Bitcoin (BTC) continues to be the focal point of the global financial stage in early 2026. After hitting a monumental peak of $126,000 in late 2025, the market is currently navigating a sophisticated "re-accumulation" phase. For creators and investors on Binance Square, understanding this shift is key to anticipating the next move.

📊 Market Sentiment & Technical Breakdown

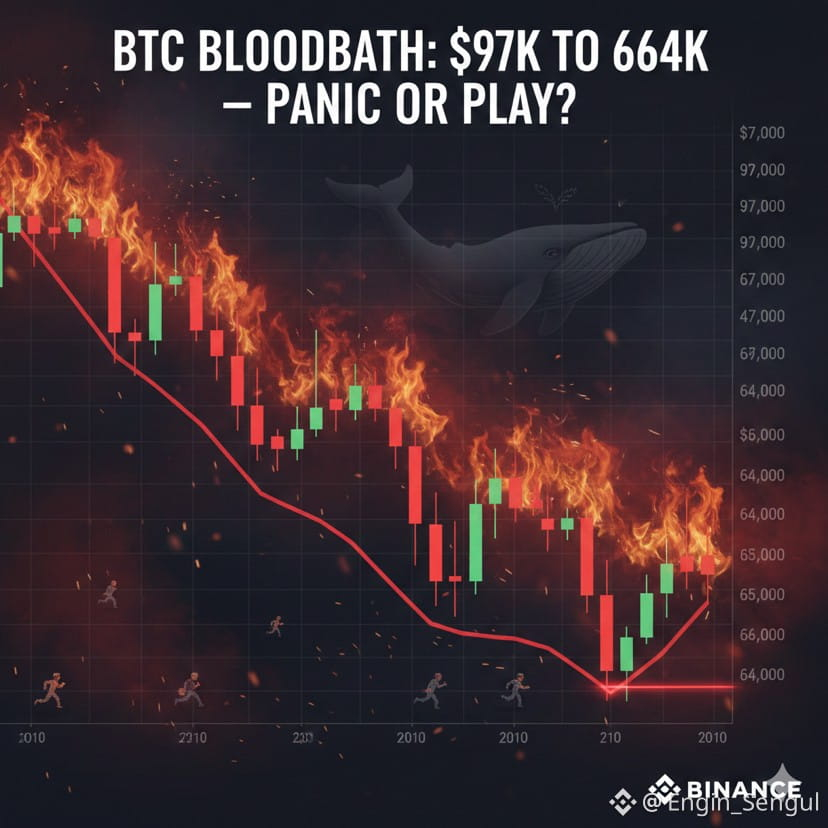

As of February 2026, Bitcoin is hovering within the $63,000 - $70,000 range. While short-term traders might see this as a stagnation, long-term whales view it as a necessary breather.

• Support Levels: The $60k mark has established itself as a "hard floor." As long as daily closes remain above this level, the macro bullish structure stays intact.

• The RSI Factor: Technical indicators suggest that the "overbought" conditions of last year have been fully neutralized, giving the market enough fuel for a potential Q3 rally.

🏛️ The Institutional Pillar

What makes 2026 different from previous cycles is the sheer depth of institutional integration.

1. Sovereign Adoption: Rumors of more nation-states adding $BTC to their treasury reserves have shifted the narrative from "digital gold" to "strategic reserve asset."

2. ETF Maturity: Spot Bitcoin ETFs have transitioned from "hype" to "standard portfolio staples" for pension funds and insurance companies.

🔮 The Verdict

We are currently in a "sideways" market that tests the patience of retail investors. However, the fundamentals—on-chain data showing decreasing exchange balances and increasing institutional inflows—suggest that the scarcity of Bitcoin is becoming more apparent than ever.

Strategy: Focus on the $72,500 resistance. A clean break above this with high volume could trigger the next leg towards the $150k psychological barrier.

#MarketCorrection

#BTC #WhaleDeRiskETH #ADPDataDisappoints #kriptogozcu