Vanar Chain’s VGN Network is taking a very different path from Solana’s gaming ecosystem, and the contrast becomes clear the moment you look past raw throughput and into how players actually experience games. VGN is built around the idea that blockchain should disappear into the background, letting players enjoy smooth gameplay while still owning assets fully on-chain. Solana, by comparison, leans into speed and composability, powering impressive crypto-native games but often exposing players to fee volatility and wallet friction. I keep coming back to the same thought here: gaming adoption depends less on headline TPS numbers and more on whether players forget they are even using a blockchain.

Predictable Costs Versus Peak-Speed Volatility

One of the strongest advantages VGN brings to gaming is cost certainty. Every transaction on Vanar Chain settles at a fixed USD-equivalent fee of about $0.0005, which means developers can design gameplay loops with hundreds of on-chain actions without worrying about congestion ruining the experience. In a typical Jetpack Hyperleague session, a player might open dozens of loot boxes, trade NFTs, upgrade items repeatedly, and claim tournament rewards. All of that activity settles in seconds and costs only a few cents in total, regardless of what else is happening on the network.

Solana shines when the network is calm, with extremely low fees and fast confirmation times. The problem appears during hype cycles. When popular mints, memecoin rallies, or DeFi liquidations hit, fees can spike and transaction reliability drops. For competitive or casual games alike, even small interruptions break immersion. VGN’s Proof of Reputation validator set, which includes gaming-focused operators, is optimized to keep lobbies and tournaments responsive instead of competing with speculative traffic. Worldpay integrations further smooth things out, converting card payments directly into usable on-chain value so players never have to think about gas at all.

Solana shines when the network is calm, with extremely low fees and fast confirmation times. The problem appears during hype cycles. When popular mints, memecoin rallies, or DeFi liquidations hit, fees can spike and transaction reliability drops. For competitive or casual games alike, even small interruptions break immersion. VGN’s Proof of Reputation validator set, which includes gaming-focused operators, is optimized to keep lobbies and tournaments responsive instead of competing with speculative traffic. Worldpay integrations further smooth things out, converting card payments directly into usable on-chain value so players never have to think about gas at all.

Building Games Without Rebuilding Studios

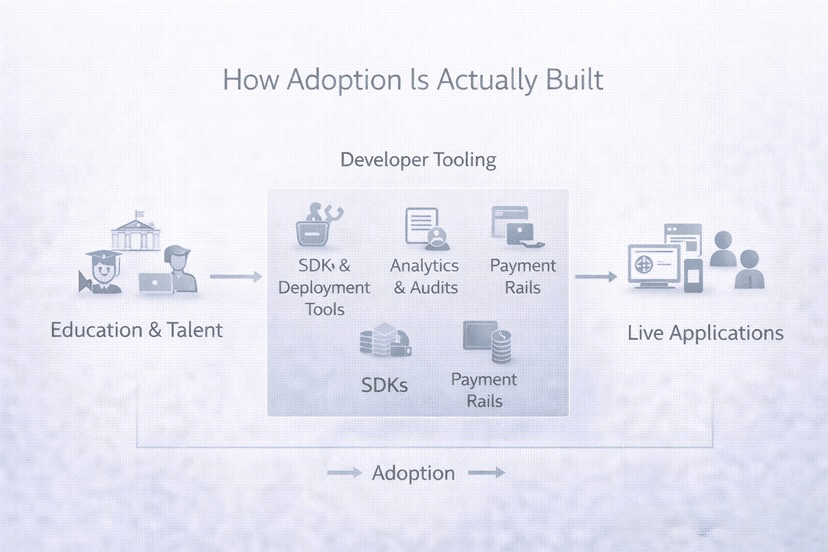

From a developer’s perspective, the difference is just as stark. VGN is designed to feel familiar to Web2 studios. Unity and Unreal plugins let teams integrate ownership, trading, and rewards without rewriting game logic or retraining staff in low-level blockchain concepts. Assets are minted and managed through EVM-compatible contracts, while Neutron Seeds handle persistence and portability behind the scenes. Kayon AI adds another layer, allowing developers to personalize quests and balance economies automatically based on player behavior.

Solana’s tooling is powerful but demanding. Rust-based development, Anchor frameworks, and SPL token standards create a steep learning curve for studios coming from traditional engines. While abstraction layers exist, many teams still face long onboarding cycles. In practice, this means VGN titles can move from prototype to live deployment in weeks, while Solana games often take months to reach the same stage. I see this speed advantage showing up clearly in developer growth, as studios choose the path that lets them ship and iterate faster.

Ownership That Travels Across Games

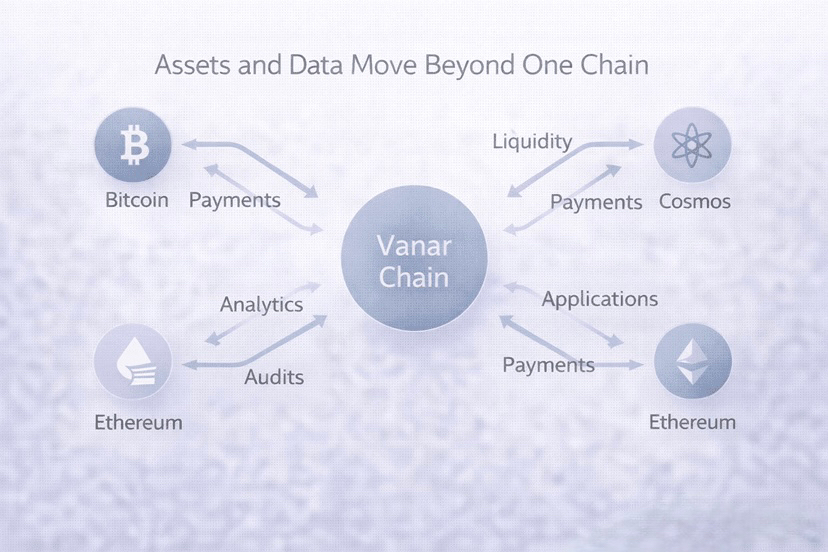

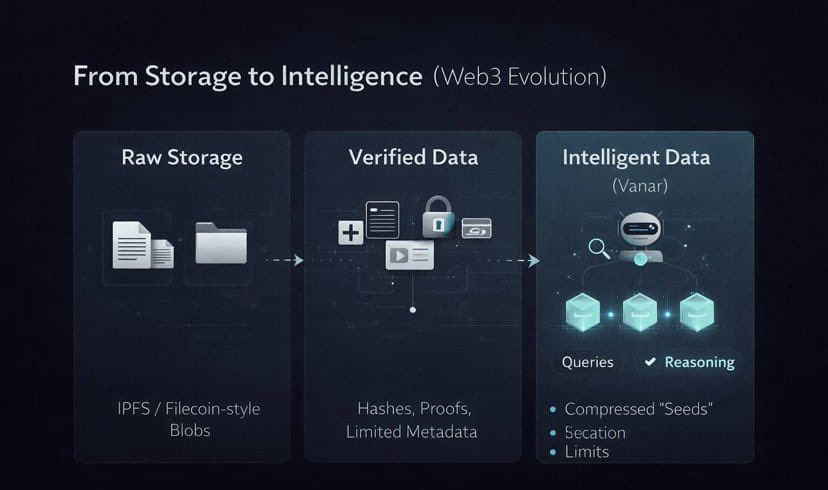

True ownership is where VGN draws its sharpest line. Neutron Seeds compress not just the asset itself but its entire history into a permanent on-chain object. A weapon earned in one game carries proof of rarity, upgrades, and past battles wherever it goes. That same asset can move between multiple VGN titles, appear in metaverse experiences, or even be used in DeFi contexts, all without relying on fragile external metadata links.

Solana’s NFT standards are efficient and widely adopted, but they still depend heavily on off-chain references. Compression improves marketplace performance, yet it does not solve the problem of semantic memory. VGN goes further by allowing Kayon to reason about assets contextually. Marketplaces can verify claims automatically, preventing common exploits and misrepresentation. The result is a sense of continuity that feels much closer to physical ownership than most digital items achieve today.

Onboarding Players Who Never Asked for Crypto

What really separates VGN from Solana’s gaming scene is how users arrive. VGN targets players who have never touched a wallet before. Social logins, invisible wallets, and fiat payments make onboarding feel identical to a normal mobile game. Players earn and trade assets without ever dealing with seed phrases or failed transactions. Over time, they realize they own something transferable and valuable, but that realization comes after fun, not before it.

Solana’s gaming ecosystem remains largely crypto-native. Wallets, DEX interactions, and token management are familiar to experienced users but intimidating to newcomers. This limits reach, especially in emerging markets where mobile gaming dominates. VGN’s approach flips the funnel, bringing players in through entertainment first and letting ownership emerge naturally.

A Healthier Economic Loop

The economic model behind VGN reflects this focus on scale. Massive numbers of low-cost microtransactions generate steady token burns, while enterprise use cases like PayFi and AI subscriptions add recurring demand. This creates a balanced loop where gaming activity strengthens network security and long-term sustainability. Staking rewards encourage players and developers to stay invested, and governance allows the community to shape prize pools and expansion plans.

Solana gaming tokens, on the other hand, often experience boom-and-bust cycles tied to speculation. When congestion hits, whales benefit while casual players get priced out. VGN’s fixed-fee design avoids this dynamic entirely, keeping the playing field level regardless of market conditions.

Reliability Over Spectacle

Technically, Vanar Chain prioritizes consistency. Sub-three-second finality and generous gas limits ensure complex game logic and AI-driven interactions execute smoothly. Proof of Reputation reduces the risk of downtime by favoring validators with real-world accountability. Solana’s architecture enables impressive parallel execution, but its history of outages during peak demand still looms large for developers building live-service games.

Two Visions of Web3 Gaming

Looking at both ecosystems side by side, it becomes clear they are solving different problems. Solana excels at high-performance, crypto-native gaming tied closely to DeFi culture. VGN is focused on mainstream adoption, where players care about fun, fairness, and ownership without friction. I find it hard to ignore which of these visions aligns more closely with how gaming actually grows.

As Web3 gaming matures, the platforms that succeed will be the ones that players forget are blockchains at all. VGN Network is betting that invisible infrastructure and portable ownership will bring millions, even billions, of players on-chain quietly. Solana will continue to attract power users and experimental titles. The real question is which approach ultimately defines what “owning a game” means in the years ahead.