1. Project Overview

Name: HashKey Exchange

Domain: https://www.hashkey.com/

Sector: Regulated Digital Asset Exchange / Web3 Financial Infrastructure / Institutional Market Access

Core Thesis: HashKey Exchange represents a structurally distinct class of crypto infrastructure—a fully licensed, compliance-first digital asset exchange designed to abstract regulatory, custody, and market-access complexity for both professional and retail participants. Rather than competing on speculative velocity, HashKey positions itself as regulated market plumbing for Asia's Web3 capital markets, serving as a compliant gateway between traditional financial capital and on-chain assets.

Protocol Vision: To enable regulated participation in digital asset markets while preserving institutional standards of custody, execution quality, and risk management. The platform operates with a clear compliance-first expansion strategy rather than pursuing regulatory arbitrage.

Stage: Fully operational with dual-entity structure:

HashKey Exchange (Hong Kong): SFC Type 1 (Dealing in securities) and Type 7 (Providing automated trading services) licensed, serving retail and professional investors HashKey Group

HashKey Global (Bermuda): Bermuda Monetary Authority (BMA) Class F Digital Asset Business License, serving global users (excluding US, China, Hong Kong) HashKey Global

Team and Origins: HashKey Exchange operates as the flagship business of HashKey Group, founded in 2018 with long-term strategy centered on regulation-first expansion. The group maintains operations across Hong Kong, Singapore, Japan, Bermuda, and Dubai, with Chairman and CEO Dr. Xiao Feng leading the organization HashKey Group.

2. System Architecture and Market Abstraction Design

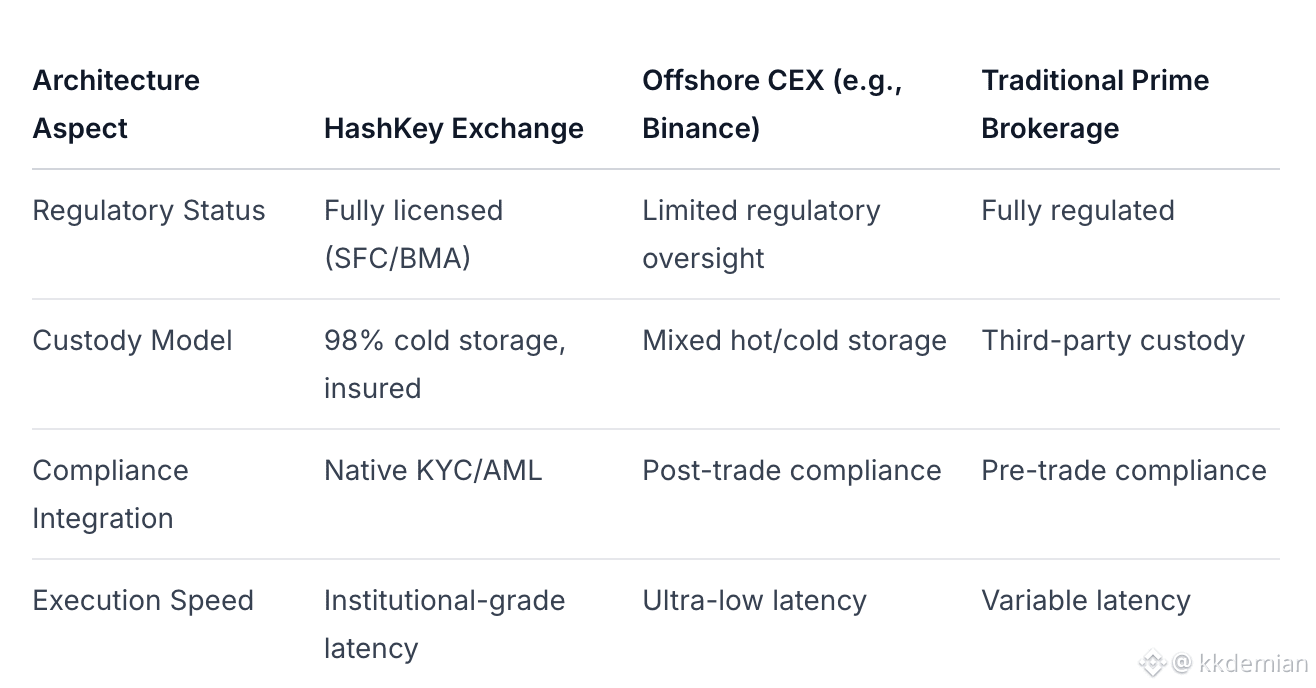

HashKey Exchange employs a sophisticated architectural model that prioritizes regulatory compliance and institutional-grade infrastructure over pure technical innovation.

Core Architectural Components:

Asset Access Abstraction Layer: The platform shields users from direct on-chain complexity through:

Segregated Custody: 98% of assets in cold storage with institutional-grade insurance protection HashKey Exchange

Compliance Integration: Native integration of KYC/AML procedures directly into the trading workflow

Banking Connectivity: Partnerships with traditional banks (ZA Bank, Victory Securities) for seamless fiat on/off-ramps HashKey Pro

Execution Engine: Centralized matching engine with regulatory-compliant risk controls, offering:

API-First Design: REST, WebSocket, and FIX protocol support for institutional connectivity HashKey Global API

Omnibus Account Structure: Enables licensed brokers to aggregate client trading while maintaining individual compliance HashKey Pro

Comparative Analysis:

Verdict: HashKey operates primarily as a regulated digital asset marketplace with strong elements of compliance abstraction layer. The architecture reflects traditional financial market structure adapted for digital assets, rather than attempting to reinvent market microstructure.

3. Asset Design, Custody Model, and Capital Connectivity

HashKey's asset framework prioritizes regulatory compliance and institutional safety over innovation velocity.

Asset Listing Standards: Stringent SFC-mandated criteria requiring:

12-month operational track record for tokens

Inclusion in two independent market indices

Comprehensive due diligence on technology, team, and legal status SUI Listing Analysis

Custody Architecture:

Segregated Accounts: Client funds held separately from operational assets

Cold Storage Dominance: 98% of assets in cold storage with military-grade protection

Insurance Coverage: 100% hot wallet insurance + 50% cold wallet coverage

Certifications: ISO 27001 (Information Security) and ISO 27701 (Data Privacy) certified HashKey Exchange

Fiat Connectivity: Integrated banking partnerships with:

ZA Bank: Direct integration for Hong Kong dollar services

Multiple Currency Support: USD, HKD, USDC trading pairs

Global Banking Network: Coverage across 32 countries and regions HashKey Quarterly Report

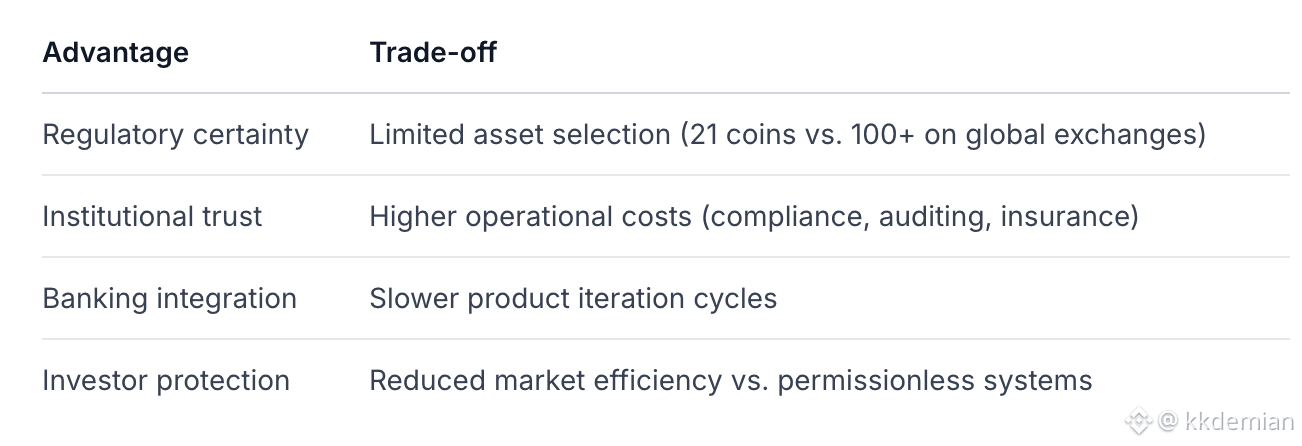

Trade-off Analysis: The compliance-first approach introduces specific trade-offs:

Capital Efficiency Impact: While HashKey's model reduces counterparty risk and regulatory uncertainty, it necessarily sacrifices some capital efficiency compared to offshore exchanges through higher compliance costs and narrower asset selection.

4. Liquidity Routing, Market Access, and Execution Logic

HashKey employs a deliberately conservative approach to market structure that prioritizes regulatory compliance over maximal liquidity.

Market Structure Design:

Siloed Liquidity Pools: No cross-entity liquidity sharing between HashKey Exchange (HK) and HashKey Global (Bermuda) confirmed

Internal Matching: Primary order execution through internal order books

External Connectivity: APIs support institutional routing but no evidence of external liquidity aggregation HashKey Global API

Liquidity Depth Analysis (BTC/USD pair):

+2% Depth: ~$1.96 million

-2% Depth: ~$1.97 million

24h Volume: $262.8 million (Feb 2026) CoinGecko

Comparative Depth Analysis:

Execution Quality Priorities:

Regulatory Compliance: All trades executed within licensed framework

Price Integrity: Minimization of market manipulation risks

Counterparty Safety: Segregated accounts and insured custody

Transparency: Regular audits and regulatory reporting

Institutional Access Tools:

FIX Protocol: Support for 4.4 and 5.0 SP2 versions with drop-copy functionality

Omnibus Accounts: 90% of Hong Kong licensed brokers use HashKey's omnibus structure HashKey Quarterly Report

Algorithmic Trading: API support for institutional trading strategies

Verdict: HashKey's execution logic unequivocally prioritizes regulatory-compliant market integrity and capital protection over maximal liquidity or price efficiency. This results in shallower order books but significantly reduced counterparty and regulatory risk.

5. Platform Economics and Incentive Structure

HashKey's economic model reflects its positioning as infrastructure rather than a speculative platform.

Fee Structure:

Spot Trading: Tiered maker-taker model with negative fees for market makers (-0.005% to -0.01%) HashKey Market Maker Program

Futures Trading: Maker rebates available with volume thresholds

Withdrawal Fees: Dynamic fees based on blockchain network conditions

Institutional Incentives:

Market Maker Program: Requirements include $10M+ in assets and ability to provide liquidity at 0.01-0.02% depth

Benefits: Lower latency, higher API rate limits, and preferential fee rates

Strategic Market Makers: Receive best-in-class trading conditions HashKey Global Market Maker Program

HSK Token Economics:

Fixed Supply: 1 billion HSK tokens

Distribution: 65% ecosystem growth, 30% team, 5% reserve fund HashKey Internal Data

Utility: Fee discounts, staking rewards, and governance (on HashKey Chain)

Value Accrual: Regular token burning from ecosystem revenue

Revenue Sustainability Analysis:

Endogenous Demand Drivers:

Institutional Adoption: 90% of HK brokers using omnibus accounts

Growing TVL: Client assets surpassed HKD 12 billion (~$1.5B) with 220% YoY growth

Diversified Revenue: Spot trading, futures, OTC blocks (single-day peak exceeding HKD 1.1B)

Cost Structure Challenges:

Compliance Overhead: Regulatory licensing, auditing, and reporting requirements

Security Infrastructure: High-cost custody and insurance arrangements

Banking Integration: Complex fiat rail maintenance

Competitive Positioning: HashKey's compliance-first model results in structurally higher costs than offshore competitors, but creates sustainable moats through:

Regulatory licensing barriers to entry

Institutional trust and banking relationships

Reduced regulatory risk premium for users

6. Governance, Security, and Risk Analysis

Corporate Governance:

Parent Entity: HashKey Group, publicly traded (03887.HK) since December 2025 IPO

Stock Performance: ~HKD 7.06 per share (Jan 30, 2026), market cap ~HKD 5-10B Bloomberg

Leadership: Dr. Xiao Feng as Chairman and CEO with traditional finance expertise

Regulatory Oversight:

Hong Kong SFC: Continuous monitoring and reporting requirements

Bermuda BMA: Regular audits and compliance checks

Cross-Jurisdictional Compliance: Operations must satisfy multiple regulatory regimes

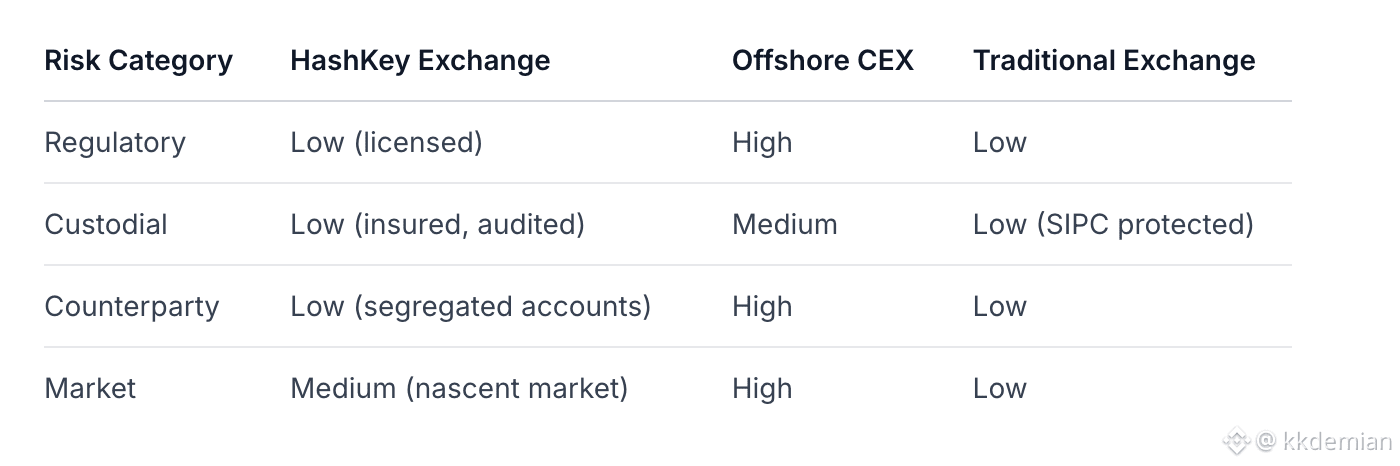

Risk Surface Analysis:

Custodial & Operational Risks:

Mitigated: 98% cold storage, institutional insurance, regular third-party audits

Residual: Smart contract risk (for tokenized assets), internal operational risks

Regulatory Risks:

Jurisdictional Changes: Evolving regulatory frameworks across operating regions

License Maintenance: Ongoing compliance with SFC/BMA requirements

Geopolitical Factors: US-China tensions potentially affecting Hong Kong's status

Market Risks:

Concentration Risk: Heavy reliance on Asian institutional market development

Adoption Timeline: Slow institutional adoption could prolong path to profitability

Comparative Risk Profile:

Verdict: HashKey's risk profile most closely resembles traditional regulated exchanges rather than crypto-native platforms, with significantly reduced regulatory and counterparty risk offset by market adoption risks.

7. Adoption Signals and Ecosystem Potential

HashKey demonstrates strong early adoption within its target institutional segment, though broader market penetration remains limited.

Quantitative Adoption Metrics:

Trading Volume: $262.8M daily spot volume (Feb 2026) CoinGecko

Client Assets: HKD 12B+ (~$1.5B) AUM with 220% YoY growth

OTC Volume: 13x YoY growth, single-day peaks exceeding HKD 1.1B

Broker Adoption: 90% of Hong Kong licensed brokers using omnibus services HashKey Quarterly Report

Qualitative Institutional Signals:

Banking Partnerships: ZA Bank integration for direct fiat services

Brokerage Network: Victory Securities and other licensed HK brokers

IPO Success: December 2025 listing oversubscribed 300x, indicating institutional confidence ChainCatcher

HashKey Chain Ecosystem Development:

Current Status: Early development phase with minimal TVL (<$1M)

RWA Focus: Tokenized money market funds (Bosera MMF), insurance products (CPIC)

Institutional Projects: Bosera tokenized MMF ETF ($100M+ launch), China Pacific Insurance tokenized fund

Technical Infrastructure: Ethereum L2 with fraud proofs (Stage 1 security) L2BEAT

Market Positioning Analysis:

HashKey is optimally positioned to capture:

Asian Institutional Flow: Primary gateway for HK/Singapore-based institutions

RWA Tokenization: Regulatory-compliant asset tokenization services

Professional Investor Services: High-net-worth and institutional onboarding

Less suited for:

Retail speculative trading

DeFi-native asset trading

Rapid innovation cycles

8. Strategic Trajectory and Market Fit

HashKey addresses structurally persistent problems in crypto markets through its regulated infrastructure approach.

Problem-Solution Fit:

Regulatory Uncertainty: Provides licensed, compliant access to digital assets

Institutional Onboarding: Abstracts away technical and compliance complexity

Capital Protection: Institutional-grade custody and risk management

Strategic Milestones (12-24 Month Outlook):

Jurisdictional Expansion:

UAE Operations: HashKey MENA licensed by VARA for exchange and broker-dealer services

European Presence: VASP registration in Ireland for EU market access

Asian Dominance: Consolidate position as leading regulated gateway for Asian capital

Product Diversification:

Derivatives Expansion: Perpetual futures and options products

RWA Ecosystem: Growth of HashKey Chain for tokenized traditional assets

Wealth Management: Expansion of professional investor products

Institutional Integration:

Banking Partnerships: Additional traditional bank integrations

Brokerage Network: Expanded omnibus account services across Asia

Custody Solutions: Enhanced institutional custody offerings

Market Fit Assessment: HashKey's strategy aligns perfectly with:

Increasing institutional demand for regulated crypto access

Asian regulatory frameworks promoting licensed operators

Traditional finance migration toward blockchain-based settlement

However, the strategy faces challenges from:

Slow institutional adoption timelines

Competition from global regulated venues

Regulatory fragmentation across jurisdictions

9. Final Investment Assessment

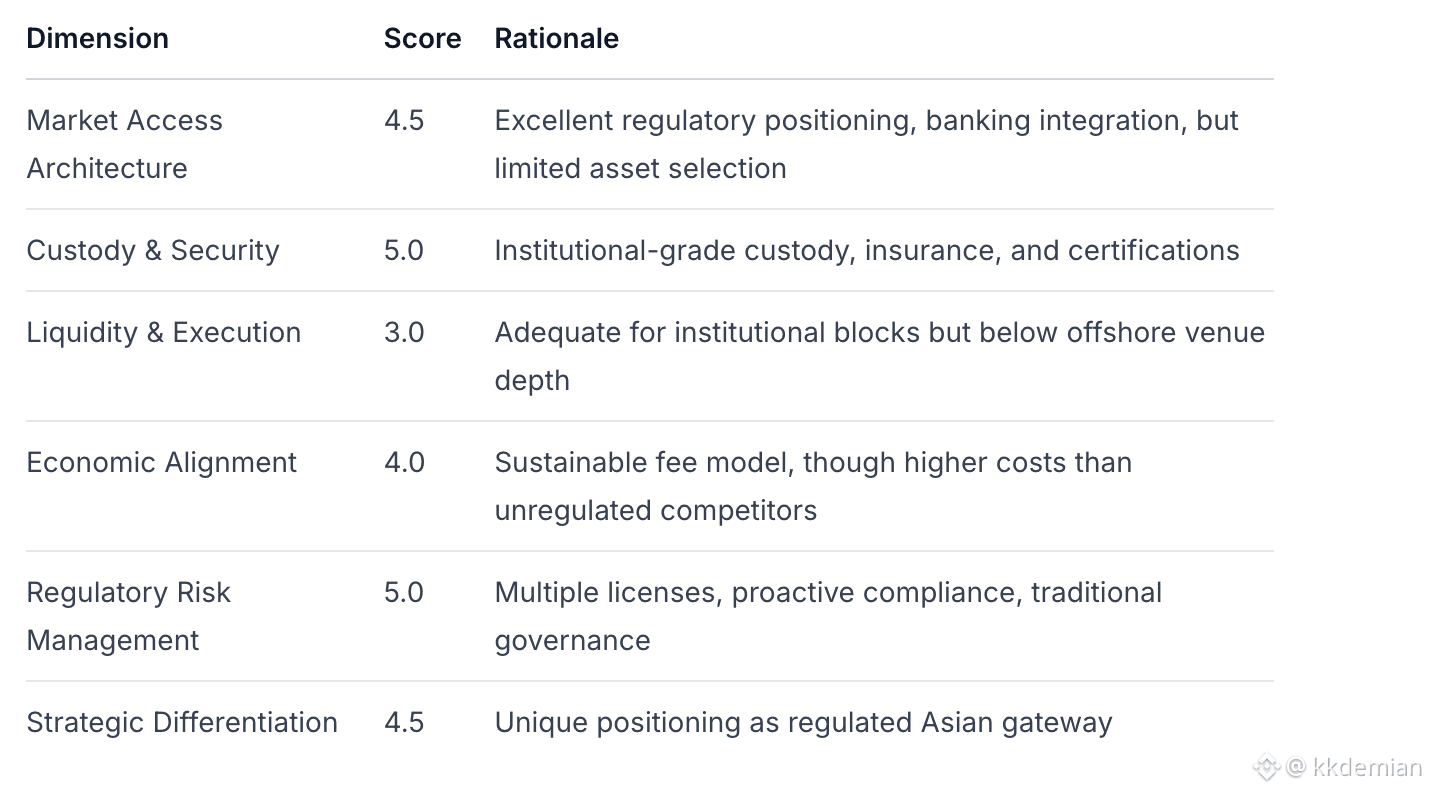

Dimension Scoring (1-5 Scale):

Overall Score: 4.3/5.0

Investment Verdict:

HashKey Exchange represents a durable piece of regulated Web3 financial infrastructure with particular strength as a regional compliance champion for Asian institutional capital. The platform successfully addresses the fundamental tension between crypto innovation and institutional risk management through its compliance-first architecture.

Key Strengths:

Regulatory moats from multiple jurisdiction licenses

Institutional-grade custody and security infrastructure

Strategic positioning as Asian regulatory frameworks mature

Successful public listing demonstrating institutional confidence

Key Risks:

Limited liquidity depth compared to global venues

Dependence on Asian institutional adoption timeline

Higher cost structure than unregulated competitors

Slow product iteration due to compliance requirements

Investment Recommendation: STRATEGIC HOLD for investors seeking exposure to regulated crypto infrastructure. HashKey is optimally positioned to capture institutional crypto flows in Asia, particularly as regulatory clarity improves and traditional finance adoption accelerates. The platform represents essential market plumbing rather than speculative upside, making it a foundation-level investment in the digital asset ecosystem.

The value proposition is clear: HashKey provides the regulatory compliance and institutional safety required for large-scale capital deployment into digital assets, abstracting away the technical and regulatory complexity that has historically prevented traditional finance participation. While growth may be slower than speculative venues, the business model creates sustainable, defensible moats that should compound over time as institutional adoption progresses.