Executive Summary

OSL Group (HKEX: 863.HK) has established itself as Asia's premier regulated digital asset infrastructure provider, bridging traditional finance and crypto through a compliance-first architecture. The company demonstrates strong financial performance with HKD 195M revenue in 1H 2025 (58% YoY growth) and HKD 68.2B transaction volume (200% YoY growth). Their recent acquisition of Banxa solidifies a global footprint across 40+ regulated jurisdictions, while their institutional-grade custody with USD 1B insurance coverage sets a new industry standard.

The core investment thesis centers on OSL's structural positioning at the convergence of traditional finance and digital assets. Unlike offshore exchanges or retail-focused platforms, OSL has built defensible moats through: (1) Regulatory licensing supremacy (SFC Hong Kong + 40+ global licenses), (2) Institutional infrastructure (Omnibus Pro, MirrorEX, SOC 2 Type 2 certification), and (3) Recurring revenue diversification (29% from OSL Pay infrastructure services).

For tier-1 institutions, OSL represents the lowest-risk entry point into Asian digital asset markets with proven compliance architecture and banking integration capabilities. The model prioritizes regulatory certainty over speculative volume, making it ideally suited for banks, asset managers, and enterprises seeking compliant crypto exposure.

1. Project Overview

Corporate Identity & Regulatory Lineage OSL operates as a publicly-listed entity (HKEX: 863.HK) with origins as BC Technology Group, transitioning to its current brand identity as a comprehensive digital asset infrastructure provider. The company maintains its headquarters in Hong Kong while expanding globally through both organic growth and strategic acquisitions.

Management Team & Governance The executive team demonstrates strong traditional finance and regulatory expertise:

Kevin Cui (CEO): Leads overall strategy and global expansion

Eugene Cheung (CCO): Oversees compliance and institutional business

Ivan Wong (CFO): Manages financial operations and reporting

Marc Newman (CISO): Responsible for security architecture and insurance frameworks

Stage Assessment: Established Regulated Operator OSL operates at the mature end of the crypto infrastructure spectrum, having secured:

Hong Kong SFC licensing since 2020 (first mover advantage)

Public listing providing financial transparency

Global expansion through acquisition strategy (Banxa completed Jan 2026)

Institutional client base including banks, brokers, and asset managers

2. System Architecture and Infrastructure Design

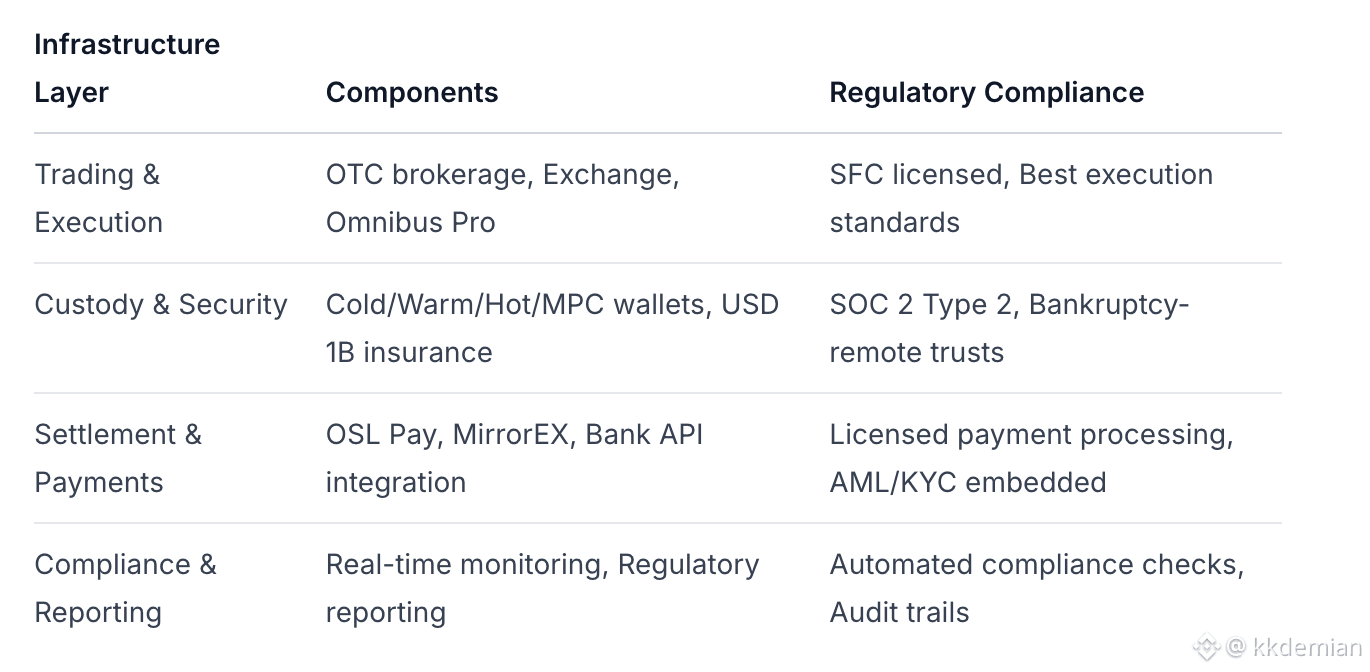

Multi-Layer Institutional Architecture

OSL has built a comprehensive infrastructure stack designed for regulatory compliance and institutional requirements:

Architecture Differentiation Analysis

Omnibus Pro vs. MirrorEX Technical Distinction:

Omnibus Pro: Unified institutional gateway providing account management, trading execution, custody, and settlement in a single integrated solution. Used by partners like TF International Securities for full-service digital asset access.

MirrorEX: Capital efficiency solution allowing institutional clients to map assets as collateral without physical movement onto exchanges. Enables escrow services and collateralized trading while maintaining off-exchange security.

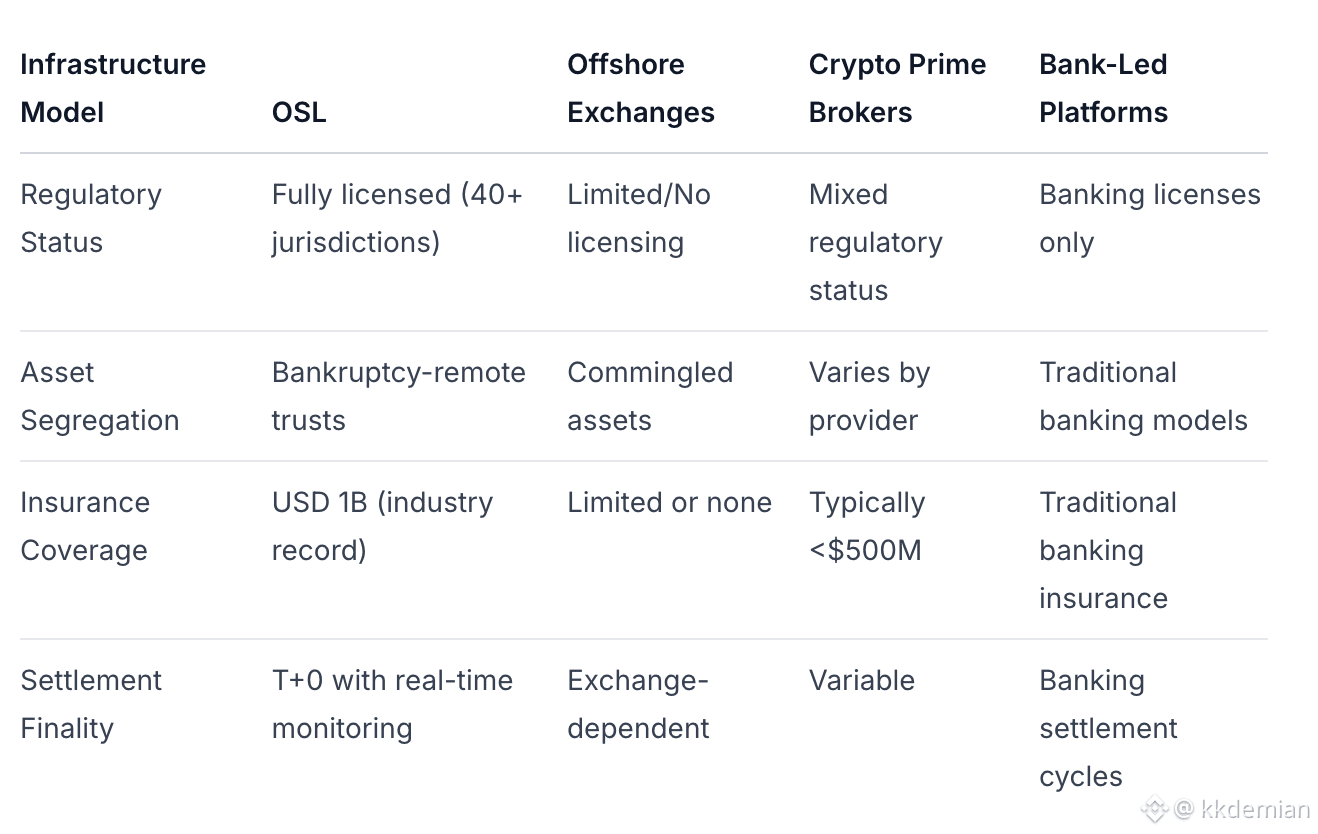

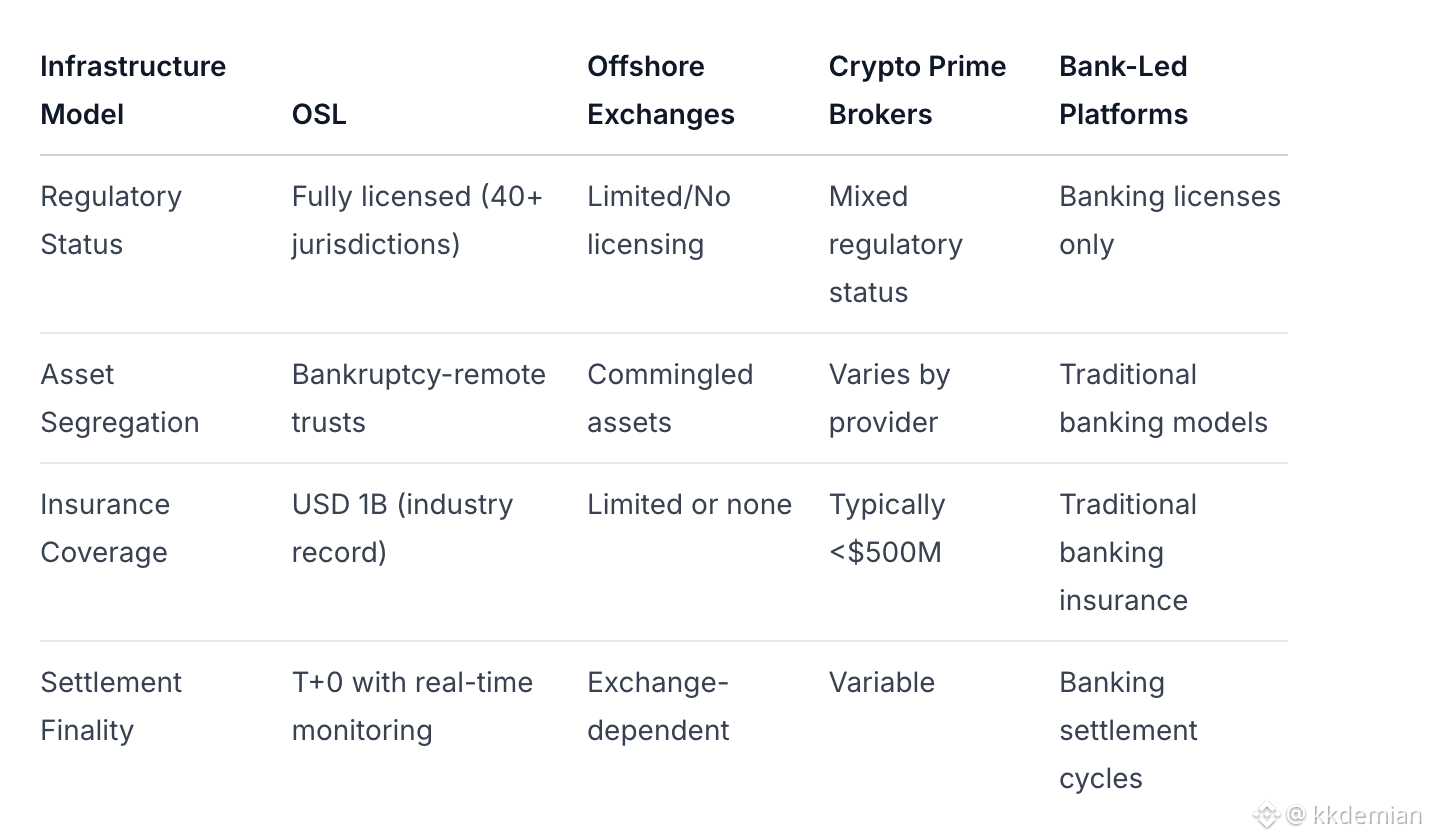

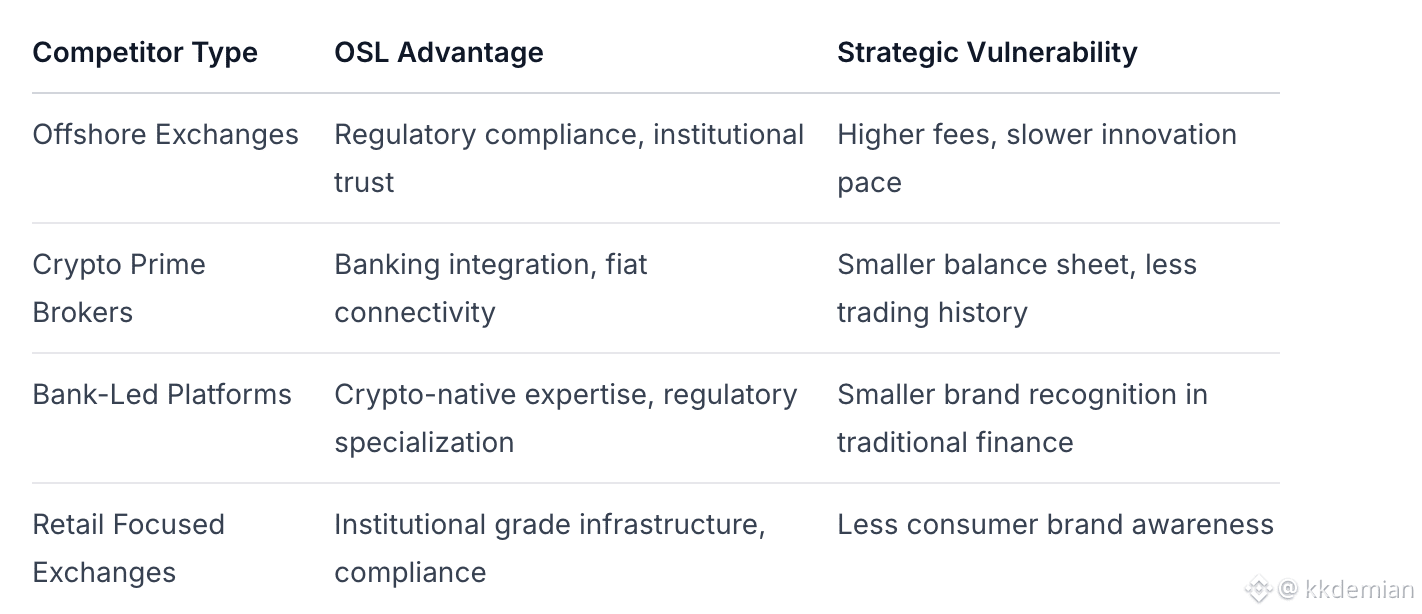

Competitive Positioning Analysis

3. Fiat-Crypto Connectivity and Asset Coverage

Supported Currencies & Banking Integration

OSL maintains robust fiat connectivity through multiple channels:

Fiat Currencies Supported:

Primary: USD, HKD, AUD

Expanded access through stablecoin pairs (RLUSD, USDGO, USDC, USDT)

Bank Frick API integration for faster deposit processing

Banking Relationships:

ZA Bank: Exclusive digital asset trading partnership since 2021

Standard Chartered: Historical JV through Zodia Markets (indicative of bank-grade relationships)

Multiple correspondent banks through Banxa acquisition network

Digital Asset Strategy

OSL employs a compliance-first listing philosophy focusing on:

Major cryptocurrencies: BTC, ETH, AVAX, XRP

Regulated stablecoins: RLUSD (Ripple), USDGO (Anchorage Digital)

Institutional products: PAX Gold (PAXG), tokenized assets

Emerging protocols: Selective listing of compliant DeFi tokens (CRV, LDO, ASTER)

Connectivity Trade-offs Analysis

OSL's model intentionally sacrifices some aspects of speed and asset breadth for regulatory compliance:

4. Market Access, Liquidity, and Execution Logic

Institutional-Grade Execution Model

OSL prioritizes regulatory certainty and capital protection through:

OTC vs. Exchange Execution:

OTC Desk: Primary institutional channel with personalized pricing and settlement

Exchange Trading: Compliant order book with institutional liquidity provisions

Omnibus Pro: White-label solution for financial institutions to offer digital assets

Liquidity Sourcing Strategy:

Direct liquidity relationships with market makers

Integration with Talos institutional network for enhanced liquidity access

Internalization mechanisms with strict risk controls

Risk Management Framework

Real-time monitoring during market volatility

Collateral requirements for institutional counterparts

Settlement finality protocols to prevent failed trades

5. Business Model and Economic Structure

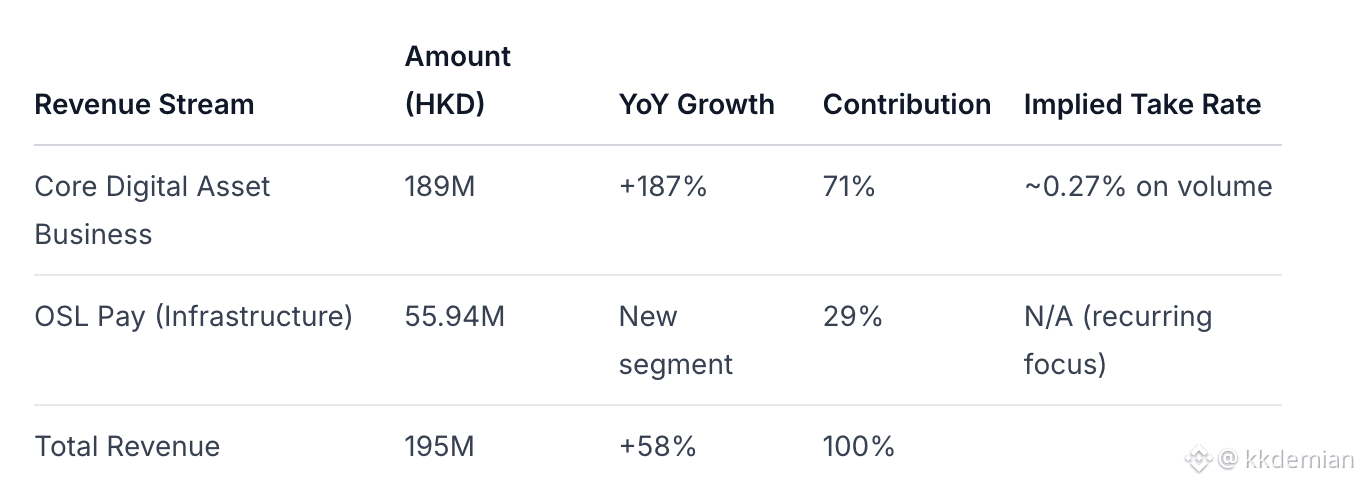

Revenue Analysis (1H 2025 Performance)

OSL demonstrates diversified revenue streams with strong growth metrics:

Key Financial Metrics:

Transaction Volume: HKD 68.2B (+200% YoY)

Assets Under Custody: HKD 5.694B (+50% YoY)

Employee Growth: 167 to 568 employees (June 2024 to June 2025)

Business Model Sustainability Assessment

Strengths:

Recurring Infrastructure Revenue: 29% from OSL Pay indicates diversification beyond cyclical trading fees

High-Growth Core Business: 187% YoY growth in digital asset services

Scalable Platform: Omnibus and white-label solutions enable leverage across clients

Risks:

Operating Expense Growth: Significant headcount increase may pressure margins short-term

Market Cycle Dependence: Trading revenue still correlates with crypto market conditions

Competitive Pressure: Margin compression possible as more regulated entrants emerge

Defensibility Factors:

Licensing Moats: 40+ jurisdictions create significant regulatory barriers to entry

Institutional Trust: USD 1B insurance and SFC licensing build durable trust advantages

Banking Integration: Deep fiat connectivity difficult for new entrants to replicate

6. Governance, Compliance, and Risk Analysis

Regulatory Architecture

OSL maintains one of the most comprehensive regulatory frameworks in the digital asset industry:

Primary Licenses:

Hong Kong: SFC Type 1 (dealing in securities) and Type 7 (automated trading service)

Australia: AUSTRAC registration

United States: MSB registrations across multiple states

Canada: MSB licensing

United Kingdom: FCA electronic money institution (EMI) and CASP registration

40+ additional jurisdictions through Banxa acquisition

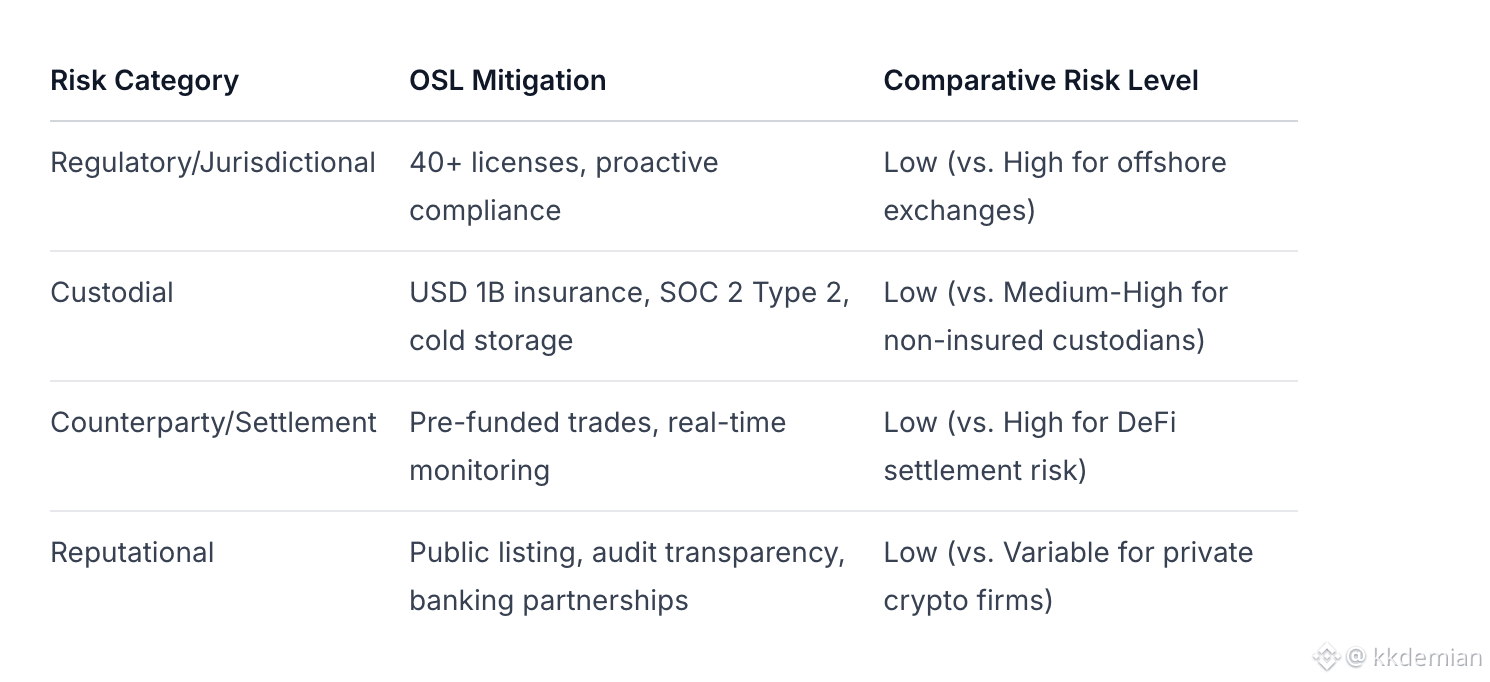

Risk Assessment Matrix

Governance Excellence

Public company reporting standards

Big Four audit requirements

Regular regulatory examinations and compliance reviews

Transparent insurance arrangements and custody protocols

7. Adoption Signals and Ecosystem Positioning

Institutional Adoption Evidence

OSL demonstrates strong traction with traditional financial institutions:

Confirmed Institutional Clients:

ZA Bank: Exclusive digital asset trading partner

TF International Securities: Omnibus Pro integration for full-service offering

Multiple hedge funds and asset managers (inferred from custody AUM growth)

Strategic Partnerships:

Talos: Institutional trading infrastructure integration

Fireblocks: Custody technology partnership

Anchorage Digital: USDGO stablecoin issuance partnership

Banxa: Full acquisition for global payment infrastructure

Geographic Expansion Trajectory

Asia-Pacific: Established leadership in Hong Kong, Australia, Japan

Europe: UK FCA licensing through Banxa acquisition

North America: MSB registrations across US and Canada

Global: 40+ jurisdiction coverage creates unique positioning

Target Client Segmentation

OSL is optimally positioned to serve:

Banks & Financial Institutions: Seeking turnkey digital asset infrastructure

Asset Managers & Funds: Requiring regulated custody and execution

Corporates & Treasuries: Exploring digital asset adoption with compliance assurance

High-Net-Worth Individuals: Seeking institutional-grade security and access

8. Strategic Trajectory and Market Fit

Addressing Structural Market Problems

OSL directly solves critical barriers to institutional crypto adoption:

Regulatory Uncertainty: Provides fully licensed access across major jurisdictions

Security Concerns: Offers USD 1B insured custody with institutional protocols

Fiat Connectivity: Maintains robust banking relationships and payment rails

Compliance Overhead: Handles regulatory requirements through embedded systems

Competitive Positioning Analysis

12-24 Month Strategic Milestones

Based on current trajectory, key developments will likely include:

OSL Pay Expansion: Leveraging Banxa infrastructure for global payment dominance

Additional Jurisdictions: Further regulatory approvals in emerging markets

Product Depth Enhancement: More sophisticated institutional products and services

Strategic Partnerships: Additional banking and financial institution integrations

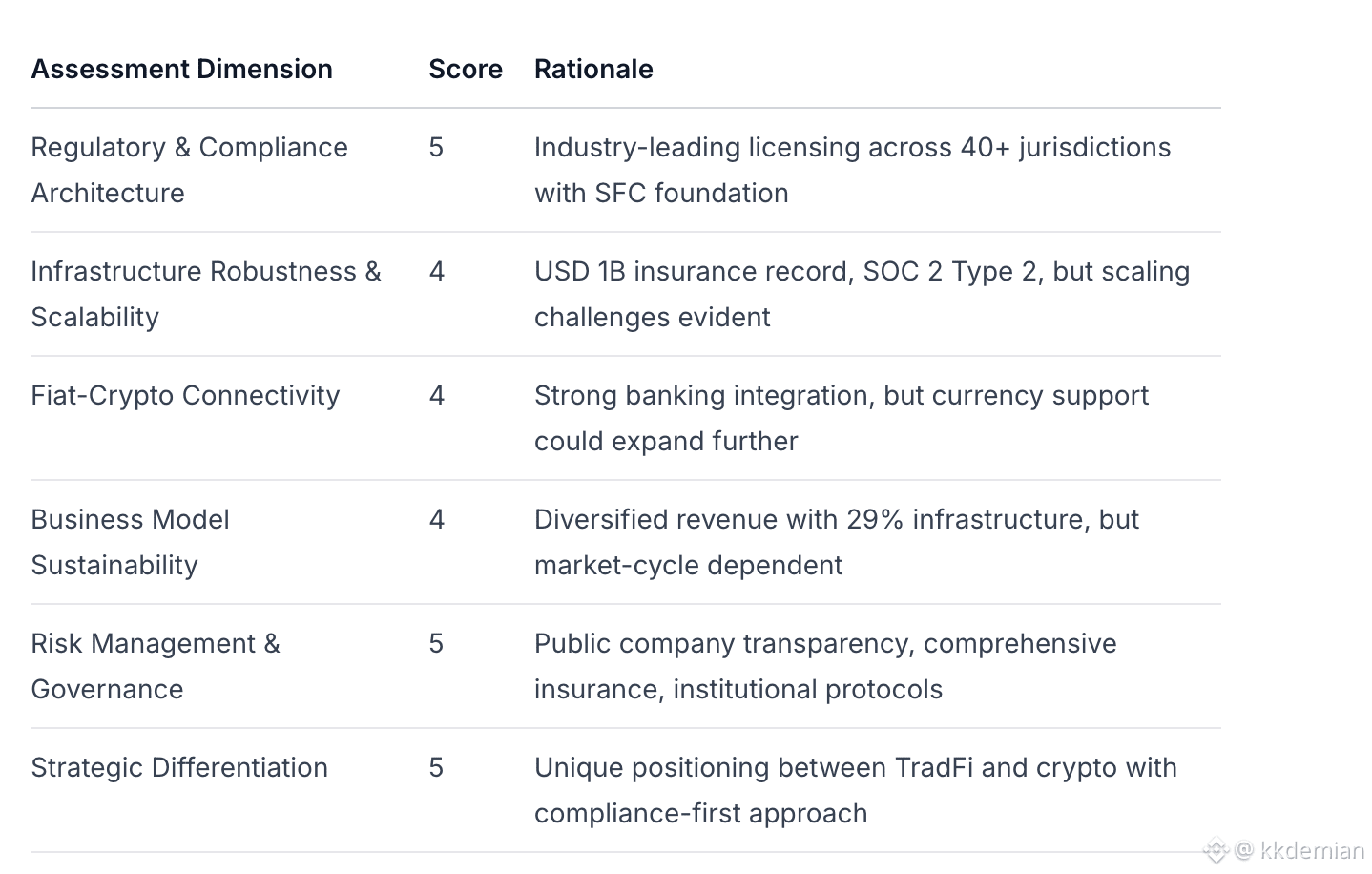

9. Final Investment and Strategic Assessment

Dimension Scoring (1-5 Scale)

Overall Weighted Score4.5

Comparative Analysis Table

Investment Verdict: STRONG PARTNER/CUSTOMER RECOMMENDATION

For tier-1 financial institutions and crypto-native funds, OSL represents the optimal partner for regulated digital asset infrastructure in Asia and increasingly globally. The combination of:

Unmatched regulatory positioning with 40+ jurisdictional licenses

Institutional-grade security with USD 1B insurance coverage

Proven revenue growth and business model diversification

Strategic acquisition strategy enhancing global capabilities

makes OSL the lowest-risk, highest-compliance option for institutions seeking crypto exposure. While fees may be higher than offshore alternatives and innovation pace may be slower due to regulatory requirements, these are appropriate trade-offs for institutional participants prioritizing capital protection and regulatory compliance.

The Banxa acquisition fundamentally transforms OSL's positioning from a Hong Kong-focused exchange to a global digital asset infrastructure provider, creating significant strategic optionality for future growth across both developed and emerging markets.

Recommended Action: Tier-1 institutions should prioritize OSL for:

Custody relationships for Asian digital asset holdings

Execution services for compliant trading

Infrastructure partnerships for white-label solutions

Strategic investments given public market accessibility and growth trajectory

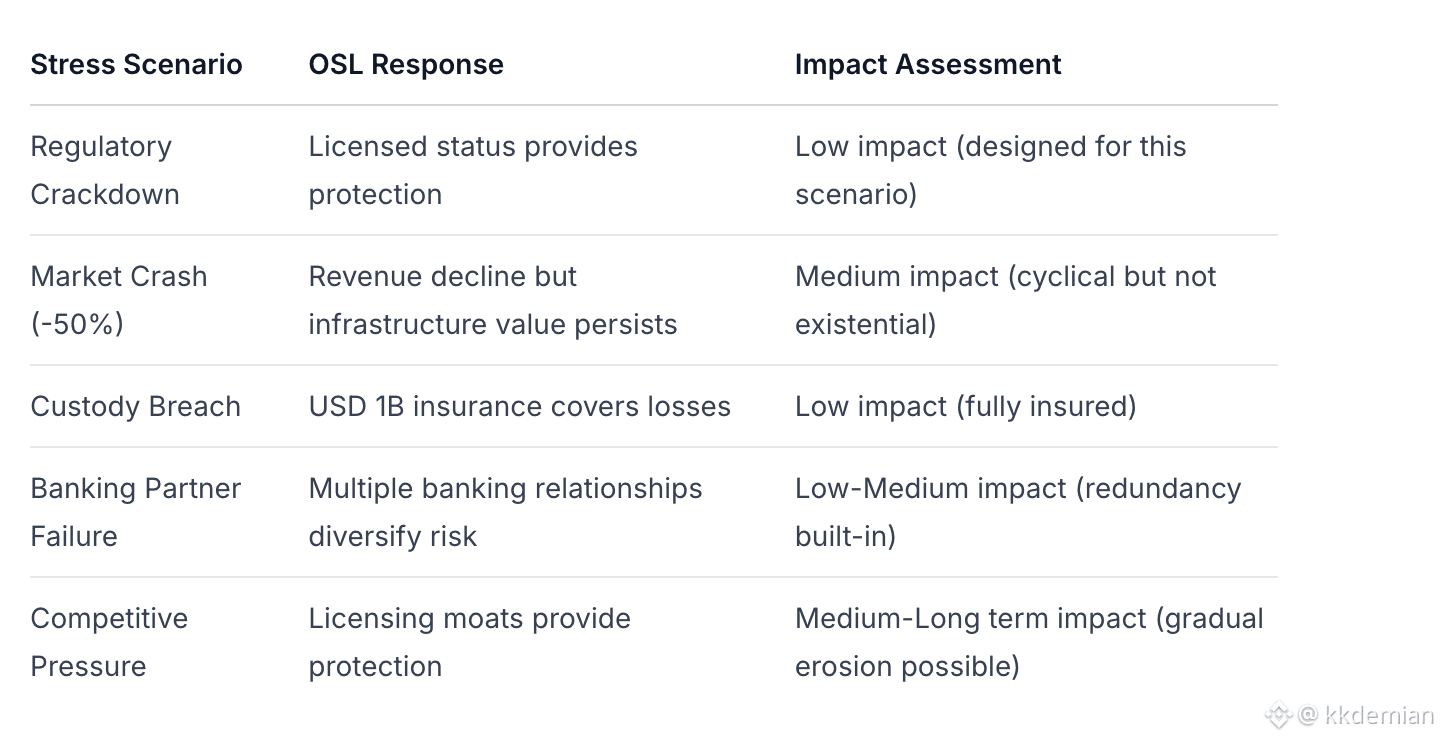

Appendix: Risk Decomposition Under Stress Scenarios

Data Sources: OSL Group HKEX filings, company press releases, partner announcements, and industry analysis. All data current as of February 2026.