In the rapidly evolving world of blockchain, stablecoins have emerged as the backbone of real-world crypto adoption. From cross-border remittances to merchant payments and treasury settlement, stablecoins now move billions of dollars daily. Yet most blockchains were never designed specifically for stablecoins. Plasma enters this gap as a purpose-built Layer 1 blockchain, engineered from day one to make stablecoin settlement fast, simple, and reliable.

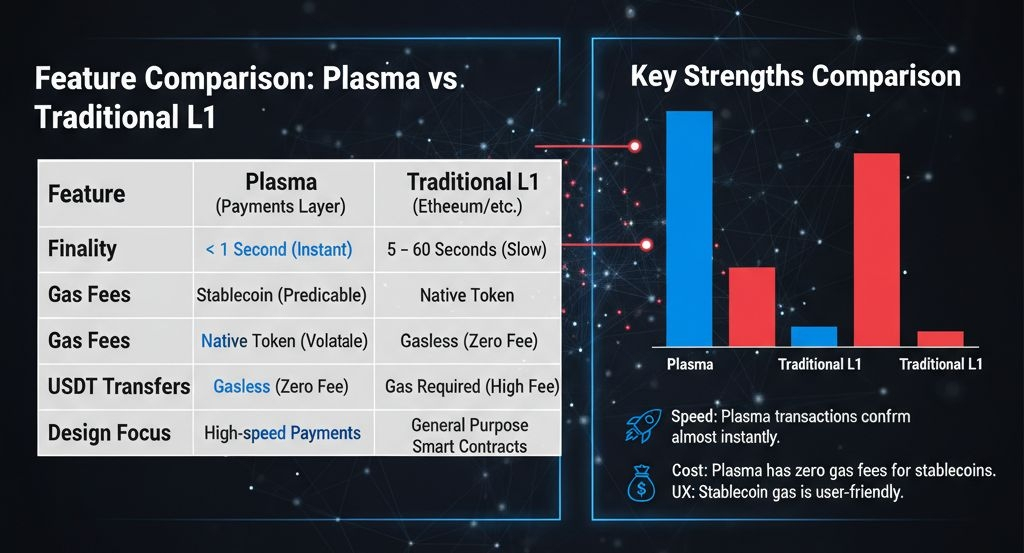

Traditional Layer 1 networks prioritize general-purpose execution, often at the cost of usability. Users face unpredictable gas fees, network congestion, and slow confirmation times. Plasma flips this model. Instead of forcing stablecoins to adapt to blockchain limitations, Plasma reshapes the blockchain itself around stablecoin needs speed, cost efficiency, and certainty.

At its core, Plasma is fully EVM-compatible, powered by Reth. This means developers can deploy existing Ethereum smart contracts with minimal friction while benefiting from a performance-focused execution environment. Familiar tooling meets a network optimized for payments, not speculation-heavy DeFi congestion.

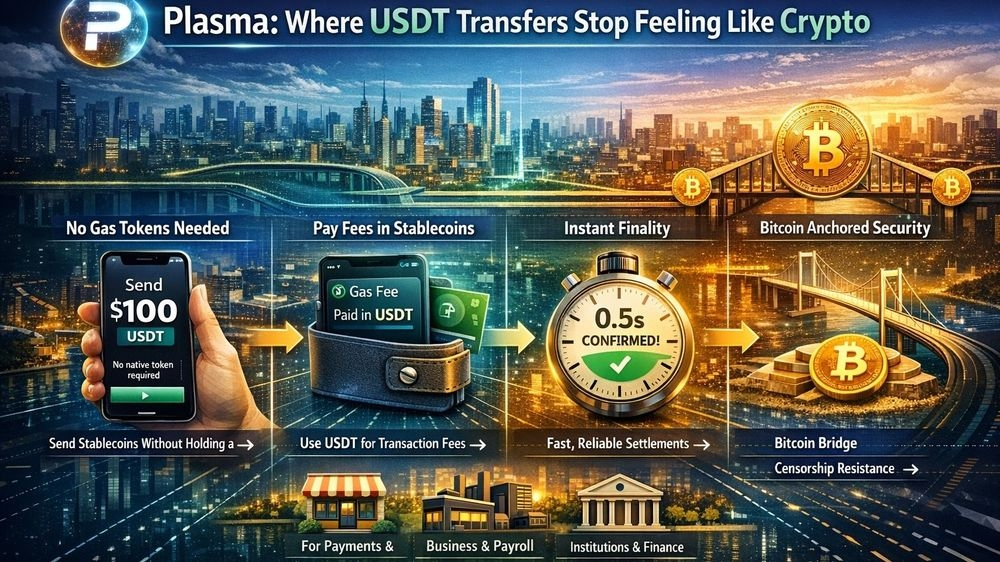

One of Plasma’s defining features is sub-second finality, achieved through its custom consensus mechanism, PlasmaBFT. Transactions are confirmed almost instantly, eliminating the waiting periods common on many L1s. For payments, settlement delays are unacceptable and Plasma treats this as a non-negotiable requirement.

Gas complexity remains one of the biggest barriers to mainstream adoption. Plasma directly addresses this with gasless USDT transfers and stablecoin-first gas mechanics. Users no longer need to hold volatile native tokens just to move stable value, making Plasma far more intuitive for non-crypto-native users.

To understand Plasma’s transaction design, consider the simplified flow below:

This streamlined process removes friction at every stage, ensuring that stablecoin transfers feel as seamless as traditional digital payments.

Security and neutrality are equally critical. Plasma introduces Bitcoin-anchored security, leveraging Bitcoin’s unmatched censorship resistance and decentralization. By anchoring to Bitcoin, Plasma strengthens trust assumptions without sacrificing performance an approach increasingly valued by institutions.

Plasma is designed for two primary user groups: retail users in high stablecoin adoption regions and institutions operating in payments, fintech, and finance. For retail users, Plasma offers simplicity and speed. For institutions, it provides predictability, auditability, and settlement confidence.

Compared to general-purpose blockchains, Plasma’s specialization becomes clear:

This contrast highlights why Plasma is not just another Layer 1 but a specialized financial rail.

By prioritizing stablecoins, Plasma reduces network noise caused by speculative activity. This creates a cleaner execution environment where payment flows are not disrupted by NFT mints, meme coin trading, or arbitrage bots competing for block space.

For developers, Plasma offers a predictable cost model and a network aligned with real-world use cases. Payment processors, wallets, and financial applications can build with confidence, knowing the underlying infrastructure will not become unusable during peak market cycles.

For emerging markets, where stablecoins often function as a dollar alternative, Plasma’s design is particularly impactful. Low fees, instant finality, and gasless transfers make everyday usage practical from salary payments to peer-to-peer commerce.

Institutional adoption requires more than speed; it demands neutrality and resilience. Bitcoin-anchored security enhances Plasma’s credibility as a long-term settlement layer, reducing fears of arbitrary censorship or governance capture.

As stablecoins move from crypto-native tools to global financial primitives, infrastructure must evolve accordingly. Plasma represents a shift away from “one-size-fits-all” blockchains toward purpose-built networks that solve specific, high-impact problems.

In a world where financial efficiency matters more than hype, Plasma delivers exactly what stablecoins need: no gas headaches, no delays, and no unnecessary complexity. It is not just a blockchain it is a settlement layer designed for how digital money actually moves.