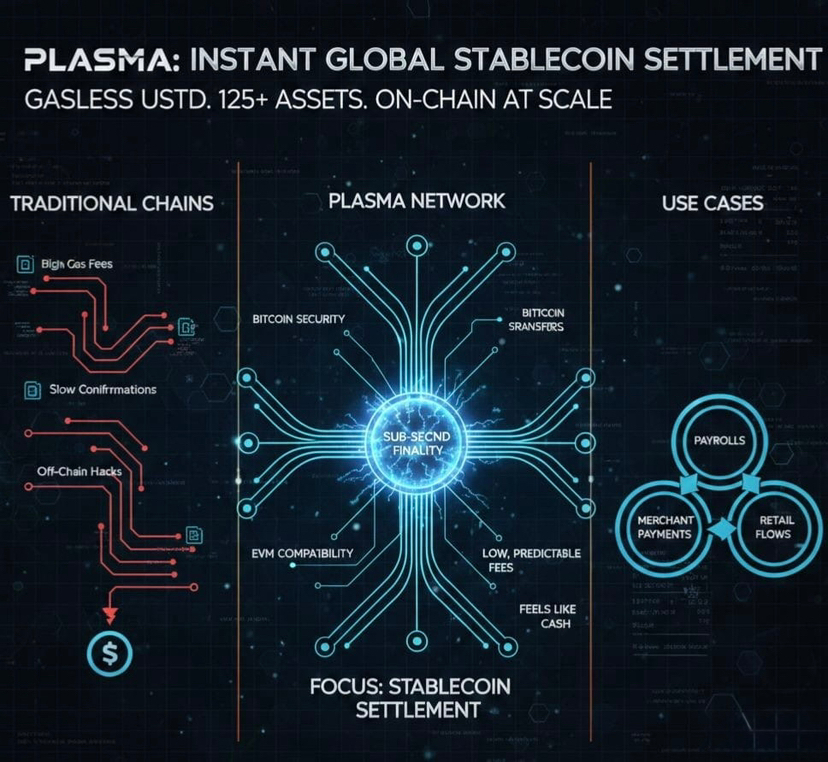

Plasma and Solana stand as two of the most advanced high-performance blockchains in the market, yet their competition becomes most revealing when viewed through the lens of stablecoins. This is where design philosophy matters more than raw benchmarks. Plasma is engineered almost obsessively around USDT movement, prioritizing predictability, zero-fee transfers, and settlement certainty. Solana, by contrast, channels its power into a broad financial ecosystem where DeFi, NFTs, memecoins, and institutional pilots all coexist and compete for blockspace. I’m noticing that this difference is no longer theoretical. It is shaping where real payment volume chooses to live.

At a time when digital dollars move hundreds of billions annually, Plasma is positioning itself as infrastructure rather than spectacle. Solana remains dominant in overall activity, but Plasma is increasingly defining the rules for everyday stablecoin usage. What looks like a rivalry is really a divergence into two very different roles within crypto’s financial plumbing.

Architectural Philosophy: Determinism Versus Throughput Ambition

Architectural Philosophy: Determinism Versus Throughput Ambition

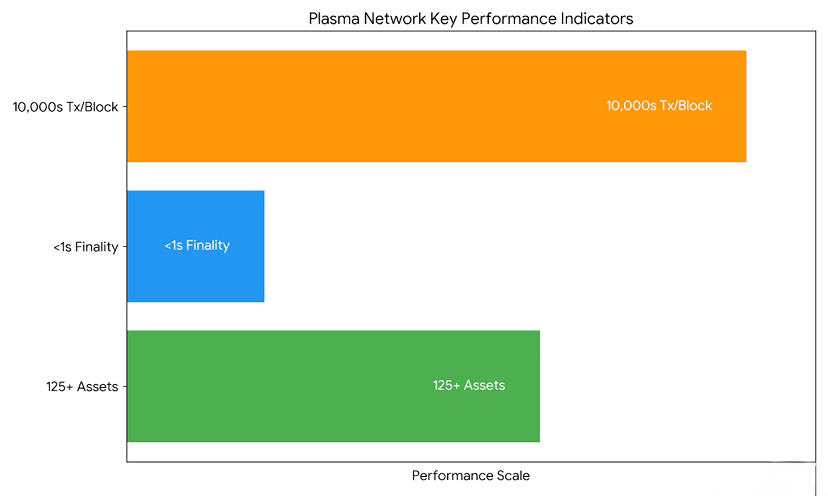

Plasma’s architecture is built around certainty. PlasmaBFT pipelines block production in tightly controlled stages, delivering sub-second finality and sustaining around ten thousand transactions per second that are specifically optimized for stablecoin transfers. Instead of chasing extreme theoretical limits, Plasma caps performance where it can guarantee reliability. I see this as a conscious trade-off. Payments need to be boring in the best possible way.

Solana’s architecture takes the opposite approach. Proof of History timestamps and parallel execution enable extremely high theoretical throughput, with ongoing upgrades pushing those limits further. This power allows Solana to host complex DeFi strategies, high-frequency trading, NFTs, and token launches all at once. The downside is that these activities compete directly with simple transfers. During speculative surges, blockspace becomes contested and priorities shift.

Plasma avoids this entirely by isolating payments. Tree-structured subchains and rate-limited transfer logic ensure that USDT flows never compete with unrelated activity. Solana excels at doing many things simultaneously. Plasma excels at doing one thing exceptionally well.

Stablecoin Transfers Under Load: Predictability Versus Elasticity

The difference becomes clearest during periods of stress. Plasma processes stablecoin transfers with protocol-sponsored fees, meaning users pay nothing for standard USDT movements. Whether activity is light or heavy, the experience remains the same. Transfers settle quickly, costs are fixed, and nothing unexpected happens.

On Solana, fees are usually low, but they are not fixed. When memecoin trading explodes or NFT demand spikes, fees rise and transaction ordering favors whichever activity is bidding highest. For traders, this is manageable. For retail payments, payroll, or remittances, it creates friction that users immediately notice.

I’m seeing Plasma’s daily stablecoin volumes remain steady even when broader markets become chaotic. Solana’s volumes often spike higher overall, but stablecoin usage becomes less predictable during those same moments. Plasma’s value proposition is not peak throughput. It is consistency.

Liquidity Behavior: Concentration Versus Dispersion

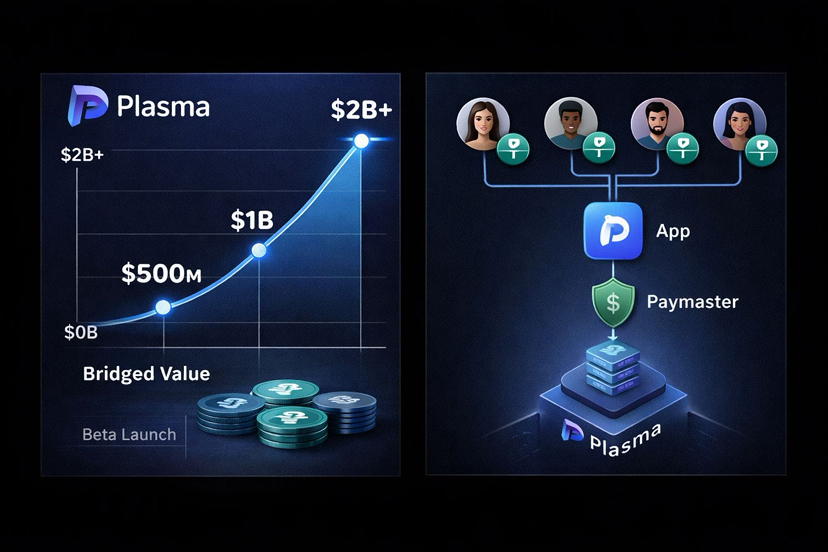

Liquidity patterns tell a similar story. Plasma attracted massive USDT inflows shortly after launch, concentrating liquidity into lending and savings vaults rather than scattering it across speculative venues. Even after early incentives normalized, most of that liquidity stayed anchored. This suggests users came for usability, not just yield.

Solana’s stablecoin supply has grown steadily over multiple years, driven by ecosystem maturity and institutional integrations. However, USDT represents only a portion of that growth. Liquidity is distributed across many use cases, from perpetuals to NFT marketplaces. This diversification fuels innovation but reduces the sense of a single dominant payment rail.

What stands out to me is velocity. Plasma reached levels of USDT concentration in months that took general-purpose chains years to achieve. That kind of acceleration only happens when friction is removed entirely.

Economic Design: Payment Capture Versus Compute Monetization

The economic models behind each network reinforce their priorities. Plasma’s token mechanics are structured so that value capture comes primarily from payment-related activity and network usage beyond basic USDT transfers. Inflation tapers over time, while burns and delegation mechanisms align long-term incentives with network stability.

Solana’s economics revolve around compute usage and MEV mitigation. Fee burning reduces supply, and validator incentives are tied to performance at scale. This model rewards high activity and sophisticated participants, but it does not specifically privilege low-value, high-frequency payments.

In simple terms, Plasma is designed to monetize trust and reliability in payments. Solana is designed to monetize computation and ecosystem breadth. Neither is inherently better, but they reward very different behaviors.

Reliability Track Records: Isolation Versus Systemic Risk

Reliability is another area where specialization shows its benefits. Plasma’s payment-focused design has avoided the cascading failure modes that can occur when many complex applications share the same execution environment. Since launch, uptime has remained intact even as volumes scaled.

Solana has improved significantly over time, but its history includes periods where congestion or spam disrupted the entire network. These events are less frequent now, yet they linger in the collective memory of users who rely on uninterrupted settlement.

I see Plasma’s isolation of payment flows as a form of risk management. By limiting what can interfere with stablecoin transfers, it reduces the chance that unrelated activity can disrupt core financial functions.

Developer and User Experience: Familiarity Versus Power

From a builder’s perspective, Plasma lowers friction by embracing Ethereum compatibility while stripping away cost uncertainty for payments. Developers can deploy familiar contracts and immediately benefit from gas abstraction for stablecoin use cases. This accelerates payment-focused applications that would be impractical elsewhere.

Solana offers unparalleled performance for developers willing to adopt its tooling and programming model. Rust-based development unlocks powerful capabilities, but it also raises the barrier to entry, particularly for teams migrating from Ethereum.

For users, the difference is felt most clearly at the point of payment. Plasma hides blockchain complexity almost entirely. Solana exposes it just enough that users still need to think about timing and fees.

Two Paths Forward in the Stablecoin Era

As the stablecoin market continues to expand, these two networks are converging on different but overlapping goals. Plasma is clearly targeting the everyday movement of digital dollars, challenging legacy remittance rails and payment-focused chains with a model that removes friction entirely. Solana is positioning itself as a comprehensive financial platform, where stablecoins are one component of a much larger machine.

I don’t see this as a zero-sum battle. Plasma excels at the capillaries of the financial system, moving small amounts constantly and reliably. Solana excels at the arteries, moving large volumes across complex markets. The real question is how much of the future stablecoin economy will value specialization over versatility.

As digital dollars continue to scale globally, the networks that remove uncertainty may quietly capture more value than those that simply push the limits of speed. If payments truly become invisible infrastructure, does the future belong to chains built for everything, or to those built for the one thing people actually do every day?