The core debate highlighted in the thread is simple but brutal: many RWA projects grow like fintech companies while their tokens behave like detached marketing assets. Revenue, partnerships, and institutional adoption rise yet token holders see no economic reflection. The reason? The token isn’t positioned in the value path.

DUSK approaches this differently by structurally embedding the token into multiple layers of the network’s economic engine.

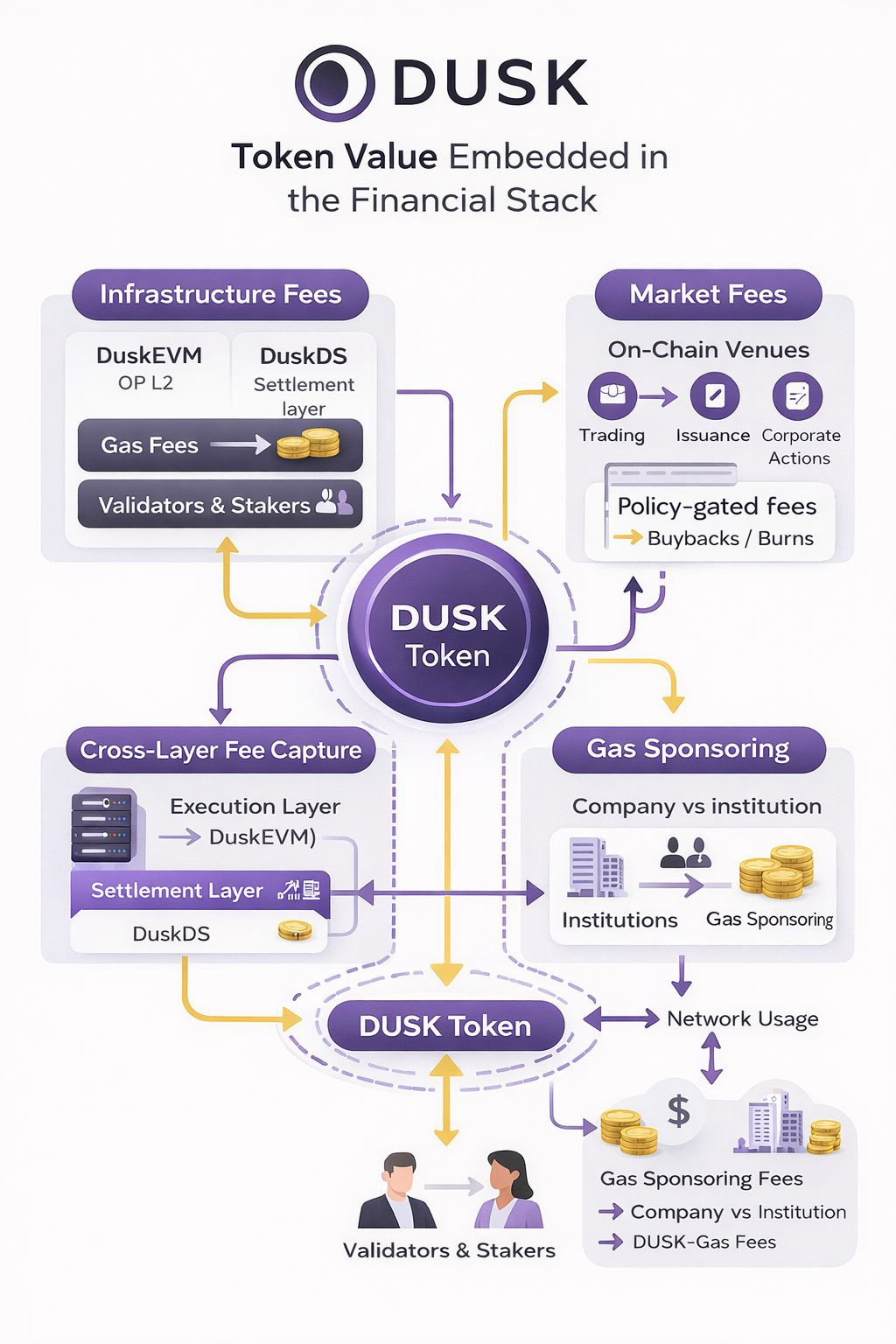

1) Infrastructure-Level Value Capture

DuskDS operates as the data availability and settlement layer, while DuskEVM serves as the application layer built for developer familiarity. Gas is paid in $DUSK , and those fees are integrated into consensus rewards. This is critical: infrastructure usage directly feeds validators and stakers. Instead of abstract governance value, the token participates in operational throughput.

That alignment changes the incentive model. As on-chain activity increases settlement, execution, data usage fee generation compounds inside the same token system securing the chain.

2) Market Layer Monetization

Beyond base infrastructure, DUSK targets regulated financial markets: issuance, trading venues, and corporate actions conducted on-chain. Listing fees and venue participation fees are structured so that value can be routed back to token holders via staking rewards or mechanisms such as buyback/burn modules.

This is not theoretical governance utility. It is an attempt to connect venue growth directly to token economics, avoiding the common industry issue where revenue accrues to an off-chain corporate entity.

3) Cross-Layer Fee Retention

DuskEVM runs on the OP Stack while settling to DuskDS. This architecture allows fee capture across both execution and settlement layers under a unified token. Developers retain familiar tooling, while the protocol retains economic coherence. Many ecosystems fragment value between L1, L2, and sequencer economics; DUSK attempts to consolidate it.

4) Gas Sponsorship Without Value Leakage

Gas sponsorship enables institutions to subsidize user transactions while still denominating fees in DUSK. Instead of abstracting the token away from users entirely, the design keeps it embedded in transaction economics. That preserves the economic loop between network usage and token demand.

The broader takeaway from the discussion is not about marketing differentiation. It’s about structural design. If a token does not sit inside settlement, execution, and market fee pathways, growth metrics will never translate into price alignment.

DUSK’s thesis is that compliance-ready financial infrastructure can exist without severing token holders from real economic flow. The experiment isn’t whether RWAs grow they are growing. The question is whether token models can evolve fast enough to capture that growth.

That alignment problem is the real battleground.