The crypto and financial markets are buzzing with pivotal

developments. From Revolut’s bold U.S. expansion to rare Federal Reserve

dissent and shifting Bitcoin and Ethereum wallet trends, here’s your concise

guide to the latest market movers. Stay ahead with Binance Square!

Revolut Eyes U.S. Banking License Through Acquisition

Digital banking titan Revolut is reportedly

considering acquiring a U.S. bank to secure a banking license, a move that

could fast-track its entry into the competitive American market. This strategic

play aims to bolster Revolut’s operational strength, offering a robust

alternative to traditional banking. As Revolut expands its global footprint,

this could reshape the U.S. fintech landscape.

Note:

A licensed Revolut could challenge legacy banks, offering crypto-friendly

services to millions.

Federal Reserve Faces Rare Dissent on Rate Cuts

The Federal Reserve is bracing for a potential split

at its upcoming meeting, with Governors Waller and Bowman advocating for a rate

cut—echoing former President Donald Trump’s stance. This would mark the first

dissent in over 30 years (259 meetings). Chair Jerome Powell and others are

likely to hold rates steady, but the divide underscores growing concerns over

inflation risks.

Note:

Fed policy impacts crypto markets, with rate cuts potentially fueling bullish

sentiment.

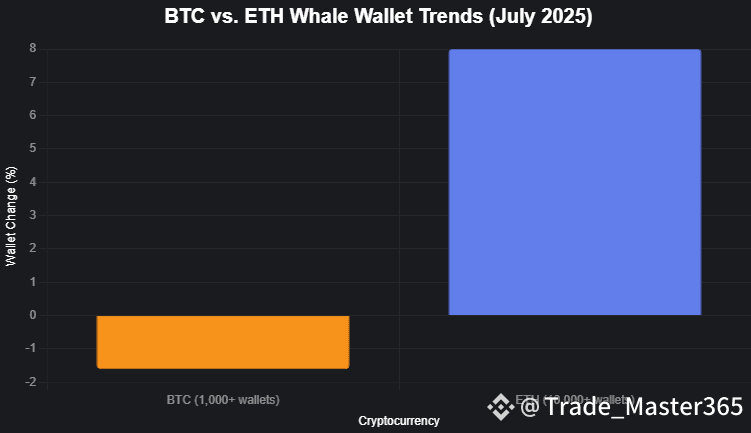

Bitcoin vs. Ethereum: Whale Wallet Trends Signal Shifting Investor Sentiment (July 30, 2025)

Recent Santiment data reveals contrasting trends in large wallet holdings for Bitcoin and Ethereum, pointing to divergent investor strategies:

Bitcoin (BTC): Wallets holding 1,000+ BTC decreased by 1.61% over the past two weeks, suggesting consolidation or profit-taking among large holders. BTC is trading near $118,000 (-0.66%), with $1.19 billion consolidated by Anchorage Digital, indicating institutional activity persists despite the drop in whale wallets.

Ethereum (ETH): Wallets holding 10,000+ ETH surged by 8.00%, reflecting strong institutional interest. ETH has climbed above $3,800 (+0.11%), fueled by ETF staking applications and growing DeFi adoption. Posts on X note ETH’s outperformance, with over $2 billion in U.S. spot ETH ETF inflows in July, driving a 40%+ price surge since late June.

Regulatory & Legal Shifts

SEC Greenlights Physical

Redemption for BTC/ETH ETFs:

Investors can now redeem ETF shares for actual crypto, enhancing liquidity

and mainstream adoption.AML Bitcoin Founder Sentenced: Rowland Marcus Andrade was

sentenced to 84 months for a $10M fraud and laundering scheme, underscoring

regulatory crackdowns.Telegram’s Pavel Durov Questioned: French authorities probed the

Telegram founder over alleged platform misuse, raising concerns about

privacy and compliance.

Note:

Regulatory clarity on ETFs and stricter enforcement shape investor confidence

and market dynamics.

Market Snapshot

Bitcoin ($BTC ): Trading near $118,000, down 0.66%. Institutional activity remains strong, with Anchorage Digital consolidating $1.19 billion in BTC, signaling continued confidence despite the slight dip.

BTC68,636.7-3.04%

BTC68,636.7-3.04%Ethereum ( $ETH ): Breaks above $3,800, up 0.11%, driven by growing momentum in ETF staking applications. This reflects increasing institutional interest in Ethereum’s ecosystem.

ETH1,976.22-5.46%

ETH1,976.22-5.46%Binance Coin ( $BNB ): Slides below $810, down 4.00%, as Binance lists Treehouse (TREE) for trading, margin, and futures, potentially diverting market attention.

BNB614.4-4.07%

BNB614.4-4.07%

Note:

Price movements and new listings reflect market sentiment and Binance’s growing

ecosystem.

Institutional & Political Moves

South Korea’s Central Bank launched a virtual asset department

to explore a KRW stablecoin, signaling institutional embrace of crypto.U.S. Senator Cynthia Lummis proposed including crypto in

mortgage assessments, a step toward mainstream integration.The White House will release its first crypto

policy report alongside ADP jobs data, potentially sparking market

volatility.

Note:

Institutional and political support could drive crypto adoption and price

surges.

What’s Next?

Revolut’s U.S. ambitions, Fed policy tensions, and ETH’s

rising institutional interest signal a dynamic market. Regulatory advancements

like ETF redemptions and staking approvals could further catalyze adoption.

Stay informed with Binance Square for real-time updates and expert

insights.

Follow us for more crypto news and analysis! 🚀

#FederalReserve #SEC @binance #CryptoNews

@Binance Square Official @Newsbit @Binance News @Binance Announcement @Binance Pay Official