ways, and patience matters more than timing perfection. If you’re looking at it, the smartest stance is probably simple: watch the usage, not the noise. The chart will follow whichever one wins.