Plasma is a Layer 1 blockchain designed for stablecoin settlement, and starting from that framing already says a lot about its priorities. When I look at this project, what stands out to me is not an attempt to redefine everything at once, but a willingness to focus on something specific and already real. Moving dollars. Preserving value. Settling payments in a way that feels reliable enough to matter outside of crypto native circles.

Over time, I have noticed a pattern across many decentralized systems. They speak convincingly about trustless execution, yet quietly depend on centralized data storage or trusted intermediaries behind the scenes. Smart contracts may run on chain, but the data they rely on often lives somewhere else, owned and controlled by a single party. That contradiction has always felt unresolved to me. If execution is decentralized but data ownership is not, then the promise is incomplete. It becomes clear over time that decentralization loses much of its meaning when it stops halfway.

What stands out to me about Plasma is that it does not treat this tension as an afterthought. The design begins with the assumption that value movement only works if the underlying system can be neutral, predictable, and resilient under real world conditions. Stablecoins already carry economic weight far beyond speculation. They are used for savings, payroll, remittances, and settlement. A system built around them has to accept that failure is not theoretical. It will happen. Networks will stall. Validators will go offline. Markets will stress test every assumption.

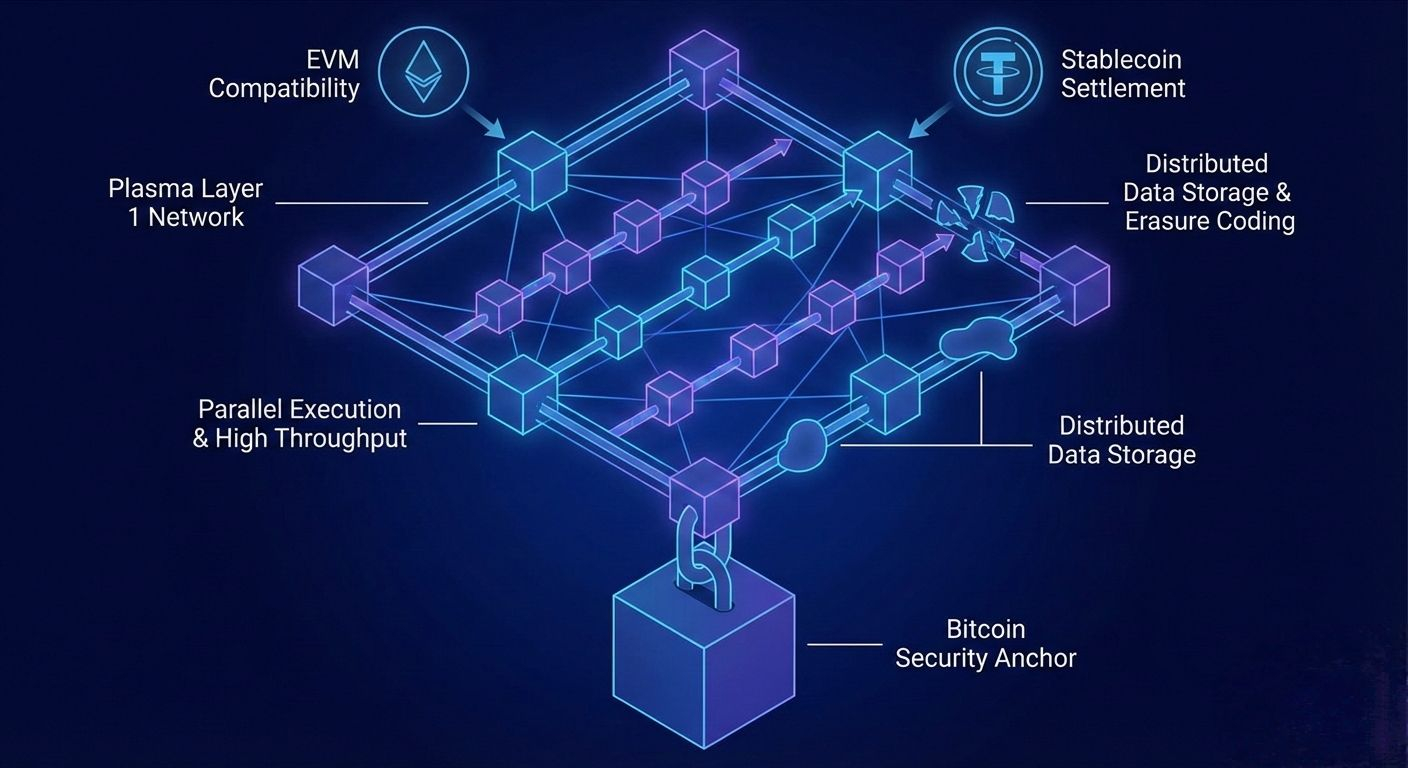

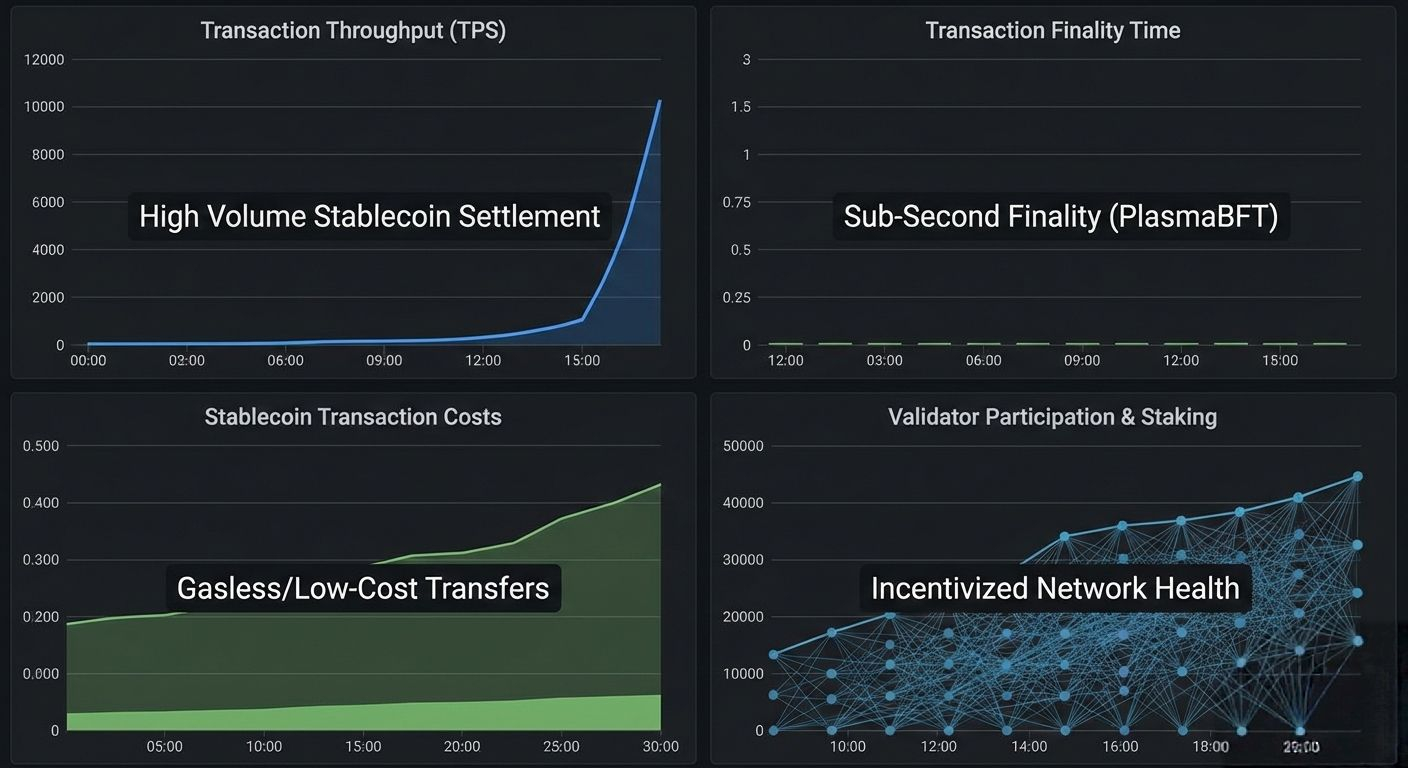

The choice of underlying architecture feels intentional rather than accidental. Full EVM compatibility allows Plasma to meet developers where they already are, rather than asking them to relearn everything. Parallel execution and high throughput are not framed as performance flexes, but as practical necessities once real payment volumes enter the picture. When many transactions need to settle at once, speed is not about bragging rights. It is about preventing congestion from becoming a form of exclusion.

As I think through how Plasma approaches data and execution, what becomes clear is a quiet respect for redundancy and distribution. Data is not treated as a monolithic object that must live in one place. Instead, it is broken apart and spread across the network in ways that allow it to be reconstructed even when parts of the system fail. Techniques like erasure coding and blob style storage shift the balance between privacy, availability, and trust. No single participant needs to hold everything, and no single failure can take the system down. That assumption that things will fail sometimes is not pessimism. It is maturity.

This mindset carries into how the network approaches finality and security. Sub second finality through PlasmaBFT is not about feeling fast. It is about giving users confidence that once value moves, it stays moved. Anchoring security assumptions to Bitcoin adds another layer of neutrality, not by copying its model, but by borrowing its credibility as a settlement anchor. It is a reminder that censorship resistance is not a slogan, but a property that must be reinforced from multiple angles.

When the conversation shifts from architecture to adoption, ideology alone quickly shows its limits. Real users care about predictable costs. Institutions care about performance they can model. Long term participants care about whether data and value will still be accessible years from now. Plasma seems to acknowledge that decentralized systems only matter if they can be used without constant vigilance. Gasless stablecoin transfers and stablecoin first gas are small details, but they signal an understanding of how people actually behave when money is involved.

Incentives play a quiet but central role here. Rather than assuming everyone will act honestly out of principle, the system rewards behavior that strengthens the network. Validators stake because they have something to lose. Participants follow the rules because doing so is economically rational. Trust is not eliminated, but it is reduced to something measurable and distributed, rather than something assumed.

The native token fits into this picture as a coordination tool rather than a promise of upside. It supports governance, staking, and participation in a way that creates a feedback loop between real usage and network health. Governance in this context does not feel like control. It feels like adaptation. A way for the system to respond to changes without freezing itself in time.

As I step back, I am reminded how the market tends to reward what is loud and immediate. Visibility often outpaces substance. Yet the infrastructure that quietly works tends to be noticed only when it becomes essential. Plasma feels like it belongs to that second category. Less concerned with excitement today, more focused on shaping how stable value moves tomorrow.

If decentralization is going to matter beyond theory, it will likely come from projects like this. Systems that accept complexity, design for failure, and treat data ownership and value settlement as inseparable. Not flashy. Not dramatic. Just steady work toward a future where trust is earned by structure, not by promises.